Petrohawk reduces Haynesville rig count to concentrate on liquids-rich Eagle Ford

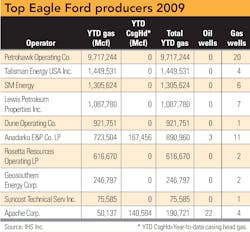

Houston-based Petrohawk Energy, the 22nd largest US producer in total assets and the 19th in stockholder equity, is the No. 1 producer in the fast-developing Eagle Ford Shale play in South Texas. The company is active in several shale plays, and is the No. 2 producer in the Haynesville Shale, just behind Chesapeake Energy.

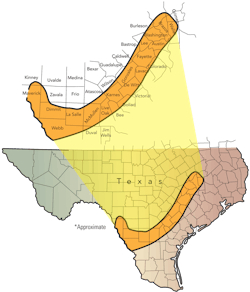

In April, Petrohawk said it would transition capital toward its 225,000 net acres in the oil and condensate windows of the Eagle Ford Shale, prompting a reallocation and overall reduction in its 2010 capital budget. The company reduced its rig count in the Haynesville in recognition of lower natural gas prices, while concentrating more of its efforts in the oil and condensate-rich component of the Eagle Ford Shale. Of Petrohawk's total Eagle Ford Shale holdings of about 360,000 net acres, roughly 225,000 net acres are located within those areas prone to significant crude oil and condensate production.

Photo courtesy of Swift Energy.

The second-, third-, fourth-, and fifth-largest producers in the Eagle Ford are Canada's Talisman Energy; Denver-based SM Energy (formerly St. Mary's Land & Exploration); Lewis Petroleum Properties; and Dune Operating Co. It is likely that Apache Corp. and Anadarko Petroleum, which were not among the five largest gas producers in the Eagle Ford in 2009, will move up in the rankings next year due to acquisitions and strong development in the play.

When Talisman announced its capital spending plans for 2010 in January, the Calgary-based firm said it plans to increase spending this year, especially on shale drilling in North America. President and CEO John Manzoni said the company is considering selling non-core conventional assets in North America in order to fund development costs in shale plays.

SM Energy president and CEO Tony Best said that his company recently entered into a long-term gas services agreement with Eagle Ford Gathering LLC to gather, transport, and process production from the company's Eagle Ford shale assets in South Texas. Under terms of the arrangement, SM Energy will commit Eagle Ford production up to a maximum level of 200,000 MMBTU per day over a 10-year year term. Eagle Ford Gathering, a joint venture between Kinder Morgan Energy Partners LP and Copano Energy LLC, will construct a pipeline to serve SM Energy's Eagle Ford assets in La Salle, Dimmit, and Webb counties.

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com