Range Resources, Chesapeake, EQT among largest producers in Marcellus

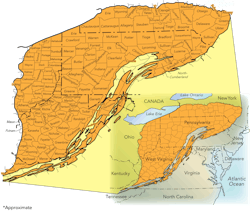

The Marcellus Shale play extends through the northern half of the Appalachian Mountain chain in the states of Pennsylvania, New York, West Virginia, and eastern Ohio. The name "Marcellus" comes from the town of Marcellus, NY, which has a visible outcrop from the shale formation.

One of the largest shale deposits in North America, the Marcellus extends nearly 600 miles north to south and has a thickness up to 900 feet. It is one of the closest hydrocarbon-producing shale deposits to the large population centers on the East Coast of the United States, and this proximity to large end-user markets makes the natural gas deposits especially attractive to petroleum development companies.

According to research by Pennsylvania State University, natural gas in the Marcellus Shale in northern Appalachia could conservatively boost proven US reserves by trillions of cubic feet (tcf).

"The value of this science could increment the net worth of US energy resources by a trillion dollars, plus or minus billions," says Terry Engelder, professor of geosciences, at Penn State.

Engelder conservatively estimates that the Marcellus shale contains 168 tcf of natural gas in place and optimistically suggests that the amounts could be as high as 516 tcf.

Fort Worth, Tex.-based Range Resources was one of the first companies to use horizontal drilling techniques and multi-stage fracturing in the Marcellus. Range had gained experience and honed these techniques previously in the Barnett Shale of North Texas.

Range pioneered the Marcellus Shale play beginning in 2004 with the successful drilling of a vertical well, the Renz #1. In 2007, Range drilled its fourth horizontal well to the formation, which was a commercial success. By mid-2009, Range had completed about 50 horizontal wells in the Marcellus. On average, these wells appear to be as good as, if not better than, the natural gas wells that are drilled in the core area of the North Texas Barnett Shale, says a Range spokesman.

Range says its estimated finding and development costs in this play are excellent at less than $1.00 per mcfe net. Range estimates the unrisked reserve upside on its 900,000 net acres to be 15 to 22 tcfe, or enough to grow its proven reserve base by as much as eight times.

Today, there are dozens of producers operating in the Marcellus, but Range Resources still remains among the largest. Oklahoma City-based Chesapeake Energy, which has entered into joint venture agreements with several global energy companies, and Pittsburgh-based EQT Production are both major producers in the formation.

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com