Recovery continues as income, revenues show steady increase over two quarters

Don Stowers, Editor, OGFJ

Laura Bell, Statistics Editor, Oil & Gas Journal

A year ago when we reported third-quarter financial results from 2008, income had jumped 66% on revenues that were up 112% from 3Q07. A lot of water has passed under the bridge since then.

Here is where we stand today compared to the same period last year and to the prior quarter: Net income for the 3Q09 was almost $15.4 billion on revenues of $221.6 billion for the 142 publicly traded companies tracked on the OGJ150 Quarterly. Income was up approximately 57.8% from the second quarter, but reflects a 70.9% decline from the third quarter of 2008. Revenues increased about 9.6% from the prior quarter, but were down 42.8% from 3Q08.

In other words, the upwards movement that began in the second quarter of 2009 continued in the third quarter with respect to revenues and income. However, the petroleum industry still has a long way to go to return to the glory days of 2007 and the first three quarters of 2008.

It's relevant to note that the OGJ150 Quarterly reflects the gradual and steady decline in the number of publicly traded companies whose financial results are reported here. Although the report covers 142 companies, only 130 of them reported results by the deadline for this issue.

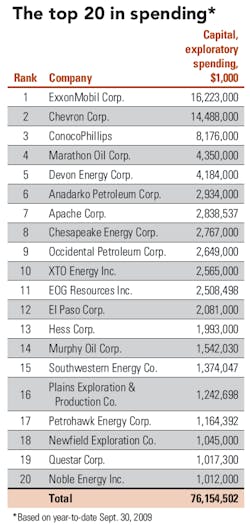

Year-to-date capital spending for this group of companies fell to $87 billion in the third quarter, down nearly 19.3% from the same period in 2008.

Total assets grew almost 1% from the prior quarter. However, total asset value for the collective group of companies is down just over $9.8 billion, or 10.4%, from the 3Q08.

Stockholders' equity for the entire group of companies rose to $491.2 billion, a 2.2% increase over the 2Q09 but was down 11.6% over the 3Q08. Total stockholders' equity year over year was down nearly $10.7 billion.

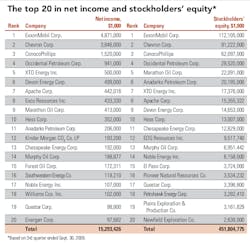

Top producers

The leading producers saw a significant climb in net income for the third quarter of 2009 compared with the prior quarter. However, all the major companies showed a steep decline in net income compared to the 3Q08.

ExxonMobil, the leading company in nearly all categories, showed a 23.3% spike in income over the prior quarter. However, this represented a sharp 67.2% drop compared with the same quarter in 2008.

In December, ExxonMobil announced its intention to acquire Fort Worth-based XTO Energy in a $41 billion transaction, which has not yet been completed as of this writing. XTO's net income of $500 million in the 3Q09 represented an increase of 0.8% over the prior quarter and a 4% drop from the 3Q08. XTO was the 15th-largest US producer in the third quarter of 2008, but moved up to the No. 5 position in 3Q09.

No. 2-ranked Chevron Corp. increased its net income by a whopping 120% over the prior quarter, but still showed a 51.3% decline from the 3Q08.

Houston-based ConocoPhillips showed a 17.1% rise in income in the third quarter compared with the previous quarter, but income dropped 70.7% compared to the third quarter of 2008.

California-based Occidental Petroleum Corp. increased its net income by 38% in 3Q09 compared with the 2Q09, but was down 58.6% over the 3Q08.

Top 20 producers as a group

Taking the top 20 producers as a group, combined net income grew by about $4.5 billion compared to the prior quarter — a 41.5% jump. However, the roughly $15.3 billion combined income was still 69% less than the nearly $48.7 billion reported for the third quarter of 2008.

Stockholders' equity for the top 20 producers rose a modest 2.6% to $451.8 billion from the prior quarter. However, this represents a 10.8% decline from the $506.6 billion reported in the 3Q08.

In a hopeful sign of things to come, capital spending increased by 42.8% to $76.2 billion in the 3Q09 compared to the previous quarter. This compares to a 10.8% drop from the $89.2 billion collective capex spending in the third quarter of 2008.

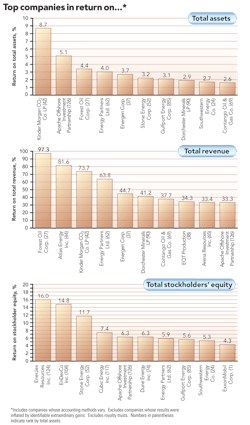

Fastest-growing companies

Denver-based Forest Oil Corp. takes honors as the fast-growing company on the OGJ150 for this quarter based on its 24.6% increase in stockholders' equity. Forest Oil's net income grew from $37.1 million in the second quarter of 2008 to $172.3 million in the 3Q08 — a 363.9% increase.

Forest Oil and its subsidiaries explore, acquire, develop, produce, and market natural gas and crude oil in North America and selected international locations.

H. Craig Clark, president and CEO of Forest Oil, commented: "With the divestitures of the Permian basin and other non-core properties, Forest is poised to grow production from its three core properties, the Greater Buffalo Wallow Area, the East Texas / North Louisiana Area, and the Deep Basin in Canada. These assets will consume approximately 75% of Forest's capital budget in 2010 and will generate the majority of the double-digit organic production growth for the Company. The program will focus not only on shales, but will also include horizontal drilling in tight gas sands and carbonates. We will also continue to focus on cost control and believe that there will be further improvement in 2010. With the recent de-levering of the balance sheet, Forest will return to its strategy of growth through the drill bit at a measured pace while staying within a reasonable bandwidth of cash flow and earning great returns on invested capital."

Gulfport Energy Corp., headquartered in Oklahoma City, was the second fastest-growing company with a 13.9% increase in stockholders' equity from the prior quarter. Gulfport's net income grew by 31.4% during this period.

Gulfport Energy's major operations are in the Permian basin of West Texas, southern Louisiana, the Bakken shale play in North Dakota and Montana, and Thailand. The company also has a 25% stake in Grizzly Oil Sands, which owns about 512,000 acres in the Alberta oil sands.