International markets driving revenue growth, margins for Geokinetics

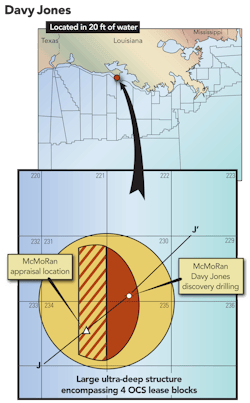

It could be one of the largest discoveries in decades on the Gulf of Mexico, said McMoRan Exploration of an exploratory well drilled recently on the Davy Jones prospect offshore Louisiana.

Initial wireline log results noted pay at Davy Jones at 135 net feet of hydrocarbon-bearing sands in four zones in Eocene-Paleocene Wilcox. Days later, New Orleans-based operator McMoRan added an additional 65 feet of pay to bring the total to 200 feet and potentially adding 0.5-1 tcf to the find.

The initial test well went to 28,263 feet measured depth in 20 feet of water on South Marsh Island Block 230. Pipe-conveyed wireline logs went as deep as 28,134 ft. The newest log, which encountered the additional pay, was a 394 feet section of the Davy Jones well, drilled from 28,134 feet to 28,530 feet.

In a conference call held after the announcement, McMoRan's co-chairman James R. Moffett noted it would likely take drilling more than 10 wells at a cost of $150 million to $175 million each to bring the field into production.

Analysis

According to Madison Williams Equity Research, stock prices of McMoRan, Energy XXI, and Plains Exploration stock prices have appreciated 51%, 38%, and 1%, respectively.

Based on the current 200 feet of pay, Dahlman Rose estimates the discovery at 3.0 tcf (gross) and worth roughly $10.00/share to MMR (risked). Analysts with the firm say that after an expected production flow test in the second quarter, Davy Jones' value "could rise significantly with derisking."

The positive results could continue as McMoRan continues to drill to its target depth of 29,000 feet. "New wireline log results, especially from the Tuscaloosa section, which have never been drilled into on the shelf, could provide additional upside catalyst to the equity," reported Dahlman Rose.

Until additional data needed to further de-risk the discovery (pressure data, production data, reserve data, additional wellbores), the value to each company at this point is largely an option value based on each company's net revenue interest and outstanding share count.

"From a structural standpoint, the 135 feet of net high quality pay, if homogeneous across the simple 4-way closure, could suggest 7,000 acres of closure updip to lowest known hydrocarbons. Volumetrics could suggest up to 1.6 tcfe," reported Madison Williams. Fully developed, a 1.6 tcfe gross reserve should produce roughly 500 gross MMcfed, which could double [Energy XXI]'s production and increase its net reserves by 50%, according to the research company.

Keep in mind Davy Jones is still undergoing exploration. There could be another 14,000 acres downdip if the reservoir was filled to spillpoint on the 20,000-acre plus structure. Such a scenario would bring the reserve up to six tcfe.

Also looking at what the Davy Jones prospect means to Energy XXI is Dalhman Rose. The company launched coverage of Energy XXI following the recent success in the Ultradeep trend. "While the corporate strategy differs, [Energy XXI] has similar large upside catalysts to [McMoRan]," however, the core Gulf of Mexico assets of Energy XXI are "much oilier, have higher working interests, and it intends to use free cash flow to be a consolidator on the shelf. If it continues to find accretive acquisition, maintains its base decline and spends 25-50% of its cash flow on Ultradeep exploration/development, we think EXXI will grow production per share at a reasonable, sub-10% pace," noted Dalhman Rose in its first rating of the company.

McMoRan operates the Davy Jones prospect, which was drilled by the Rowan Mississippi jackup, and is funding 25.7% of the exploratory costs. It holds a 32.7% working interest and 25.9% net revenue interest. The company currently has three convertible securities outstanding, including a 6.75% preferred stock, 8% preferred stock and a 5.25% Convertible Senior Notes.

Energy XXI is funding 14.1% of the exploratory costs to earn a 15.8% working interest and 12.6% net revenue interest in the prospect. Plains Exploration and Production Co. also holds a significant working interest in the prospect with 27.7%. Other participants include Nippon Oil Exploration USA Ltd. with 12%, and W.A. "Tex" Moncrief, Jr., with 8.8%.

— Mikaila Adams

Ex-Im Bank to commit $1B to Columbia's Ecopetrol

The Export-Import Bank of the United States (Ex-Im Bank) has approved a $1 billion preliminary commitment to help finance the sale of goods and services from various US exporters to Ecopetrol SA, Colombia's national oil company.

With the commitment, Ecopetrol may request the financing to buy oil field-related equipment and services from US companies in order to develop oil and gas reserves, improve existing oil field production, and upgrade refineries. The national oil company has plans to significantly increase its petroleum production to 1 million barrels of oil equivalent per day by 2015.

While at Columbia's Presidential Palace, Ex-Im Bank chairman Fred. P. Hochberg said, "This preliminary commitment will help Ecopetrol expand its production base, contribute to Colombia's economic growth, and offer enormous opportunities to US exporters to provide goods and services to this important market."

The announcement was made after Hochberg met with Colombian President Alvaro Uribe and other senior Colombian government officials in an effort "to build stronger relations with the Colombian market, for the benefit of both our countries."

Ecopetrol President Javier Gutierrez said the decision will allow Ecopetrol to "more easily purchase US products and services to expand its investments in: exploration, production, refinery modernization and clean energy." Examples, he noted, are the Cartagena and Berrancabermeja refinery modernization projects, valued at over US$6.5 billion—the largest and most complex industrial projects Colombia has undertaken in many decades.

Gutierrez also commented that Ex-Im's support will have a "tremendous, positive impact" on Cartagena's and Barracabermeja's industrial and social development with improvements in worker education and job and business creation.

Ecopetrol will have the opportunity to request conversion of the preliminary commitment into final transactions for medium- and long-term loans and guarantees during the next two years as it identifies potential US exporters for its projects. The transactions will be submitted to Ex-Im Bank's board of directors for final approval.

Gas hit at Eagle Ford prompts Pioneer Natural Resources to form dedicated team

Pioneer Natural Resources has hit gas at its second significant well in the Eagle Ford Shale, prompting the company to accelerate development with the help of a joint venture and a newly-created team to focus on the play.

The Robert Crawley Gas Unit #1 well, which is located in Live Oak County, Texas, flowed at an initial production rate of roughly 17 million cubic feet of gas per day on a 24/64 inch choke with 7,300 pounds per square inch wellhead flowing pressure. It was drilled to a true vertical depth of nearly 14,000 feet and completed in a 5,400-foot lateral section with a 16-stage fracture stimulation. The well is currently producing to sales.

The new well is located approximately three miles south of Pioneer's previously announced liquids-rich Sinor #5 discovery well. The Eagle Ford Shale formation at the Crawley #1 location is 1,000 feet deeper and has a 30% thicker pay zone than at the Sinor #5 location.

Scott Sheffield, chairman and CEO, noted that the objective of the Crawley well was to test productivity towards the dry gas window in a deeper, thicker shale section with a longer lateral and additional frac stages. "With the highest gas rate reported to date in the play, the Crawley #1 exceeded our expectations and confirms that dry gas wells provide strong economics at today's prices," he said.

Preparing for increased activity

To accelerate Eagle Ford Shale development, the company is pursuing a joint venture, with bids expected in the second quarter of 2010. In preparation for an aggressive development drilling program in the Eagle Ford Shale, the company has formed a new asset team to focus on the play. Additionally, the company has realigned responsibilities for certain executive vice presidents (EVP) to ramp up Spraberry drilling and other Permian services.

William F. Hannes, formerly EVP business development, has been named EVP South Texas operations. Two asset teams will report to Hannes, the existing South Texas Asset Team and the newly formed Eagle Ford Shale Asset Team.

Danny L. Kellum, formerly EVP domestic operations, has been named EVP Permian operations and will focus his attention on Pioneer's expanding Permian activities. Pioneer plans to drill 1,000 wells per year by 2012 in the Spraberry Trend, the company's largest asset.

Jay P. Still, EVP domestic operations, will add executive responsibility for Pioneer's Mid-Continent operations to his current responsibilities for the company's Rockies, Alaska and Barnett Shale assets.

Chris J. Cheatwood, formerly EVP Geoscience, has been named EVP business development and technology and will have executive responsibility for business development and geoscience/engineering technology.

— Mikaila Adams

Apache makes 5,085 b/d oil discovery in Egypt's Western Desert; acquires majority stake in Kitimat LNG project

Houston-based Apache Corp. has been busy on both the upstream and midstream fronts with another discovery in Egypt's Western desert and an agreement to acquire a 51% stake in Canada's Kitimat LNG Project.

The company's WKAL-A-2X discovery tested 5,085 barrels of oil and 130 thousand cubic feet (Mcf) of gas per day - the fourth successful exploration test in West Kalabsha Concession and the company's sixth discovery in the Faghur Basin play in Egypt's far Western Desert near the Libyan border.

The WKAL-A-2X discovery is located about one-half mile north of the Apache WKAL-A-1X discovery and five miles west of Apache's Phiops Field.

"With this latest discovery and other recent wells, we anticipate production from the Phiops-West Kalabsha area will double to 20,000 barrels per day as additional infrastructure is brought on line in the third quarter," said Rod Eichler, Apache's co-COO and president - international. "We estimate the discovered resource potential in the Phiops and Kalabsha areas exceeds 50 million barrels of oil equivalent.

The company has identified additional prospects and is working to acquire more 3D seismic in the Faghur Basin to the northeast and southwest of the recent discovery. Seven additional exploration wells are planned for the basin in 2010.

The latest well was designed to test Cretaceous-age Alam El Buieb (AEB) formations in a new fault block in a structurally higher position than the WKAL-A-1X well. The WKAL-A-2X well logged a total of 198 feet of pay in four AEB intervals including the 3G interval which was highly productive in a test of the WKAL-A-1X well. The latest well was perforated over the top 10 feet of a 29-foot section of the AEB-3C10 sand.

Apache operates the West Kalabsha Concession and has a 100% contractor interest.

Elsewhere on the gas chain, the company's Canadian subsidiary, Apache Canada Ltd., has agreed to acquire 51% of Kitimat LNG Inc.'s planned liquefied natural gas (LNG) export terminal in British Columbia. The company also reserved 51% of capacity in the terminal.

The proposed Kitimat project, located at Bish Cove near the Port of Kitimat about 405 miles north of Vancouver, has planned capacity of about 700 MMcf of natural gas per day, or five million metric tons of LNG per year. Preliminary construction cost estimates of Cdn$3 billion will be refined at the conclusion of front-end engineering and design.

G. Steven Farris, Apache's chairman and CEO said the development of the project "has the potential to open new markets in the Asia-Pacific region for gas," including the 10 trillion net cubic feet of estimated resource potential from its Horn River Basin in northeast British Columbia.

Apache will make an initial payment to the current owners of Kitimat LNG with additional consideration due upon achievement of certain commercial and regulatory milestones. Apache will fund the project's FEED - to begin shortly - with a final investment decision expected in 2011. First LNG shipments are projected for 2014. Apache will become operator of the project.

Kitimat is designed to be linked to the pipeline system servicing Western Canada's natural gas producing regions via the proposed Pacific Trail Pipelines, a Cdn$1.1-billion, 300-mile project originating at Summit Lake, B.C. Through this recent acquisition, Apache will acquire a 25.5% interest in the pipeline, currently a 50/50 partnership between Galveston LNG) and Pacific Northern Gas Ltd.

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com