LINN Energy's Permian Basin deal is month's largest

For the first time in months, the largest US oil and gas transaction for the past 30 days was not in an unconventional resource play. Rather, it was in the very conventional Wolfberry trend in the Permian Basin of West Texas and adjacent parts of New Mexico.

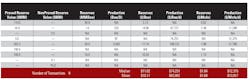

Houston-based LINN Energy announced on Sept. 7 that it had signed three definitive purchase agreements to acquire oil and natural gas properties in the Wolfberry trend for a combined price of $353.2 million from an undisclosed seller (or sellers). A LINN spokesman says he anticipates the acquisitions will close before the end of November and that they will be financed with proceeds from borrowings under its revolving credit facility.

"These acquisitions are an excellent addition to our existing Permian assets in the Wolfberry trend and a significant addition to our inventory of high-return oil projects," said Mark E. Ellis, LINN's president and CEO…LINN's Permian Basin production is approximately 10,000 boe/day. Proved reserves are more than 74 million boe with a high liquids content of approximately 76%, and are 41% proved developed. Since our first Permian acquisition in August 2009, we have built this region into the company's second-largest operating area. An important component of our organic growth will be derived from approximately 400 proved oil-focused Wolfberry drilling opportunities, which we expect will provide LINN with a five-year drilling inventory. We expect these acquisitions to be immediately accretive to cash flow per unit upon closing."

Significant characteristics of the three acquisitions are:

- Net production of approximately 3,300 boe per day (73% oil);

- Proved reserves of approximately 30 million boe (72% oil); and

- More than 230 Wolfberry drilling locations representing proved undeveloped reserves of 23 million barrels of oil equivalent; and

- Reserve life of approximately 25 years.

LINN has been on a buying spree lately. On July 19, the company agreed to pay $95 million for oil and natural gas properties located in the East Texas Oil Field in Gregg and Rusk Counties. That deal was set to close on or about Oct. 1. The 100% proved and developed reserves are 93% oil.

On July 1, LINN announced the purchase of $90 million of oil and natural gas properties in the Wolfberry trend, much of it proved, low-risk oil infill drilling locations. Back in March, LINN said it had signed a purchase agreement to acquire another $305 million in Permian Basin assets.

Also in March, LINN acquired natural gas properties in the Antrim Shale in northern Michigan for $330 million. The company believes there are about 300 proved low-risk drilling and optimization opportunities in the properties.

Energen Resources dealEnergen Corp., headquartered in Birmingham, Ala., said on Aug. 23 that its oil and gas E&P company, Energen Resources Corp. (ERC), had signed a purchase and sale agreement to buy Permian Basin assets in the Wolfberry trend from a private seller for $185 million. The cash transaction was expected to close by the end of the third quarter.

The bulk of the acquisition's 8,700 net acres is located in Martin County, Texas, in what the company calls "a prime Wolfberry location." The Permian Basin in West Texas is a major oil-producing basin in the US and is ERC's second largest area of operation. The acquisition includes 19 producing wells, and ERC has identified 142 proved undeveloped (PUD) locations and approximately 50 probable locations. It is 100% operated.

Estimated proved reserves total 18.0 million barrels of oil equivalents (MMBOE) of which 16.0 MMBOE (89%) are PUDs; sweet oil represents 65% of total proved reserves; natural gas liquids (NGL) comprise 22%; and natural gas makes up the remaining 13%. The acquisition also includes an estimated 6.2 MMBOE of probable reserves.

Rex Energy-Sumitomo JVOn Aug. 21, Rex Energy Corp. announced a joint-venture agreement with Summit Discovery Resources II LLC, a wholly owned subsidiary of Sumitomo Corp., one of the largest trading and investment firms in Japan. Under the agreement, Rex Energy will sell and transfer interests in its Marcellus Shale assets located in Pennsylvania, including 12,900 net acres, certain producing Marcellus Shale wells and associated midstream assets, in a transaction valued at nearly $140.4 million. Sumitomo will pay about $88.4 million in cash upon closing and an additional $52 million in the form of a drilling carry. Rex Energy will continue to serve as the operator of its Butler County, Pa., project area.

Pursuant to the agreement, in addition to funding its own share of drilling obligations, Sumitomo has agreed to fund 80% of Rex Energy's remaining share of drilling and completion costs until the $52 million drilling carry is fully utilized. The transaction is expected to close in September 2010.

Benjamin W. Hulburt, Rex Energy president and CEO, said, "Upon closing this deal, we will once again be debt free with substantial cash on hand. We believe that this will enable us to continue to aggressively develop our assets, while maintaining one of the cleanest balance sheets in the industry. With approximately 91% of our capital being invested in oil and liquids-rich gas assets, combined with our debt-free balance sheet, we strongly believe we are very well positioned to prosper in the current commodity price environment."

Denbury Resources dealOn Sept. 15, Denbury Resources said it had entered into an agreement to acquire for $115 million a 42.5% non-operated working interest in the Riley Ridge Federal Unit, located in southwestern Wyoming, together with approximately 33% of the CO2 rights in an additional 28,000 acres adjoining the Riley Ridge Unit. The acquisition is expected to close in late October.

Dallas-based Denbury is the largest oil and natural gas operator in both Mississippi and Montana, owns the largest reserves of CO2, used for tertiary oil recovery, east of the Mississippi River; and holds significant acreage in the Rockies and Gulf Coast regions.