Shell-East Resources deal valued at nearly $5 billion

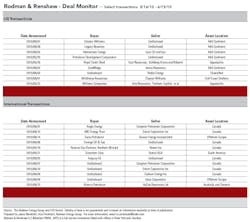

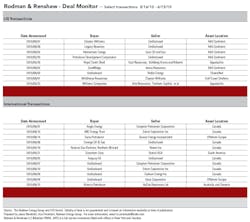

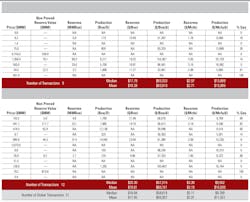

The major deal of the past 30 days (May 16 through June 15) is Royal Dutch Shell's acquisition of US natural gas firm East Resources for $4.7 billion. The deal increases Shell's exposure to natural gas prospects in North America, as East Resources controls 650,000 net acres in the Marcellus Shale and a little more than one million net acres overall. Production is 10,000 boe per day, mostly in natural gas.

"These acreage additions form part of an ongoing strategy, which also includes divestments, with an objective to grow and to update the quality of Shell's North America tight gas portfolio," said Peter Voser, CEO of the Anglo-Dutch oil and gas major. "The opportunity now is to consolidate our tight gas portfolio, divest from non-core positions across North America, and to invest for profitable growth," he added, calling the East Resources assets "the premier shale gas play in the Northeast US."

Besides its majority owners, East Resources counts private equity firm Kohlberg Kravis Roberts as an investor.

The second major US deal is SandRidge Energy's June 2 announcement that it is buying Arena Resources for just under $1.3 billion. Arena Resources has current operations in Texas, Oklahoma, Kansas, and New Mexico. SandRidge Energy, an E&P company with operations in West Texas, the Permian Basin, the Midcontinent region, the Cotton Valley Trend in East Texas, the Gulf Coast and the Gulf of Mexico.

Tim Rochford, chairman and co-founder of Arena, commented, "The amended merger agreement allows for a 'go-shop' period, an increase in the cash consideration, and a lower termination fee."

Internationally, the largest deal of the past 30 days was Sinochem Group's decision to buy 40% of the Statoil ASA's Peregrino holdings, located in the Campos Basin in offshore Brazil for the equivalent of nearly US$3.1 billion. Statoil maintains 60% ownership and operatorship of the field, which is set to start production in early 2011.

Sinochem Group, incorporated in China in 1950, is 100% state owned and is the fourth-largest Chinese oil company.

The other big international deal is in Canada. Nexen Inc. has signed a deal to sell its heavy oil properties in Western Canada to privately owned Northern Blizzard Resources for nearly US$900 million. The properties sold had about 39 million boe in proved reserves at the end of 2009. Northern Blizzard is based in Calgary and backed by Natural Gas Partners, a Texas-based $7.2-billion family of investment funds.

Nexen said in March that it was putting its heavy-oil producing properties up for sale as it turned its focus to oil sands, where Nexen has a joint venture with Opti Canada Inc. and operates the Long Lake project.