Chevron buys Atlas Energy in $4.3B deal, enters shale business

Deal will bring production growth, needed balance to portfolio

Following recent shale asset acquisitions in Poland, Romania, and Canada, Chevron Corp. has made a large grab at the North American shale industry, particularly the gas-rich Marcellus shale. The California-based company holding the title of world's fifth-largest oil company has agreed to pay $3.2 billion in cash to acquire Atlas Energy in addition to assuming pro forma net debt of approximately $1.1 billion.

The acquisition gives Chevron an attractive natural gas resource position, primarily in southwestern Pennsylvania's Marcellus Shale–one of the most sought after shale plays.

"This acquisition is the right opportunity for Chevron," said George L. Kirkland, Chevron vice chairman. "We are acquiring a company that has one of the premier acreage positions in the prolific Marcellus. The high quality resource, competitive cost structure in the Marcellus, strong growth potential of the asset base and its proximity to premier natural gas markets make this targeted acquisition a compelling investment for Chevron."

Some may say Chevron is acquiring the shale acreage a little late in the game as other big energy players–Total, Shell, ExxonMobil, BP, and Statoil–have already snapped up acreage and interest in major shale plays, but analysts at IHS say the purchase brings production growth opportunities, delivers key assets, and brings a balance to the company's portfolio.

In a research note, Robert Gillon, director of energy company research at IHS, called the deal sensible, but expensive. And necessary.

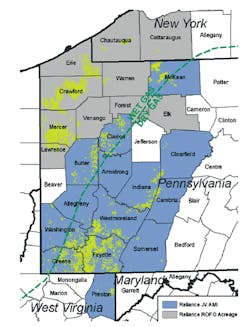

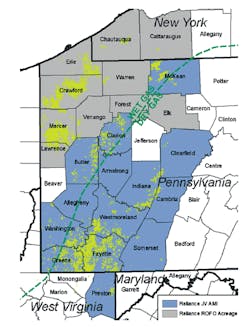

Map courtesy of Atlas Energy

"This type of asset was missing from Chevron's portfolio," Gillon said. "Large projects such as Gorgon or those in the deepwater Gulf of Mexico are great, but the incremental production is lumpy. This Marcellus-type play smoothes their production profile and gives them access to significant proved reserves of 0.9 tcf and resource potential estimated by Chevron at nine tcf."

And as far as the price paid for the net-acquired resources, Gillon said the metrics are in-line with what other new entrants have been paying despite looking "relatively expensive on a proved basis," particularly given present low natural gas prices. He noted, too, that one should look also at the acreage acquired and think more long term.

"Presumably," he said, "They have an advantage over latecomers to the Marcellus," because Atlas has been involved in the area for many years, so "the acreage may be better situated than what others have amassed."

Under the terms of the agreement, Atlas shareholders will receive a package worth $43.34 per share, a 37% premium to the company's closing price on November 8, the day before the deal was announced. The package includes $38.25 in cash for each outstanding share and a pro-rate distribution of over 41 million units of Atlas Pipeline Holdings.

Atlas plans to sell its controlling interest in Atlas Pipeline Holdings before the Chevron deal is completed.

Atlas assets

Chevron will gain Atlas Energy's estimated 9 tcf of natural gas resources, which includes approximately 850 bcf of proved natural gas reserves with about 80 MMcf of daily natural gas production. The assets in the Appalachian basin consist of 486,000 net acres of Marcellus Shale; 623,000 net acres of Utica Shale; and a 49% interest in Laurel Mountain Midstream LLC, a joint venture that owns over 1,000 miles of intrastate and natural gas gathering lines servicing the Marcellus. Assets in Michigan include Antrim producing assets and 100,000 net acres of Collingwood/Utica Shale.

In April 2010, Atlas Energy entered into a joint venture to develop its Marcellus assets with a wholly owned affiliate of India's Reliance Industries Ltd. Atlas sold a 40% undivided working interest in roughly 300,000 net acres for $1.7 billion ($14,100 per acre). Upon closing, Chevron will assume Atlas Energy's role as operator with 60% participation in the joint venture. Reliance will continue to fund 75% of the operator's drilling costs, up to $1.4 billion.

Pending

Before the deal is completed, Atlas Energy will acquire a 49% interest in Laurel Mountain Midstream LLC from Atlas Pipeline Partners LP for a cash consideration of $403 million and sell all interests in existing investment partnerships, 175 bcf of proved natural gas reserves, and certain other energy assets to AHD for a consideration of $250 million, comprised of $30 million in cash and $220 million in newly issued AHD units.

On November 10, Standard & Poor's Ratings Services placed its "B+" corporate credit rating and its "B" issue-level ratings on Atlas Energy Resources' senior unsecured notes on CreditWatch with positive implications, reflecting the potential that the ratings agency may raise or affirm those ratings when the buyout is complete.

As of Sept. 30, Atlas Energy Resources had outstanding $400 million principal amount of 10.75% senior unsecured notes due 2018, $200 million principal amount of 12.125% senior unsecured notes due 2017 and $76 million under a revolving credit facility, S&P said.

The acquisition is subject to certain Atlas Energy restructuring transactions, approval by Atlas Energy shareholders, and regulatory clearance.

While it may only be a minor pebble in Chevron's path, at least one Atlas shareholder is unhappy with the proposed merger. On Monday, November 15, an Atlas shareholder filed a compliant in Delaware's Chancery Court (while headquartered near Pittsburgh, Atlas is incorporated in Delaware) in hopes of blocking the acquisition saying, "The timing of the proposed sale of Atlas to Chevron appears opportunistically timed to take advantage of the current economic downturn, and is grossly unfair, inadequate, and substantially below the fair or inherent value of the company."

Citing a statement from Chevron, Reuters reported Chevron as saying it believes it made a fair offer for Atlas and that the lawsuit is without merit.

Goldman, Sachs & Co. is acting as financial advisor to Chevron in the Atlas acquisition. Skadden Arps Slate Meagher Flom LLP is acting as legal advisor to Chevron. Jefferies & Co. Inc. and Deutsche Bank Securities Inc. are acting as financial advisor to Atlas Energy. Wachtell Lipton Rosen Katz is acting as legal advisor to Atlas Energy.

–Mikaila Adams

Newfield buys Marcellus acreage from transitioning EOG ResourcesCompany to reallocate Gulf of Mexico dollars to develop Appalachian assets

Newfield Exploration Co. has agreed to purchase nearly 50,000 net acres in the Marcellus Shale from EOG Resources Inc. for $405 million, or $8,100 an acre. Nearly all the acreage associated with the deal is located in Bradford County, Pennsylvania, in the Susquehanna River Basin.

Five wells on the properties generate gross production of nearly 7 MMcf/d and 11 wells sit uncompleted. Current gathering capacity is 25 MMcf/d with capability to expand to 95 MMcf/d in early 2011. Newfield estimates that more than 400 gross operated well locations exist on the acreage and that net unrisked reserve potential is 1.5 - 2.0 tcfe.

EOG in transition

"The sale of this Marcellus acreage is a part of EOG's previously announced tactical plan to sell certain producing and non-producing natural gas assets in North America. These sales will add liquidity to partially fund EOG's liquids weighted capital expenditure program," said Mark G. Papa, chairman and CEO of EOG Resources.

In early August, Houston-based EOG Resources announced its plan to sell roughly 180,000 acres in US shale plays as part of an effort to refocus its portfolio as liquids-rich. According to EOG, this divestiture, along with others signed and expected to be signed by year-end 2010, will generate proceeds of nearly $1 billion.

The properties represent less than one-half of one percent of EOG's total North American production and the company will retain nearly 170,000 net acres in the Marcellus in northwestern Pennsylvania following the transaction's close, which is expected before year-end 2010.

Newfield's plan

Newfield plans to finance the transaction using the company's undrawn $1.25 billion revolving credit facility and then pay down the borrowings by selling certain non-strategic assets.

The company also plans to curtail deepwater Gulf of Mexico drilling in 2011 and re-allocate nearly $70 million to its $100 million Appalachian development program. Ten wells are expected to be drilled by year-end 2010 and two operated rigs are planned in 2011 to substantially hold the acreage by production.

"This transaction doubles our footprint in the Marcellus and adds core acreage with attractive development drilling opportunities," said Lee K. Boothby, Newfield chairman, president, and CEO.

"This transaction doubles our footprint in the Marcellus and adds core acreage with attractive development drilling opportunities," said Lee K. Boothby, Newfield chairman, president, and CEO. A November 16 report by Global Hunter Securities noted that, based on the location of the acreage, the transaction "potentially high grades" Newfield's current acreage position.

Newfield entered the Appalachian Region in October 2009 through an operated 50/50 joint venture with Hess Corp. in Wayne County, Pennsylvania. Three exploratory wells have been drilled in the county to date. Newfield operates the venture with a 50% interest.

–Mikaila Adams

Shell to sell Australian assets for $3.3 billionShell has agreed to sell part of its stake in Australia's Woodside Petroleum Ltd. to equity investors for US$3.3 billion.

Shell's subsidiary, Shell Energy Holdings Australia Limited (SEHAL), has entered into an underwriting agreement with UBS AG, for the sale of 78.34 million shares in Woodside, representing 29.18% of its interest in Woodside and 10.0% of the issued capital in Woodside at a price of $42.23 (Australian dollars) per share. Upon completion, SEHAL will continue to own a 24.27% interest in Woodside, Australia's largest publicly traded E&P company and one of the world's largest producers of LNG.

As part of this transaction, SEHAL has committed to retain its remaining shares in Woodside for a minimum of one year, with limited exceptions, including a sale to a strategic third party of an interest greater than 3% in Woodside provided the purchaser agrees to be bound by the same escrow restrictions to which SEHAL is subject or in pursuit of an acceptance to a bona fide takeover offer for Woodside.

Shell CEO, Peter Voser, commented, "Our Australian LNG portfolio has developed rapidly in recent years, with exploration success around Gorgon and Prelude, and our entry into coal bed methane plays through the joint acquisition of Arrow Energy. This is a strong platform for new growth."

Voser added, "Our stake in Woodside has been an important part of Shell's portfolio in Australia for many years. We are looking forward to working with Woodside on important new growth projects where we are partners. However, with Shell's recent portfolio progress in Australia, our worldwide push to simplify the company and to improve our capital efficiency, we will increasingly focus our investment in Australia through direct interests in assets and joint ventures, rather than indirect stakes. We will manage our remaining position in Woodside over time in the context of our global portfolio."

Petrobras, partners sign $3.46B contract for pre-salt production hullsPetrobras states that, together with partners BG, Galp Energia, and Repsol, and through its Tupi-BV and Guará-BV affiliated companies, it signed today two contracts totaling $3.46 billion with the Brazilian outfit Engevix Engenharia SA for the construction of eight hulls for the platforms to be used in the first phase of the production development for the pre-salt area in the Santos Basin.

Each platform, all of which FPSOs (floating, production, storage and offloading units) will be able to process up to 150,000 barrels of oil and 6 million cubic meters of gas per day. All units are expected to start operating by 2017 and to reach the production targets set in Petrobras' Business Plan for the pre-salt area. The expectation is that these platforms will add about 900,000 barrels of oil per day to domestic production when operating at maximum capacity.

The hulls will be built at the Rio Grande Naval Pole (state of Rio Grande do Sul), with local content expected to reach around 70%. The first steel shipments will take place in January, and hull constructions will start in March. The first two hulls will be delivered in 2013, and the others in 2014 and 2015.

Eight hulls for platforms to be used in the pre-salt area will be built at the Rio Grande Naval Pole. Photo courtesy of Petrobras

Of the eight units, six will be operated by the consortium formed for Block BM-S-11, where the Tupi and Iracema areas are located. The two others will be operated by the consortium formed for Block BM-S-9, where the Guará and Carioca fields are located.

The Block BM-S-11 consortium is operated by Petrobras (65%), in partnership with BG E&P Brasil Ltda. (25%), and Galp Energia (10%). The Block BM-S-9 consortium is operated by Petrobras (45%), in partnership with BG E&P Brasil Ltda. (30%), and Repsol Brasil S.A. (25%).

In October, operations went on stream at the first definitive production system (FPSO Cidade de Angra dos Reis) installed in Tupi, on the Brazilian coast.

In a webcast held after the company's 3Q10 results announcement, Petrobras' CFO and chief investor relations office, Almir Guilherme Barbassa noted the potential of the pre-salt region. "In the pre-salt region we have a set of blocks with potential to produce more than 20 billion barrels, something almost unique in the world. We will have many opportunities to optimize costs and income in the future," he said.

The company reported a net profit of R$8.566 billion in the third quarter, 3% more than 2Q10 noting the higher sales volumes on the Brazilian market (+10%) and the improved financial results.

Anadarko hits oil pay offshore Sierra LeoneAnadarko Petroleum Corp. has encountered roughly 135 net feet of oil pay in two Cretaceous-age fan systems from its Mercury-1 exploration well offshore Sierra Leone.

Mercury is the company's second deepwater test in the Sierra Leone-Liberian Basin and was drilled to a total depth of approximately 15,950 feet in about 5,250 feet of water by Transocean's Deepwater Millennium.

"The Mercury well demonstrates that the stratigraphic trapping systems we've identified are working, and that the petroleum system is generating high-quality oil," Anadarko senior vice president, Worldwide Exploration Bob Daniels said. "In the primary objective, the Mercury well encountered approximately 114 net feet of light sweet crude oil with a gravity of between 34 and 42 degrees API, with no water contact. An additional 21 net feet of 24-degree gravity crude was encountered in a shallower secondary objective."

The company is preserving the wellbore for potential re-entry, DST (drillstem testing) or a down-dip sidetrack to further delineate the reservoir s areal extent, quality and deliverability, continued Daniels. The plan going forward is to "continue working with the government of Sierra Leone and our partnership to accelerate exploration and appraisal activity in the area in 2011," he concluded.

The Mercury discovery is located in offshore block SL-07B-10 approximately 40 miles east-southeast of Anadarko's previously announced Venus discovery. Anadarko holds an interest in more than 4.6 million acres on five deepwater blocks offshore Sierra Leone and Liberia, and has identified more than 17 prospects and leads on 3-D seismic on this acreage. Once operations are complete at the Mercury well, the company has committed to mobilize the drillship to Ghana to accelerate the appraisal program at the Owo and Tweneboa fields, which the company anticipates sanctioning in 2011.

Anadarko operates block SL-07B-10 with a 65% working interest. Co-owners in the block include Repsol Exploracion Sierra Leone, S.L. (25% working interest) and Tullow Sierra Leone BV (10% working interest).

PXP completes Eagle Ford acquisitionPlains Exploration & Production Co. has closed its previously announced acquisition of interest in nearly 60,000 net acres in the oil and gas condensate window in the Eagle Ford shale play.

In early October, the Houston-based company announced it would pay $578 million in cash for the South Texas assets.

Of the 60,000 net acres, approximately 20,400 net acres are located in a joint operating area between PXP and EOG Resources Inc. A Dahlman Rose & Co. research report dated October 12 put PXP's working interest at 100% in 40,000 acres of the acquired properties, and a 50% working interest in 40,800 gross acres that are included in its joint venture with EOG.

The properties are located primarily in Karnes County of South Texas and PXP estimates the net resource potential to be roughly 140 to 175 MMboe, projected net production capability of approximately 2,000 boe/d and a year-end 2011 production target exit rate of approximately 5,000 boe/d net to PXP.

JP Morgan provided financial advisory services related to the acquisition.

The October report by Dahlman noted PXP, at the time, was trading at 5.5x 2011 EV/EBITDAX, a discount to its peer group average of 6.5x. The company estimated PXP PXP "should trade in line with its peer group due to the growth potential of its assets in the Eagle Ford, Granite Wash, and Haynesville Shale and the exploration/monetization potential in the GoM."

In late September, PXP sold its Gulf of Mexico shelf properties to McMoRan Exploration (MMR) for $75 million in cash and 51 million McMoRan shares ($818 million total consideration using McMoRan's stock price of $14.57 on September 17, 2010), executing its previously announced plan to divest its Gulf of Mexico assets, while maintaining some the Gulf of Mexico's upside potential.

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com