US producers show steady gain in revenues, net income for 2Q10

Don Stowers, Editor, OGFJ

Laura Bell, Statistics Editor, Oil & Gas Journal

It's become clear that the domestic oil and gas industry in the United States has made a dramatic comeback since financials fell into a deep pit in late 2008 and early 2009. Although all is not rosy with each and every producer, the OGJ150 group collectively is performing well.

For the group of US companies tracked by Oil & Gas Journal and Oil & Gas Financial Journal, net income for the second quarter of 2010 rose 4.5% over the previous quarter and climbed 151% over the same period in 2009. Total revenues for the group were up 2.2% over the prior quarter and 4.5% over the second quarter of 2009.

Net income for the companies was nearly $24.4 billion in the 2Q10 compared with $23.3 in the first quarter and $9.7 billion for the 2Q09. Total revenues increased by almost $5.5 billion from the previous quarter, and grew by $55 billion from the same quarter last year.

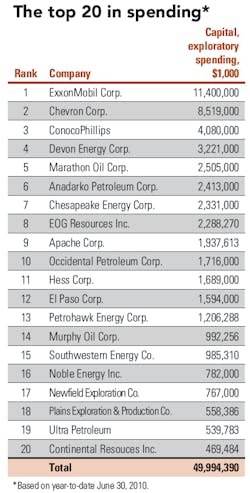

Year-to-date capital spending fell by $2.5 billion from $62.1 billion in the 2Q09 to $59.6 billion in 2Q10, down nearly 4%. This is the second consecutive quarter this year in which YTD capital and exploration spending was down. Last quarter, spending fell by $2.9 billion compared to the same period in 2009.

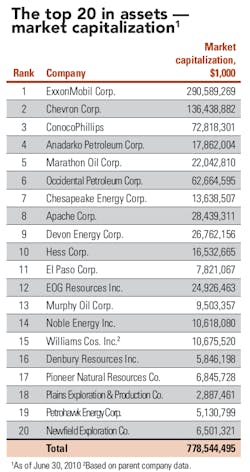

Total assets for the group increased to $1.118 trillion from $1.109 trillion the previous quarter, about a 0.84% gain. Assets grew by $68.3 billion from the comparable quarter in 2009 — a 6.5% rise in one year.

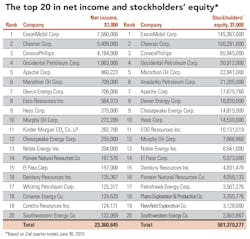

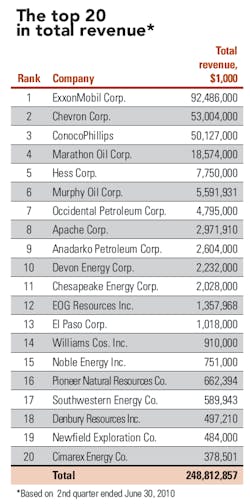

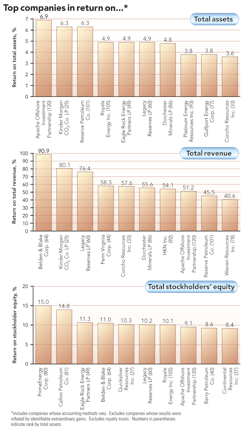

The 20 largest companies in net income, total revenues, and stockholders' equity continue to command the lion's share in each of these categories. Comprised of the oil majors and large independents, these 20 companies accounted for 95.8% of net income, 96.8% of total revenues, and 92.2% of stockholders' equity among the 130 companies tracked in the OGJ150 Quarterly Report. The remaining 110 companies account for just 4.2% of net income, 3.2% of total revenues, and 7.8% of stockholders' equity.

The top five companies in net income — ExxonMobil, Chevron, ConocoPhillips, Devon, and Occidental — together account for 62.5% of total net income for the OGJ150 group. ExxonMobil, the largest of the group, accounts for 25.8% of the group's net income. ExxonMobil ranked third on our list of fastest-growing companies for the quarter, showing a 23.5% increase in stockholders' equity for the 2Q10 over the previous quarter.

The top five companies in total revenues — ExxonMobil, Chevron, ConocoPhillips, Marathon, and Occidental — together account for 86.3% of total revenues for the OGJ150 group. ExxonMobil alone accounts for a whopping 36% of total revenues — $92.5 billion — out of $257.1 billion in revenues for the entire list of 130 companies, leaving the other 129 companies to split the remaining 64%.

Largest in net incomeAmong the Top 20 companies in net income, 12 showed increases over the prior quarter. Occidental remained virtually the same, and 7 companies showed a decline in net income. Six companies dropped out of the Top 20 — Anadarko Petroleum, Dominion Energy, Ultra Petroleum, Newfield Exploration, Miller Petroleum, and XTO Energy, which merged with ExxonMobil during the quarter. And 6 companies joined the Top 20 — Southwestern Energy, Concho Resources, Whiting Petroleum, Denbury Resources, Murphy Oil, and Exco Resources.

As a group, the Top 20 in net income earned $23.4 billion for the quarter, up $5.2 billion (12.5%) from the previous quarter.

Largest in total revenuesAmong the Top 20 companies in total revenues, 11 showed increases over the prior quarter. Occidental remained virtually the same in total revenues, as it did in net income. Eight companies showed a decline in total revenues, and 3 companies dropped out of the Top 20 in total revenues — Dominion Energy; Questar Corp, which merged with and into QEP Resources Inc.; and XTO Energy, which merged with ExxonMobil. Three new companies joined the Top 20 — Denbury Resources, Newfield Exploration, and Cimarex Energy.

As a group, the Top 20 had $248.8 billion in total revenues for the quarter, up $6.5 billion (2.7%) from the previous quarter.

Fastest-growing companiesAustin, Texas-based Brigham Exploration Co. tops the list of fastest-growing companies for the quarter with a 107.1% increase in stockholders' equity over the 1Q10. The company had a 63.3% increase in net income during this period.

Brigham is active in the Williston Basin and has completed 39 consecutive high frac stage long lateral Bakken and Three Forks wells in North Dakota with an average early peak flow rate of about 2,777 boe/d. CEO Bud Brigham says the company outperformed and exceeded the high end of its production volume guidance. Brigham Exploration was profiled in the December 2008 issue of OGFJ.

Gulfport Energy Corp., headquartered in Oklahoma City, was the second fastest-growing company in stockholders' equity with a 27.7% change over the previous quarter. The third fastest-growing company by stockholders' equity was ExxonMobil, which had a 23.5% change from the 1Q10.

Gulfport saw a 4.1% increase in net income quarter to quarter, while ExxonMobil enjoyed a 20% rise in income over the same period.

Click here to download the pdf the OGJ150 Quarterly ending June 30, 2010

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com