Stock market rewarded liquids-rich firms in 2013

Investors in North American liquids plays are top performers, says IHS.

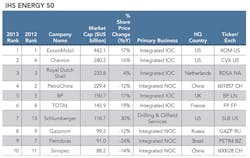

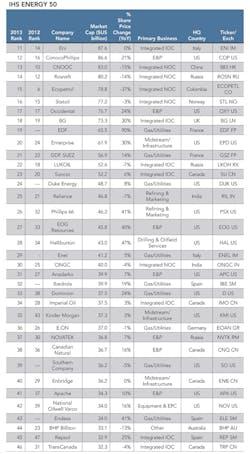

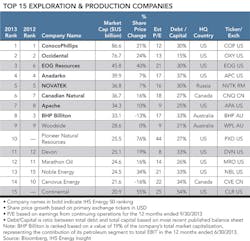

Demonstrating the continuing attraction of liquids-rich North American unconventional plays, the stock market rewarded companies with significant investments in these plays in 2013, namely EOG Resources, which experienced a 40% rise in value to just under $46 billion in 2013, making the company the largest market capitalization gainer for upstream E&P companies, according to the 2014 IHS Energy 50 ranking of the world's top energy companies.

The IHS Energy 50, formerly the PFC Energy 50, has for 15 years served as the definitive ranking of the world's leading publicly traded energy companies by market capitalization. IHS acquired PFC Energy in 2013.

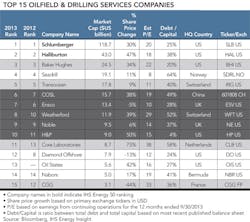

According to the IHS ranking, service companies with significant investments in North America also saw their earnings growth significantly. The Top 15 service sector companies rose in value by 25%, reflecting industry demand and global optimism about new developments. Halliburton, one of the top performers, posted an impressive 47% increase in its share price value and a market cap of $43 billion. Schlumberger also saw its share price grow 30% to nearly $119 billion in market capitalization.

Not surprisingly, some strategically positioned North American midstream companies, which are a critical link in the unconventional energy value chain, also saw their value grow significantly. Enterprise grew in market value by 37%, reaching a market cap value just shy of $62 billion. Like their service sector cousins, the midstream companies also were star performers in 2013, with the 2013 Top 15 midstream companies garnering a 26% rise in value above returns for the same set in 2012.

"The 2014 IHS Energy 50 ranking of the world's top energy companies tells a very compelling story of how the market appeared to reward companies that prioritized North American investments in 2013 while divesting elsewhere," said Atul Arya, senior vice president of Energy Insight at IHS. "This value also was evident not only in the upstream sector, but also in downstream operations. The availability of low-cost feedstocks from inexpensive domestic crude supply also benefitted the five predominantly US refiners among the top 15 refining and marketing companies on our list, which saw a combined market cap increase of 33%. This increase in value compared with a combined decline in value of 10% for the rest of refiners on the IHS list, which is a significant value gap."

Not to be overshadowed, the giant International Oil Companies (IOCs) maintained their top rankings on the IHS Energy 50 list by delivering steady growth and the highest market capitalizations. The United Kingdom's BG, which grew 31% in value to more than $73 billion, and Spain's Repsol, which grew its value by 27% in 2013, or slightly less than $33 billion in market capitalization, recovered to win the segment's titles of best performers after falling in value in 2012. The group of 16 companies in the IOC category posted a combined market capitalization of $1.7 trillion at the end of 2013, slightly more than 10% above their 2012 value.

The IHS Energy 50 again showed little change in overall market capitalization in 2013, ending with a combined total of $3.78 trillion, which is 0.8% more than the value of the same set of companies one year ago.

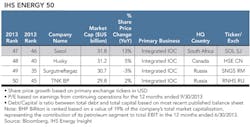

In terms of year-over-year market capitalization, National Oil Companies (NOCs) fared poorly said IHS – with the nine companies on the IHS Energy 50 dropping in market value by 16 %, and as a group, falling below $1 trillion for the first time since 2008.

According to IHS, investors became increasingly concerned that these NOC companies' privileged access to resources is often tied to expectations that they will build value, not only for shareholders, as other companies must, but also for the parent state and key sectors of the host economy -- a heavy burden for any one company to bear. Following some years of impressive market cap growth, the two Latin American NOCs on the Energy 50 suffered the greatest one-year market cap decline.

"While economic and geopolitical uncertainty will certainly continue driving energy company values, it is clear that a thought-out and well-executed strategy positively affects value," said Daniel Trapp, senior energy analyst at IHS and principal author of the IHS Energy 50 report. "This was particularly true with companies that refocused on North America in 2013, notably Occidental, which saw its value expand 24%, and ConocoPhillips, which grew 23% in value. While US refiners benefitted from geography, their positions allowed them stellar growth, which has sparked questions for their leadership about what to do with the higher profits."

Added Trapp, a shift of investment back to North America is a clear indicator of concerns about uncertainty far afield, notably escalating costs. As a result, he said, operator reaction to cost inflation may already be factoring into the value of equipment and EPC companies, which showed only modest growth in 2013. According to the IHS report, the group only showed roughly a 5% growth in market capitalization over the end of 2012.

Said Trapp, “Value and a strong strategy played exceedingly well to the markets in 2013, with fears of global economic uncertainty – and questions over access to barrels – waning."

Note: The IHS Energy 50 – formerly the PFC Energy 50 – has been published for more than 15 years as the definitive ranking of the world's leading publicly traded energy companies by market capitalization. The listing includes companies from nine sectors: International Oil Companies; National Oil Companies; Exploration & Production; Gas/Utilities; Oilfield & Drilling Services; Equipment, Engineering & Construction; Midstream/Infrastructure; Refining & Marketing; and Alternative Technologies. The full report is available at www.ihs.com/ihsenergy50, which also provides the IHS Energy 100.