Producing properties with upside dominate US deals at year-end 2013

David Michael Cohen, PLS Inc., Houston

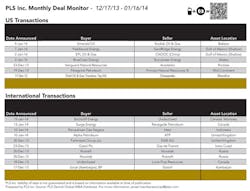

Reflecting themes previously noted by PLS regarding the end of the unconventional land grab as a primary mover of US oil and gas deal activity, transactions during the period from December 17 to January 16 displayed a marked preference for producing properties. A number of these acquisitions have undeveloped upside, but generally all or most of the deal value is attributable to existing proved reserves.

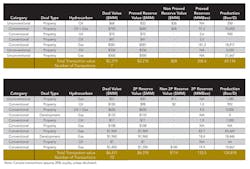

The biggest US deal during this period was Fieldwood Energy's $750 million acquisition of SandRidge's Gulf of Mexico assets which have estimated net proved reserves of 57.2 MMboe (72% proved developed) and current production of 25,000 boepd (52% oil, 90% operated). In addition to the cash value, Fieldwood is assuming $370 million in plugging and abandonment liabilities from SandRidge.

For Riverstone-backed Fieldwood, the acquisition solidifies the new company's position as the largest asset holder on the GOM shelf, which it established with its initial purchase from Apache in July 2013 ($3.75 billion cash plus $1.5 billion in P&A liabilities). The deal also brings the GOM assets full circle: SandRidge acquired the bulk of them in February 2012 in its $1.275 billion buy (not including P&A liabilities) of Dynamic Offshore Resources — whose CEO Matt McCarroll and other execs went on to form Fieldwood the following January. Upside includes a number of near-term, high-quality drilling prospects including two exploration prospects where SandRidge is retaining 2.0% ORRI: one at South Pass Block 60 on the GOM shelf and the other targeting the deep Miocene at deepwater Bullwinkle field. PLS attributes about 90% of this deal's value to proved reserves at $12/boe and the remaining 10% to probable reserves at $6/boe.

Another notable deal during the period is Vanguard Natural Resources' $581 million acquisition of Anadarko Petroleum's 100% non-operated interests in the prolific Pinedale and Jonah fields of southwest Wyoming. While the properties have current net production of 113.4 MMcfed (16% NGLs, 4% oil) from ~2,000 wells, they also hold 970 proved undeveloped drilling locations plus 5,200 additional unbooked locations representing a 10-year drilling inventory. As noted by management, this marks a significant departure for Vanguard, which will for the first time be allocating capital to drill new wells. The 847.3 Bcfe of proved reserves being acquired are 57% undeveloped, unlike in previous Vanguard deals which have tended to be PDP-heavy.

More than the undrilled potential, an unusual aspect of the acquisition for an MLP like Vanguard is the fact that it is 100% non-operated. MLPs have very tight business models that require control of cash flow, so it is unusual for an MLP to acquire non-op assets at such a large scale relative to its existing portfolio.

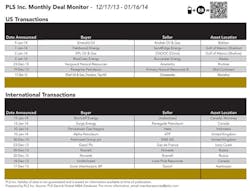

In Canada, Surge Energy continued its transition from an E&P junior to an intermediate producer with a sustainable, modest-growth business model, acquiring low-decline conventional light oil properties in Saskatchewan from Renegade Petroleum for $100 million. Located within Surge's core operating area, the assets have current production of 1,450 boepd (95% liquids), proved reserves of 3.44 MMboe, and a reserve life index of 10 years. The acquisition includes 12,227 net undeveloped acres, which PLS values at $180/acre. The bulk of the deal value goes to proved plus probable reserves at $21/boe.

On the international scene, the most notable deal was Statoil's sale of 10% WI in the Shah Deniz gas development in the Caspian Sea and the associated South Caucasus Pipeline to operator BP and Azerbaijan's state-run oil company Socar for $1.45 billion. The divestment continues Statoil's strategy of portfolio optimization based on rigid prioritization of future investment, and reduces the Norwegian company's share in the project to 15.5%. More importantly, the deal coincides with a positive final investment decision by the consortium to move forward with the $28 billion Stage 2 of the project, expected to increase volumes to Turkey by 600 MMcfd, provide 1.0 Bcfd to European countries farther west and more than double condensate volumes to 120,000 bpd.

Also, Indonesian gas transport firm Perusahaan Gas Negara preempted half of Hess' $1.3 billion asset divestment in that country, acquiring the company's producing Ujung Pangkah field in the East Java Sea (75% WI) for $650 million. State-run Pertamina and its Thai counterpart PTTEP still get Hess' 23% WI in the Premier Oil-operated Natuna-A gas project, having closed that part of the deal December 6.