GOM consolidation, Canadian revival mark recent upstream M&A activity

David Michael Cohen,PLS Inc., Houston

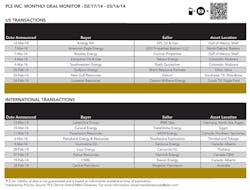

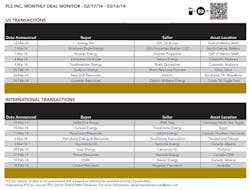

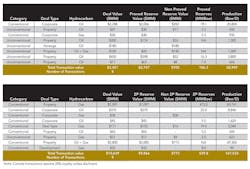

The Period from February 17 through March 16, 2014 saw 42 upstream transactions in the US, totaling $4.5 billion, with Energy XXI's $2.3 billion acquisition of EPL Oil & Gas dominating the month's activity. Internationally, 54 deals totaling $12.8 billion included two multi-billion-dollar transactions: Devon's Canadian asset sale and LetterOne Group's acquisition of RWE Dea.

Highlighting the consolidation occurring on the Gulf of Mexico shelf, the biggest US deal by far during the period was Energy XXI's $2.3 billion acquisition of EPL Oil & Gas. Energy XXI acquired EPL by paying a 34% stock price premium and will now be the largest pure-play publicly traded GOM company and almost a pure-oil play (70% oil by production, 91% by revenue). This deal is indicative of the continued changing ownership occurring on the GOM shelf as privately held Fieldwood Energy bought Apache's GOM shelf assets last July for $3.8 billion and Freeport McMoRan Copper & Gold bought out Plains E&P for $17.6 billion in December 2012.

EPL owns stakes in 37 producing fields with 78.1 MMboe in proved reserves (90% operated—similar to Energy XXI's 94% operated) and production of 20,800 boepd (77% oil). Combined, the company will operate 10 of the largest GOM shelf oil fields, with additional organic growth potential via increased recovery from developed reservoirs as well as near-infrastructure exploration. In this respect Energy XXI expects to benefit from EPL's advanced seismic data and field studies, facilitating exploration in the subsalt and other deep horizons below the producing zones. Furthermore, the enlarged GOM shelf footprint should drive down capital costs and improve operating efficiencies.

Meanwhile, the Canadian upstream sector appears to be in a rebound from last year's anemic $11 billion deal total (63% below the average of the previous six years), having already surpassed $6.4 billion this year as of this writing. Getting the ball rolling in terms of large deals was Devon's $2.8 billion sale of its Canadian conventional gas portfolio to Canadian Natural Resources Ltd. (CNRL). It was a notably quick sale for such a large asset package (put on the market after Devon's $6.0 billion Eagle Ford buy in mid-November), consisting of 86,600 boepd pre-royalty (12% light oil, 14% NGLs, 72% operated), 2.2 million undeveloped net acres and 2.7 million royalty and fee simple net acres—all near or adjacent to CNRL's existing operations. CNRL reports YE13 proved reserves of 1.6 Tcfe for the acquisition, excluding the royalty assets. Post-transaction, CNRL will be producing 780,330 boepd, an 11% increase vs. 3Q13.

CNRL chief Steve Laut cited an improving Canadian gas price outlook for 2014 and potentially 2015 as supporting factors for the transaction, which was Canada's biggest since ExxonMobil bought Celtic Exploration for $3.2 billion in late 2012. It is notable that the buyer is a Canadian company, and the deal was followed by two big acquisitions by home-grown E&P firms: Whitecap Resources ($669 million) and Vermilion Energy ($361 million). Contrast this with the dominance of overseas and particularly Asian buyers in recent years: Of 28 announced deals exceeding $1.0 billion in Canada between 2009 and 2013, only seven involved a Canadian buyer.

Nor are international companies ignoring Canada. While last year did see record-low foreign investment, Petronas' Progress Energy Canada subsidiary has proven the country's continuing appeal to overseas companies. The company has sold a 10% stake in its Montney assets and associated Pacific NorthWest LNG project to Oil India Corp. (reportedly for $1 billion) and has another deal in the works to sell 15% WI to an Asian LNG buyer widely identified as Sinopec.

Finally, this period saw Germany's RWE sell its upstream subsidiary RWE Dea for $7.1 billion to LetterOne Group, the investment vehicle of Russian billionaire Mikhail Fridman. With major investments in Egypt and other North African countries as well as Germany and the North Sea, RWE Dea has YE13 proved plus probable reserves of 2.8 Tcfe (73% gas) and contingent reserves of 5.8 Tcfe. During 2013 its average production was 503 MMcfed (52% gas). Fridman and co-investor German Khan set up LetterOne last year to invest part of the $14 billion they gained from selling a stake in TNK-BP to Rosneft. This is the biggest acquisition by a Russian company outside of Eastern Europe in the past several years, and the other $1 billion-plus deals on record were all by TNK-BP (50% owned by BP at the time) in Latin America.