Deepwater spend forecast to surge from 2016

Balwinder Rangi,Douglas-Westwood

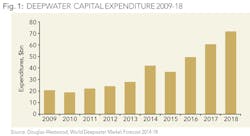

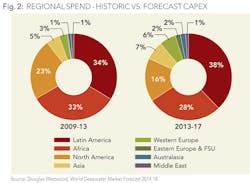

Deepwater capital expenditure (Capex) is expected to increase by 130%, compared to the preceding five-year period, totaling $260 billion from 2014 to 2018. Africa and the Americas continue to dominate deepwater Capex, with $213 billion set to be spent. Africa is also forecast to experience the greatest growth, as East African natural gas developments begin production and become more prominent in the latter years of the forecast period. Latin America will, however, remain the largest market and North America is expected to experience the least growth. These are the key findings from Douglas-Westwood's (DW) 12th edition of its World Deepwater Market Forecast 2014-2018.

Drivers of deepwater

Deepwater E&P activity is driven by a variety of supply and demand-side factors:

- The need to offset declining production from onshore and shallow-water basins

- Potential for discoveries of large hydrocarbon reserves such as in East Africa and

- Increased economic viability of deepwater developments.

As production from mature basins onshore and in shallow water declines, development of deepwater reserves has become increasingly vital. Robust oil prices over the past few years have increased confidence in the sector.

Discoveries of large fields are a key driver of activity, as they provide a large return on investment; however, they require high levels of capital investment to explore. Examples include the recent large natural gas discoveries off Tanzania and Mozambique such as the Mamba and Prosperidade developments.

We expect a continued trend towards exploration in ultra-deep waters in excess of 2,000 meters (m). The world's deepest platform installation is currently BW Offshore's BW Pioneer FPSO in the US Gulf of Mexico (WD 2,600m), operational since Feb 2012.

Photo courtesy of Transocean.

Deepwater economics

High oil prices provide a promising outlook for deepwater activity, but rising cost inflation is a concern.

The deepwater market requires significant continued investment in infrastructure. Whilst the economic feasibility of deepwater fields vary, typically oil prices of $80 per barrel (WTI) over the long-term ensure the viability of the majority of developments. Oil prices have remained above $92 over the past year.

However, despite robust oil prices, a number of flagship projects have been cancelled through surging E&P costs (averaging in excess of 10% per annum) despite relative stability in the oil price. Notable examples include Chevron's Hadrian and Rosebank developments.

Project execution

Delays and cost over-runs remain the norm but can E&P companies continue to absorb the impact?

Project execution challenges continue to result in major delays and cost increases. Imposition of local content requirements in countries such as Angola & Brazil, compound problems with project delivery due to lack of industry experience. In Brazil's 12th oil & gas round, local content requirement for exploration was increased further to 73%. Concerns exist within the industry that oil prices are not rising relative to the continued growth of E&P costs. Consequently, operators have cut Capex by delaying/cancelling projects.

Project financing & outlook

Despite the above, the deepwater market is now poised for a period of significant growth.

Relaxed Basel III requirements, lower costs of borrowing and an increased number of financial institutions willing to finance deepwater developments have improved finance conditions for both operators and contractors. Challenges in project execution, cost and local content are not unique to deepwater. Ultimately, the maturity of onshore and shallow producing areas is driving increased and unprecedented levels of activity in deepwater.

Market Summary

Deepwater expenditure is set to grow by almost 130% compared to the preceding five-year period, totaling $260 billion between 2014 and 2018. This growth is driven primarily by Africa and the Americas, accounting for 82% of Capex. Continued development of traditional deepwater regions; W. Africa, Latin America and GoM, coupled with the emergence of East Africa, will ensure these regions remain the key deepwater hubs. GoM remains a key deepwater region despite a limited growth forecast.

Capex declined following the global recession (2009-2011), which led to a sharp fall in oil prices. This coupled with the significant capital requirements of deepwater developments rendered many fields economically unviable relative to shallow water or near shore developments. This resulted in project delays/cancellations and thus reduced levels of Capex until 2014.

The recent consistency in oil price has given operators confidence in the continued viability of developing deepwater fields. Appropriately, DW forecast growth in deepwater Capex of 14% per annum.

We have identified a temporary trough in expenditure in 2015 primarily driven by delays to FPS units in Latin America. Likewise, African projects have also experienced delays resulting in a surge in Capex from 2016 onwards.

E&P operators take a long term view of deepwater projects and following decreases in oil prices, operators merely delay rather than cancel projects. Barclays Capital Survey estimates that global E&P budgets will increase by 6% in 2014. Furthermore, 37% of all companies interviewed are increasing the percentage of their budget dedicated to E&P. Therefore, the outlook for oil companies remains positive.

Latin America

Latin America continues to lead investment in deepwater activity, despite Petrobras' struggles and OGX failure. In Brazil, production targets for 2020 have been cut due to decline in aging fields and delays in bringing new fields onstream. The revised production target still remains ambitious. Bankruptcy of Brazilian operator OGX has caused further disruption and the cancellation of a number of high-profile field developments.

Mexico, however, shows much promise after reform of its energy sector to allow foreign upstream participants. The first licenses are not expected to be awarded until 2015, however, the vast area of unexplored acreage is expected to yield deepwater finds and perhaps even reverse Mexico's production decline.

North America

North America is expected to experience the least growth in Capex globally (2% CAGR). High cost inflation relative to price inflation has resulted in many projects becoming unviable, crippling growth.

Emergence of East Africa

East Africa is a potential deepwater natural gas hub, with discoveries in Tanzania and Mozambique likely to come onstream towards the end of the forecast period. Development of these fields, coupled with the high Asian gas price, creates a promising outlook for the region, and could allow East Africa to develop into a major deepwater province in the future. Similarly impacted, the Australian market is well positioned to take advantage of Asian gas prices through the viable development of Western deepwater gas reserves.

Smaller regions

The installation of major deepwater pipelines - e.g. South stream in Eastern Europe & FSU - boosts expenditure forecasts in countries with limited deepwater production potential. Western Europe's Capex is expected to grow fastest at a CAGR of 56% to $15.5 billion. The Middle East will grow second fastest (38%) with Eastern Europe & FSU third (32%).

Despite moderate growth of 8% CAGR, Asia will remain the largest deepwater market outside Africa and the Americas. However, the lack of available rigs is causing delays to some projects in Asia; Reliance Industries had to delay exploratory drilling on Block D3 until mid-to-late 2014 following issues with rig availability.

Australasia is the second smallest deepwater region by Capex ($3.9 billion). However, it has a promising outlook, especially if the high gas prices in Asia can be exploited through continued development of Australia's deepwater gas fields.

Components

Drilling and completion (D&C) represents by far the largest segment of the deepwater market with expenditure totaling over $90 billion, the majority of which will be spent on subsea well completions. DW forecast Capex on D&C will grow at a CAGR of 17% between 2014 and 2018. The greatest number of wells drilled will be located in Africa; almost 40% of all wells, although the greatest levels of Capex will be in Latin America due to lengthier drilling and completion times in this region.

Floating production systems (FPS) account for the second largest segment of deepwater Capex, with over a quarter to be spent on FPS units and installations and dominated by Latin America with almost half of forecast FPS Capex. Deepwater expenditure on FPS units will primarily be on FPSOs, accounting for almost 80% of forecast FPS expenditure. However, DW forecast FPS Capex to grow the least of all segments due to high cost inflation causing operators to reevaluate development plans for fields and ultimately leading to project delays/cancellations.

Subsea Equipment (Subsea Production hardware and SURF) jointly account for almost a third of global expenditure over the forecast period. Subsea production hardware is driven by the number of wells drilled; therefore Capex is related to D&C Capex and is expected to total in excess of $35 billion between 2014 and 2018. Africa is the largest market for subsea production hardware over the forecast, both in terms of units and Capex. SURF is also primarily driven by subsea well numbers, Capex on SURF and production hardware is similar at almost $40 billion.

Capex on trunklines totals $25 billion over the forecast period; Eastern Europe & the Former Soviet Union will dominate trunkline Capex – driven by large projects such as South Stream, which will transport gas in Russia.

Conclusions

Despite the potential delays caused by local content requirements and Capex compression, significant investment continues in Africa and the Americas. Petrobras will maintain heavy investment levels to develop the Brazilian pre-salt basins, despite recent announcements suggesting a reduction in their production targets. Regions such as Eastern Europe & FSU, the Middle East and Western Europe with historically low levels of deepwater activity will experience considerable growth over the next five years, primarily due to the installation of major deepwater trunklines. Recent discoveries in East Africa will come onstream towards the latter years of the forecast creating a potential deepwater province of the future.

Furthermore, financing for deepwater developments is now easier to obtain, as confidence in the global economy has been restored by the economic recovery. The deepwater market is now poised for a period of significant growth, with Capex totaling over $260 billion between 2014 and 2018.

About the author

Balwinder Rangi joined DW as a researcher, after graduating from the University of Kent with a degree in Economics and Econometrics. He has carried out extensive research on the deepwater sector and is the lead author of the ‘The World Deepwater Market Forecast 2014-2018'.