OGJ200 Quarterly: OGJ200 group posts lower results for 1Q07

The OGJ200 companies’ combined earnings in the first quarter of 2007 (1Q07) moved lower from a year earlier.

The group’s revenues declined 6.5%, while net income totaled $24 billion, down from $25.2 billion for the first quarter of 2006.

Downstream results led to earnings gains for some integrated firms in the group. As refiners’ crude costs eased a bit, cash refining margins were little changed from the first three months of 2006. Refinery utilization climbed year-on-year.

Results for upstream operations were mixed for the firms in the OGJ200. Overall, though, most oil and gas producers in the group reported declines in 1Q07 earnings from a year earlier, as oil and gas price realizations declined and expenses increased.

The OGJ200 group consists of the US-based oil and gas producers that appear in Oil & Gas Journal’s annual special report (OGJ, Sept. 4, 2006, p. 20), which ranks the publicly traded firms by year-end total assets.

The group now contains 132 companies. The results of 8 of the firms do not appear in this edition of the 200 Quarterly, as these companies had not filed their 1Q07 results with the US Securities & Exchange Commission by press time.

Changes

Two companies that were on the list in the previous edition of the OGJ200 Quarterly no longer appear in the compilation. These are Peoples Energy Production and Whittier Energy Corp.

Peoples Energy Production during 1Q07 merged into WPS Resources Corp., which then changed its name to Integrys Energy Group Inc. The company is in the process of divesting its oil and gas operations, which the company said should be complete by the end of 2007.

Sterling Energy plc acquired Houston-based Whittier Energy Corp. in March 2007 for $145 million plus the assumption of liabilities.

Market forces

Strong worldwide demand and the threat of supply disruptions in some key producing regions kept a floor under oil prices during 1Q07, although prices eased slightly from the corresponding 2006 quarter.

The front-month futures closing price for crude oil on the New York Mercantile Exchange averaged $58.25/bbl during 1Q07, compared to $63.48/bbl in the first quarter a year earlier.

Natural gas prices also averaged lower during 1Q07 from a year earlier. In the recent quarter, the front-month NYMEX closing price averaged $7.18/MMbtu, down from $7.84/MMbtu in the first quarter of last year.

Average refining margins were mildly weaker for US East coast and US Gulf coast refiners during 1Q07 as compared with a year earlier, but margins were a bit higher for refiners on the US West coast.

The cash margin for West coast refiners averaged $25.18/bbl during the recent quarter, this compares to an average of $23.92/bbl during the first quarter of last year and $15.53/bbl in the first period of 2005, according to Muse, Stancil & Co.

1Q07 results

Forty-five of the companies in the OGJ200 group whose results were available at press time reported net losses for the recent quarter. Only 18 of the firms in the OGJ200 group improved on positive first-quarter 2006 earnings.

Top-ranked ExxonMobil Corp. posted a 10% gain in 1Q07 earnings. Net income for the recent quarter was $9.28 billion on revenues of $87.2 billion.

ExxonMobil reported capital and exploration spending during 1Q07 of $4.3 billion, down from $4.8 billion a year earlier. Upstream results were slightly lower from the first quarter of 2006, mainly due to lower realizations and decreased natural gas volumes driven by lower European demand, the company said.

Cheniere Energy Inc.’s results for 1Q07 reflect a net loss of $34.6 million, compared to a net loss of $15.8 million for the first quarter of 2006.

The major factors contributing to the recent net loss were LNG terminal and pipeline development expenses of $5.8 million, general and administrative expenses of $21.3 million, and interest expense of $26.4 million. These expenses were partially offset by interest income of $21.6 million, the company reported.

Financial results for Cheniere’s LNG and gas marketing segment for 1Q07 reflect a net loss of $5.5 million, compared to a net loss of $1.2 for the first quarter of 2006.

Cheniere reported revenue of negative $1.256 million as it incurred a marketing and trading loss of $2.1 million in 1Q07 compared to zero in the first quarter of last year. The company began gas trading activities in December 2006.

Forest Oil Corp. posted an 88% increase in net income in spite of an 18% decline in revenue during 1Q07. On March 2, 2006, Forest spun off its Gulf of Mexico operations.

Ranked No. 2 by assets, ConocoPhillips posted an 8% year-on-year gain in earnings for 1Q07, while the Houston-based company’s revenues declined nearly 11%.

ConocoPhillips’ upstream net income was $2.3 billion, down from $2.55 billion in the first quarter of 2006. The decrease primarily was due to lower commodity prices, higher taxes, and higher operating costs.

The company reported that this decrease was partially offset by the current-year net benefit from asset rationalization efforts and higher production volumes. The increase in volumes reflected the post-merger inclusion of Burlington Resources Inc. results, partially offset by normal field decline and OPEC reductions in Venezuela and Libya.

Refining and marketing net income for ConocoPhillips was $1.1 billion in 1Q07, up from $390 million in the first quarter of 2006. The company said the increase primarily was due to higher worldwide refining and marketing margins, higher worldwide refining volumes, the 1Q07 reduction in previously reported impairments, and lower turnaround costs.

No. 3-ranked Chevron Corp. reported an 18% earnings increase and a 12% slide in revenues vs. the first quarter of last year.

Chevron reported that its downstream earnings increased $1 billion, due mainly to the $700 million gain on the sale of refining assets in Europe. The company sold its 31% interest in the Nerefco refinery and related assets in the Netherlands. Meanwhile, Chevron’s upstream earnings declined $550 million on lower average oil and gas prices.

No. 4 Anadarko Petroleum Corp. posted an 84% decline in net income from the first quarter of 2006. While Anadarko’s revenues climbed across its gas, oil and condensate, natural gas liquids, and gathering, marketing, and processing segments, the company incurred sharply higher costs and expenses for 1Q07 as compared with the corresponding 2006 period.

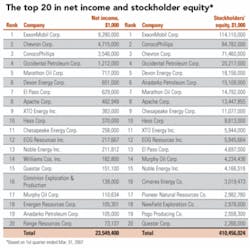

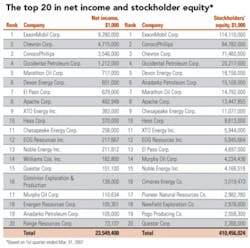

Top 20 firms

Collectively, the earnings of the top 20 companies as ranked by total assets did not fare as badly as the entire OGJ200 group.

The top 20 posted a combined 2.7% decline in net income for 1Q07, whereas the entire group recorded a combined 4.4% decline.

Total revenues for the top 20 fell 6.8%, while the entire group’s revenues declined 6.5%. With a combined $221.8 billion in revenue for the first three months of this year, the top 20 companies accounted for 97% of the revenues of all 124 firms whose results are included in the compilation.

Both the top 20 and the OGJ200 group posted a gain in stockholders’ equity of 2.1% from the final 2006 quarter.

But the companies ranking highest reported a smaller increase in capital and exploration expenditures for 1Q07. Total capital spending for the OGJ200 group as a whole were $27 billion, up 8.6% from the first quarter of last year. Meanwhile, outlays of the top 20 companies in the group totaled $22.2 billion, up 5.3% from a year earlier.

The market capitalization of the top 20 companies totaled $1.006 trillion at the close of 1Q07. This was down just 0.7% from 3 months earlier. Seven of the 20 companies saw a decline in market cap from the end of the previous quarter, including ExxonMobil, ConocoPhillips, and Chevron. ExxonMobil’s market cap led the declines, down 3% from the end of 2006.

Fast growers

GMX Resources Inc. was the fastest-growing company among the OGJ200 firms during 1Q07. Along with a 50% gain in stockholders’ equity from the preceding quarter, this Oklahoma City-based producer posted a 60% surge in net income from the final quarter of 2006.

GMX Resources also reduced its long-term debt during the quarter and reported that its oil and gas production more than doubled from the first quarter a year earlier.

The fastest-growing companies are determined primarily by growth in stockholders’ equity. For a company to qualify for this list, it must have reported positive net income for the fourth quarter of 2006 and for 1Q07, and it must have posted an increase in earnings in the most recent quarter from the fourth quarter of 2006. Excluded from this list are limited partnerships, subsidiaries, and newly public companies.

Second on the fast-growers list is Pioneer Oil & Gas, which topped the list based on its performance during the final 3 months of 2006. Pioneer, ranked No. 112 by assets, recorded another climb in stockholders’ equity during 1Q07, as it grew its earnings 57% over its fourth quarter 2006 earnings.

Pioneer Oil & Gas recorded $2.75 million in earnings for the first 3 months of this year, up from $178,000 in the first quarter of 2006. The company reported revenues for the quarter of $5.1 million, with $4.8 million from project and lease sales income. The remaining revenue was from oil and gas sales and royalty revenue.

Other companies on the current list of the 20 fast growers that also appeared on the list for the previous quarter’s results are Ultra Petroleum, Hess Corp., Aspen Exploration Corp., and Questar Corp.