Monetizing stranded natural gas

Juan Marcano and Roman Cheung, Taylor-DeJongh, Washington DC

Natural gas as a global energy source has been gaining wider currency in recent years as a result of sustained high oil prices, a need for energy diversification and security, the growing global awareness of environmental issues, and due to the development of new gas-related technologies.

-Photo by Bryan & Cherry Alexander

Current global natural gas reserves total approximately 6,100 trillion cubic feet (tcf), according to EIA estimates. Of these, roughly half are considered to be “stranded”, that is, uneconomic to deliver to market. This typically occurs when identified reserves are in remote locations, or when they are located deep under the ocean floor and/or in complex geologic formations. Some of the regions with significant stranded reserves include Western Siberia and the Yamal Peninsula in Russia, offshore eastern Canada, northern Australia, Vietnam, and Indonesia.

Another form of stranded natural gas is “associated gas,” or gas found in association with development of large oil fields. While crude oil can be transported to distant markets with relative ease, the practice in the past has been to flare associated gas at the well head. This practice however is no longer acceptable due to environmental concerns and, more recently, due to the growing economic value of these reserves in a high energy price environment. Oil producers are now looking to use technology to capture associated gas and take it to consuming markets.

Alternative technologies

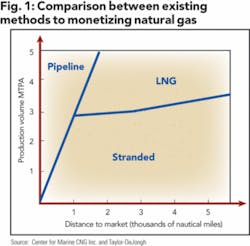

Traditionally, natural gas has been delivered to markets using a small number of commercially-proven methods: pipelines, liquefied natural gas (LNG) and most recently, onshore gas-to-liquids (GTL). Each of these alternatives is highly capital-intensive, and requires considerable gas reserves to justify its deployment. Figure 1 shows, in terms of production volume and distance to markets, where current technologies are viable.

As shown by Figure 1, the available methods to transport gas are not economical when the size of the fields is small, with a production volume of less than three million tons per annum (MTPA), and the markets are located more than 1,000 nautical miles (nm) away.

A number of alternative technologies exist that have the potential to make the development of small fields - of under five tcf in size - economically viable. None of these however, has yet been developed and proven on a commercial scale, though they have each proven themselves viable on technical parameters. The most advanced among these alternative technologies include i) floating LNG, ii) GTL floating production storage and offloading (GTL-FPSO), iii) natural gas hydrates, (NGH) and iv) compressed natural gas (CNG). These technologies have been developed to a point where commercial scale deployment is not too far away, in the case of GTL and NGH, and demonstration plants have been in operation for several years. What remains to be seen is whether these technologies can run on a commercial scale and still be economically viable.

Floating LNG (FLNG): This concept combines LNG processing and storage technologies with deepwater offshore production experience. Floating oil production vessels have been around for nearly forty years, during which time more than 125 such vessels have been put into service. FLNG vessels are conceptually attractive because of the potential they provide to develop small and remote natural gas fields. Ships with liquefaction facilities onboard can be deployed over several fields in sequence as each field is depleted, eliminating the need to build new facilities. These vessels will work in association with relatively small and isolated installations. Few people would be affected in the event of an accident, enhancing safety and security by virtue of their remoteness. This factor is of particular importance in today’s security-conscious world. Several companies, most notably Royal Dutch Shell, have been actively promoting this concept.

GTL FPSO: This technology combines the infrastructure of an FPSO vessel with proven GTL technologies, and is broadly similar in concept to a floating LNG vessel. GTL is based on the Fischer-Tropsch (FT) process, which was originally developed in the 1920s, but did not attract commercial interest until the recently emerged emphasis on energy diversity, energy efficiency, and environmental responsibility. Syntroleum Corp., a developer of GTL technology, together with Bluewater Energy Services BV, recently finished the feasibility study of the world’s first FPSO with GTL capabilities. The vessel will have daily production capacity of 17,000 barrels of FT products, 40,000 barrels of oil, and 10,000 barrels of distillates, and will have a storage capacity of 2.3 million barrels. Initial estimates place the capital expenditures for a vessel with these characteristics at $1.3 billion. Syntroleum estimates that it would take about five years to build the first ship.

Natural Gas Hydrates (NGH): Crystallized natural gas, if economically developed on a large scale, would be much more cost effective to transport than liquefied or compressed gas. Japan’s Mitsui and Mitsubishi, the BG Group, and Marathon Oil, among others, have been developing gas-to-solids technology for both the production and shipping of natural gas hydrates. NGHs are chemically stable at about -20 degrees Celsius compared with -162 degrees Celsius for LNG, reducing the costs of transportation and storage. One cubic meter of NGH contains approximately 160 cubic meters of natural gas, while one cubic meter of LNG contains 600 cubic meters of natural gas, thus limiting the quantity of gas that can be transported with the NGH technology.

Gas-to-solids plants, however, are relatively cheaper to build than an LNG liquefaction facility. A feasibility study by Mitsui Engineering and Shipping, comparing an NGH production, shipping and regasification chain with an identical capacity LNG chain (one million tons per annum) found the costs of the NGH chain to be about $4.7/MMbtu versus $5.5/MMbtu for the LNG chain.

Compressed Natural Gas (CNG): Bulk transport of CNG by truck is well established. What is new, however, is the application of technologies to increase the volume of CNG transported by ships over long distances.

Marine CNG is particularly useful when gas reserves are relatively small and are located far from required infrastructure, such that pipeline or LNG terminal development would be un-economic. With CNG, natural gas can be offloaded through an offshore mooring buoy, thus avoiding the necessity of expensive land-based liquefaction facilities.

Transportation costs for CNG, exclusive of field development costs, are in the range of $1.00-2.50/MMbtu, depending on the volume of reserves, distance from market, and environmental considerations. Capital costs for a CNG delivery chain range from $500 million to $1.5 billion, of which approximately 90% is associated with vessel construction, and the balance on compressing, and loading and unloading facilities. This compares favorably with LNG and GTL facilities, as does the shorter construction time-frame of CNG. However, CNG cannot be transported in large volumes, whereas LNG vessels are able to transport three times more gas than the largest envisioned CNG vessel.

CNG technology can deliver gas more cheaply than LNG for distances up to approximately 2,500nm. Another attraction of CNG is that the bulk of the investment is in movable assets, while for LNG, a substantial part of the investment is in fixed assets. This particular fact makes investments in CNG relatively less risky than those in LNG in terms of asset flexibility. Some of the companies supporting this technology include Statoil, TransCanda, and ExxonMobil.

Comparison between various methods

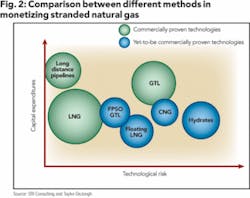

In light of the various methods for monetizing stranded natural gas, it is useful to provide some comparison among them. Figure 2 compares the unit development cost and technology risk involved in each method. The size of the circles represents the relative size of potential new markets. The sizes and positions of the circles as depicted in the figure are indicative only, as the ultimate cost of any project will depend on the specific circumstances.

The development of stranded gas is highly dependent on new technologies, their relative maturity, and cost effectiveness. The size of gas reserves, distance to markets, and supply volatility will determine which technology is optimal for each application.

Most of the technologies described in this article have reached a stage where commercialization on a wide scale is only a few years away. However, their use carries risks in terms of technology, credit worthiness, revenue security, and market competition risks, each of which needs to be appropriately mitigated.

Final remarks

For several decades, the energy industry has been looking for ways to economically exploit stranded gas reserves in remote regions of the world, many of which are offshore. Current high energy prices have put in play different technologies once considered too costly. Added to the constant search for new sources of energy supply, it is only a matter of time before these technologies enter the market. Improvements in technology, economies of scale, and synergies will doubtless lower capital costs and further improve the project economics over the next few years.

References

Energy Information Administration’s International Energy Outlook 2006.

“Options to Monetize Natural Gas: Where Fischer-Tropsch GTL Fits In”, presentation by Ronald M. Smith, Senior Consultant, Process Economics Program, SRI Consulting, Menlo Park, California, at Chemical Week Conference, Houston, Texas on October 25, 2004.

“Marine CNG Viability of Supply”, presentation by the Center of Marine CNG Inc. to the National Energy Board of Canada on April 25, 2006.

Economic Study on Natural Gas Transportation with Natural Gas Hydrates (NGH) Pellets, paper presented by Kanda H., Mitsui Engineering & Shipbuilding Co., Ltd. at the 23rd World Gas Conference, Amsterdam, The Netherlands June 5-9, 2006.

About the authors

Juan Marcano is an associate at Taylor-DeJongh in Washington, DC. He can be reached at [email protected] and 202-775-0899.

Roman Cheung is an analyst at Taylor-DeJongh in Washington, DC. He can be reached at [email protected] and 202-775-0899.