Chesapeake taps first gas well in unprecedented project at DFW International Airport

Roughnecks from Chesapeake Energy Corp. lowered a massive gold drill bit into the ground and began drilling for natural gas at Dallas/Fort Worth (DFW) International Airport, starting a new era for both the airport and the energy company. The 170-foot-tall rig launches the largest natural gas exploration effort at a major US airport and the project represents the single largest natural gas lease in the Barnett Shale formation.

The event kicked off an exploration and production program expected to span more than a decade and bring hundreds of millions of dollars in economic development activity to the North Texas region. In addition, DFW and Chesapeake will be providing clean energy to the United States energy market from a secure domestic source. Chesapeake will bring a total of 5 rigs to DFW to begin drilling on other locations around the airport.

Henry J. Hood, general counsel for Chesapeake stated, “The Barnett shale has emerged as one of America’s largest natural gas fields. The start of drilling at DFW is a prime example of unconventional opportunities created as a result of recent advances in horizontal drilling and completion technology. We also have a much better scientific understanding of how shale gas can best be extracted, and improved economics with structurally higher natural gas prices make it cost effective to pursue large-scale drilling initiatives such as this one.”

Chesapeake could drill as many as 300 wells on DFW’s land, and each one will maintain a safe distance from both the airfield and inbound and outbound aircraft. Jeff Fegan, CEO of DFW said, “Drilling will create jobs and business opportunities for local firms and the revenue will keep costs down for the airlines that operate at DFW, making our airport more attractive and more hospitable for travelers for years to come. Chesapeake brings a proven track record of success to this monumental drilling project and we look forward to seeing Chesapeake’s drilling success translate into value creation and quality-of-life enhancement for our local communities.”

Chesapeake and DFW worked closely with the Federal Aviation Administration (FAA) to determine safety and security requirements for the exploration and drilling process. Almost all of DFW’s 18,000 acres are available for exploration, with more than 9,000 of those acres available for surface drilling. The exploration effort will have no impact on airfield operations.

In the summer of 2006, Chesapeake paid DFW Airport $186 million in initial bonus and will continue to pay a 25% revenue-sharing royalty on all natural gas produced from the airport’s leasehold.

Passengers will soon see benefits from the partnership, as DFW has earmarked $40 million of its initial bonus to begin renovations of the airport’s original 4 terminals. The improvements will include new amenities, improved customer service, and an environment to rival DFW’s sparkling International Terminal D.

Under the terms of the agreement, Chesapeake assembled a group of minority investors that collectively hold a 20% working interest in the wells and bear a corresponding percentage of the exploration risks and production costs.

Engineers with Chesapeake say the first well will be drilled to an average vertical depth of about 8,000 feet - more than a mile and a half deep. At that point, the well bore will turn horizontal, with an anticipated lateral length of approximately 4,000 feet parallel to the ground above, resulting in a total well bore length of more than 12,000 feet to the lower Barnett shale formation. The DFW A6HZ is the first of 11 wells scheduled to be drilled from the AZ pad site.

The start of a drilling program for clean-burning natural gas at DFW represents a strategic move on the part of the airport to continue pursuing new revenue streams to generate non-aviation related income. The proliferation of drilling activity in the Barnett shale in the past 3 years and the growing popularity of natural gas as fuel made the timing ideal for leasing the available land at the airport.

Geophysical seismic testing for the project began in November 2006 and was completed in March 2007. This testing used sound waves to determine the locations of potential natural gas-bearing reservoirs deep below the surface of the airport. Since jet engine noise and vibration from the airport’s nearly 1,900 daily flights could cause false seismic readings, Chesapeake’s geoscientists conducted the tests exclusively at night.

The data is expected to help guide Chesapeake geoscientists and engineers to locate the optimal drilling pads to generate maximum natural gas production as well as enhance operational safety. Seismic testing results have identified more than 50 pad sites where more than 300 gas wells can be drilled over the next several years.

Glitnir Bank poised to finance US geothermal energy development

The Nordic financial specialty group, Glitnir Bank, joined geologists, government officials, investors and other thought leaders in geothermal energy in San Francisco, Calif., at the first annual West Coast Geothermal Energy Development and Finance Workshop. The bank has taken interest in US projects and is poised to finance geothermal energy development throughout the western US.

Magnús Bjarnason, executive vice president of Glitnir, said, “The US market is extremely attractive to us. The amount of megawatts slated for delivery from geothermal energy is trending upward; 50% higher than just 6 months ago. To US officials and project consortiums seeking investment, Glitnir has the right combination: a proven track record and size - over $31 billion dollars in assets. Our experience and capital mean that we are poised to be the investor and trusted advisor of choice in the ‘new frontier’ of geothermal energy in the United States.”

Geothermal energy, which uses the earth’s heat to generate energy, produces almost no greenhouse gases and is one of the most sustainable energy sources available.

In Iceland, geothermal energy supplies about 18% of the country’s electricity, 90% of heating, and 90% the country’s hot water supply, and geothermal power plants are turning substantial profit. Glitnir is utilizing Iceland’s experience and expertise to efficiently develop geothermal energy production in other countries, including the US. The US market for geothermal energy is currently valued between $1.3 billion and $1.7 billion a year.

“We are in talks with a California energy company to build a major geothermal power plant in the state with 50 MW capacity. New plants can produce energy at costs comparable to conventional fossil-fuel burning plants, and in the long run are much more economical,” said Bjarnason. Glitnir plans to expand its role in developing America’s geothermal energy sector by underwriting research and development as well as power-plant construction and geothermal exploration.

For every dollar invested on geothermal energy, the resulting growth of output to the US economy is $2.50. States with significant geothermal resources include: California, Nevada, Utah, Arizona, New Mexico, Hawaii, Alaska, Oregon, Washington, and Idaho.

The workshop included representatives from the Union of Concerned Scientists, US House of Representatives Speaker Nancy Pelosi’s office, and the US Department of the Interior, among others.

Saudi Aramco tops study of best-performing oil companies

Saudi Aramco is the Middle East’s best-run national oil company (NOC), according to an exclusive analysis of the region’s national oil companies carried out by the Middle East Economic Digest (MEED).

The study scored NOCs in 10 key areas of activity, including commercial performance, downstream investment, freedom from political interference, commitment to staff training, and environmental protection. Scores out of 10 were awarded under each of the criteria, with these then analyzed to provide an overall company performance ranking.

Saudi Arabia’s state oil company, Saudi Aramco, scored highest in a comprehensive survey of the region’s 10 biggest national oil companies carried out in early May. Combining statistical performance indicators with expert opinion from top industry executives in the public and private sector, leading analysts and senior academics, the survey put Aramco at the top with a score of 80 out of a possible 100.

MEED’s editor-in-chief Sean Brierley commented, “The Saudi oil giant has outperformed its regional counterparts in almost all categories. When it comes to production, technology development and commercial performance it is head and shoulders above the competition.

“Saudi Aramco falls short on just two measures - its effectiveness in partnering with other companies and its record on the environment. Time will tell whether they will replicate here, the other high standards they have set.”

The Abu Dhabi National Oil Co. (ADNOC) and Qatar Petroleum were tied in second place with 73 points, and Algeria’s Sonatrach and Petroleum Development Oman also scored well. However, the study went on to reveal that the region’s other 5 major producers all failed to make the grade, with the national oil companies of Kuwait, Egypt, and Iraq being the worst performers.

The study highlighted the crucial importance of political independence, quality of personnel and development of technology to the performance of state oil firms. All were notable failings in the worst-ranked companies.

It also drew attention to the challenge presented to international oil companies by the onset of an era in which national oil companies are expected to dominate. If the major foreign oil firms are to maintain their strategic position in the market, they too will need to adapt to the new environment.

Addax Petroleum trading LSE; optimistic following independent exploration potential study

Addax Petroleum Corp., an international oil and gas exploration and production company with a strategic focus on West Africa and the Middle East, has been admitted to the official list of the UK Financial Services Authority and have begun trading on the main market of the London Stock Exchange under the ticker symbol “AXC”.

Commenting, Addax Petroleum’s president and CEO, Jean Claude Gandur, said, “Our LSE listing will provide investors with an additional venue for trading the corporation’s shares and we believe that it will increase the Addax Petroleum’s visibility and expand its investor base. Given the size the corporation has achieved and the growth still to come, we felt that a secondary listing in London would be an excellent complement to our primary listing in Toronto.”

The primary listing for common shares of Addax Petroleum will continue to be the Toronto Stock Exchange, further, Addax is not issuing any new common shares in connection with admission.

Citi is the financial advisor, Freshfields Bruckhaus Deringer is the legal advisor, and Pelham Public Relations is the public relations advisor to the corporation in connection with the LSE admission.

In related news, Addax is optimistic about recent exploration potential study findings. Netherland, Sewell & Associates Inc. (NSAI), independent oil and natural gas reservoir engineers, completed the prospective oil and contingent gas resources report, which evaluated Addax’s identified prospective oil resources and contingent gas resources.

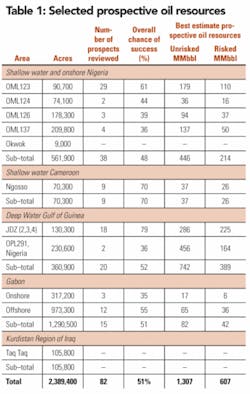

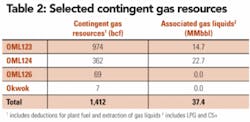

As of December 31, 2006, NSAI estimates working interest best estimate unrisked gross prospective oil resources for Addax to be 1,307 MMbbl and the corresponding risked estimate to be 670 MMbbl. In addition, NSAI estimates working interest best estimate gross contingent gas resources for the corporation’s properties to be 1,583 bcf. The prospective oil resources and contingent gas resources are in addition to Addax’s proved, probable, and possible reserves as reported by the corporation on January 18, 2007.

Gandur said, “The independent assessment by NSAI of our prospective oil and contingent gas resources clearly demonstrates the upside potential of Addax Petroleum. We have built and continue to build a true E&P company that has a balance of both significant cash flow generating production and high impact exploration potential. We have also assembled the capabilities required, including a high quality exploration team, for us to develop and realize on the substantial upside identified in the NSAI Resource Report.”

In undertaking its assessment of prospective oil resources, NSAI relied upon the prospect, lead and work-in-progress inventory developed by Addax Petroleum as at December 31, 2006. At that time, the corporation’s prospect and lead inventory was more developed in some license areas and less so in others. The corporation considers its exploration prospect inventory to be well developed for its shallow water and onshore Nigeria license areas, to be partially developed for its Cameroon and deepwater Gulf of Guinea license areas, to be predominantly undeveloped in its license areas in Gabon, and yet to be developed the Kurdistan Region of Iraq.

Development of a complete exploration prospect inventory for each license area includes the acquisition, processing, interpretation of seismic or geological mapping of prospects.

Table 1 summarizes selected prospective oil resources information as of December 31, 2006.

Since December 31, 2006, Addax Petroleum has undertaken exploration activity on its OML123 and OML137 license areas, offshore Nigeria. On OML123, the corporation successfully explored and appraised the Antan prospect, whereas on OML137, the corporation is currently drilling the Ofrima North prospect and has encountered gas and oil zones.

In respect of contingent gas resources, the NSAI Resource Report is limited to the corporation’s producing license areas in the shallow water and onshore license areas in Nigeria. They are categorized as contingent because the commerciality of the gas resources and the corporation’s rights to produce the gas resources have yet to be established. Table 2 summarizes selected contingent gas resources information as of December 31, 2006, including associated gas liquids quantities.

Addax is in negotiation with Nigerian government for the development of the contingent gas resources from the corporation’s license areas.

Addax Petroleum is one of the largest independent oil producers in West Africa and has increased its crude oil production from an average of 8,800 b/d in 1998 to an average of nearly 116,000 b/d for the first quarter of 2007.