ATP’s business model: bringing undeveloped properties to production

Don Stowers, Editor, OGFJ

EDITOR’S NOTE: Houston-based ATP Oil & Gas made headlines in 2006 by giving all its employees a trip to Sweden and a new Volvo by way of thanking them for a highly successful year. The company has steadfastly continued its strategy of acquiring low-risk undeveloped properties in the Gulf of Mexico and the North Sea and bringing them to production. As a result, ATP’s performance is a cut above the industry average. Paul Bulmahn, chairman and president of the company, sat down with OGFJ recently to explain his company’s strategy and elaborate on his plans.

OIL & GAS FINANCIAL JOURNAL: ATP ended 2006 with record reserves, an annual production increase of 155%, and a robust reserves replacement ratio of 315%. How did you do it?

PAUL BULMAHN: Thank you, Don, for giving me an immediate opportunity to recognize and applaud the efforts of the exceptionally productive people around me at ATP. We have consistently addressed our business plan of acquiring low-risk undeveloped properties, developing them rapidly to secure high rates of return, and producing and marketing them effectively. The execution of that business strategy by our highly productive people is what has enabled ATP to achieve the growth metrics year on year and quarter on quarter we have enjoyed.

Significant production growth was driven by the company’s successful completion of 100% of its wells (10 of 10) over a 15-month period. Further, the company continues its exceptionally strong development success record of 98% taking projects to production that were previously undeveloped and non-producing.

In addition to achieving record production growth, ATP added significantly to its portfolio of low-risk reserves with acquisitions surrounding strategic hub locations. We have been able to secure high working interests and operating control of a number of opportunities near our infrastructure hubs, creating economies of scale and operational synergies. That has further contributed to our robust metrics as a company.

OGFJ: Earnings have fallen for many US producers the past couple of quarters, yet ATP had record quarterly revenue and net income in the first quarter of 2007. The company moved up two places in the latest OGJ200 rankings [August 2007 OGFJ], past Swift Energy and Penn Virginia Corp., to 43rd among US producers. How did ATP manage to produce better results than the industry average?

BULMAHN: We have steadfastly “stuck to our knitting” and over time we have steadily improved our ability to perform offshore development operations. I also firmly believe ATP’s personnel are not just average – I think our employees are exceptional and we should be producing above average results, as we are doing.

ATP’s revenue for the first half of 2007 was $278.5 million. The total annual revenue for ATP in 2005 was $146.7 million. That huge growth is from projects in our inventory getting developed and the way we have expanded our inventory ensures dramatic growth through 2009 from projects we already own and operate.

It is perhaps unfair to be comparing the success ATP is enjoying with other companies in the E&P sector because our inventory of development projects has become so robust. The development of properties which have already been drilled by another company enables ATP to build consistently with sound information from a combination of seismic interpretation, drilled logs and core sampling, instead of the much higher risk gamble of the exploration company that your next wildcat may be the elephant you hope for or may turn out to be something much less.

OGFJ: When we previously talked over lunch at the St. Regis back in April, ATP shares were trading at about $38. Today, they’re around $45. What do you need to do to increase shareholder value further?

BULMAHN: Currently there is still a disconnect between ATP’s value and the value shown in the market. Investors have a “wait-and-see” attitude pertaining to our production step changes. With a company our size that is first tripling then doubling its production in consecutive years, it may be hard for investors to believe that this growth will continue. However, looking at the capacity of the next projects already being developed, we expect production levels to be at 300 million cubic feet per day (MMcfe/d) by the end of 2007 and 400 MMcfe/d by the end of 2008. ATP strives to continue reserve and production growth to increase shareholder value and when we discover property additions to our inventory, particularly at or around our hub infrastructure locations, we are able to factor them into our projections.

OGFJ: According to your website, ATP is engaged exclusively in development and production of oil and natural gas in the offshore Gulf of Mexico and the North Sea. Do you plan to diversify the company by expanding into other geographic areas or get involved in onshore activities?

BULMAHN: The opportunity set in the deepwater Gulf of Mexico and North Sea is so strong ATP does not want for projects to add to our already extensive inventory. However, ATP is continually evaluating new opportunities. ATP’s business strategy can operate anywhere in the world where particular criteria exist:

OGFJ: How did ATP fare during the 2005 hurricane season? Were any of the company’s properties damaged or production impacted by Katrina or Rita? If so, what have you done to minimize the disruption caused by future storms?

BULMAHN: Hurricanes Katrina and Rita negatively impacted ATP’s production by deferring to future periods approximately 9.0 Bcfe of anticipated 2005 production. Tie-in of off-line production was delayed due to damage to third-party infrastructure at a time of scarce resources and ever increasing costs due to the demand for such services. Hurricane-related repairs impacted ATP with increased lease operating expenses (LOE) in 2005 and 2006. Fortunately, on the Outer Continental Shelf, our operations are now sufficiently scattered geographically that the impact to ATP of any one storm should be limited.

We continue to design every offshore facility to weather the 100-year storm criteria and, for example, specifically modified our mooring system from eight anchor lines to 12 taut-leg polyester mooring lines utilizing suction embedded plate anchors for the ATP Innovator, a semi-submersible deepwater production platform at our Gomez field in Mississippi Canyon Block 711.

OGFJ: What are some of ATP’s major producing projects in the GOM and the North Sea and how did you happen to acquire them?

BULMAHN: In the GOM Deepwater, ATP’s Mississippi Canyon 711 (“MC 711”) is ATP’s largest project on production. Previously, the field was producing at 115 MMcfe/d net, meeting the existing processing capacity of the ATP Innovator. After a facility capacity upgrade, production is expected to rise to approximately 200 MMcfe/d. During the second quarter, ATP drilled a MC 711 #8 well and on a well test the well flowed at the limit of the testing equipment. We anticipate booking additional proved reserves at year end because of the results of this well.

Three successful wells were drilled during 2007 at ATP’s Ship Shoal (“SS”) 351 in the Gulf of Mexico Shelf. Based on the results of two of those wells at SS 351 which are currently producing, ATP plans to drill possibly two additional wells.

In the UK North Sea ATP produces from three wells at Tors, the most recent of which (G1) was placed on production in February of 2007. ATP is currently drilling a fourth well (K3) at Tors. The K3 well is expected to be completed and on production in the fourth quarter 2007 in time to take advantage of expected higher winter prices.

Wenlock is a property about to produce in the Southern Gas Basin of the North Sea. The well flowed at a rate of 58 MMcfe/d, the limit of the test equipment, and was completed in the Rotliegend Leman sandstone in two fault blocks. The platform is installed, the pipeline is completed and all that must happen for production to begin is the completion of tie-in activities at the host platform.

All of our properties are secured from the most active exploration companies. It makes more sense for them to continue to drill their biggest and best prospects than to devote precious resources, time, money, and talent to developmental activities. If they can flip their less strategic discoveries to a developmental company like ATP, which is capable of rapid development and is willing to reward them with value, like an overriding royalty interest, they can be more focused on what they can do best – exploration.

OGFJ: ATP is headquartered in Houston with overseas offices in the UK and the Netherlands. At this time, how much of your production is in the Gulf of Mexico and how much in the North Sea? Do you expect this to change significantly in the future?

BULMAHN: Approximately 80% of ATP’s production is in the US and 20% is produced in the North Sea. Our proved reserves are more balanced, 57% in the US and 43% in the North Sea. Production mix will change over time due to new acquisitions, developments, and natural gas prices; however with current plans, UK production is expected to increase to 30% of total production when Wenlock begins to produce.

OGFJ: You mentioned previously that ATP likes to acquire and develop properties with proved undeveloped reserves that are economically attractive to ATP but are not strategic to exploration-oriented oil and gas companies. This sounds like a low-risk but capital intensive strategy. How successful have you been, and how did you go about securing funding for this type of development?

BULMAHN: ATP often acquires properties with royalty interests, and thereby the exploration company that divested itself of a property to ATP can enjoy a continuing revenue stream from that property after it is placed on production. We believe it makes a big difference when they are able to work with a company like ATP with a high success rate of bringing properties to production. ATP also reduces capital outlays by developing projects to a “value creation” point and then selling or bringing in partners.

Marshalling capital has always been critical to offshore development, but it is easier to finance development activities than exploration. During ATP’s early years we project-financed the development of each of our projects. The discipline it takes to satisfy project financing has stood us well through the years. Because of our 98% success rate since the beginning of ATP bringing undeveloped properties to production, it has become much easier to finance our activity level with each passing year. I also am willing now to leverage our development projects with debt financing because of our strong track record and success rate. The last handful of financings we have completed have been well oversubscribed.

OGFJ: You have said that management’s decision to invest significantly in state-of-the-art technology has helped position ATP as a leader in the industry and that ATP’s people consistently extend existing technology to find the economic answers demanded by these times. Can you elaborate?

BULMAHN: We are proud of the fact that ATP has been recognized for its innovative use of technologies. For example, in 2003, ATP recycled and relocated a platform from our GOM Vermilion 410 development located in 365 feet of water and installed the removed platform directly onto a newly constructed plinth at our Garden Banks 142 property located in 542 feet of water. By utilizing the plinth, ATP was able to immediately re-employ a platform that would have otherwise been towed to the beach and reworked or salvaged, which dramatically improved project economics. We have now utilized that technology repeatedly with great success.

In 2006, with limited infrastructure in the vicinity and an aggressive schedule to first production, ATP elected to develop its Mississippi Canyon 711 property in the Gulf of Mexico with a converted first generation semi-submersible rig. The nearest platform for tieback was over 30 miles away, which would have introduced flow assurance problems and cost impediments. The ATP Innovator semisubmersible floating production platform is permanently moored by a 12-point taut-leg polyester mooring system, fixed to the seabed via suction embedded plate anchors. This is the first time a floating production unit is using these types of anchors in the GOM; polyester mooring provides lower cost and, we believe, better performance than conventional steel catenary systems. The company installed the facility and began first production within 16 months of project sanction, despite hurricanes Katrina and Rita. Those are a couple of examples of “practical innovations” that benefited ATP greatly.

OGFJ: Can you tell us a little about your senior management team and professional staff and the role they play in bringing these projects to fruition?

BULMAHN: Everything at ATP begins with the acquisition of an undeveloped property to develop containing a hydrocarbon discovery. Jerry Schlief, senior vice president, is ATP’s acquisition specialist and with his negotiating skills and numbers-oriented background (a CPA/MBA), he can conceptualize a transaction intellectually and creatively find a way to make it work for both parties. Al Reese, our CFO who is also a CPA/MBA, enjoys the building of trust between ATP and its shareholders and finding financial solutions for ATP’s acquisitional and developmental needs. Leland Tate, chief operations officer, heads up all ATP operations in the Gulf of Mexico and the North Sea from his wealth of experience with ARCO in both of those regions, and, just prior to joining ATP he retired as president of an ARCO subsidiary. John Tschirhart, general counsel and senior vice president, international, has effectively found ways to minimize the company’s legal exposures and maximize our contractual advantages internationally. Isabel Plume, chief communications officer and corporation secretary, joined ATP seven years ago after being named the outstanding graduate of the Texas State Graduate School of Business, adeptly manages investor relations and public communications for the company as well as assumes responsibility for all corporate records and record keeping. Keith Godwin, chief accounting officer, has done an awesome job of building our accounting department and enabling it to address the many responsibilities of public company financials. Every member of the senior staff has been remarkable in contributing mightily to ensure ATP smoothly achieves exceptional growth over time.

In addition, ATP has assembled a technical team that averages 21 years of oil and gas experience with comprehensive backgrounds in engineering, geology, and geophysics, and extensive technical and operational expertise. They consistently continue to educate themselves with latest technology changes, enabling ATP to remain on the cutting edge of what’s going on in the industry and to apply that technology to ATP’s projects.

OGFJ: Where will your drilling focus be in the next year?

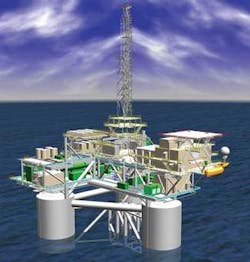

BULMAHN: Drilling will continue in our core areas of the GOM and in the North Sea where ATP is evaluating additional drilling opportunities in the vicinity of the Wenlock property. One exciting development for ATP is the construction of a floating drilling and producing platform called MinDOC. At ATP’s deepwater GOM Telemark hub, drilling will occur at Mississippi Canyon 941/942 via a platform rig to be located on the MinDOC. The Atwater (“AT”) 63 well is expected to be drilled from a floating drilling unit with an eventual subsea well at AT 63 tied into the MinDOC. It will serve as the primary production facility for MC 941/942 and AT 63. Construction of the hull is underway in Texas and construction of the topside is progressing in Louisiana. The MinDOC sail-out is currently scheduled for the summer of 2008 with first production late in the same year.

OGFJ: Is rig availability a serious concern, and what are you doing to keep down costs?

BULMAHN: ATP addresses rig availability by utilizing long-term contracts when planning its development schedule. To manage rising costs, ATP is beginning to utilize its own platform rigs on structures, for example, on the Telemark MinDOC.

OGFJ: How difficult is it to find good employees – from professionals to blue collar workers – and what are you doing to assure that you hire and retain qualified people? What do you offer to make ATP more competitive in this area?

BULMAHN: Several weeks ago, the Houston Business Journal published a list of the top 100 public companies in Houston, ranked by fiscal year-end 2006 revenue. ATP jumped onto that list for the very first time. Of those 100 companies, 19 of them have fewer than 1,000 employees. Of the entire 100 companies, ATP has the smallest number of employees with only 59 employees globally. We have become a mini-powerhouse of productivity, in 2006 generating $419.8 million of revenue with only 59 employees. All of our employees have an incredible work ethic. Since its inception ATP maintains an entrepreneurial work culture, offers a variety of work experiences and international work opportunities.

However, there is a definite shortage of talent in our industry known for layoffs during business downturns. The industry needs to do a better job of retaining qualified individuals and rewarding them. Since the inception of the company I have given stock or options for stock to employees as they join the company. I want to appropriately incentivize employees and give them an ownership mentality. ATP employees own approximately 30% of the company’s equity. When ATP does well, employees share in that success, as do all shareholders.

The retention of high-caliber people is so important I have tried to be creative in the incentives we have employed. For 2005 we set ambitious goals with the reward being a new Volvo S60 for each employee. By the deadline ATP practically tripled its production rate and surpassed its goal of increasing proved reserves 200% by achieving an impressive 1,367% reserve replacement. In 2006, ATP employees and their spouses (or best friends if not married) traveled to Sweden to visit the Volvo factory, received their new cars, drove around the countryside, and had their cars transported back to the states by Volvo. But it is interesting as we looked back, it was not about the cars or the trip, ATP really bonded as a company from the camaraderie we experienced.

OGFJ: ATP was founded in 1991 and went public in 2001. What were your goals, and is this where you expected to be after 16 years?

BULMAHN: Our goal, then and now, is execution of our business plan with continued growth. The company has blossomed with strengths I had not anticipated at the outset. ATP has maintained its focus on its core competencies and has demonstrated its effectiveness in evaluation, development, operations, and production technologies.

OGFJ: What would your attitude be if another company made an offer for ATP and how would you react?

BULMAHN: ATP began as a family-owned business. We remain a very close knit group that is always interested in exploring new opportunities for growth. Having said that, however, as a public company our fiduciary responsibility is to our shareholders and it would be incumbent upon us to understand and evaluate the terms of any valid offer.

OGFJ: What will ATP look like in the next five years – bigger, more diversified?

BULMAHN:ATP is primed for continued growth. We have a strong development track record. With our reserve acquisitions over the last three years surrounding strategic hubs and our large inventory of deepwater and North Sea development and exploratory opportunities, we believe we will continue to drive sustainable exceptional production growth.

OGFJ: Is there anything you’d like to add that we haven’t covered?

BULMAHN: Having just issued our second quarter results, it was satisfying to have exceeded all of the estimates of First Call and the consensus of all of the bright knowledgeable analysts who cover ATP. Our production outstripped projections, our revenue exceeded all consensus estimates and our EPS and CFPS actuals were substantially in excess of the consensus estimates. We are pleased to have once again exceeded all expectations for our performance.

OGFJ: Thank you for your time. OGFJ