Fiercely competitive Central GoM lease sale nets $2.9 billion

Fiercely competitive Central GoM lease sale nets $2.9 billion

The Minerals Management Service (MMS) recently conducted one of the most competitive auctions ever held in the central and eastern Gulf of Mexico region. Lease Sale 205 saw 723 tracts off the coasts of Mississippi, Alabama, and Louisiana up for grabs in what became the largest total of high bids for a Gulf lease sale since 1983, when the MMS conducted an initial sale of tracts across the entire Gulf.

In total, 73 oil and gas companies bid for blocks, particularly those found in deep and ultradeep waters. Spending on deepwater blocks alone topped $2.66 billion while the overall sale totaled $2.9 billion.

“This year’s lease sale for the Gulf of Mexico attracted a record amount of interest,” said Matthew Jurecky, analyst, Gulf of Mexico Research for Wood Mackenzie. “We forecasted bidding to reach $1 billion, but company spending exceeded our expectations and more than doubled that. This proved to be the most competitive round in history, eliminating the discount that once existed for leases in the region,” he added.

“Companies who looked at past lease sales to value the potential of certain blocks were out–bid,” explained Jurecky. “Bids that historically would have been competitive were mediocre by the new standards set at this year’s sale. Traditional powerhouses such as BHP Billiton, Anadarko, and Hess in the region won less than 25% of their submitted bids in the deepwater.”

Nexen was the high bidder on 30 offshore blocks in the Central Gulf of Mexico OCS Lease Sale 205 with bids totaling net $113 million. Nexen’s current deepwater portfolio totals approximately 230 blocks. Nexen Inc. is an independent, Canadian–based global energy company.

Marathon Oil Corp. was the apparent high bidder on 27 blocks offered in the federal Outer Continental Shelf Lease Sale No. 205 conducted by the Minerals Management Service (MMS). Representing a total investment of $221.7 million net to the company, 13 blocks are 100% Marathon and the remaining 14 blocks were bid in conjunction with partners.

The blocks cover roughly 153,000 acres (gross) in the deepwater Gulf of Mexico, ranging in water depths from approximately 1,450 feet to 8,350 feet.

During the second quarter of 2007, Marathon announced the Droshky discovery (100% working interest) in the Gulf of Mexico. In addition, Marathon entered into a two–year contract for a new deepwater semi submersible drilling rig for Gulf of Mexico activity, which should commence in late 2009 or early 2010. During the fourth quarter of 2007, Marathon plans to commence an exploration well on the Flathead Prospect (100% working interest) and will participate in an appraisal well on the Stones discovery (30% working interest).

Ranking amongst the top ten competitors, with the biggest number of winning bids, was Petrobras. It was the highest bidder for 26 blocks in the sale with the total value of winning bids reaching $108.1 million.

Of the 26 blocks, Petrobras ensured 100% participation and the operator status for 20. The remaining six were bid for in partnership with Devon Energy, two of which will also be operated by Petrobras, while four by the partners. Participation will be shared 50/50.

Participation in the lease sale 205 auction is in line with Petrobras’ strategic plan, which calls for strong international growth with investments in priority areas, including the American sector of the Gulf of Mexico.

Mariner Energy Inc. also did well in the sale. The company was the apparent high bidder on 23 of 61 blocks in the oil and gas lease sale 205. Mariner’s net cost exposure for the high bids was roughly $66.2 million.

Stone Energy was the high bidder on 16. Stone will have a 100% working interest on 10 of the 16 blocks, a 50% working interest on one and a 33% working interest on the remaining five. Stone’s total share of all 16 lease blocks total nearly $12.9 million. The company has five joint bids with Anadarko and one with Samson.

Noble Energy Inc. won nine deepwater lease blocks. Of the nine high bids, Noble Energy joined with Samson Offshore Co. on three and bid alone on the remaining six. In addition to the nine high bids, Noble Energy has the option to acquire an interest in two third–party high bid blocks.

Noble Energy’s share of the lease bonuses on the nine high bids came to nearly $53.5 million. The nine blocks cover in excess of 48,428 acres in water depths ranging from approximately 2,605 feet to approximately 7,651 feet. Noble Energy concentrated its bids on deepwater opportunities in the Mississippi Canyon, Atwater Valley, Green Canyon, Walker Ridge and Garden Banks areas of the Gulf of Mexico.

Of its nine high bids, Noble Energy has a 100% working interest in six and a 50% working interest in the remaining three. If awarded by the MMS, Noble Energy will be the operator of all nine blocks.

All winning bids are subject to verification by the Minerals Management Service.

Attention to operations leads to subsea success for Expro

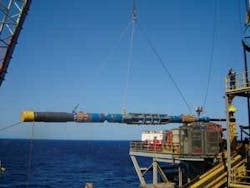

Oilfield service company Expro has completed the 1,000th deployment of its Expro Landing String Assembly (ELSA) subsea safety system, which provides a safe and environmentally–secure operating system for the commissioning of subsea wells.

It has been 10 years since large bore safety systems became the established method of completion installation in conjunction with horizontal subsea trees.

Expro’s track record includes over 15,000 rig days with an operational uptime of over 99%, and the company’s Brazilian team holds the world record for performance at a depth of 8,993ft.

The company has designed the industry’s first 15,000psi, 250degF–rated, large–bore, electro–hydraulic system to clean up wells developed with horizontal subsea trees. This system allows large–bore subsea completion and interventions to be conducted safely in water depth up to 10,000ft. The system is poised to tackle the emerging demands of the deepwater high–pressure subsea Gulf of Mexico market.

Expro also recently completed an ultra deepwater job off the coast of Egypt using the Subsea ELSA–EA landing string in conjunction with the Express–EH deepwater control system. This was the first ultra deepwater test performed in North Africa, in a water depth of 7,861ft, using a 10,000ft reel pack.

Recently, the company completed a deepwater operation in over 5,000ft of water in the Gulf of Mexico, using its ELSA and Express 7 landing string system.

Newfield Exploration exitsNorth Sea business with sale

Centrica plc, the owner of British Gas, has purchased the entire share capital of Newfield UK Holdings Ltd., the UK subsidiary of Newfield Exploration Co., for $486.4 million in cash. The sale, which is subject to UK government approvals, is expected to close in the fourth quarter of 2007. This marks a complete exit by the company from the North Sea.

Centrica will take an 85% operated interest in the Grove gas field which started production in summer 2007, an 80% interest in the Seven Seas gas development, the Sloop gas discovery, and associated exploration acreage. Centrica’s partner in the field is Sojitz, a Japanese conglomerate, with 15% interest. Seven Seas is a development prospect which Centrica will operate with an 80% interest, with Sojitz holding 20%.

First production is anticipated around 2010. Exploration acreage includes interests in six licenses within the Southern North Sea. The seller is Newfield International Holdings Inc. The purchaser is GB Gas Holdings Ltd., a subsidiary of Centrica plc.

Newfield’s production guidance (issued July 25) accounted for this sale and other anticipated divestitures and remains 240 – 253 bcfe in 2007 and 215 – 230 bcfe in 2008.

Jefferies Randall & Dewey acted as financial advisor for Newfield in this transaction.

Newfield Exploration is an independent crude oil and natural gas exploration and production company. Newfield’s domestic areas of operation include the onshore Gulf Coast, the Anadarko and Arkoma Basins of the Mid–Continent, the Rocky Mountains, and the Gulf of Mexico. The company has international operations in Malaysia and China.

Roxar launches next generation structural modeling

Roxar, a technology solutions provider to the oil and gas industry, has launched its next generation structural modeling solution.

The solution, which includes an intuitive user interface, new fault and horizon modeling tools, and improved 3D and integrated simulation gridding, will lead to quicker and more accurate characterizations of the reservoir, better decision–making with greater financial returns on data acquisition, and maximum reservoir performance.

Roxar CEO, Gunnar Hviding said, “Increasing operators’ ability to build or update structural reservoir models accurately and rapidly is one of the most significant productivity enhancement opportunities available in reservoir management today.”

“Through Roxar’s structural modeling solution, operators will be able to dramatically speed up the structural modeling process and improve the quality of their models with the level of structural complexity modeled being a user choice rather than one imposed by the technology. The result will be the unlocking of huge productivity improvements, a much greater return on investment from data acquisition and interpretation expenditure, and the very best in reservoir characterization,” he continued.

BLM brings in $8M in recent lease sale

Ninety–nine parcels of Federal subsurface land in Arkansas and Louisiana brought in almost $8 million during a competitive auction of oil and gas leases in which 100% of the available leases sold.

The sale was conducted by the US Department of the Interior’s Bureau of Land Management (BLM) on September 13, 2007 in Springfield, Virginia. Approximately $3.9 million will go to the US Treasury and $4 million will be shared by the affected States.

The highest per–acre bid of the auction was by Stellios Exploration Co. of Lafayette, La. at $5,400 per acre for subsurface land in Louisiana. Chesapeake Exploration LLC of Oklahoma City paid over $885,000 for a 552 acre parcel in Arkansas.

Leases are awarded for a term of 10 years and as long thereafter as there is production of oil and gas in paying quantities. The Federal government receives a royalty of 12.5% of the value of production. Also, each State government receives a 25% minimum share of the bonus bid and the royalty revenue from each lease issued in that State.

The next competitive oil and gas lease sale is scheduled for December 13, 2007 in Springfield, Virginia.

Successful results for Nobleat Belinda appraisal well

Initial results from Noble Energy’s Belinda appraisal well on Block “O” offshore Equatorial Guinea are encouraging. The O–3 appraisal well, located in 1,740 feet of water and roughly 4.2 miles southwest of the original Belinda discovery (O–1), was drilled to a total depth of 9,500 feet.

The O–3 well successfully extended the Belinda discovery by establishing significant downdip resources. Reservoir quality at the O–3 location was even better than was encountered at the O–1 discovery location while maintaining reservoir thickness.

Test results show condensate–rich natural gas producing at maximum flow rates of 30.4 MMcf/d of natural gas and 1,540 b/d of condensate, or roughly 6,607 boe/d. Maximum flow rates from the original Belinda discovery were 24 MMbcf/d of natural gas and 1,225 b/d of condensate, or nearly 5,225 boe/d. With the installation of cooling and processing facilities, condensate yields can be increased.

Noble is the technical operator of Block “O” with a 45% participating interest. Its partners on the block include GEPetrol, the national oil company of the Republic of Equatorial Guinea, with a 30% participating interest, and Glencore Exploration Ltd. with a 25% participating interest.

Charles D. Davidson, Noble’s chairman, president, and CEO, said, “The success of our Belinda appraisal well exceeded our expectations and is significant from several perspectives. It infers lateral continuity and quality of the reservoir, confirms significant resources downdip of the original discovery well, and it provides another calibration point for seismic attributes.”

Chevron secures Australian approvals for Gorgon natural gas development

Chevron Corp. has received Australian government environmental approval for the Gorgon liquefied natural gas (LNG) development proposal located off the northwest coast of Australia.

“Chevron recognizes both the state and federal governments’ thorough environmental review process,” said George Kirkland, executive vice president, Upstream and Gas. “This environmental approval is based on four years of extensive work and collaboration, which included a wide range of local and global scientific experts, conservation groups and government agencies.”

The Federal Minister for the Environment’s decision follows state environmental approval received from the West Australian Minister for the Environment earlier in September.

Headquartered in Perth, Western Australia, Chevron Australia is operator and 50% joint–venture participant in the Gorgon Project; a joint–venture participant in the North West Shelf Venture; operator and joint venture–participant in the Barrow Island and Thevenard Island oil fields; and operator of significant exploration acreage located off the northwest coast of Australia.