Share repurchase activity could hit $25 billion this year

Arthur L. Smith

John S. Herold Inc.

Houston

Don't look now but the super giant oil companies are on the Atkins Diet, too. And they're getting slimmer by the day, that is in total shares outstanding.

John S. Herold's analysis of the common stock acquisition activity of the Big Six – BP (BP:$54.88), ChevronTexaco (CVX:$99.65), ConocoPhillips (COP:$76.27), ExxonMobil (XOM:$46.98), Royal Dutch (RD:$51.73)/Shell Transport (SC:$45.20), and Total SA (TOT:$99.10) – found share repurchases amounted to a record $10 billion in the first half of 2004 (versus $12 billion for all of 2003).

Herold estimates that for the full year the Big Six could return an impressive $25 billion to shareholders through treasury stock repurchases.

ConocoPhillips is not yet active in share repurchases. Instead, that company is concentrating on strengthening its balance sheet. Also, Royal Dutch/Shell's turmoil in the boardroom slowed its pace of share buybacks to $600 million in the first half of 2004 versus a peak of nearly $4 billion for all of 2001.

Consider that the Big Six have repurchased $67.2 billion of their common shares over the past seven and one half years – equivalent to collective market values of mini majors Amerada Hess (AHC:$82.48, $7.5 billion); PetroCanada (PCZ:$48.36, $12.8 billion); Marathon (MRO:$37.09, $12.8 billion); Murphy (MUR:$76.93, $7.1 billion); Norsk Hydro (NHY:$65, $16.6 billion); and Suncor (SU:$28.98, $13.0 billion).

Channeling surplus cash flow

Much has been written concerning the "new religion" in capital investment performance of the super giant oil companies. Remaining true to capital discipline principles, these companies have seen the pace of upstream and downstream investment greatly lag strong oil and gas prices and rising cash flows in 2003 and 2004.

For investors, this thrifty behavior by the petroleum giants is a welcome contrast to the historical Pavlovian response to soaring cash flows coupled with even greater increases in capital expenditures. Another benefit to petroleum sector returns has been moderate oilfield drilling and equipment sector inflation.

Cash has been building on the balance sheets of the super majors. Herold estimates that the Big Six will generate roughly $138.2 billion of cash flow this year versus capital outlays budgeted at $68.5 billion. The Big Six will return about $27.6 billion to investors through common dividends this year – an average yield of approximately 2.9 percent. Cash flow for 2004 minus capex and dividends equals $38.2 billion of surplus cash for the Big Six, by our reckoning.

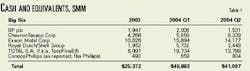

As shown in Table 1, the Big Six were still sitting on a lot of cash at the end of the June quarter. Total SA paid out its annual dividend in the second quarter, and that accounts for the decline in its cash on hand. However, it should be noted that Total's stake in Sanofi (which is being divested sometime during 2005) is valued at $12 billion ($9 billion after tax) and is not reflected in the data in the table.

The Big Six seem to be taking the advice of Warren Buffett, who told his investors in Berkshire Hathaway, "Cash never makes us happy. But it's better to have money burning a hole in Berkshire's pocket than resting comfortably in someone else's."

What to do with the cash

The corporate finance equation is quite simple: whatever cash flow is left after capital investment and the payment of regularly scheduled dividends builds on the balance sheet unless directed to net debt repayment, special dividend payments, or treasury stock repurchases. Herold's analysis suggests that the Big Six oil companies could step up share repurchases to as much as $10 billion per quarter over the balance of 2004 – double the rate of the first six months.

Treasury stock repurchases can offset creeping dilution from options exercised and restricted shares issued, always a good thing for pre-share metrics. Aggressive treasury share buybacks can markedly shrink the capitalization of a company – as industry leader ExxonMobil has done – and underpin its stock valuation.

Share buybacks help ROACE, too

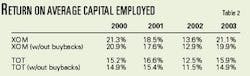

Riding strong coincident upstream and downstream cycles, the financial returns of the super giant oils – as measured by the popular Return on Average Capital Employed (ROACE) – have climbed beyond respectable to impressive levels in the 20-percent range. Since share buybacks are in effect negative book value adjustments, they enhance ROACE results (Table 2).

Net income is divided by a lower denominator of net capital. For example, XOM and TOT, the most aggressive share repurchasers since 2000, have seen their ROACE returns aided (between 0.5 percent and 1.0 percent) by the voluntary reduction in the net equity capital employed of $19 billion and $14 billion, respectively.

Average investor likes buybacks

As our analysis of the super giants has demonstrated, sizable and consistent share repurchases are indeed the friend of the average investor. Consider Total, ExxonMobil, and BP – all among the most aggressive to buyback shares over the past five years, and all among the top-performing large oils in total return to shareholders (Table 3).

The stock buyback trend is spreading to the larger capitalization E&P companies. It is noteworthy that Anadarko's new CEO, Jim Hackett, has incorporated up to $1.5 billion of APC share buybacks into the company's new strategic plan that also features significant divestiture and debt retirement.

Meanwhile, EnCana – despite an active cash acquisition program that swallowed up Tom Brown Inc. in a $2.7 billion cash transaction this year – retired $868 million of stock in 2003 and an additional $230 million for the first six months of 2004.

Other converts to E&P share buybacks are Burlington Resources ($356 million of share purchases in 2003), Encore Acquisition ($176 million), Forest Oil ($185 million), Talisman ($139 million), and Canadian Natural Resources ($103 million). Noticeably absent are super independents Apache, Kerr-McGee, and Unocal.

Intentions of the super giants

ExxonMobil – It can be said of ExxonMobil that when it comes to share repurchases the Las Colinas, Texas-based firm truly "wrote the book." Exxon initiated significant share repurchases in the mid-1980s and from 1986 through 2003 the company has added 1.871 billion shares to treasury at a total cost of $40 billion, or an average of $21.37 per share. Share buybacks at XOM have averaged roughly $5 billion per annum over the past three years. Herold analyst Lysle Brinker opines that XOM could hit $10 billion in share repurchases for 2004, after acquiring nearly $4 billion through June.

Total – It is hardly household knowledge that, after ExxonMobil, Total has been the most aggressive acquirer of its own stock. Since buybacks were initiated by Total in 2000, the Paris-based giant has acquired 100.5 million shares through 2003 for $14.1 billion. Total's share shrinkage since 1999 is an impressive 11 percent relative to ExxonMobil's six percent over the same period. Total acquired some $1.9 billion in shares through June 2004. Armed with $9 billion of expected cash proceeds from its divestment of Sanofi sometime in 2005 and essentially zero net debt, Total is expected to remain a voracious acquirer of its own stock.

BP – Managed by CEO Lord Browne of Mayerling and perhaps the most active portfolio re-shuffler among the giants, BP has mixed a host of acquisitions (Amoco, ARCO, TNK) with sizable divestiture programs and regular share buybacks over the past few years. The price swoon of 1999 caused BP to halt share repurchases, but annual buying of stock has ranged from $600 million to $2 billion in all other years since 1997. With strong results from upstream and downstream driving BP's cash flow to the stratosphere, the company stepped up share acquisitions to a $6 billion annual pace for 2004.

Royal Dutch/Shell – It took new legislation in the Hague for Royal Dutch to institute legal share buybacks, and it did so with gusto in its first year (2001) with $4 billion of shares returned to treasury. RD/Shell's share buyback fell to $1.4 billion in 202 and to zero last year as the Anglo-Dutch giant struggled with boardroom turmoil and major downward reserve revisions. Share buybacks of $600 million were completed in the first half of 2004, and the pace should accelerate in the final months.

Chevron/Texaco – CVX had not been active in the share repurchase game since 2001 when it bought back $1.6 billion worth of its own equity. That changed in the second quarter of this year when the company announced a three-year, $5 billion share-repurchase program. To kick off the program, CVX purchased $600 million worth of shares during the second quarter.

ConocoPhillips – COP has no current significant program to repurchase its own stock. The company is intent on getting its debt level below 30 percent, which should be accomplished by the end of the year. In the meantime, COP may do some minor share purchases to cover option exercises, etc., aiming to keep shares outstanding below 700 million. However, should commodity prices stay firm, the company could possibly institute a share-repurchase program starting in 2005. ogfj

The author

Arthur L. Smith is chairman and CEO of John S. Herold Inc., a specialized research and consulting firm focusing on valuation, strategy, and performance measurement of the world's leading oil and gas companies. He is a Certified Financial Analyst, a former appointee to the National Petroleum Council, and a member of IPAA, API, TIPRO, AIPN, IAEE, and the Houston Society of Financial Analysts. Smith serves on the board of Plains All American Pipeline LP and on the Board of Visitors of Duke University's Nicholas School of the Environment and Earth Sciences.