Credit rating upgrades trailing high oil, gas prices

Paula Dittrick

Senior Staff Writer

Oil & Gas Journal

Corporate credit rating upgrades have not materialized for US oil and natural gas companies nearly as fast as have high commodity prices and abundant cash flow, primarily because free cash flow volumes relative to total debt still have yet to change.

"The firepower has not been used yet to strengthen balance sheets," Bruce Schwartz, Standard & Poor's senior analyst for the oil and gas ratings group, told clients during a September briefing in Houston.

S&P uses long-term outlooks based upon conservative pricing models. It notes that the exploration and production industry faces a rising cost structure, and that reserve replacement rates have not changed significantly. Meanwhile, merger and acquisition prices for oil and gas assets are escalating.

"Leverage as measured by total debt per barrel of oil equivalent remains largely unchanged for the industry, although the industry should have the capacity to lower it materially in the last few months of 2004 and in early 2005 if it chooses to do so," Schwartz noted in an Oct. 13 research statement.

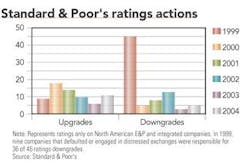

S&P's rating actions during 1999-2004 have been a "surprising net positive," Schwartz said, noting that upgrades have outlasted the downgrades except for 1999.

Credit ratings criteria

A trend of positive ratings actions has outnumbered negative ratings across the E&P industry since 2003 because companies are generating very strong cash flow. But Schwartz noted that increased cash flow is not the only criterion for a ratings upgrade.

"Companies must use the free cash flow for improving their business and financial profiles. Much of the upgrade activity is likely to occur among companies rated subinvestment grade. Most independent E&P companies target the 'BBB' rating category. Therefore, companies with 'BBB+' ratings are largely precluded from ratings upgrades because of financial policy considerations," Schwartz said.

Anadarko Petroleum Corp., Houston, provides an example of S&P's rating policy regarding leverage as measured by total debt/bbl of oil. Anadarko has a BBB+/Stable/A-2 rating.

The company is reducing debt through at least $1.4 billion in anticipated property sales, yet Anadarko's rating upside remains capped because S&P believes Anadarko eventually will use its improved financial position to invest in new growth areas, he said.

Integrated companies are posting very strong profits, but the credit-friendly environment is unlikely to result in many upgrades because many majors already hold high credit ratings consistent with their financial objectives, such as ChevronTexaco's AA.Stable/A-1+. ExxonMobil's literally cannot be upgraded because it holds an AAA/Stable/A-1+, the highest possible rating.

Despite high oil and gas prices, oil and gas companies still face challenges, and managements need to remember that it's always possible for downgrades to be issued, he noted.

"Besides changes in commodity prices and competition for projects and properties, the principal issues confronting E&P companies are depletion—particularly for North American natural gas—cost-containment, merger and acquisition activity, reserve revision risks, and sovereign risks," he said.

Smaller E&P prospects and accelerating depletion rates mean that future cost-containment strategy could hinge on technological innovation. S&P analysts said that they do not see any new technologies immediately available that are likely to slash costs during the next few years.

"The most vulnerable companies are those with short reserve lives because their high asset turnover causes them to experience inflation trends more rapidly than longer-lived companies," Schwartz said.

In addition, S&P is concerned that debt leverage could rise in the near term as companies use mergers and acquisitions to counter accelerating depletion rates and to continue their growth in reserves/share and production/share—key equity valuations.

"An increase in M&A activity could be accelerated by an easy fundraising environment for companies with good credit quality and periods when the value of a company's reserves implied by the futures strip are greater than the price recognized by the equity market," Schwartz said.

Cyclicality

S&P has the job of determining credit ratings throughout cyclical swings in oil and gas prices.

"We may be a little backward looking, but we all have a little whiplash after the last few cycles," Schwartz said. In evaluating a company's credit rating, S&P is using a base price of $24/bbl for oil and a $4/Mcf for gas on the New York Mercantile Exchange.

"The fourth quarter and early 2004 appear to be a rarity: a perfect cycle in which all four segments (E&P, refining, drilling and services, and petrochemicals) simultaneously will have strong profits," he said.

S&P believes that high oil prices are sustainable because of growing demand from emerging markets such as China and India, and because spare production capacity worldwide (excluding Iraq) is estimated at less than 1 million b/d.

"In practical terms, the oil market is close to being sold out. Tight production capacity is also occurring when oil inventories are relatively low. . .If supplies are interrupted for any reason, be it weather or political events, price spikes will likely be necessary to ration demand. Such spikes have occurred in reaction to events in Nigeria and elsewhere," Schwartz said.

If the world economy continues to expand, oil demand and prices are expected to rise. But if world economies slow and the winter were warmer than average, it is likely that oil and gas prices could moderate.

"Until 2006, when several large projects start production, the supply and demand balance is likely to remain exceptionally tight, barring a macroeconomic shock," Schwartz said.