2Q revenues, income inch up, remain down compared to 2012

Don StowersEditor - OGFJ

Laura BellStatistics Editor - Oil & Gas Journal

Revenues for the group of publicly-traded US-based companies tracked by Oil & Gas Journal and Oil & Gas Financial Journal rose slightly in the second quarter of 2013 compared to the first quarter. They increased approximately $3.4 billion (1%) from 1Q13 but were down around $25.6 billion (9%) from the same quarter last year. The second quarter increase halts a string of quarterly revenue declines dating back to the first quarter of 2012 with only one exception during that time, the 4Q12.

Net income for the collective OGJ150 companies increased by nearly $2.2 billion (8%) from the first quarter to the second. However, income fell by more than $5.2 billion (16%) compared to the second quarter of 2012.

The number of reporting companies remained at 129, the same as the previous quarter. Nine companies included in the OGJ150 report failed to report their earnings to the US Securities Exchange Commission by press time for this issue.

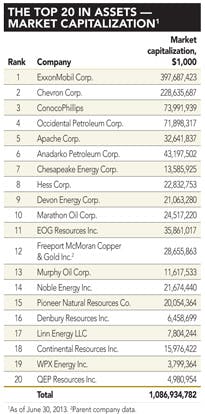

Two companies on the previous report, McMoran Exploration Co. and Plains Exploration & Production Co., are no longer listed as they were acquired by Freeport McMoran Copper & Gold Inc., headquartered in Phoenix, Ariz. The new company enters the list in the No. 12 position as ranked by total assets ($26.6 billion) in the second quarter.

Year-to-date capital spending stood at slightly more than $96.4 billion in the second quarter. This is less than 0.1% difference from YTD capital spending in the 2Q12.

Total asset value for the group grew to more than $1.388 trillion from the previous quarter's total asset value of approximately $1.355 trillion, representing about a 2% increase. Total assets grew by nearly $90.6 billion (up 6%) from the second quarter of 2012.

Stockholder value for the entire group grew by more than $8 billion to $666.6 billion (up 1%) from the prior quarter and by $26.1 billion (up 4%) from the second quarter of 2012.

LARGEST IN NET INCOME

The 20 largest companies ranked according to net income had approximately $24.6 billion in collective net income for the second quarter of 2013. This compares with $26 billion for the 1Q13 and $35.1 billion for the 2Q12. The latest figures represent a 5% decrease from the preceding quarter and a 29% drop from the same quarter in 2012.

The top three companies in net income — ExxonMobil Corp., Chevron Corp., and ConocoPhillips — each showed significant decreases in income from the previous quarter and from the same quarter in 2012. However, ExxonMobil showed the most precipitous drop in income — 28% from the first quarter and 60% from 2Q12. XOM's net income was $17.7 billion in the second quarter of 2012, $9.8 billion in the first quarter of 2013, and $7.0 billion in the second quarter of 2013 (all figures are rounded up).

Despite the net income decline, the three petroleum giants collectively had $14.2 billion in net income for the quarter. This represents around 59% of the total net income for the top 20 companies and approximately 53% of the total net income for the entire group of 129 companies.

Aside from the top three companies, five other companies (Hess Corp., Apache Corp., Anadarko Petroleum, Chesapeake Energy, and Pioneer Natural Resources) moved up one or more positions on the top 20 list; eight companies (Occidental Petroleum, Devon Energy, EOG Resources, Marathon Oil, Murphy Oil, Kinder Morgan CO2 Co., Continental Resources, and Southwestern Energy) fell one or more positions; and one company (Noble Energy) kept the same position. Three companies joined the top 20 list (Linn Energy, Quicksilver Resources, and QEP Resources), while three (Exco Resources, Cimarex Energy, and Denbury Resources) fell from the list.

LARGEST IN TOTAL REVENUE

The top 20 companies in total revenue saw a modest increase from the 1Q13 — a $1.8 billion bump to $226.2 billion (less than 1%). Compared to the same quarter in 2012, total revenue dropped by $27.4 billion (10%) from $253.6 billion.

Total revenue for the entire OGJ150 group was $238.9 billion, so the $226.2 billion in revenue for the top 20 companies in revenue represents 95% of the total for the entire group. The three largest companies ranked by total revenue (ExxonMobil, Chevron, and ConocoPhillips) together accounting for nearly $178 billion in total revenue, or 75% of the total revenue of the 129 companies on this report.

TOP SPENDERS

YTD spending by the top 20 companies as ranked in spending in the second quarter of 2013 roughly equaled spending in the second quarter of 2012. Total spending was roughly $81.2 billion — up just $721 million from 2Q12. The top five spenders for the quarter were Chevron ($16.8 billion), ExxonMobil ($16.6 billion), ConocoPhillips ($7.1 billion), Apache Corp. ($5.1 billion), and Occidental Petroleum ($4.3 billion).

FASTEST-GROWING COMPANIES

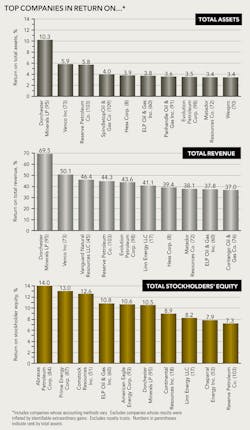

The three fastest-growing companies, ranked according to stockholders' equity, for the 2Q13 are Rosetta Resources (up 48.1%), Halcon Resources (up 18.1%), and Abraxas Petroleum (up 17.6%). Rosetta Resources and Halcon Resources are based in Houston, while Abraxas Petroleum is headquartered in San Antonio.

Rosetta Resources trades on the NASDAQ stock exchange under the ticker symbol "ROSE." Halcon Resources is listed on the NYSE under the symbol "HK," and Abraxas Petroleum trades on the NASDAQ under the symbol "AXAS."

Jim Craddock is chairman, CEO, and president of Rosetta Resources; Floyd Wilson is chairman and CEO of Halcon; and Robert Watson is president and CEO of Abraxas.

Click here to download the PDF of the OGJ150 Quarterly "Quarter ending June 30, 2013"

Click here to download the PDF of the "The OGJ150 Company Index"