Oslo: The new old city

This sponsored supplement was produced by Focus Reports. Project Coordinator: Isabella Romeo Gomez; Editorial Coordinator: Martijn Jimmink; Project Publisher: Ines Nandin. For exclusive interviews and more info, please log onto energy.focusreports.net or write to [email protected] |

The generation living at the time of hydrocarbon extraction is by no means the sole ‘owner' of its value, and is therefore not entitled to spend it," explains Sigbjørn Johnsen, former Minister of Finance, which effectively encapsulates the ideological basis for the economic and financial model that Norway follows in order to preserve and grow its oil wealth for future generations. To hedge the economy against fluctuating revenues and to maintain competitiveness in other sectors of the economy, petroleum revenues are invested abroad through the Government Pension Fund Global (GPFG), referred to in the country as the ‘oil fund.' The profits from this fund are then reinvested back into the economy, building infrastructure and public works that will benefit Norwegians for generations to come, all while continuing to grow the size of the oil fund.

However, the current strategy of the oil fund may now change, following the election of a Conservatives-led coalition in Norway in September 2013, which is considering a number of different changes to the structure of the fund. Proposals from the various groups in the coalition include splitting the fund into two or three competing funds, investing in foreign private equity and infrastructure, or even using the fund for direct investment into domestic infrastructure projects. The fund currently contains around USD 755 billion, with the Norwegian Ministry of Finance forecasting that the fund will reach USD 1 trillion by the end of 2019. Despite the recent change of government, Norway knows that its oil and gas will not last forever, and plans to ensure that for as long as possible, its citizens will be able to benefit from this all-too-temporary good fortune.

Oil As Financial Muscle

The GPFG is open about its investment strategy, its annual results, and the size of the fund. With investments of the GPFG in over 7,500 companies around the world, in both stocks, bonds and real estate, the fund's risk is quite mixed. And just because the fund has the intention of diversifying investments away from Norway, this does not mean that energy is left out: the fund is currently invested in 147 of the world's 200 largest companies in terms of reserves of coal, oil and gas.

The fiscal guidelines for the fund state that only the profits from investment can be reinvested into the Norwegian economy. However, with the fund returning 13.4 percent on its investments in 2012, the second best performance in its history, this strategy appears to be no barrier to investment. In the Nordic region, Norway is commonly referred to as the ‘rich cousin' for a very good reason.

As Christer Tryggestad, director at McKinsey & Company explains, the discovery of oil on the Norwegian Continental Shelf (NCS) has revolutionized life in Norway. "For more than 40 years, petroleum production on the shelf has created considerable wealth for the country. The Norwegian government and regulatory bodies have done an extremely good job in getting the most out of the resources on the shelf. In fact, other hydrocarbon-rich governments now implement the Norwegian model."

While it may seem that Norway is benefiting from its attempts to diversify its economic base, the problem of over-dependency on oil may be more deeply entrenched than the government likes to admit. As the Pareto Group, a Norwegian holding company, wrote in its 2012 annual report: "The Norwegian economy was solid to the core — but was probably more oil-fueled than most people realize." Svein Støle, CEO of the holding company, explains that with a continued high oil price, "the oil sector will remain extremely profitable and as a result will attract the best people, thus increasing labor costs. At the same time the public sector will continue to grow, while many ordinary businesses are feeling the pressure between a lucrative and profitable oil industry and the public sector increasing its wages."

Despite the attempts of the government to preserve oil wealth for future generations, it is clear that Norwegian citizens today do feel the results of the oil boom in their everyday lives. On The Economist's 2013 ‘Big Mac Index', which aims to show the purchasing power of citizens in countries around the world, Norway comes in at the top of the list, at USD 7.51 for a Big Mac, against USD 4.66 in the EU area and USD 4.56 in the US: in raw terms, the Big Mac is overvalued in Norway by 64.7% when compared to the exchange rate between the NOK and the USD. There is a danger that Norway's oil sector will leave other industries out in the cold because of the salaries on offer for skilled workers.

However, this situation is not a new one, and despite the challenge of rising wages and increased living costs, the Norwegians remain generally stoical, as is their wont. Eivind Reiten, former Minister of Petroleum and Energy and former CEO of Norsk Hydro, sums up the situation by saying: "It has been a consistent issue, albeit a small one, ever since we found oil in the country. However, Norwegians have not broken a single window in any shop over the last 40 years despite some challenging decisions. Norwegians citizens are extremely disciplined."

While economically, the country might be heavily influenced by the oil and gas sector, in power generation at least, Norway has established real independence: today, over 99% of Norway's electricity production comes from hydropower plants. Around 850 small hydroelectric plants situated all over the country generate almost all of the country's electricity. As a result, all of Norway's produced gas and most of its oil is exported.

Oslo's Heritage

Until today, the Stavanger area has seen most of the effects of the Norwegian oil boom; the city is widely referred to as the oil capital of Norway, despite being a town with a population of just under 125,000. The largest company in Stavanger, alongside a number of large E&P players working and operating on the Norwegian Continental Shelf (NCS), is Norway's national oil company (NOC) Statoil, which has its headquarters located just outside town. Nevertheless, an increasing number of oil-related firms are now setting up head offices in Oslo.

Among the firms that decided to establish in Oslo is Lundin Petroleum, a Swedish independent oil and gas exploration and production company with core operations in Norway and Southeast Asia. "That we remained in Oslo was something new," says Torstein Sanness, Lundin's Managing Director. Lundin, with its main offices in Lysaker in the Oslo area, is involved in one of the largest oil discoveries ever made on the Norwegian shelf, Johan Sverdrup, together with Statoil and Det Norske Oljeselskap.

"In Oslo we take advantage of a larger talent pool. We have seen quite a few companies wanting to participate on the NCS setting up their offices in Stavanger. As a result these companies are facing challenges, as people stay for only two years then leave. For that reason, companies are starting to move from Stavanger to Oslo. Naturally, if you change out your crew every two years there is no continuity; it is expensive and makes it impossible to establish a company culture," Sanness explains. Among other companies that have recently moved to the Oslo region is also the French oil company Technip, which hired an additional 100 staff in 2012.

Even though Statoil is headquartered in Stavanger, the company has now opened a new 67,000m2 non-headquarters office in the Oslo area for 2,600 employees, which has corporate functions and heads the NOC's international operations. The noteworthy structure, costing the company around USD 313 million and comprised of nine-floor building blocks stacked vertically and horizontally, has enabled Statoil to consolidate its activities and strengthen its position in the Oslo region.

Amund B Tørum, Partner at law firm Schjødt, explains that the heritage of Statoil derives from three major Norwegian petroleum companies: Statoil, Norsk Hydro and Saga Petroleum, which were all originally based in the Oslo area. "After the merger between these companies, a number of excellent people in Oslo became available. This explains the little boom of small to medium-sized oil companies establishing in Oslo."

Saga Petroleum was a Norwegian upstream company established in 1972 that was acquired by Norsk Hydro in 1999. After the merger between Norsk Hydro's oil and gas division and Statoil it became a part of the latter. "As a result of the merger in 2007, former Statoil, Saga and Hydro people are dominating many of these newly established companies in Oslo," Tørum adds. He acknowledges that it is a relatively new trend for oil and gas companies to establish themselves in the Oslo area rather than Stavanger. "The most obvious explanation is the availability of human resources, which is rather challenging in the booming Stavanger," he says.

Pushing Out Exports

The shipping and offshore drilling industries present unique challenges anywhere in the world: high capital requirements, frequently volatile markets and mobile assets that require special financing structures. Swedish bank Nordea expects capital expenditure for offshore drilling and support vessels to rise to USD 22.3 billion in 2013 from USD 14.4 billion in 2012 before falling back to USD 14.6 billion in 2014. "There is not enough money in the banks to fund the capital expenditure requirements in the offshore exploration and production sector," says Magnus Piene, global head of offshore at Norway's DNB bank.

The Nordic Investment Powerhouse

ABG Sundal Collier (ABGSC) is the result of a 2001 merger between ABG Securities and Sundal Collier & Co. The company has become an important force in the Nordic investment banking sector. Knut Brundtland, Chief Executive Officer of ABGSC, discusses ABGSC's positioning and achievements since he took the reins in 2010.

What is ABGSC's added value in the Norwegian and international markets?

ABGSC is a Nordic-based investment bank focused on three main areas: research, sales and distribution, and corporate finance. The company has a large footprint in Norway, Sweden, and Denmark, providing a wide range of investment banking services. Moreover, we are present in financial centers of London, New York and Frankfurt.

We provide superior distribution of Nordic securities to local and international investors. The combination of global reach, top-ranked research and high quality corporate finance advisory services has established us as a preferred supplier in the markets where we compete. Our slogan is ‘Nordic companies, global money.'

Additionally, we serve the international investment community with top-ranked equity research, sales, and seamless execution. ABGSC has been voted ‘best Nordic broker' in the annual Thomson Reuters Extel survey, in which both local and international investors compete. ABGSC has won three out of the four ‘grand slam' titles: best sales team, best sales trading team, and best Nordic research team.

Looking back at ABGSC's 2012 achievements, what are you most proud of?

We are proud of our leading position as a lead manager for IPOs and our unique position within convertible bonds. Last year ABGSC was sole lead manager for two IPOs in Oslo. These transactions in combination with last year's USD 400 million Petrominerales convertible bond illustrates the strength of our distribution platform and our global reach.

To illustrate our strengths with an example: if a large oil company has the desire to sell one of its branches on the stock exchange, we will advise the client from our corporate finance team and execute through our sales and sales trading arm, all backed by independent research. Subsequently we will follow the client for our investors through regular research updates, roadshows and other events.

You were appointed Chief Executive Officer in 2010. What made you the right person to take charge of the company?

It is my background, which is a combination of business and law. As a lawyer, I advised on M&As, transactions, and IPOs, thus having a great deal of experience with the products that ABGSC offers to its clients. This allows me to make quick judgments and not to involve many external parties or follow long procedures.

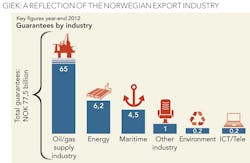

"Since the banks cannot perform the role they used to, we are looking for alternatives, and we hope that pension funds will join us and help finance the Norwegian oil and gas export industry," Wenche Nistad, CEO at the Norwegian Guarantee Institute for Export Credits (GIEK) said. GIEK, established in 1994 as a public sector enterprise, promotes investment and the export of Norwegian goods and services by helping companies to secure competitive loans and by taking on some of the investment risk. GIEK makes it simpler for a company to obtain sound funding and secure key export agreements. The agency is currently targeting pension funds for investment in the offshore oil and gas export sector, as the Eurozone debt crisis and tighter financial regulation mean that banks are not able to provide enough funding.

In January 2013, GIEK and the Brazilian NOC Petrobras signed a cooperation agreement with the aim of financing Norwegian exports of capital goods and services. After the EU and the US, Brazil is the country where Norway has its largest investment abroad: currently, a quarter of the offshore vessels operating in Brazilian waters have Norwegian owners. The first agreement with Petrobras in 2010 provided guarantees from GIEK totaling USD 1 billion. "Under the existing agreement, several Norwegian companies within the oil and gas industry, including their sub-suppliers, have entered into business contracts with Petrobras," says Wenche Nistad, CEO of GIEK.

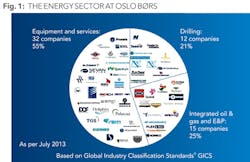

Critical in the capitalization and financing of the Norwegian oil sector from the early phases to today has been the Oslo Stock Exchange (Oslo Børs). Many of the companies listed in Oslo are considered industry leaders, and a listing in the same market as Statoil, Seadrill and Subsea 7 will always be attractive for new international energy companies. Per Gunnar, Listing Manager, Oslo Børs explains the role that Norway's global investment banks play in bringing investment to Norway: "Norwegian investment banks have also built up top notch competences in the oil and gas sector in terms of research capacity and have a well proven ability to raise capital in the market on behalf of energy companies, which is very important for such a capital intensive industry. In addition, many of the Norwegian investments banks have offices around the world in cities such as Rio de Janeiro, London, New York, Houston and Singapore, and we are confident that Oslo Børs is high on the agenda when international oil and gas companies are considering going public."

Nordic Playing Field

In June 2013, the Norwegian Government awarded 24 production licenses in the country's 22nd licensing round: 20 in the Barents Sea and four in the Norwegian Sea. 29 companies were offered participating interests, while 14 companies were offered operatorships. Among the winners is Lukoil Overseas North Shelf, a part of the Russian Lukoil group. Lukoil participated in the 22nd licensing round in alliances with Lundin Petroleum and North Energy, and was awarded two production licenses in the Barents Sea. The company will bring its knowledge and expertise gained over decades of exploration and production in the Russian Federation and abroad.

In the words of Leonid Surguchev, Managing Director of Lukoil Overseas North Shelf: "In Timan Pechora and in the Caspian region, the company has been producing fractured carbonate and low permeable heterogeneous reservoirs with new well and IOR technologies. This experience of our geoscientists and reservoir engineers will be useful for exploring and developing Permian formations in the Barents Sea." The Norwegian affiliate will also use Lukoil Overseas deepwater exploration drilling experience from its West African projects, according to Surguchev.

Surguchev goes on to say that the long-term objective in Norway is to become a full-cycle upstream company with projects in different stages of the upstream process: exploration, development and production. "Over the years," Surguchev explains, "we aim to have Lukoil activities on a level comparable to major international oil companies operating in Norway."

Repsol, active in exploration on the NCS since 2005, decided to open a permanent office in Oslo in 2009. The company has since acquired participation rights in 17 production licenses in the North Sea, Norwegian Sea and Barents Sea areas of the NCS. In the 22nd licensing round the company was awarded four licenses, two as operators. "We have been active on the NCS in recent years and we are now getting closer to the level we intend to reach. Our objective is in the range of 20 to 25 licenses and drilling two or three wells a year in order to make at least one discovery annually," says Jaime Suarez Alba, General Manager of Repsol Exploration Norge.

The Spanish company spudded its first operated exploration well in March 2013. The well targeted the Darwin prospect, which is located in the Western Barents Sea. Currently, Repsol is participating in another well in the Barents Sea and will spud its second operated well in the North Sea later this year.

Alba explains that the two operated blocks awarded in the last licensing round have been a milestone for Repsol in Norway. "This has made us a serious player in operational activities on the NCS and it is definitely recognition of the Norwegian authorities. Now it is up to us to fulfill expectations," he says.

For engineering consultancies, the growth of the Norwegian energy market represents immense opportunities. Ramboll Oil & Gas, headquartered in Denmark, holds offices in Norway, Qatar, Abu Dhabi, Russia and India, and ranks among the top five consultancies in Norway. The company expects to grow its Norwegian operations significantly in the coming years.

In 2010, Ramboll published a strategy for its global oil and gas division, which set the bar high: in 2010, the division employed 500 staff. That number is 1,000 today, with aims to reach 4,000 staff by 2020.

"In Norway we are betting big on the early phase and conceptual studies and Front End Engineering Design (FEED). We have contracts with major operators, including Statoil, ENI, ConocoPhillips, RWE Dea and Petoro. In the longer term we will also focus on detail design and smaller EPC projects," explains Gro Baade-Mathiesen, Managing Director of Ramboll Oil & Gas Norway.

Statoil, one of the company's largest customers, awarded Ramboll Oil & Gas the Polarled pipeline project in January 2013. "This challenging project will involve pipeline installation at water depths reaching 4,150 ft, setting a world record for deepwater installation of a 36" pipeline," says Baade-Mathiesen. "Furthermore, the job encompasses installation assessment for the large diameter, deepwater pipeline and mechanical design including wall thickness optimization and buckle arrestor design."

John Sørensen, Ramboll's global Managing Director of Ramboll, describes the company's key strengths: "we have trained ourselves to be cost-efficient and very innovative engineering partners to the industry."

Senergy: Expanding its reach

"What fascinates me in the service sector is that you have to earn the right to grow. You have to make money today in order to invest in tomorrow," said Frode Linge, Regional Manager Scandinavia at Senergy. A global organization built around 750 people, the company has a network of locations around the world including the UK, Scandinavia, the Middle East, Australia, Southeast Asia and the Americas, and worked on 1,460 projects in 84 countries throughout 2012.

Founded in 2005, Senergy delivers services and solutions to all segments of the energy sector. These services span the full project lifecycle of any energy development, from initial evaluation of the opportunity, its associated risks, challenges and outputs, through to full delivery and operation.

The organization reinforced its growing Norwegian footprint by opening new business premises in Oslo in 2011. Senergy appointed highly regarded industry figure Frode Linge to strengthen the company's position in Oslo. Linge has 25 years of experience with Shell, which took him to work in the Netherlands, Brunei, the UK, Nigeria, United Arab Emirates, Oman and Russia. With his extensive background in the oil and gas industry, having worked in technical, planning, commercial, general management and business development, Linge has an impressive breadth of expertise. "Having worked on both sides of the equation, both E&P and consulting, I felt that I had something to offer," Linge says.

Ranked the UK's tenth fastest growing international business, Senergy is rapidly expanding its capabilities and service offering in Norway. In August 2013, the consultancy secured its first major business agreement with Statoil for its projects on the NCS. "Although Senergy has operated in Norway successfully for a number of years, the agreement with Statoil, an NOC and the major resource holder in Norway, represents a significant development for us as we seek to internationalize and grow the business," Linge explains. The company aims to double its Norwegian operations over the next three to four years

365 Days at the Helm of Lundin

The Johan Sverdrup oil field was the largest oil discovery in the world in 2011, with reserves estimated at between 1.7 and 3.3 billion barrels of recoverable oil. Johan Sverdrup was initially believed to consist of two fields, four miles apart: Avaldnes, discovered by Lundin in 2010, and Aldous, discovered by Statoil in 2011. Further exploration activities revealed that they actually constitute one giant field, which was renamed Johan Sverdrup in 2012.

Building a new Songa.

Drilling costs in Norway are much higher than in other North Sea nations. Øystein Michelson, EVP of Development & Production at Statoil, said recently that the NOC was pushing for a different ownership model of drilling rigs on the NCS and targeting more ‘fit-for-purpose' rigs to reduce the high cost of drilling.

Bjørnar Iversen, Chief Executive Officer of Songa Offshore, one of the leading mobile drilling players on the NCS, explains that Statoil currently has eight rigs under construction, all of them through suppliers. Out of these eight are four jackup rigs and four semi-submersible rigs. The latter four are Songa's and in line with Statoil's strategy, Songa is bringing in assets with higher efficiency and more tailored to the conditions of the NCS.

After some turbulent years, Songa has started to implement important steps to streamline the group and restore liquidity, and has strengthened both board and management in order to achieve this. Iversen was appointed Chief Executive Officer of Songa, effective June 1, 2013. His mission is to build a new Songa.

The company currently owns and operates five semi-submersible mid-water rigs. Three rigs are operating in the North Sea on contracts with Statoil, the other two in Southeast Asia. Songa is currently building four identical drilling units that Statoil has developed together with the industry.

"This will materialize into operational excellence and substantial synergies on equipment, personnel and logistics which will give us a competitive advantage compared to other companies that have a mixed bag of equipment," Iversen explains. "Songa's objective is to become a leading mid-water rig operator in harsh environments. With seven rigs operating in the North Sea on contracts with Statoil, we are in a position to achieve that goal." Due to its unique relationship with Statoil, Iversen believes that Songa is well placed to become one of the flagship rig companies on the NCS.

Discussing the progress of the exploration activities, Torstein Sanness, Managing Director of Lundin Norway says: "Since 2012, a total of 15 wells have been drilled at the Johan Sverdrup field. During the first quarter of 2013, two wells and one sidetrack were completed and one additional appraisal well has commenced drilling. We will probably need to drill another two or three additional wells within the license area PL501, where Lundin Norway is the operator with a 40 percent stake."

Sanness explains that the Swedish company is looking to gather as much quality data as possible before making a decision on field development. "The reserve figure is so large that even a minor change in the recovery factor could have a significant impact, as we are looking at half a million barrels a day," he says.

Fortunately, Lundin has both the financial muscle and the experience to handle such a demanding project. "In 2013, Statoil will drill 25 appraisal and exploration wells, while Lundin will drill 18. As a result, Statoil and Lundin will be the two largest explorers on the NCS," says Sanness. "After Statoil and ConocoPhillips, Lundin has the largest capital expenditure budget on the NCS. Almost all of the company's budgeted development expenditure for 2013 is focused on development projects in Norway. Half of our budget is allocated for capital expenditure for the Johan Sverdrup, Edvard Grieg and Luno fields, and the other half for exploration and appraisal wells. Full speed ahead!"

Adapting Strategies

Energy is a major part of the makeup of the Oslo Børs exchange: when Statoil, the largest company in Norway by market capitalization, listed in 2001, energy became the dominant sector. However, the Oslo Børs used to be known primarily for listing companies in the maritime industry. Oslo is an important center of maritime knowledge in Europe.

Oslo is home to approximately 980 companies and 8,500 employees within the maritime sector. Shipping companies represent the largest segment of the Norwegian maritime industry, and shipping is Norway's largest export industry after oil and gas. Traditionally, Norwegian shipyards have focused on four main areas: offshore vessels, small specialist vessels, fishing vessels and passenger ferries. However, this is changing thanks to global demand for Norwegian vessels in the global oil and gas sector: in 2012, 95 percent of the vessels ordered at Norwegian shipyards were offshore vessels tailored for supply to oil and gas related companies. In the words of Eivind Reiten: "the only way a society can benefit from oil and gas income is to bring it into the economy. As a result, Norwegian society as a whole has benefitted from the oil and gas industry."

With few signs of recovery in the global shipbuilding sector, Chinese and South Korean yards are also eager to win contracts in the offshore construction markets, including rigs, to compensate for the dip in new ship orders. On the NCS, South Korean shipyards are cooperating with Western European engineering companies, and are turning their manufacturing capacity away from commercial shipbuilding to offshore. Industrial group Kvaerner, which builds heavy offshore equipment including oil platforms, recently warned of fierce competition, particularly from Asian firms. In the last year, Kvaerner lost a significant number of engineering, procurement and construction (EPC) contracts to South East Asian competitors. All of these contracts have been awarded for projects off the coast of Norway.

The listing of the new Kvaerner on the Oslo Børs in July 2011 marked a revitalization of an almost 160 year old brand: once part of the Aker group, the company was once again spun off as a separate business with a specific focus on the delivery of platforms and onshore plants.

According to Jan Arve Haugan, CEO of Kvaerner, the demerger and establishment of the new Kvaerner in 2011 was a response to customers' requests for more flexible and specialized EPC contractors. "More flexible, in the sense that Kvaerner would be able to meet low cost requirements through strategic partnerships, and local content requirements through regional partnerships. More specialized, in the sense that increased attention to cost and risk efficiency is a prerequisite for a global EPC player and requires a dedicated management focus on project execution and risk management."

When asked about where his company sees the biggest demand for oil and gas services in Oslo, Christer Tryggestad, Director at McKinsey & Company, confirms the trend that companies like Kvaerner have adapted to: "We increasingly help our clients crafting global strategies and setting up global organizations: striking the right balance between the centralization to benefit from economies of scale, skills, and technologies on the one hand side, and local autonomy and specialization on the other."

This also applies to Interoil Exploration & Production, a Norwegian junior with a strategic focus on onshore exploration and oil production in Colombia and Peru. The company went through a period of comprehensive restructuring in 2013; the company was on the verge of bankruptcy when Erik Sandøy and Thomas Fjell took over in January 2013 as CFO and CEO respectively. The company is reducing operating expenses by minimizing corporate overheads, terminating related-party consultancy agreements and optimizing the operating structure of the group.

Fjell, today the CEO of Interoil, explains that in order to salvage shareholder value, Interoil needed to increase production and fund investments through equity. "In March this year [2013], we completed an equity issue of USD 35 million," he explains. "This enabled us to fund an expansive drilling program in Colombia of approximately 65 wells. As of today, we are in the process of executing the first phase of this drilling program and have so far completed seven wells in the first phase."

In Peru, the company's licenses were due to expire in March 2013. However, Interoil was awarded an injunction to continue operating these licenses due to force majeure caused by El Nino (1998-99 and 2002-03) until October 2014 in the case of Block III, and until March 2016 in the case of Block IV. "We are currently in arbitration proceedings with licensing agency PeruPetro", says Fjell, "to determine whether Interoil has the right to extend the term of its original licenses in Peru until October 2014 (Block IV) and March 2016 (Block III)." The work towards a long-term extension will recommence if the arbitration case is won, unlocking 18 million barrels of 2P reserves.

Navigating a High-Cost Environment

A report published in 2012 by Swiss bank UBS crowned Oslo as the world's most expensive city. Meanwhile, according the study, workers in Oslo enjoy the fourth highest wages on the planet. While figures confirm that executive pay in Norway is modest, even low, compared to other countries, the average oil worker makes USD 180,300 a year, the highest salary anywhere in the world, recruiting firm Hays said in a 2012 report: USD 93,000 more than a UK oil worker makes and above the USD 177,000 pay for the average US CEO.

Asked about this high cost operating environment, Jarle Tautra, Managing Director of Eureka Pumps responds: "In order to survive in a high cost country like Norway, you need talented and motivated people, state of the art technology, top-notch facilities and efficient execution. In other words, the fundamentals must be in place." Looking at the company's progress in recent years, he continues: "Over the course of the last year, Eureka Pumps has invested significant amounts into our people, systems and facilities. Revenues from international new-built pumps last year were around 30% of our total business. This is expected to increase to 50% over the next two to three years. However, as we continue to expand internationally we have to consider moving our assembly operations to other locations to get closer to customers and cut cost," he adds.

A decrease in production from North Sea oil fields over the last decade has led the government to encourage technological innovation as a new means of competing internationally in the oil sector. Over the years, Norwegian firms have built a reputation for innovative and high quality technologies that are growing in demand as oil companies start drilling in deeper and deeper waters. Around the world, the average rate of recovery of oil in place is approximately 35 percent. Statoil however, plans to increase the average oil recovery rate from its fields on the NCS to 60 percent.

"The North Sea has a wonderful history of innovation, and of the innovative use of technology. New and more advanced technology for improved recovery is no exception. New technology to develop methods to improve reservoir monitoring and thus improve recovery has always been high on the agenda in Norway," says Jarle Tautra, Managing Director of Eureka Pumps.

Eureka Pumps, a market leader among companies servicing operators on the NCS, has recently strengthened its presence in Houston, Texas. Tautra explains that the company is in the process of expanding its business both internationally and in Norway, in order to build close customer relationships and win customer confidence. Eureka Pumps has served customers for more than 100 years, and is a leading manufacturer of various types of pumping systems for the offshore oil and gas industry, including firewater pumps, seawater lift pumps and cargo pumps.

The best solution to deal with Norway's high-cost environment is efficiency. Statoil leads by example: at the end of 2012, Statoil had only 23,028 employees: a tiny figure for a company characterized as being among the most profitable and geographically developed in the world. This low employee count has enabled Statoil to have the highest rate of production per employee in the industry, at an average of 78.4 bpd/employee in 2012.

Providing solutions that offer this type of efficiency is key for companies like PG Marine Group. Roy Norum, CEO of PG, explains that the company's aim is to manufacture smart solutions that will provide high value and diversification to its customers. "Frankly, PG has an impressive track record in efficiency over the last ten years, and at the same time, the majority of PG's solutions are logic-engineered, object-specific and customized," he says.

PG, a technology-focused company specialized in liquid handling solutions, established a pump engineering division in order to increase its focus on solutions for customers. The company adjusts existing products and brings new innovations to the table, and has presented many novel, smart solutions to the market over years. "This makes our products significantly more challenging to copy than commodity-oriented products," he adds.

In August 2013, PG inaugurated a new 8,750m2 factory, and a new unit known as PG Fabrication. This is a brand new, tailor-made facility will present the PG Group with unprecedented possibilities for future business, including subsea-pump tests pits with up to 1.4MW fixed power capacity.

Norum has taken PG to a new level in international markets, bringing its annual export turnover from USD 13.5 million to more than USD 108 million in 2013: more than 70 percent of the company's current revenues. "Today, we see demand for our products in Korea, China and Singapore, but also North and South America: we have had a significant market share since 2000 in Brazil, a critical market for the oil and gas industry," he says.

Discussing the high-cost environment related to offshore operations, Åge Landro, Group CEO at AGR, stresses: "The cost of a well depends mainly on the daily rate of the drilling rig, which is around half a million USD per day. For that reason efficiency and quality is critical for operators. The service AGR provides is less than 5% of total project costs. This does not make a significant difference for our client. What does make a substantial difference is the access to our experienced team."

The day-to-day work in other sectors has changed as a result of Norway's oil expansion. Consultancy firms such as Boston Consulting Group and McKinsey & Company have set up their global centers of competence in Oslo. McKinsey & Company's oil and gas group in Oslo is one of three global clusters, together with Houston and Amsterdam. Christer Tryggestad, Director at McKinsey, acknowledges that Norwegian companies are seen as technically highly competent. "My impression is that their competence is sought after internationally. Many of our clients are in the midst of significant global expansion."