Energy Transfer's acquisition of Williams Companies advances Energy Transfer's plans for Marcellus

Energy Transfer Equity LP of Dallas and Williams Cos. Inc. of Tulsa agreed to a $37.7 billion merger, including the assumption of debt and other liabilities in a deal giving ETE an immediate presence in the Marcellus and Utica plays upon closing, which is expected in 2016 subject to conditions.

Terms outlined in late September called for a newly formed ETE affiliate, Energy Transfer Corp LP, to acquire Williams. The agreement came after ETE had made an unsolicited offer for Williams earlier this year, and that offer had been rejected.

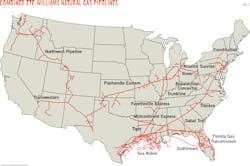

Each of the companies already own extensive natural gas and liquids infrastructure. Williams had a strong business in the Northeast where ETE sought a stronger presence.

"This transactional combination will take us into every basin," Jamie Welch, ETE chief executive officer and head of business development, said during a conference call. "It gives us every type of hydrocarbon and every type of midstream service offering that we can provide producers across this country."

ETE operated 71,000 miles of pipelines connecting wells and processing centers throughout Texas, the Gulf Coast and the Midwest. Williams operated about 33,000 miles of pipelines.

Williams offers Northeastern network

The crown jewel for Williams was its Transcontinental Gas Pipeline (Transco), which stretches from South Texas to New York City. Analysts expect Transco will become more valuable when linked to ETE's existing network of Permian basin and Eagle Ford systems in Texas.

Welch said ETE's planned Rover pipeline will connect with Williams' Appalachian Connector. He also planned to capitalize on connecting ETE's Trunkline and Panhandle Transmissions systems with Transco. He said Williams Northwest Pipeline could connect with ETE's Transwestern.

"It goes on and on... the connectivity of things," he said, adding the combined assets will provide "a natural gas highway system designed to benefit producers and end-user customers."

Meanwhile, ETE's ongoing Revolution project to build gas-gathering pipelines in the Marcellus is scheduled to come online in 2017.

Williams executives said Williams gathered 38% of gas volumes from fields in the Marcellus and Utica during the first-quarter of this year. Williams also had additional projects under development there.

Alan Armstrong, Williams president and chief executive officer, in announcing the merger with ETE said that the combined company "will have enhanced prospects for growth, be better able to connect our customers to more diverse markets, and have more stability," during oil and gas price downturns.

"Importantly, Williams Partners will retain its current name and remain a publicly traded partnership headquartered in Tulsa," Armstrong said. Williams and Williams Partners dropped their previously announced merger agreement as a condition paving the way for the ETE transaction.

Three MLPs involved

In announcing the deal, executives said all stakeholders are expected to benefit from the cash flow diversification associated with ownership in three large investment-grade MLPs: Energy Transfer Partners LP, Sunoco Logistics Partners LP, and Williams Partners.

ETE oversees Energy Transfer Partners and Sunoco Logistics Partners. Welch said the ETE-Williams combination also would enhance the natural gas liquids business.

"We will have a fully integrated liquids platform," Welch said. "It is not secret that we've obviously spent an inordinate amount of capital and investment, financial and mental acumen in developing our overall NGL business in Mont Belvieu," which is in eastern Texas.

He said ETE had been focused on developing the Northeast region, in particular on working in conjunction with Sunoco Logistics on the Mariner East and Mariner West systems.

"This is all about alleviating bottlenecks, taking us into places that we don't currently have a beach head," Welch said. "We will not only be able to increase the movement through our NGL system at Mont Belvieu, but also we will now get connectivity in a much larger context into the Rockies and also into the Northeast with the Williams existing business."