Encana dives into Eagle Ford; deal will double oil production

Rachael Seeley,

Editor

Encana Oil & Gas (USA) Inc. took a leap forward on plans to increase oil production with its $3.1 billion purchase of assets in the Eagle Ford shale.

The deal marks the traditionally gas-weighted producer's entrance into the booming South Texas play and is set to more than double the company's oil production.

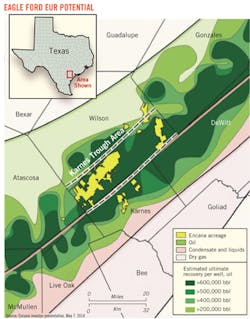

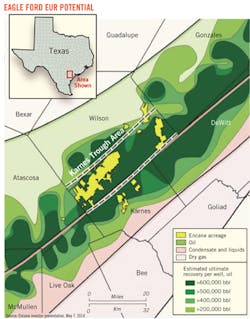

Encana is purchasing the 45,500 net acre, largely contiguous, position in the Eagle Ford's oil window from Freeport-McMoRan Oil & Gas LLC.

The acreage produced 40,000 b/d of oil in the first three months of this year.By comparison, Encana's company-wide oil production totaled 32,100 b/d in the same period.

Doug Suttles, president and chief executive officer of Encana, told analysts that, "Gaining a position in a world class, oil-rich resource play like the Eagle Ford accelerates the transition of our portfolio and underscores our investment focus on high-margin assets."

The majority of the acreage is in the Karnes Trough area in Karnes County and extends into adjacent Wilson and Atascosa counties. It contains more than 355 gross producing wells and 400 gross identified drilling locations.

"This acquisition is in the very heart of the play, and these are high-margin barrels, predominantly oil production," Suttles said. The Eagle Ford asset produces 42° gravity crude that sells for Louisiana Light Sweet crude prices and has good access to markets.

Development plans

Encana will likely put a fourth rig to work on its new leasehold before the end of the year. EOG Resources Corp. operates two of the three rigs already working on the acreage.

Suttles said Encana plans to focus on developing the acreage efficiently and not on maximizing the rig count.

"We also believe year-on-year improvements and things like well performance will also be critical," Suttles said.

Encana is closely watching the downspacing efforts of nearby operators and seeking to design completion stages that maximize recoveries.

Regulatory filings indicate Freeport-McMoRan's Eagle Ford leasehold was being developed with horizontal wells with total depths of 9,500-11,500 ft and total measured depths of 14,500-17,500 ft. Lateral lengths ranged from 3,500-6,000 ft.

Freeport-McMoRan acquired the leasehold in the summer of 2013 in its merger with Plains Exploration & Production Co. At yearend 2013, proved and probable reserves were estimated at 69 million boe.

Changing portfolio

Encana announced in November that it would shift from funding operations in about 30 different plays to focusing onfive key, liquids-rich areas.

The effects of Encana's strategic transition are apparent. Although the bulk of Encana's production remains natural gas, that proportion shifted in the first quarter.

Company-wide liquids production increased 56% to 67,900 b/d, including 35,800 b/d of NGL, while gas production slipped 2% to 2.8 bcfd compared to the same period a year earlier.

Seventy-five percent of Encana's $2.5 million capital spending budget is allocated toward the company's five core liquids plays: the Montney and Duvernay shales in western Canada; the Denver-Julesburg basin in Colorado; the San Juan basin in New Mexico; and the Tuscaloosa Marine shale in Louisiana and Mississippi.

Chief Financial Officer Sherri Brillon said spending guidance may be adjusted after the closure of the Eagle Ford acquisition and recent asset sales.

Encana has this year divested certain gas-rich assets as it seeks to replace natural gas production with oil and liquids production that yields higher margins. In the first half of 2014, the company sold its Jonah field operations in Sublette County, Wyo., for $1.8 billion and certain East Texas properties for $530 million.

Suttles hinted that more asset sales could occur in the months ahead. "I think we will continue to test the market with some of our gas assets," Suttles told analysts.

The Eagle Ford acquisition is expected to close by the end of June and carry a retroactive effective date of Apr. 1.

ENCANA ACQUISITION*

Buyer: Encana Oil & Gas (USA) Inc.

Seller: Freeport-McMoRan Oil & Gas LLC

Cost: $3.1 billion

Acres: 45,500 net

Location: Karnes, Wilson, and Atascosa counties, Tex.

Net production: 53,000 boe/d (75% oil)*

Producing wells: 355 gross

*Reflects data for first-quarter 2014.

Source: Encana