Wolfcamp shale graduates to 'world class' play

DENVER, Colo.—"The Wolfcamp could possibly become the largest oil and gas discovery in the world," said Scott Sheffield, chief executive officer, Pioneer Natural Resources Co.

The operator is the largest acreage holder in the Spraberry/Wolfcamp field with about 900,000 gross acres (730,000 net acres), the majority of which could be prospective for the horizontal Wolfcamp shale.

Based on Pioneer's extensive geologic database, petrophysical analysis, and successful drilling results to date, there is significant horizontal Wolfcamp shale resource potential in this acreage.

A vast resource

"The Wolfcamp is interesting because it's been out there," said J. Ross Craft, chief executive officer, Approach Resources Inc. Since the onset of Permian development in the early 1920s, operators have drilled through this formation. "Early in my career, we knew the Wolfcamp as a nonproductive shale that would put oil in the pits every once in a while," Craft said. "That was about it."

Today, Approach Resources holds 170,000 gross acres (mostly contiguous) in the Permian basin with a reported production of 8.4 MMboe/d as of the first quarter of 2013. In 2012, thecompany held 95.5 MMboe of proved reserves, with 69% represented by oil and natural gas liquids. "When we firststarted the company in 2006, we had a $5 million commitment, 0 acres, and 0 reserves," Craft said.

Both Pioneer and Approach Resources tout Wolfcamp potential as a boon for the industry. According to Sheffield, Pioneer's Eagle Ford success has provided a smooth transfer into the Wolfcamp. "When comparing phases of development, we see the Wolfcamp trending higher than the Eagle Ford based on activity and production," he said.

According to Sheffield, the company will test 13 zones within the next 3 years. Sheffield noted that recoverable reserves were based solely on the Wolfcamp A, B, and D shelves and the Jo Mill formation. The potential is enormous, and "more reserves are yet to be discovered," Sheffield said.

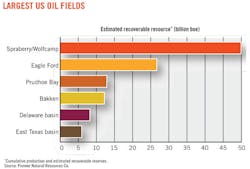

Pioneer combines its Spraberry/Wolfcamp acreage. It operates on the northern end of the play, which is said to contain an estimated 3,500-4,000 ft of shales, which translates to nearly 3 to 4 million acres when considered in 3D space as opposed to surface area. "Compare that to the Eagle Ford shale formation, which is about 300 ft thick and the Spraberry/Wolfcamp shale, with its 50 billion boe, begins to dwarf the Eagle Ford and the Bakken with 27 billion boe and 13 billion boe, respectively," Sheffield said.

The Wolfcamp's variety of geological zones places it as a frontrunner among the world's largest onshore plays. Based on recoverable reserves, the Wolfcamp is second only the Ghawar field in Saudi Arabia. "We believe this field will reach 100 billion boe recoverable reserves at some point in time," Sheffield said.

Approach Resources has identified 2,000 drilling locations. "We're running three horizontal rigs, and plan on moving to four in 2014," Craft said.

Prudhoe Bay, which covers 215,000 acres, is geographically the largest play in the US with reserves around 13 billion boe. "Approach's acreage in the Wolfcamp is about 1,000, and if you look at these from the perspective of a 1,200-ft column, that equals 7 billion boe recoverable reserves," Craft said. The company is risking this development at 25% with a 3.5% recovery factor for oil and a 10% recovery factor for natural gas. "It's not quite there with what you see with Prudhoe Bay, but when you expand the Wolfcamp out to where the bulk of the activity has been up to just recently, that adds another 1 million acres," Craft said.

Pioneer recently announced several discovery wells in Martin and Midland counties. "That puts quite a bit of real estate between those counties and the majority of activity that's been developed to date," Craft said. "This is the reason why the Wolfcamp has appealed to us."

According to Approach Resources, the Wolfcamp alone has the potential to become the largest oil field in the US. "And it was right in the industry's sight," Craft said. "It wasn't developed until producers ran out of the easy stuff and gas prices tanked that companies started focusing on newer sources of oil."

Unique properties

"What sets the Wolfcamp apart from similar plays is its inherent rock properties," Craft said. Typical total organic carbon (TOC) runs between 2.24-7.24%. "We've looked at core samples from 30-40 miles away, and they all fall within this range." Some fall lower or higher, but a uniform average in TOC across a wide span provides a solid base from which to work. "With the variety of shale plays out there, anything between 2-10% is considered excellent," he added.

Thermal maturity also is an important factor. "What's unique about the Wolfcamp is that it's normal pressured," Craft said. "It's probably one of the few shale plays out there that has normal pressure." While temperature is not an issue for drilling and completion activities, normal pressured reservoirs can present their own unique challenges as production begins.

Photo by Approach Resources Inc.

Wolfcamp generally displays vitrinite reflectance (Ro) values ranging from 0.95-0.97%. "Likewise, these are on the same band in core samples from 30-40 miles away," Craft said. Ro indicates the level of organic maturity. Ro values greater than 0.78% usually indicate gas-prone rocks. High values can suggest "sweet spots" for completing gas shale wells. "The Wolfcamp's Ro values places it right into the deep oil and wet gas generation window, and this is beneficial because it takes the gas to help move the oil out of zone in this normal pressured reservoir," Craft explained.

Normal porosity for the Wolfcamp ranges from 4-10%, with an average of about 7% throughout much of the play. According to Craft, "This provides plenty of porosity for the process to work." Organic material for Wolfcamp is about 72 scf/ton. "If the Wolfcamp was a pure gas play that would be on the borderline and probably wouldn't work, but for an oil play it gives us plenty of upside potential."

According to Craft, the rock composition is favorable. "Wolfcamp is sitting right where it needs to be," he said. Typical cores show the composition to consist of carbonate (26%), quartz (36%), and clays (25%). This creates a brittle environment conducive to natural fracturing from thrust during the drilling process. Approach Resources uses logging-while-drilling technology to avert risks associated with stuck tools, Craft said. "Our laterals are 7,000 ft on average with a natural frac density ranging from 1,500-4,000 fractures per lateral (2,000 on average)," he said. The formation responds further to hydraulic fracturing.

"The most important attribute to the Wolfcamp is its uniformity," Craft said. As the play tracks east to west, the Wolfcamp A, B, and C shelves are uniform and consistent. "The D interval ranges from 500-1,000 ft," he added. The company currently produces out of all four of these zones.

Learning curve

Approach Resources estimates Wolfcamp thickness at 1,200 ft. The Clearfork above this acts as a trap. "How do you develop shale that is 1,200-ft thick," Craft asked. "You have to be very careful with what you put into the reservoir."

The company initially tested the Wolfcamp in 2005 through an acid treatment of an older perforation. The well produced about 2 b/d of oil. "This was not a stellar result, but it indicated that something was there," Craft said. In 2008, the company made a second attempt with a CO2 foam treatment. "That turned out to be the wrong thing to do in a shale formation," Craft noted.

While the well proved to be uneconomic, the company learned from this enterprise. "It's important to keep in mind that you are dealing with a nanodarcy environment," Craft said.

The company began with an aggressive approach to fracing its wells but soon learned that more planning was needed to increase ultimate recovery. On its first completions, Approach Resources attempted gels to achieve the necessary heights on its fracture stimulations. The initial thinking was that this would be the only method capable of pushing the sand upward into fractures. The company's earliest wells made very good gas wells in the first 30 days of production but would rapidly decline by the 60-day mark. "We would be lucky to have a well that was producing 200 Mcfd of gas and 50 b/d of oil," Craft said. Because the Wolfcamp is a normal pressured reservoir, the gel was condensing and its residuals were reducing permeability.

Due to the lack of production from fracing with gels, the company moved to slickwater and started to see improvement. A typical frac job for Approach Resources in the Wolfcamp consists of 9,000 lbs of sand with 250,000 bbl of fluid.

"Once we began to cut the friction reducer (FR) down to about 0.35 per 1,000 gal of fluid, our production increased dramatically," he said. "The biggest mistake people make in the Wolfcamp right now is running too much FR in their slickwater completions," he added. FR is slick in small quantities, and according to Craft, it is common for operators to increase FR in slickwater frac jobs up to 0.75 or 1 gal per 1,000 gal of fluid. The extra FR can produce positive results early on but ultimately acts as a gel and can deteriorate production over time. "As it opens fractures, it is also plugging them," he explained.

Approach Resources also benefited from running microseismic on its earliest wells. "We wanted to see what the fractures would do," Craft said. In the Wolfcamp A bench, which has a frac rating of 0.56 as opposed to the average of 0.81 or 0.82 for the remaining intervals, the company quickly learned that landing high in this interval would result in height thrust into the Clearfork formation during frac jobs. "Once you get here, fracs will run for a long distance, so it is important to be careful in this portion of the reservoir," he added. For the most part, frac heights were contained in the A bench at 300-350 ft using slickwater. The B bench showed similar results.

For the Wolfcamp C, the company planned to land into the upper portion allowing the fracs to extend through the C bench into the lower B. "We were surprised to find a 10-ft thick dolomitic stringer right at the top of the Wolfcamp C," Craft said. The stringer is traceable across the field.

For its first frac job in the Wolfcamp C, only half of the fracs were landed. The dolomitic layer acted as a frac barrier. "It's not a permeability barrier, as pressure will move through it, but fracs will not penetrate it," Craft explained.

Because of the overshadowing from the containment stringer, the company revised its well plan to land the lateral 100 ft deeper in the Wolfcamp C. It has since drilled three additional C bench wells with positive results.

The key element in the Wolfcamp is to increase the surface area through optimal rock breakage. "There is little concern for the competitive nature of the reservoir when you conduct hydraulic fracturing all at once," Craft said. However, the company's experience has shown that waiting between frac jobs on different intervals can have a negative effect on the outcome.

Field development

Approach Resources practices full-field development in its Wolfcamp acreage using pad drilling from one side of the field. "Maximizing the surface area requires drilling and fracing all the way across. Our system is to stack the wellbores from A, B, and C," Craft explained. In addition, these stacked completions are optimized for the total production of all three intervals. In some cases, one well could produce 700,000 boe with one below producing 200,000 boe. "What's important is that the total volume equals to 1.35 MMboe," he said.

With a recovery factor of only 3.5%, in-place reserves range from 518 million boe to 648 million boe. "If you can raise that recovery factor by 0.5%, that is a huge increase in recoverable reserves," Craft said.

The company produces from stacked laterals in the A and B and in the B and C intervals of the Wolfcamp. It is currently optimizing three stacks and researching the proper distances for this layout to be productive. "We hope to have those answers within the next 6 months," Craft said.

Cost control

Like many operators working in other major shale plays, Approach Resources has dramatically reduced its drilling and completion costs in the Wolfcamp. "We can't control commodity prices, but controlling cost is a key element to our success in the Wolfcamp," Craft said. Originally, a Wolfcamp well was on average a $9 million investment. It is now down to $5.5 million/well. "We will be at $4.8 million/well by the end of 2013 or early 2014," he said.

A mix of adding infrastructure, experimenting with frac zones, and reducing the number of frac stages per well has contributed to the overall cost reduction in the Wolfcamp, making it a prime investment for unconventional resource development.

Editor's note:Comments were presented at the first annual Unconventional Resources Technology Conference (URTeC), a joint effort among SPE, SEG, and AAPG, held in Denver, Aug. 12-14, 2013.