Sudan could support growth as non-OPEC oil exporter

Sudan, mired in a long-running civil war, could become an even more important oil producing and exporting country in the short to medium term.

In little more than 4 years, the country's production has built to around 270,000 b/d.

Depending on oil and gas exploration and drilling levels and its ability to achieve a lasting ceasefire, Sudan could be producing as much as 800,000 b/d by 2009-2010, suggests a report by Centre for Global Energy Studies, London.

Such an output level would make Sudan non-OPEC Africa's second largest exporter.

The east African nation has been invited to OPEC meetings as an observer since 2001, illustrating its emergent stature as an oil exporter.

"Both China and India see Sudan as an important strategic oil supplier and have snapped up licenses in the wake of the Western companies' departures, with a view to invest in Sudan's infrastructure as well," CGES noted.

Not presently tagged for development is as much as 3 tcfe of gas-condensate at the Suakin discovery made on Sudan's Red Sea continental shelf off Port Sudan by Chevron Corp. in 1976 (see map, OGJ, Dec. 7, 1992, p. 46).

Exploration history

Chevron Corp., after discovering what might have been as much as several billion barrels of oil in the Muglad basin, abandoned its concessions in 1985 due to civil war.

Arakis Energy Corp., Calgary, acquired Chevron's concessions in 1993 and formed Greater Nile Petroleum Operating Co. in 1996 in partnership with China National Petroleum Corp., Petronas of Malaysia, and Sudan's state Sudapet.

Talisman Energy Inc. acquired Arakis in October 1998, including interests in 12.2 million acres in Sudan. Talisman's mean estimate of undiscovered original oil in place was 10 billion bbl, with an estimated range of 8.5-12.5 billion bbl. Recovery factors were expected to average at least 30% (OGJ, May 31, 1999, p. 21).

GNPOC completed a 1,504-km crude oil pipeline from Unity and Heglig fields to Port Sudan on the Red Sea and started production in late 1999.

Under pressure from human rights groups who said oil revenues helped the government suppress the rebels near the oil fields, Talisman sold its 25% stake in GNOPC to India's ONGC Videsh Ltd. earlier in 2003. OMV AG, Vienna, sold its Block 5A interests to ONGC Videsh (Fig. 1).

"Russia's Slavneft left Block 9 in 2002, and Lundin sold all holdings except for a prospective interest in Block 5B to Petronas. Although Total retains its Block 5 (Central) license (also known as "Block B"), it has no physical onshore upstream presence in Sudan at present," CGES reported.

"Petronas has the largest interest of any foreign company operating in Sudan, now holding licenses in producing blocks 1, 2 and 4 and exploration blocks 3, 5A, 5B, 7 and the recently awarded block 8, as well as downstream interests."

Greater Nile project

GNPOC produces practically all Sudan's current production from fields on blocks 1 and 2.

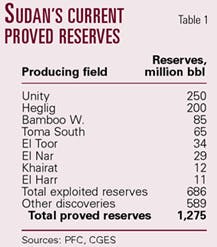

The US Energy Information Administration estimated Sudan's proved reserves at 563 million bbl at the beginning of 2003. This figure, although double that of 2001, "cannot account for the production levels we have seen so far," CGES points out.

"The Petroleum Finance Co. in 2002 estimated proven Sudanese reserves at around 1.2 billion barrels (Table 1), but this is also likely to be a sizable understatement, since the producing blocks are far from exploration maturity," CGES said.

Table 1 still gives a reasonable idea of discovered reserves distribution.

"Only six other smaller fields are producing at the moment out of around 50 discovered fields. Production in the near future is thus likely to come from Sudan's smaller fields," CGES said.

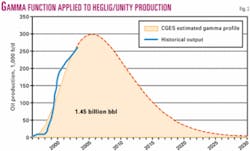

"Most industry sources now believe the Unity/Heglig group of fields contains 1.2 billion barrels of recoverable oil, but in view of the conservative nature of proven reserve estimates, the CGES is using a higher assessment of 1.45 billion barrels of reserves for the fields.

"CGES has fitted a gamma function to the existing production profile in order to predict the maximum future production that is likely to come from Block 1 & 2 fields (Fig. 2).

"Assuming uninterrupted development of Block 1 & 2, the results suggest that production is likely to peak at around 300,000 bpd by 2006 at the latest," CGES said.

Growth prospects

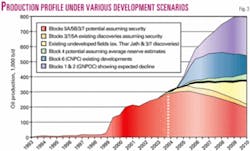

With decline setting in from GNPOC Blocks 1 & 2 within 3-4 years, new fields will be needed to keep production flat or increase capacity so Sudan "can begin to export significant quantities of oil to its neighbours and reduce its budget deficit," CGES reasons.

The security situation limits exploration and development to blocks 1, 2, 4, and 6.

"The remaining blocks have seen enough exploration activity to suggest that significant additions to Sudan's production levels are possible, but rebel activity has made it too risky for foreign companies to allow their workers back into these areas," CGES noted.

Secure blocks

Near-term production growth must come from the four blocks considered secure (Fig. 3).

"Recent discoveries by CNPC in block 6 are expected to add 40,000 b/d by 2005, assuming a pipeline to Khartoum is built," CGES said.

"Block 6, however, is not considered to be as promising as the Muglad basin's blocks 1 & 2, with higher reserves estimates around 250 million barrels, and so block 6 growth is unlikely to offset the expected decline from Blocks 1 & 2," CGES said.

Still relatively unexplored, Block 4 has the potential to be as fruitful as the Greater Nile Project because it is part of the same geological configuration as the Muglad basin.

"Block 4's reserves, which at this stage can only really be estimated from a statistical standpoint, seem to average around 0.4-0.5 billion barrels, but could be anything from 10 million barrels as a minimum to over 1 billion barrels," CGES said.

Assuming that 500 million bbl is realistic and that development begins soon, Block 4 output could peak around 150,000 b/d by 2010.

"Adding this production to the modest developments in block 6 can stabilise Sudanese production at a level above 300,000 b/d once the Heglig/ Unity fields start to decline."

Unsecured blocks

Lundin had discovered oil at Thar Jath even before OMV took over the acreage, and reserves there are estimated at around 150 million bbl, CGES said. Rebel activities ensued, prompting OMV's recent agreement to sell its interest in blocks 5A and 5B to ONGC Videsh (OGJ Online, Sept. 11, 2003).

"Petrodar, a consortium consisting of the Gulf Petroleum Corp. (Qatar), Al-Thani Corp. (Sudan), and Sudapet, led by the CNPC, has announced 4 discoveries with a possible total of 1 billion barrels of reserves in Block 7. They believe their Melut basin concessions of blocks 3 & 7 can produce 160,000 b/d from 2005, if the security situation allows.

Regional ambitions

Sudan is working on plans to build pipelines to its neighbors Kenya, Eritrea, and Ethiopia.

CGES noted that Total and other western majors have remained active in Sudan's downstream industries and that the country has four refineries which process enough crude to allow Sudan to export refined products and crude.

Sudan is exporting products by road to Ethiopia under a January 2003 agreement that may ultimately result in construction of a pipeline via which Sudan might meet as much as 60% of Ethiopia's oil demand.

Adapted from Global Oil Report Market Watch, published by Centre for Global Energy Studies, London, Oct. 2, 2003.