OPEC states seeking more foreign investment in petroleum sectors

David Knott

Senior Editor

The push by members of the Organization of Petroleum Exporting Countries to attract foreign investment in their petroleum sectors is in full swing.

OPEC member countries dominated worldwide oil production in the 1960s and 1970s because they held vast reserves that could be produced at a low price.

While OPEC still dominates global oil reserves, commercial and state-owned oil and gas companies in many of OPEC's customer countries since the oil price spikes of the 1970s have become more competitive.

While production outside OPEC had been relatively expensive in the late 1970s and early 1980s, oil companies in non-OPEC countries since then have focused strongly on new technology and efficiencies to pare costs closer to OPEC levels.

Now OPEC faces a future of low prices. And its members increasingly are finding budgets too tight to allow capital investment needed to meet production plans and production operations in need of an infusion of new technology.

Some OPEC members have always welcomed foreign participants in oil production ventures, but mainly there long has been a perception that OPEC areas are closed to foreign oil companies, particularly western majors.

Recently, however, even the most independent of OPEC's members have found economic problems at home have put a curb on their oil production ambitions. Some are welcoming foreign participation as their main hope of survival as oil producers.

An OPEC official told Oil & Gas Journal the organization places no restrictions on how members fund their projects and that historically members differed in their views on outside involvement in their respective oil and gas industries.

"Some think they have enough resources to keep on in the way they currently operate," said the OPEC official. "Saudi Arabia and Kuwait in particular have not opened up to western investment.

"However, Algeria, Venezuela, and Nigeria especially are thinking of broader partnerships with western companies."

Economic squeeze

Of the 'go-it-alone' states, OPEC analysts believe Saudi Arabia has perhaps been hit hardest by internal economic pressures.

In addition, there has been speculation over long term viability of the country's autocratic government.

The OPEC official said opening up to foreign company involvement has advantages in bringing in finance and state-of-the-art technology, adding, "Recent trends in the Saudi economy in particular make this a prospect in the future."

Rilwanu Lukman, OPEC secretary general, has spoken out frequently in recent years about the need for OPEC to look for new sources of investment if it is to survive.

At Davos, Switzerland, in February, Lukman told a conference OPEC needs to spend $100 billion by 2000 to build its sustainable production capacity to 36 million b/d.

A further expansion of capacity to 44 million b/d by 2010 would need an additional investment of $160 billion, said Lukman.

OPEC reckons global oil demand is going to grow to about 80 million b/d by 2010 from 69 million b/d today. The organization predicts worldwide oil industry will need to invest $950 billion by then to meet this need.

"Many of the investments required in OPEC member countries may become harder to realize if prices do not improve and taxation and other distortions continue to play havoc with our income, since OPEC member countries need to devote a large part of their oil revenues to other uses."

Julian Lee, oil analyst at London's Centre for Global Energy Studies (CGES), said CGES has long held the view that foreign involvement is a sensible way forward for OPEC producers.

"OPEC members are increasingly moving in this direction," said Lee. "The only ones holding out are Saudi Arabia and Kuwait.

"Iran is trying to get foreign involvement, Iraq looks certain to need and accept upstream involvement once sanctions are lifted, and all the others have foreign involvement."

Of other OPEC members, Lee said Algeria and Venezuela are going for broke to attract foreign investment, while Nigeria needs foreign investment but is not being helped by its government.

Lee said OPEC's remaining members all have foreign involvement in one way or another, and all members are looking to expand capacity to some degree (see table [28492 bytes]) .

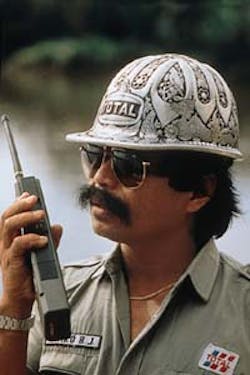

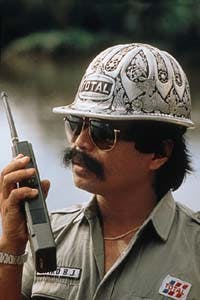

Gas production facilities operated by France's Total in Indonesia supply natural gas to the liquefied natural gas export project at Bontang, Kalimantan. Indonesia is one of the few OPEC members that has continuously sought foreign investment in their oil and gas sectors, a growing trend today in the exporters' group. Inset: Total produced decorative safety helmets to mark its 25 years of operations in Indonesia. Photos courtesy Total.

Algeria

"Algeria has accepted it needs greater involvement from outside," said Lee. "It has welcomed foreign oil firms recently and has been bringing them in with a fair degree of success. This process will continue."

Algeria has made headlines several times in recent months with a string of agreements with foreign firms. Algeria is southern Europe's main gas source but is angling to take a share of the central European market.

Algeria is one of 12 Asian or African countries bordering the Mediterranean Sea that are planning, along with European Union countries, to integrate their gas and electricity networks, creating a giant gas grid with Algeria as a major supplier (OGJ, June 24, Newsletter).

The first and largest of the recent gas megadeals was secured by BP Exploration Operating Co. Ltd. in late 1995 and involves exploration and development of gas fields in the In Salah license area 1,200 km south of Algiers.

At the time of the deal, BP Chief Executive John Browne said: "This is a landmark agreement that could increase BP's worldwide gas production by 30%.

"It is the first major gas joint venture a foreign company has signed with Sonatrach, the sole gas producer in Algeria for the past 30 years. It has the potential to open a new era of gas production in Algeria and from the next decade onward to give European consumers greater choice in their sources of gas supply."

A $3.5 billion development program will be financed 65% by BP and 35% by state firm Sonatrach. The partners aim to export 350 bcf/year of gas to southern Europe through a 50-50 marketing venture.

BP and Sonatrach say seven discoveries in In Salah have estimated reserves of 5 tcf of gas, while prospects in the license could hold a further 5 tcf.

The partners aim to begin production in 2002 or 2003. Development is expected to involve drilling of 200 production wells, installation of surface flow lines, and construction of a 48 in. diameter export link to Hassi R'Mel field (OGJ, Dec. 25, 1995, p. 26).

In Salah gas will find its way to European markets via the existing Transmed link from Morocco to Spain, to which Hassi R'Mel is linked.

Also, the Maghreb-Europe gas pipeline from Morocco to Spain is due to begin operation in October 1997, taking as much as 42.2 bcf/year of Algerian gas to Spain and Portugal.

Total became the second foreign firm to win a major gas deal with Sonatrach with an agreement in January to develop Tin Fouye Tabankort gas/condensate field.

Field reserves are estimated at 1 billion bbl of oil equivalent. Development, including construction of a gas separation/treatment plant, is expected to cost $850 million.

Total and Sonatrach each will hold a 35% interest, while Repsol SA of Spain will hold 30%. They will set up a joint operating venture, and are considering a joint gas marketing venture.

Under the deal, Total and Repsol will receive their share of output in natural gas liquids and condensate, with dry gas being allocated to Sonatrach.

First production is expected in 1998, with output expected to reach 630 MMcfd of dry gas, 14,000 b/d of NGL, and 20,000 b/d of condensate (OGJ, Feb. 5, p. 46).

Tin Fouye Tabankort field lies in the Illizi basin 500 km southeast of Hassi R'Mel field. Sonatrach has been producing oil from the field since the late 1960s, with output most recently estimated at 8,000 b/d.

Development will involve production from 60 wells, 34 previously drilled by Sonatrach and construction of a two-train separation plant slated for completion in 1998.

Exxon Corp. is also rumored to be pursuing a third gas megadeal in Algeria, with sporadic press reports appearing about negotiations for a gas field development near BP's In Salah license. Exxon declined comment.

While large gas projects have been in the headlines, Algeria has also been pursuing smaller oil field developments in conjunction with foreign firms.

Recently Atlantic Richfield Co. secured a $1.4 billion production sharing agreement for enhanced oil recovery in Rhourde El-Baguel field, intended to double oil recovery to about 40%.

ARCO and Sonatrach intend to raise oil production to 100,000 b/d from around 20,000 b/d today and install a liquid petroleum gas plant capable of processing 800 MMcfd of gas.

Middle East Economic Survey (MEES) said that in November 1991 Sonatrach disclosed plans to implement enhanced oil recovery in 10 oil fields, with investment of $3.7-4.2 billion expected to lead to recovery of an extra 1-2 billion bbl of oil in 20 years.

Meanwhile foreign firms have also been licensed to explore new tracts, leading to a number of developments. Most recently a group led by Anadarko Petroleum Corp. received a provisional production license for two oil fields.

License partner Lasmo plc, London, said the partners won a license to produce oil from two fields in Ghadames basin Block 404. These are the 1994 Hassi Berkine discovery and 1995 Hassi Berkine South find.

First phase production of as much as 40,000 b/d under a $210 million development is to begin early in 1998. A new export link to the existing El Bourman-Haoud-El-Hamra pipeline is planned.

Second phase production, involving full production from the block, is expected to cost a further $1.5 billion. This will include construction of a 30 in. pipeline direct to Haoud-El-Hamra terminal.

In June Sonatrach signed a production sharing contract with Agip SpA for the Wadi El Teh license in the Ghadames basin. Agip will spend $21 million there in 4 years, acquiring 3D seismic data and drilling three wells.

Agip recently found oil with a new field wildcat well in the Hassi Berkine North field area. The find is on a block where Agip is currently producing about 46,000 b/d from three other fields: Bir Rebaa North, Bir Rebaa West, and Bir Rebaa Southwest.

Nigeria

Nigeria has had foreign involvement throughout its oil industry's history, said Lee, but Nigeria's oil producers are going through a difficult period they say the government is doing nothing to alleviate.

Lukman said Nigeria needs to attract more private foreign capital, into the oil industry in particular. Lukman views recent government moves to attract investment with optimism.

"Nigeria may soon be able to achieve an investment environment that will attract more foreign capital," said Lukman. "There is a need for Nigeria to adopt policies now that utilize its oil income to promote actively the revival of the real sectors of the economy, particularly agriculture, solid minerals, manufacturing, and the energy sector.

"Nigeria needs to increase its oil reserves and production capacity while also pursuing the speedy execution of its LNG and petrochemical projects. Increased local utilization of natural gas to replace oil should also be pursued."

Nigeria's LNG export project and offshore exploration are receiving a lot of interest, said Lee, although the situation is complicated by the government slashing its oil industry budgets this year.

As far as existing onshore production goes, Nigeria's government appears to be doing little to help oil companies involved with Nigerian National Petroleum Corp. (NNPC) in producing joint ventures.

For example, Nigeria's government has cut NNPC budgets for this year, threatening refurbishment of field operations as well as investment in community projects. Government's refusal to plow some of its massive oil revenues back into community projects in oil producing regions has led to civil unrest and targeting of oil companies-particularly Royal Dutch/Shell by protest groups (OGJ, Apr. 22, p. 32).

Government sidestepped the onshore problems by offering offshore acreage to foreign companies under production sharing agreements rather than as joint ventures.

This has sparked a flurry of interest in deepwater exploration, and so far two companies have reported discoveries.

Shell Nigeria Exploration & Production Co., a new Shell unit set up for offshore ventures in the country, made a find with its 1 Bongo wildcat on License 212.

There has been speculation of a major discovery, but Shell says only that it has tested the well and will not know if it is commercial for some months (OGJ, Mar. 18, Newsletter).

An official of Elf Aquitaine SA also said his company recently found oil in Nigeria's deep offshore play. This was made with 1 Bonga wildcat, said the official, which has yet to be appraised.

"Nigeria's offshore prospects are much easier to deal with politically," said Lee, "because they don't involve a local population that will start expecting a share of revenues-a welcome relief for government."

CGES reckons that if Nigeria's current financial problems continue, government will find it difficult to maintain current levels of investment. Maintaining current production capacity is viewed as a priority over seeking more new investment.

Biggest step for Nigeria, though, has been the go-ahead, after almost 30 years of deliberations, of the LNG export plant at Bonny Island. The $4 billion plant is expected to come on stream in 1999.

Even as the deadline approached for signing of contracts, project partner Shell found itself besieged by protests over its approval of the project. This was seen as tacit approval of Nigeria's military regime by activists alleging human rights violations by the junta (OGJ, Dec. 25, 1995, p. 28).

Venezuela

CGES' Lee said that, of the countries chasing foreign partners, "Venezuela is the most interesting case, because it reversed its position from a go-it-alone stance. This was because of a combination of factors.

"Petroleos de Venezuela SA (Pdvsa) has long felt it wants foreign investment, but not the government. However, the country's financial difficulties have reduced political opposition.

"For the time being, foreign involvement will be limited to marginal or difficult fields, but this represents a significant amount of oil."

On July 12 Venezuela's President Rafael Caldera disclosed signing of the first profit sharing exploration and production contracts between Pdvsa and eight groups of foreign oil companies (OGJ, July 22, p. 28).

The contracts are for eight new license areas throughout Venezuela covering a total 18,000 sq km. Exploration spending is expected to amount to $1 billion to prove a resource estimated at at least 7 billion bbl of light and medium gravity crude oil. Under the contracts exploration risk is taken by license holders, with Pdvsa buying in if a find is declared commercial.

This is only the latest in a string of E&P project awards by Venezuela's government in a bid to increase oil revenues despite claims by others in OPEC the country is currently violating its OPEC quota agreement.

Last December Chevron Corp. and Pdvsa unit Maraven formed an alliance for further development work in Boscan field, which will lead to supply of heavy crude oil to Chevron's U.S. refineries.

Chevron will operate the field and spend as much as $2 billion there in 20-30 years. Output will be boosted to 115,000 b/d after 3 years' work from the current 80,000 b/d (OGJ, Dec. 25, 1995, p. 29).

Only a month before, Conoco Inc. and Maraven SA signed an agreement to develop and market heavy crude oil from the Orinoco belt heavy oil region. Conoco plans to use its delayed coking process to produce synthetic crude for shipment mainly to its Lake Charles, La., refinery (OGJ, Nov. 20, 1995, p. 41).

In 1993 BP became the first major to win an upstream venture in Venezuela since nationalization in 1976 when it won a contract to bring Pedernales field back into production.

The field was discovered in 1933 and has been shut in at various times, most recently in 1985. BP predicts waterflooding will help bring production back to 20,000 b/d by 1997.

Maxus Energy Corp., Dallas, also secured an agreement to revive output in Quiriquire field, which was producing 900 b/d of oil when the deal was concluded in 1993. BP acquired a farmout of this project in 1994 to take a 45% stake. The partners are undertaking a 3D seismic survey and drilling two exploratory wells in the field.

Indonesia

Wood Mackenzie Consultants Ltd., Edinburgh, contends Indonesia remains the center of Southeast Asia's upstream oil and gas sector, with 21 new field developments either under way or likely to be developed the next few years.

Eighteen of the new developments are gas discoveries. These are expected to be producing a total 1.6 bcfd of gas by 2000, compared with 40,000 b/d from the three oil projects.

Most of the new developments are being led by western majors or independents. Mobil Corp., for example, plans to develop five fields with estimated reserves of 22 million bbl of oil and 2.33 tcf of gas.

Total is operator of four development prospects with estimated reserves of 220 million bbl of oil and 8.1 tcf of gas. ARCO is operator of two planned gas developments, with total reserves amounting to 1.6 tcf of gas.

In addition to these projects, Indonesia also has Exxon's massive Natuna gas discovery, with reserves estimated at 46 tcf, and ARCO's Wiriager Deep find, with estimated reserves of 7-8 tcf of gas, waiting in the wings.

In June Indonesia's state company Pertamina disclosed a new offering of exploration acreage under joint ventures and production sharing contracts with foreign partners (OGJ, June 17, p. 26).

Copyright 1996 Oil & Gas Journal. All Rights Reserved.