OGJ Newsletter

Market Movement

Possible tight oil market may give way to competition, analysts say

Now that the Organization of Petroleum Exporting Countries has extended its production quotas through the third quarter, industry analysts are focusing on potentially tight market fundamentals through the rest of this year and increased competition between OPEC and Russia in the future.

The likelihood for a tight market through the rest of this year is supported by the seasonal increase in demand, increased industrial activity, and low exports of Iraqi crude, estimated at 650,000 b/d in the first 3 weeks of June under the United Nations oil-for-aid program, said Matthew Warburton with UBS Warburg LLC, New York.

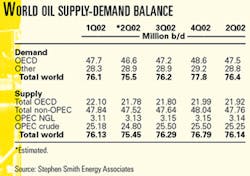

On June 27, the day after OPEC members voted to hold the line on production, the August contract for benchmark US light, sweet crudes settled at $26.86/bbl on the New York Mercantile Exchange. That's the highest level for a front-month oil futures contract in that market since mid-May, Warburton noted. And it occurred "despite the end of official 'cuts' from key non-OPEC producers (Norway and Russia) as well as no explicit reference to (maintaining) a $25/bbl price target in OPEC's communiqué&," he said.

Reversed situation

The rest of this year should be "something of a reversed situation as compared with the first half" of 2002, said Stephen A. Smith, founder of Stephen Smith Energy Associates, Natchez, Miss., in a recent report.

Oil inventories among the Organization for Economic Cooperation and Development (OECD) countries should "return to near normal levels," with prices for benchmark US crudes spending "less time above the $25/bbl mark," he predicted.

"OECD stocks appear to be trending from well-above-normal levels on Mar. 31 back towards normal, but at a slower pace than we had previously expected," Smith said.

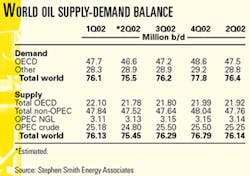

World oil demand is expected to average 76.4 million b/d for all of 2002, up 0.6% from 2001 levels, Smith said (see table). During the first quarter of this year, demand was about 1.4% lower than in the same period of 2001, largely as a result of mild winter weather. But with some economic recovery, it is estimated to have increased by 0.4% over year-ago levels in the second quarter.

"Our forward balances are based on a 0.9% year-over-year world demand increase during the third quarter and a 2.1% year-over-year demand increase for the fourth quarter," said Smith. "The relative strength of fourth quarter growth is due in part to being measured against the immediate aftermath of Sept. 11 last year."

Meanwhile, OPEC's official production quota of 21.7 million b/d will be padded by cheating among its members averaging 1.3 million b/d during the second half of the year, up from 1.2 million b/d in the first half, Smith figures. Assuming Iraq's production averages 2.5 million b/d, he calculates total production among all 11 OPEC members at 25.5 million b/d through the last half of 2002, up from 25 million b/d during the first half.

Despite that increase and a net gain of 160,000 b/d in non-OPEC production, world demand for oil will still outstrip production through the rest of this year, Smith predicted.

Yet he also expects prices for benchmark US oil to be lower than the $25-28/bbl that prevailed for most of the second quarter. He sees four main reasons for the "aberrational" strength of oil prices during that quarter:

- The "extraordinarily high" level of Middle East tensions stemming from the Israeli-Palestinian conflict.

- The perceived risk to oil supplies stemming from the "next step" in the US war on terrorism. "Iraqi oil supply is one obvious concern, and energy-directed terrorism is a second," Smith said.

- OPEC's apparent success in regaining control of its own output and the ability to influence non-OPEC production.

- A "perception" that the surprising early economic rebound from the Sept. 11, 2001, terrorist attacks created a false impression as to both the strength and timing of (a generally) global economic recovery that "may have spilled into energy markets." Smith said, "Outlooks for the world economy have become more subdued over the last 2 months, and this implies weaker growth in oil demand."

Russia's potential

In any event, he said, "Oil prices have only one foot planted in politics; the other is firmly planted in the marketplace." The most visible threat to OPEC-the "one that appears to have forward momentum"-is Russia and the other former Soviet Union oil-producing countries.

The International Energy Agency estimates that oil production from Russia and other FSU countries will average 9.17 million b/d this year, up from 7.95 million b/d in 2000. "This is a staggering increase for only a 2-year period," said Smith. "In total, all other non-OPEC producers are expected to increase by 0.35 million b/d over the same period. Adding all non-OPEC producers together (including Russia and the Caspian) yields a 2-year increase of 1.57 million b/d, or almost 0.8 million b/d per year for non-OPEC."

Such an increase in non-OPEC production "might be acceptable if world oil demand were increasing at the pace of the 1.4 million b/d per year that it averaged for 1993-1999," he said. "But IEA's world oil demand projection for 2002 implies a 3-year average annual increase from 1999 to 2002 of only 0.4 million b/d per year. If world oil demand and non-OPEC supply trends of the last 2-3 years were to persist, then OPEC would be losing (market shares totaling) 0.4 million b/d per year."

Future trends

That "suggests several trends going forward: increased bickering within OPEC for larger shares of a slowly growing or perhaps constant pie, increased cheating, and increasingly aggressive OPEC efforts to pressure Russia, Mexico, Norway, and others to participate in production management," said Smith.

"This problem may not come to its first serious testing point until the next pullback in world oil demand. This could be as early as next January if the winter is mild again," he said.

"We are not suggesting an imminent price collapse. This would be akin to attempting to pinpoint the location of the next tornado," Smith said. "We are merely arguing that the conditions that tend to spawn tornadoes have become more pronounced."

Industry Scoreboard

Scoreboard

Due to a holiday in the US, data for this week's Industry Scoreboard are not available.

null

null

Industry Trends

LOWER 48 natural gas reserve additions per rig-year are declining while, counterintuitively, the reserves-to-production (R/P) ratio of new reserve additions is climbing.

Those trends were detailed in a new report by Stephen A. Smith, founder of Stephen Smith Energy Associates, Natchez, Miss.

Smith noted that rig productivity, measured as billion cubic feet of reserve additions per average gas rig-year, has been trending lower. Over the last 5 years, he said, gas reserve additions have averaged 37.7 bcf/rig-year, down from a previous average of 43 bcf/rig-year.

"Without the boost from coalbed methane additions in 2000 and 2001," he said, "the 1987-2001 average would be close to 30 bcf/rig-year."

Smith said, "The second trend is less obvious in the aggregate Lower 48 gas reserves data and mainly inferred: The reserves-to-production ratio of new reserve additions appears to be trending up.

"The conclusion we draw is that, despite lower bcf/rig-year productivity, the substantial increase in (the US) gas rig count is likely to more than replace production for the next few years," said Smith.

In the last 5 years, Lower 48 gas reserves increased by 8%, but Lower 48 production increased by only 2%, he said.

"With an average gas price of $4.07/Mcf in 2001, we can reasonably conclude that production was supply-limited (no one curtailing production waiting for better prices), and that the reserves-to-deliverability ratio increased by 6% over this interval. We expect more of that."

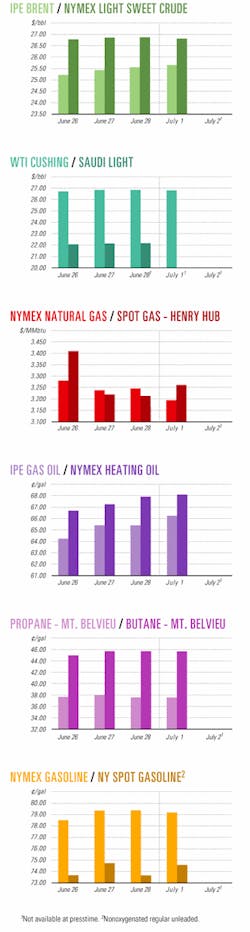

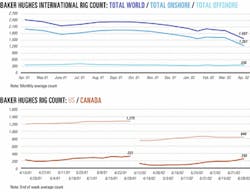

SHARP INCREASES in oil and natural gas spending plans in the US and Canada have reaffirmed earlier signals that oil service fundamentals and activity levels should continue to improve.

That conclusion comes from UBS Warburg LLC in its latest monthly PatchWork Survey. The survey compiles responses from oil and gas operating personnel, who are polled as to their expectations of price and activity level.

"Positive expectations keep on rolling this month on the heels of last month's turnaround in activity," UBS said in its June survey. "(US and Canadian) operators followed through on their plans from the last survey, and if this survey follows the same path, activity and pricing levels should continue the positive trend."

Outside the US and Canada, activity indicators are still positive, although not as high as in May, said UBS analyst James Stone of New York.

"The results of this survey, along with those of prior surveys, further validates our belief that the second quarter will be the bottom of earnings in the current cycle. In addition, the group should, in our view, show significant improvement in the latter half of 2002 through the beginning (of) 2003," Stone said of service companies.

Government Developments

SAFETY AND SECURITY of oil and gas industry infrastructure is a high priority in Washington, DC.

The House Committee on Energy and Commerce last month pushed its own proposal to update US pipeline safety rules, helping set the stage for a larger debate on the issue in talks on comprehensive energy legislation.

Another House committee, transportation and infrastructure, last month passed its own version of the bill, HR 3609, which gives the Department of Transportation's Office of Pipeline Safety authority to order pipelines to take immediate action if the agency determines it is needed for public safety or to counter a terrorist threat (OGJ Online, May 23, 2002).

Both proposals would strengthen safety laws for natural gas, oil, and refined products pipelines and would authorize funding for new and existing training and inspection programs over the next 4 years starting Oct. 1.

The Senate included its own pipeline safety measure in a pending comprehensive energy bill (S. 517). Negotiations to reconcile that plan with a House energy bill-passed last August-recently got under way (see related story, p. 41).

What kind of environmental enforcement role the federal government should play when a pipeline is built or replaced is considered the biggest sticking point for House committee members. Under the energy and commerce committee plan, a new interagency committee would have to approve pipeline environmental permitting based on comments from a broad swath of agencies. The transportation committee bill gives DOT most of the environmental siting authority in an effort to streamline permitting, a major goal of the White House's energy plan.

Industry is most worried about the pipeline safety plan now in the Senate's energy bill. It requires more-frequent inspections than either House proposal and imposes much higher penalties if safety lapses occur. Pipeline operators also would have to report any release of hazardous liquids or carbon dioxide greater than 5 gal to OPS.

THE DEPARTMENT OF JUSTICE, meanwhile, has released new security guidelines for refineries and other industrial plants, including about 15,000 chemical facilities nationwide. DOJ said the guidelines would be used to identify and assess potential security threats, risks, and vulnerabilities.

In developing its own methodology, DOJ, in conjunction with the Department of Energy's Sandia National Laboratories, said it focuses primarily on terrorist or criminal activities that could have a widespread "national" impact.

The agencies also considered localized situations where the release of hazardous chemicals might compromise the integrity of a facility, cause serious injuries or fatalities among facility employees, contaminate adjoining areas, and cause injuries or fatalities among nearby populations.

In a related effort, a pending bill by Sen. Christopher Bond (R-Mo.) is designed to restrict public access to information about worst-case accident scenarios at refineries and other chemical facilities.

Industry maintains that the current availability of such information may put plants and their surrounding communities at a higher risk of terrorist attack. Pressure groups maintain, however, that local officials and residents need access to accident scenarios to mitigate the much larger risk of accidents.

Quick Takes

The Kashagan supergiant oil discovery in the northeastern sector of the Caspian Sea off Kazakhstan was officially declared commercial June 28, opening the way for preparation of a development plan.

A 2-year appraisal program undertaken by contracting companies in the North Caspian Sea production-sharing agreement, in conjunction with the Kazakhstan government, resulted in a preliminary estimate of producible reserves at 7-9 billion bbl in that field. These figures will be revised as necessary on the basis of further studies and data, officials said.

First oil from the field is expected by 2005. Meanwhile, the contracting companies will continue to explore other structures in the North Caspian Sea contract area.

ENI SPA is operator for the project through Agip KCO, formerly Offshore Kazakhstan International Operating Co. (OKIOC), with a 16.67% interest. Other contractors include BG Group PLC 16.67%, ExxonMobil Corp. 16.67%, Inpex Masela Ltd. 8.33%, Phillips Petroleum Co. 8.33%, Royal Dutch/Shell Group 16.67%, and TotalFinaElf SA 16.67%.

The apparent supergiant field was discovered in the 11-block Kashagan production-sharing contract area by the OKIOC consortium in 2000. Edinburgh analysts Wood Mackenzie last year estimated the field's potential reserves at 10 billion bbl of oil and 25 tcf of gas, although members of the consortium have not confirmed any reserves estimates (OGJ, Dec. 17, 2001, p. 18). F

Elsewhere on the development front, Houston-based Noble Energy Inc. and partners have signed a final definitive agreement with an Israeli power utility covering sale of natural gas from their field off Israel. The deal marks the latest progress in the first commercial gas field development off a country long deemed bereft of hydrocarbon potential-until a string of world-class gas discoveries was made by foreign firms in recent years (OGJ, May 20, 2002, p. 22). Officials of Noble and its partners Delek Drilling LP, Avner Oil Exploration LP, and Delek Investments & Properties Ltd. late last month formally executed the final definitive gas sales agreement with Israel Electric Corp. Ltd. Initially, the IEC supply contract is for 630 bcf of natural gas over 11 years.

Earlier in June, Noble Energy (formerly Noble Affiliates Inc.), was granted a license from the Israeli government to build an offshore pipeline from the company's Mari-B field to Ashdod. The direct route to Ashdod (see map, OGJ, May 14, 2001, p. 9), Noble said, would allow the company and its partners to supply gas to IEC's power station at Ashdod in the beginning of the fourth quarter of 2003-earlier than previously expected. The pipeline would have ultimate capacity of 600 MMcfd. Progress on construction of the jacket, platform, and other production equipment continues on schedule, and costs remain within budget, Noble said. The jacket and platform are scheduled for shipment to Israel this winter. Installation of the jacket, platform, and related production facilities are expected to be completed in third quarter.

Operators have awarded drilling contracts related to world-class projects off Kazakhstan and in the deepwater Gulf of Mexico to Pride International Inc., Houston.

The first, awarded by Agip KCO, is for Pride's 3,000 hp Rig 319 to work in the world's newest supergiant oil field, Kashagan, in the Caspian Sea (see related item, this page). The rig will drill under a 1-year contract with the option for two 1-year options.

Rig 319 will be modified and enhanced for deployment to an artificial island in the Kazakh sector of the Caspian Sea, Pride said.

The total contract value-excluding option periods but including the rig's modifications-is more than $35 million. The rig should be ready to be mobilized in the third quarter, with operations expected to begin during second quarter 2003, Pride said.

The other contract, covering 1 year, is for Pride's Rig 1503 (formerly Rig 1004). The contract, let by Dominion Exploration & Production Inc., is to conduct drilling operations from the Devils Tower spar platform in 5,600 ft of water on Mississippi Canyon Block 773. Plans for development of Devils Tower oil field were revealed last year (OGJ, July 2, 2001, p. 8).

The Dominion rig contract includes work to upgrade the rig to 1,500 hp from 1,000 hp and to equip it for dynamic-environment operations. The contract, which is expected to take effect during the second quarter of 2003, is valued at $11 million, including rig modifications.

Kerr-McGee Oil & Gas Corp., a unit of Oklahoma City-based Kerr-McGee Corp., began oil production June 24 from its Boomvang field in the Gulf of Mexico from the first of three subsea wells. The first Boomvang well, which lies in the East Breaks area about 150 miles south of Houston in 3,450 ft of water, is flowing 50 MMcfd of gas. A second well will be brought on production soon.

At peak production, Boomvang will produce 160 MMcfd of gas and 32,000 b/d of oil by the second quarter of 2003, Kerr-McGee said. Boomvang contains reserves estimated at 70-100 million boe.

Boomvang interest holders are operator Kerr-McGee 30%, Enterprise Oil PLC 50%, and Ocean Energy Inc. 20%. Earlier this year, Royal Dutch/Shell Group announced an offer to acquire Enterprise (OGJ, Apr. 8, 2002, p. 39).

The Boomvang field covers East Breaks Blocks 642, 643, and 688. The field was developed using a truss spar that is a twin to the truss spar installed at Kerr-McGee-opeerated Nansen field 9 miles away, the company said. Kerr-McGee is currently building a third truss spar, which will be used to develop neighboring Gunnison field. First production from Gunnison is expected in early 2004.

In other production news, a unit of Europa Oil & Gas Ltd., London, and its Ukrainian partner, Zahidukrgeologia, began gas production from Horodok field, which lies in the L'viv region of western Ukraine. The field is operated by Europa's Ukrainian unit. Horodok field is estimated to hold 25-42 bcf of gas reserves in Miocene sandstone at less than 1,000 m. The field will be developed incrementally, Europa said, with additional reserves potential in the northern extension of the field to be tested in 2003. Initially, three wells will produce gas into the nation's gas supply grid, with a fourth well being considered over the next month. In addition, the partners said they would consider drilling an additional development well sometime later this year. Europa's other gas assets in western Ukraine include licenses covering Niklovich and Veliki Mosty fields, both of which are new developments. Europa said it would start predevelopment well testing later in 2002. Europa estimates that it holds interests in 66-97 bcf of net gas reserves in its western Ukraine acreage. In addition, Europa holds exploration interests in the Carpathian oil province in Romania and Poland that have substantial reserves potential, the company said.

Noble Energy started production June 25 from Lost Ark field in the deepwater Gulf of Mexico. The field flowed from a single well on East Breaks Block 421 at a rate of 28 MMcfd with flowing tubing pressure of 3,100 psi. Noble plans to ramp up production to 40 MMcfd. Noble Energy's wholly owned subsidiary, Samedan Oil Corp., operates the field with 48% working interest. Forest Oil Corp., Denver, has 50% interest, and Noble Drilling Exploration Co. has 2%. Lost Ark was discovered in 2001 and is in 2,700 ft of water. The field was developed with a subsea completion tied back via a 26-mile umbilical and flow line to a host platform (OGJ, Feb. 19, 2001).

Stelmar Shipping Ltd., Athens, has taken delivery of two new Panamax tankers, which completes Stelmar's newbuilding program for 2002. Both tankers already have multiyear charter contracts.

Daewoo Shipbuilding & Marine Engineering Co. Ltd. built the two double-hull tankers, the Rosemar and the Goldmar. The time-charter contract for the Rosemar is for 24 months at $17,500/day. The Goldmar contract is for 5 years at $18,500/day.

The Rosemar and Goldmar are sister ships to the Rubymar, Jademar, and the Pearlmar, which were delivered in the first 4 months of 2002 and have 24-month charters at an average rate of $18,000/day.

Stelmar Pres. and CEO Peter R. Goodfellow said, "Our Panamax newbuilding program has enabled us to create a strong presence in a 'niche market' that has an over-age and under-built fleet and to take advantage of the increasing oil trade from South America to the US." F

Kinder Morgan Energy Partners LP declared a successful open season for a new natural gas storage project designed to help ease the supply infrastructure bottleneck for Rocky Mountain region gas.

KMEP's Kinder Morgan Interstate Gas Transmission LLC unit reported that the added 6 bcf of gas storage capacity to be created by its Cheyenne Market Center service was fully subscribed under 10-year contracts during a 2-week open season that ended last month. Bids totaled more than 26 bcf.

Pending approval by the Federal Energy Regulatory Commission, KMIGT will construct pipeline, compression, and storage facilities to provide the new service at a capital cost of $30 million.

The new service offers firm storage capabilities that will allow for the receipt, storage, and subsequent redelivery of natural gas supplies at applicable CMC points located near the Cheyenne Hub in Weld County, Colo., and KMIGT's Huntsman facility in Cheyenne County, Neb.

The additional infrastructure will have injection capability of 38.4 MMcfd and withdrawal deliverability of about 62.4 MMcfd. CMC, which is expected to be in service during the summer of 2004, will not affect existing KMIGT transportation or storage services, KMEP said.

Increased coalbed methane production and transportation infrastructure bottlenecks have been depressing markets for Rocky Mountain gas (OGJ, July 1, 2002, p. 7).

Richard D. Kinder, chairman and CEO of KMEP parent and Houston-based Kinder Morgan Inc., noted, "Rapidly growing natural gas supplies in Wyoming and ongoing pipeline expansions have led to increased need for services at the Cheyenne Hub."

The advancement of gas-to-liquids technology received another boost late last month with the award of a contract to implement a semicommercial GTL unit in South Africa.

South Africa is one of the pioneering nations in GTL technology; for decades its domestically produced transportation fuels and some chemicals were derived by state oil concern Sasol Ltd. from a coal-based synthetic oil industry based on Fischer-Tropsch technology that incorporated a GTL process. Sasol remains one of the GTL field's leaders.

Petroleum Oil & Gas Corp. of South Africa (Pty.) Ltd. (Petro SA)-a merger of South Africa's Mossgas Pty. Ltd. and other state petroleum assets-on behalf of a joint venture of itself and Norway's state oil firm Statoil ASA let an engineering-services contract to Paris-based Technip-Coflexip to implement the unit. It will be based on Statoil's low-temperature Fischer-Tropsch technology. The plant, with a nominal capacity of 1,000 b/d, will be based at Mossel Bay. The expected start-up is yearend 2003.

Mossel Bay is also the site of a major GTL complex that produces liquid fuels from gas produced from fields off South Africa.

Under the contract, Technip-Coflexip will carry out detailed engineering as well as procurement services and supervision of construction.

The project will be undertaken at Technip-Coflexip's engineering center in Rome, in association with Technip-Coflexip's new affiliate, to be created as a joint venture in South Africa with a local partner.

MMS introduces well logs online

The Department of the Interior's Minerals Management Service announced a new online ordering system that allows companies to research oil and gas well logs online; the information can also downloaded onto a customized CD-ROM for $15.

About 170,000 well logs with run dates of December 1995 and prior are available to the public. The logs are scanned in raster format (tagged image file format, or TIFF, images) and include 1-in. and 5-in. induction, neutron density, formation density, and dipmeter logs. The information is on the MMS website at www.gomr.mms.gov.

Data may be retrieved for an individual well log by entering a specific area and any of the following criteria: API number, lease number, block number, well name, or log type, MMS said. Once the requested logs are identified, they can be added to a shopping cart and ordered online.

"The new system spares MMS customers the inconvenience and expense of having to visit the Gulf of Mexico OCS Region's Public Information Office in New Orleans to duplicate well logs on paper," said MMS Director Johnnie Burton. MMS's new system will mean that, after August, paper copies of online well logs will no longer be available.