OGJ Newsletter

Market Movement

OPEC on a 'war footing'

Traders' perceptions of increased quota-breaking by the Organization of Petroleum Exporting Countries, coupled with reduced prospects for war in the Middle East, have driven down oil futures prices in recent weeks.

But rather than losing "cohesion," as some traders claim, "OPEC appears to be on a war footing," said Paul Horsnell, JP Morgan Chase & Co., London. "Oil is being moved out of the (Persian) Gulf to fill up producer-held storage closer to market. We suspect that much of OPEC's apparent increase is not actually making its way to refiners. Some is, as oil is also being moved to Asian refiners who have a certain sense of panic that their inventories are too low for normal times, let alone for a period of Middle East uncertainty."

In a Nov. 6 critique of futures speculation, Horsnell said, "Grievous bodily harm has been inflicted on oil prices over the last month. It doesn't take Sherlock Holmes to work out who and how, but why is more arguable." Commodities and Futures Trading Commission data "show the heaviest selling of crude oil futures by noncommercial traders over any 4-week period since 1998."

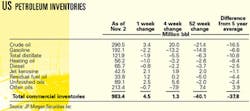

Futures prices for gasoline and heating oil also have been stung by the crude sell-down, despite evidence of potential supply shortages (see table).

"US heating oil inventories have now passed beyond critical into dangerously low. They are too low for a normal US winter, let alone the lower-than-normal temperatures of late. There will be serious price spikes unless the weather warms up significantly and inventories increase very sharply," Horsnell said.

Moreover, he said, "Reformulated gasoline can also be added to the intensive care list, after 13 inventory falls in the last 15 weeks. The overall level of gasoline inventories is also far too low for a market where October demand showed a remarkable 4% annual growth rate."

US oil inventories have increased recently, with refinery runs still depressed as result of extended storms along the US Gulf Coast. However, oil stocks "are still...below normal levels, and the extent of the recent increase still falls short of what we would have expected given the refinery slowdown," Horsnell said. "The oil market has then not slipped from tight to slack."

BULLETINS

Baghdad's acceptance last week of the United Nations Security Council's resolution to allow weapons inspectors to return to Iraq after nearly 4 years helped push oil markets downward. Market players hadn't expected a response from Iraqi President Saddam Hussein until the end of the week. On Nov. 13, the December contract for US light, sweet crudes plunged by 71¢ to $25.19/bbl on the New York Mercantile Exchange, while the January contract fell by 82¢ to $24.48/bbl. Some recovery was made early Nov. 14, however, when the US Energy Information Administration reported that crude oil stocks had dropped unexpectedly by 6.9 million bbl the week ended Nov. 8. As progress is made by weapons inspectors, analysts expect the so-called "war premium" to fluctuate.

The US Congress last week killed a 2-year effort to pass comprehensive energy legislation (see story, p. 22). Lawmakers earlier in the week briefly considered a so-called "energy lite" House proposal that included pipeline safety and nuclear plant insurance. But dozens of other pending proposals, including expanded drilling incentives, favorable tax treatments for construction of a new Alaska gas pipeline, updated clean fuel rules (including an ethanol mandate), and royalty reform measures will be now considered at an undetermined future date. Passage of the pipeline safety bill still was a possibility at presstime (OGJ Online, Nov. 14, 2002). Republicans vowed to resurrect the legislation in January, but Democrats remained skeptical.

Industry Scoreboard

null

null

null

Industry Trends

US ENERGY MERCHANTS will need $90 billion in refinancing by 2006.

That word comes from Standard & Poor's Rating Service, which reported that access to capital will be crucial to survival for energy merchants looking to refinance medium-term debt. For the most part, banks originally financed the debt, analysts said.

"It should be noted that certain companies have better access to capital than others," said Arleen Spangler, an S&P credit analyst. "Generally, however, bad news relating to accounting irregularities, trading losses, regulatory uncertainty, and a general lack of investor confidence in the overall business model have plagued the sector, making this one of the worst times in recent history to refinance debt." Credit analyst Tanya Azarchs added, "Banks are also significantly exposed to this troubled sector since many of the construction projects and major acquisitions were financed through widely syndicated bank loans. In addition, the banks have exposure to this sector through general corporate credit facilities or other commitments."

S&P based its conclusions on data compiled from 23 power companies, of which 15 had revenues from both regulated and unregulated activities and 8 were totally unregulated. The report compared total dollar amount of refinancing needs during the next 4 years as well as refinancing needs as a percent of total capitalization and as a percent of total debt outstanding.

OVER-THE-COUNTER (OTC) ENERGY BROKERS formed the Washington, DC-based Energy Brokers Association (EBA) to help the US energy merchant industry navigate its "uncharted waters."

EBA Pres. and APB Financial LLC Vice-Pres. Chris Edmonds said EBA members represent brokers of natural gas, electricity, coal, and refined crude products. "This coordinated effort is being made as a proactive response to the current challenging environment in the energy markets. The association recognizes the need for all the key players in the energy markets to define and adopt reliable practices and standards in order to improve and advance the industry, both now and in the future," a news release said.

EBA will work with energy companies and trade associations, other financial industry participants, and government agencies to address financial, regulatory, and operational issues. EBA also will more clearly define the role of OTC brokers.

"We are going to come together and put our competition aside for the moment. We are saying, 'What can we do that is in the best interest of the business?'" Edmonds said.

Seven companies had joined when the EBA was announced Nov. 5, and another six companies have indicated an interest in joining, a spokesman said. EBA also is intended as a vehicle to work with other organizations having an interest in the energy market whether it's a government agency like the Federal Energy Regulatory Commission or another nonprofit association like the National Energy Marketers Association. The founding members are Amerex Group, Houston; APB Financial LLC, Louisville, Ky.; TFS Energy LLC, Stamford, NY; and New York-based GFI Group Inc., Natsource LLC, Prebon Energy Inc., and Starsupply Petroleum LLC.

Government Developments

IRAN is considering participation in the Energy Charter, an intergovernmental organization devoted to promoting East-West energy cooperation among its 51 European and Asian member states.

Upon the invitation of the Iranian government, Energy Charter Sec. Gen. Ria Kemper visited with numerous energy officials in Tehran Nov. 5-7.

Discussions focused on the Energy Charter's promotion of international cooperation regarding energy trade, transit, investments, and energy efficiency (OGJ, Mar. 4, 2002, p. 20).

Procedures for accession to the Energy Charter Treaty (ECT) by nonmember states also were discussed. Kemper said a nation could convey a positive signal to the international community of investors by signing on to the ECT's rules on investment protection and nondiscrimination.

Member states already include all the countries of the former Soviet Union. Iran is the only littoral state of the Caspian Sea that is not a member of the Energy Charter process. "The Energy Charter offers its member governments a forum for discussions on energy policy matters, in particular with regard to the security of oil and gas exports from emerging production areas in the Caspian basin and Central Asia," Kemper said. "As an important producer-state, but also as a potential transit route to world markets for Central Asian energy resources, Iran in my view has a clear interest in participating in these discussions within the charter's framework," she added.

As a next step in developing its relations with the charter, Kemper invited the Iranian government to consider applying for observer status at the Energy Charter Conference, the organization's governing body. If such an application were accepted, Iran would become the seventh member of the Organization of Petroleum Exporting Countries to be granted observership at the Energy Charter. The others are Algeria, Kuwait, Qatar, Saudi Arabia, UAE, and Venezuela.

GUYANA plans to resume onshore exploration.

It has been prevented from pursuing offshore oil exploration by border disputes with both Suriname and Venezuela.

The Guyana government intends to offer the 10,000 sq km Takutu basin in the south, 500 km from the coast and east of the Brazilian border, the only one of Guyana's three neighbors that is not arguing over territory.

Robeson Benn, commissioner of the Guyana Geology and Mines Commission, told OGJ applications for prospective licenses are available "on a first-come basis." Guyana does not conduct bid rounds but prefers one-on-one negotiations. Hydrocarbons have been discovered in the area, Benn said.

Meanwhile, Guyana is not giving up its offshore oil exploration rights, despite border disputes. "There is no intention to abandon resources, which are ours by right of sovereign jurisdiction," Benn said. Suriname, which has both land and marine border disputes with Guyana, sent a gunboat to expel employees of CGX Energy Inc., Canada, from a drilling site on the Corentyne block.

A Joint Border Commission subcommittee completed a confidential report, and commissioners are expected to review it within weeks. International laws and conventions—which Guyana and Suriname signed—also could help resolve disputes.

A border dispute with Venezuela also has preempted exploration on the Pomeroon and Stabroek concessions off Guyana.

Quick Takes

RAS LAFFAN LIQUEFIED GAS CO. LTD. II (Rasgas II) has awarded a turnkey contract for the fourth train at the Ras Laffan LNG complex in Qatar to a joint venture of Snamprogetti SPA—a unit of Italy's ENI SPA—and Japanese companies Chiyoda Corp. and Mitsui & Co. Ltd.

The fourth LNG train will produce 4.7 million tonnes/year of LNG when it is completed in 2005. The JV will provide detailed engineering, procurement, and construction services.

The plant expansion is in line with Qatar's revised 2010 LNG production target of 40 million tonnes/year of natural gas produced from Qatar's giant North field.

Ras Laffan's two existing LNG trains together produce 6.6 million tonnes/year of LNG, and Snamprogetti currently is developing a third train under a contract awarded in April 2001. When completed in 2004, the third train also will have 4.7 million tonnes/year of capacity, making the third and fourth trains the two largest LNG trains currently being built. Rasgas II is a partnership of Qatar General Petroleum Corp. 70% and ExxonMobil Corp. affiliate Mobil QM Gas Inc. 30%.

QATAR SHIPPING CO.'s LNG-driven business plan calls for the company to acquire interests in several LNG vessels next year and other ships in 2004, OPEC News Agency reported.

Last week at Shina Shipyard in Tongyoung, South Korea, Qatar Shipping launched the MT Al Noman, the first in of three 37,000 dwt product and chemical tankers. The vessel currently is tied up at a lay-by berth for fitting-out in preparation for delivery in January.

The other two vessels, Dukhan and Jinan, will be delivered by March and June, respectively, OPECNA said.

The company last April ordered its first LPG vessel, scheduled for delivery in April 2004, and it has signed a newbuild contract with STX Shipbuilding Co., Busan, South Korea, for construction of a second LPG vessel. It is a 23,000 cu m, fully refrigerated tanker that is scheduled for delivery in December 2004.

Last month—to accommodate LNG exports from RasGas—Qatar Shipping agreed to take a one-fourth equity interest in an LNG carrier that Mitsui OSK Lines is constructing.

BG Group PLC reported it has discovered a gas accumulation on the South West Seymour prospect east of BG-operated Armada field in the central North Sea. The prospect lies on Block 22/5b, which BG, with 57% equity, operates on behalf of partners TotalFinaElf SA 25% and Centrica PLC 18%.

The Galaxy III jack up, working from the Armada platform, spudded the 22/5b-A12 discovery well, which encountered a 150 ft hydrocarbon column within Fulmar sands and another oil column within the underlying Pentland sands. The prospect was drilled following completion of BG's $100 million Armada field Phase 2 drilling program of three additional wells, which began in December 2001.

By drilling South West Seymour as part of the existing Armada development program, the company said it "maximized opportunities using existing resources." The South West Seymour partners intend to make some minor modifications to the Armada platform and will sidetrack the well. First production is expected in second quarter 2003. x‡

Apache Corp., Houston, operator of the West Mediterranean (Block I) concession off Egypt, recently made its third consecutive natural gas discovery in the deepwater portion of the concession. The 31,200 sq km concession is in the gas-prone Nile Delta. The El Max-1X well is in 3,100 ft of water 5.5 miles south of the partnership's first deepwater discovery, the Abu Sir-1X (Blue prospect), which was completed in May (OGJ Online, May 22, 2002). The El Max potential pay interval is similar to both the Abu Sir and the subsequent Al Bahig discovery (OGJ Online, July 23, 2002), but with a larger interpreted gas column of more than 500 ft. Apache said it will drill two additional wells by yearend. The partnership is working towards establishing sufficient reserves to support a deepwater development soon and hopes for at least 3 tcf of gross natural gas reserves in the deepwater part of the concession. Apache holds a 55% interest in the project, RWE DEA AG holds 35%, and BP 10%.

Marathon Oil Co. received expressions of interest totaling 17 billion cu m/year of term transportation capacity (1.65 bcfd) from prospective gas shippers in a recently completed open season for shipping capacity on its proposed Symphony natural gas pipeline in the North Sea. A second phase of discussions with interested parties is now under way to determine how best to supply UK gas demand.

Announced in February, the 675 km Symphony pipeline is designed to deliver about 900 MMcfd of dry natural gas from Norway's Heimdal North Sea area to Bacton on the UK's southeastern coast. The line would pass through the Marathon-operated UK Brae complex and near the UK Miller and Britannia complexes (OGJ, Mar. 11, 2002, p. 8).

Marathon said the pipeline could come on line in 2005, assuming timely regulatory approvals, financing, and final engineering design.

Trans-Northern Pipelines Inc., Richmond Hill, Ont., has applied to Canada's National Energy Board to increase its petroleum products pipeline system capacity from Montreal, Que., to Farran's Point, Ont., and to reverse the direction of flow from Farran's Point to Toronto. The project would include replacing four line segments totaling 45 miles of 10-in. pipe with 16-in. pipe between Montreal and Farran's Point, upgrading four existing pump stations at Montreal and Como, Que., and Lancaster and Ingleside, Ont., and constructing storage tanks at the Farran's Point pump station. Trans-Northern also proposed to construct three pump stations along the existing 10-in. pipeline near Iroquois, Mallorytown, and Kingston, Ont., to accommodate flow reversal. Following completion of the expansion project, capacity from Montreal to Farran's Point will increase to 741 Mcfd from 371 Mcfd. The project is estimated to cost $82.25 million (Can.), and targeted completion date is mid-2004, Trans-Northern said.

AGIP GAS, a 50:50 joint venture of Libyan National Oil Co. and Italy's ENI SPA, has awarded a turnkey contract to an international consortium headed by Snamprogetti SPA.for the construction of a grassroots natural gas treatment plant at Mellitah, Libya. ABB Lummus Global Inc. and South Korean company Hyundai Engineering & Construction are the other consortium members.

The 700 million euro contract covers engineering, materials procurement, and construction services. Work is scheduled to complete in 29 months.

The 6.66 billion cu m/year plant will be built on the Libyan coast 80 km west of Tripoli. It will treat raw gas and liquid hydrocarbons from Libyan offshore fields and will supply products with specifications proper for sale.

The treated gas will be suitable for transportation in the Italian gas network, Snamprogetti said.

Engineering for the Petroleum & Process Industries, Cairo, has awarded a contract to Prosernat IPF Group Technologies to supply a molecular sieve gas dehydration package for the United Gas Derivatives Co. (UGDC) $300 million natural gas liquids extraction plant at Port Saïd, on Egypt's Mediterranean coast. UGDC, a consortium of Egyptian Natural Gas Co. unit Gasco, BP PLC, and Agip SPA, will operate the NGL plant, which will produce about 330,000 tonnes/year of LPG, 280,000 tonnes of propane, and 1 million bbl of condensate, as well as ethane for the petrochemical industry, sales gas, and LPG. The Prosernat dehydration package, to be delivered in mid-2003, will treat 1.1 bscfd of natural gas. Prosernat is a wholly owned subsidiary of France's Institut Français du Pétrole.

J. Ray McDermott, a unit of McDermott International Inc., New Orleans, has completed fabrication, transportation, and installation of facilities for the Bayu-Undan gas recycle project being developed in 80 m of water in the Timor Sea.

Fabrication, which took 17 months, was carried out at McDermott's Batam Island fabrication yard, P.T. McDermott Indonesia.

ConocoPhillips unit Phillips Petroleum (91-12) Pty. Ltd., holding a 58.6% interest, is the project's operator. Other partners are Santos Ltd., Inpex Ltd., and Agip SPA.

Facilities included two 10,000 tonne, 8-leg jackets, a personnel bridge, and flare system. Earlier this year the Intermac 650 launch barge towed the two jackets—a drilling, production, and processing platform jacket and a compression, utilities, and quarters platform jacket—3,000 km from Batam Island to the Timor Sea for installation as part of the Bayu-Undan gas recycle project.

The flare barge constructed is one of the world's longest and heaviest, McDermott said, measuring 226 m long and weighing 2,000 tonnes. During the transportation stage, the jackets were moved on a single barge, in one tow.

Woodside Energy Ltd. awarded a $55 million contract to a joint venture of Australian companies Technip-Coflexip Oceania and Subsea 7 (Australia) Pty. Ltd. to install subsea installations for the second North West Shelf trunkline project off Western Australia. The subsea work is associated with Woodside's new 142 km, 42-in. trunkline being constructed from Goodwyn and Rankin gas condensate fields on the North West Shelf to a point onshore near Karratha on the Burrup Peninsula, where an LNG plant also is being expanded (OGJ Online, Dec. 21, 2000). The $800 million trunkline, currently being installed by a unit of Saipem SPA, will facilitate increased production from area fields when it comes online in April 2004, coinciding with completion of a 4.2 million tonne/year fourth LNG train at the plant (OGJ Online, Feb. 7, 2002). The scope of the JV contract includes tie-ins of the trunkline into existing infield facilities near the North Rankin A platform. Connections will be via hyperbarically welded and flanged spool pieces and a 350Te valve manifold. Pipeline work includes dewatering and conditioning the trunkline and stabilizing it with 900 concrete gravity anchors. Following start-up of the second trunkline, extensive pipeline system modifications will be carried out on the existing first trunkline at North Rankin A platform. Engineering has begun. Technip-Coflexip will utilize its CSO Venturer vessel to carry out subsea installations in three phases during August 2003-April 2004.

Britain's Department of Trade and Industry (DTI), Aberdeen, has approved the £60 million Blake Flank development in the UK North Sea. BG Group PLC is field operator, with a 44% ownership interest, and its partners Talisman Energy UK Group and Paladin Resources PLC, London, hold 53.6% and 2.4% respectively. First oil production from Blake Flank, which is an extension of BG-operated Blake (Channel) field in the same production license, is scheduled for third quarter 2003. Facilities will include two production wells and a single waer injector tied into the existing Blake production manifold. The Blake Flank development is expected to produce 20 million bbl over 10 years. Blake Flank lies 64 miles from Aberdeen in the Outer Moray Firth, directly northeast of and immediately adjacent to Blake oil field. Due to the increased oil production rate of the combined development, the economic life of Blake field will be extended by 2 years. The subsea controls contract has been awarded to Kværner Oilfield Products AS, and subsea valve assemblies to Cameron Cooper Corp. BG currently is evaluating tenders for the drilling unit and subsea engineering, procurement, installation, and construction contract, and is expected to announce award details soon.

Correction

An article on p. 7 of the Nov. 11, 2002, issue addressing refiners' concerns about pending low-sulfur diesel regulations should have stated that API and the National Petrochemical & Refiners Association had endorsed an EPA independent panel's report, not the National Petroleum & Refiners Association.