China's ethylene sector continues to expand, attract foreign investment

China will continue to use a variety of refined products and condensate to produce ethylene, but the predominant feedstock in the next 10 years will be naphtha. China will soon become a net importer of naphtha; naphtha import requirements will increase substantially in 2010 and after.

The ethylene sector is one of the fastest-growing industrial sectors in China due to the country's increasing demand for petrochemical products and huge import requirements.

Because China needs huge amounts of capital and advanced technology, the Chinese government encourages foreign companies to invest in the petrochemical sector or refinery-petrochemical integration projects.

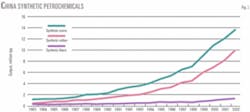

China's petrochemical sector expanded continuously in the 1980s, 1990s, and early 2000s. Demand for petrochemicals has grown just as fast as capacity has expanded. China is therefore still a big importer of petrochemical and chemical products.

The country has many large olefin projects, particularly ethylene, in development and is also expanding its downstream petrochemical producing capacity.

China has a long history of developing refineries alongside petrochemical plants; integration of these two operations is not a new strategy.

China has one of the few downstream oil sectors in which the government encourages foreign investment. In contrast, international oil companies that intend to form refinery-only joint ventures in China will face impediments for years.

In China, feedstocks for ethylene production are primarily oil products. The growth of China's ethylene production and feedstock requirements will partially affect China's future refining sector developments.

China's two state oil companies, China Petroleum & Chemical Corp. (Sinopec) and PetroChina Co. Ltd., have a near total monopoly in ethylene production.

China National Offshore Oil Corp. (CNOOC) will soon complete a joint-venture project with Shell Chemicals Ltd. Sinopec and PetroChina have plans to substantially expand their production capacity for ethylene and other olefins.

Sinopec, in addition to CNOOC, has also formed joint ventures with major international oil companies to build greenfield projects.

The state oil company's joint venture projects with BASF AG in Jiangsu province and BP PLC in Shanghai should be operational by 2005.

China had a unique feedstock structure for ethylene production in which gas oil played a key role. The structure has changed dramatically since the early 1990s. Naphtha will become the leading source of olefin feedstock in China.

China's petrochemical sector

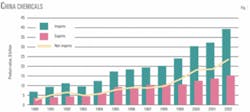

China currently imports nearly every type of major petrochemical. In 2002, China imported $39 billion of chemicals, plastics, rubbers, and related products, up from $6.6 billion in 1990 and $17.3 billion in 1995; exports were $15.3 billion in 2002.

The trade deficit was therefore $23.7 billion in 2002, up from $2.9 billion in 1990 and $8.2 billion in 1995 (Fig. 1).

The continuing trade deficit in chemicals, plastics, rubbers, and related products is largely due to the spectacular demand growth for these products in the 1990s, caused by rising living standards and a strong economy.

China generally has a short supply of organic chemical feedstock materials, synthetic petrochemicals (resins, rubbers, and fibers), fine chemicals, and fertilizers; therefore, the country needs various amounts of imports. Because China has a strong demand for petrochemicals, domestic production of these products has risen rapidly.

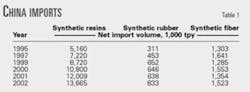

Table 1 shows the net imports of synthetic resins, synthetic rubbers, and synthetic fibers in 1995-2002.

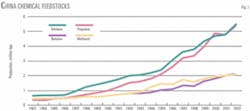

Figs. 2 and 3 show domestic production of selected basic organic petrochemical feedstocks and synthetic petrochemicals in 1983-2002.

Olefins and aromatics are two of the basic organic chemical feedstock materials in China. In 2002, China produced 5.4 million tonnes of ethylene, 5.4 million tonnes of propylene, and 2.1 million tonnes of benzene. Between 1983 and 2002, the average growth of ethylene, propylene, and benzene production in China was 11.8 %/year, 15.0 %/year, and 8.9 %/year, respectively.

China has an olefin shortage; new expansion projects are under way. For benzene, China currently is a net exporter.

Among the intermediate organic chemical feedstocks, methanol production increased rapidly, to 2.1 million tonnes in 2002 from 432,000 tonnes in 1983, an average growth of 8.7 %/year (Fig. 2). China, however, currently imports substantial amounts of methanol: 1.8 million tonnes in 2002, up from 138,000 tonnes in 1995.

China must import large amounts of various synthetic resins (plastics). Plastic production reached 13.7 million tonnes in 2002, up from 2.3 million tonnes in 1990 and 1.1 million tonnes in 1985. Net imports of plastics, however, were equally as large as production in 2002.

Also in 2002, China produced 3.5 million tonnes of polyethylene but imported 4.6 million tonnes, up from 1.4 million tonnes and 1.8 million tonnes, respectively, in 1995.

China is also a large importer of polystyrene, imports of which jumped to 2.4 million tonnes in 1998 from 1.1 million tonnes in 1995 but declined to 1.6 million tonnes in 2002. For polypropylene, China produced 3.7 million tonnes in 2002 and imported 2.4 million tonnes.

China is a large importer of polyvinyl chloride. In 2002, China imported 2.2 million tonnes, up from 576,000 tonnes in 1995. In 2000, China imported 1.5 million tonnes of acrylonitrile butadiene-styrene resin, but imports declined to 164,000 tonnes in 2002.

China has fairly large production capacities for various synthetic fibers, synthetic fiber monomers, and polymers, but imports are still needed. In 2002, China produced 9.9 million tonnes of synthetic fibers, up sharply from 2.8 million tonnes in 1995. Imports in 2002 were more than 1.7 million tonnes, up from 1.4 million tonnes in 2001 but down from 1.8 million tonnes in 1997.

China is a net importer of synthetic rubbers. In 2001, China produced 1.0 million tonnes of synthetic rubber (Fig. 3) and imported 753,000 tonnes. In 2002, production increased to 1.1 million tonnes and imports increased to 916,000 tonnes.

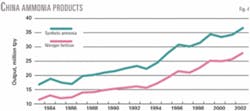

China is one of the world's largest chemical fertilizer producers, but its production still falls far short of demand. In 2002, China produced 37.9 million tonnes of chemical fertilizer (based on a conversion to 100% effective content), of which 27.4 million tonnes was nitrogenous fertilizer.

The country imported nearly 17 million tonnes of manufactured fertilizer in 2002, up from 11 million tonnes in 2001 but down from nearly 20 million tonnes in 1995. Synthetic ammonia production has also increased in recent years, reaching 36.5 million tonnes in 2002 (Fig. 4).

Overall domestic production cannot meet the demand for most major petrochemicals.

The government therefore attaches great importance to the petrochemical industry's development in the next 5-10 years and beyond.

Prospects for China's petrochemical sector development in the near term are generally bright.

Potential petrochemical investment opportunities are huge, especially in areas where domestic producing capacities are far less than consumption levels. Foreign investment is needed to help expand the country's petrochemical production capabilities.

Current ethylene situation

Ethylene is one of the most important organic chemical raw materials for downstream petrochemicals.

The size of a country's petrochemical base is often described by its ethylene capacity.

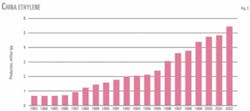

China's ethylene capacity has expanded rapidly since 1990.

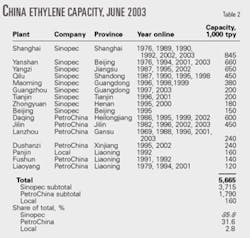

Table 2 shows that as of June 2003, China's 16 ethylene complexes had a combined capacity of 5.7 million tonnes/year (tpy).

Of the 16 complexes, 7 have capacities greater than 350,000 tpy, with the largest one being Shanghai Petrochemical Corp.'s 845,000-tpy complex.

The average size of the seven larger ethylene plants is 576,000 tpy. The remaining nine, however, all have capacities of 240,000 tpy or less, averaging 181,000 tpy.

Sinopec owns five of the seven large plants and PetroChina owns two. Of the nine smaller plants, four belong to PetroChina and its parent company, China National Petroleum Corp. (CNPC), four belong to Sinopec, and the local government owns one.

The total ethylene capacity for Sinopec's nine units is 3.7 million tpy, accounting for 66% of the national total.

CNPC/PetroChina currently owns six plants with a total capacity of nearly 1.8 million tpy, accounting for 32% of the national total. The only ethylene plant that the local government still owns is the 160,000-tpy Panjin plant, which uses natural gas from the offshore condensate fields as feedstock.

Ethylene production has increased rapidly, reaching a record high of 5.4 million tonnes in 2002, up from 1.6 million tonnes in 1990 and 2.4 million tonnes in 1995 (Fig. 5). From 1983 to 2002, China's ethylene production increased by more than sevenfold.

In 2002, production from Sinopec was 3.5 million tonnes, followed by CNPC/PetroChina at 1.8 million tonnes, and Panjin at 162,000 tonnes. Each company's share of production was in line with its portion of ethylene capacity.

Ethylene feedstocks in China have undergone a dramatic change during the past two decades.

Due to a lack of straight-run naphtha, China long relied on light gas oil to feed its ethylene plants before the mid-1980s. Before 1985 for instance, gas oil and gas oil-range hydrocracking tail oil accounted for more than 70% of the ethylene feedstock requirements in China, followed by naphtha and others at 15% each.

The situation has changed rather significantly. In 1992, the share of naphtha in China's total ethylene feedstock requirements rose to 37% while the share of gas oil and gas oil-range hydrocracking tail oil declined to 48% (Fig. 6).

The share of naphtha increased to 50% in 1997 and 63% in 2000. In 2001, the total ethylene feedstock amounted to approximately 350,000 b/d, of which naphtha accounted for 65%.

The share of gas oil and gas oil-range hydrocracking tail oil decreased sharply to 18%, followed by light hydrocarbons and others at 17%.

Ethylene prospects

China's ethylene producing capability will expand during the next 15 years.

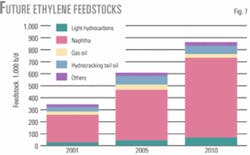

The structure of the ethylene feedstock requirements will also change, which will impact significantly the refining industry.

Between mid-2003 and yearend 2005, 12 expansion and greenfield projects will start up, including joint-venture projects with BASF, BP, and Shell Chemicals, with a combined new capacity of 4.7 million tpy.

Table 3 shows that when these 12 projects are complete, total ethylene capacity will increase to 10.4 million tpy in 2005.

Between 2005 and yearend 2010, five more new ethylene plants could be built. They would add 3.3 million tpy of capacity. If all were built, China's ethylene producing capacity would reach 13.7 million tpy by 2010.

After 2010, many other projects, including those in Guangzhou (involving ExxonMobil Corp.) and Shanghai (Shanghai chemical zone), may also be built, further raising China's ethylene production capacity.

Although there are many uncertainties associated with the joint-venture ethylene plants in China, the continuous expansion of China's ethylene industry is almost certain. Ethylene feedstocks must be available to support these expansions.

When ethylene capacity expands during the next 10 years, more naphtha will be used as feedstock. Imports will have to supplement the insufficient naphtha production from domestic refineries.

Given the huge feedstock requirements, however, our projections for naphtha use are conservative.

This means that a considerable amount of middle-range petrochemical feedstocks, including light gas oil, hydrocracking tail oil, and some residual oil, will continue to feed ethylene plants in China. For the Shell/CNOOC Nanhai petrochemical complex, condensate is the likely feedstock for the first years.

Fig. 7 shows our base-case projections for the changing structure of ethylene feedstock requirements in China. The share of naphtha in China's ethylene requirements will probably increase to 70% in 2005 and 77% in 2010.

Due to the huge ethylene expansion program, foreign investment and advanced technologies are essential to enable Sinopec and PetroChina to realize their ambitious targets.

Foreign technology acquisition has played a key role in the modernization of the Chinese petrochemical industry. For instance, all the existing ethylene plants with capacities greater than 300,000 tpy use imported technology.

Of the installed ethylene units in China, the ABB Lummus Global design accounts for more than 60%.

Foreign investment is also indispensable for China's petrochemical expansion plans. International majors and foreign companies have invested hundreds of millions of dollars in various petrochemical joint ventures in China. Most major new ethylene projects at present are contracted with foreign companies.

Proposed joint ventures account for the majority of the greenfield ethylene projects by 2010.

Without foreign investment and technology acquisition, the future development and expansion of China's petrochemical industry would be constrained.

Currently, major international oil companies that have formed joint ventures to build large ethylene plants include BASF, BP, Shell, ExxonMobil, and Saudi Arabian Oil Co. (Saudi Aramco).

All of these joint-venture projects should be completed and begin operating in the next 2-5 years.

These projects will therefore make a major contribution to China's ethylene and olefin production capability in the near future.

Of the four major joint-venture ethylene projects, the BASF-Yangzi Petroleum Corp. (subsidiary of Sinopec) project is moving the fastest and the ExxonMobil-Saudi Aramco project in Fujian is moving the slowest.

BASF signed a contract in July 2000 and began construction in 2001. The project includes 600,000 tpy of ethylene capacity and 10 downstream petrochemical units including:

- 300,000 tpy of benzene, toluene, and xylene extraction.

- 400,000 tpy of low-density polyethylene.

- 300,000 tpy of glycol.

- 160,000 tpy of acrylic acid.

- 215,000 tpy of acrylic ester.

- 250,000 tpy of oxo-alcohol.

- 50,000 tpy of formic acid.

The ethylene capacity may eventually increase to 700,000 tpy. BASF has 50% equity share and Sinopec has the other 50% share.

With an investment of about $2.7 billion (OGJ, Sept. 4, 2000, p. 9), this is the first joint-venture ethylene project in China.

When the plant is completed in 2005, China's ethylene capacity will be significantly boosted in Jiangsu because Sinopec Yangzi already has a 650,000-tpy plant there.

BP's joint-venture olefin project with Sinopec began in March 2002 (OGJ, Dec. 17, 2001, p. 8). BP has a 50% equity share in the project, which is scheduled for completion by 2005. Located in the Shanghai Chemical Industry Zone, the joint-venture project features a 900,000-tpy ethylene unit and seven downstream production units:

- 500,000 tpy of benzene, toluene, and xylene extraction.

- 90,000 tpy of butadiene extraction.

- 500,000 tpy of styrene.

- 300,000 tpy of polystyrene.

- 600,000 tpy of polyethylene.

- 250,000 tpy of polypropylene.

- 260,000 tpy of acrylonitrile.

The total investment is about $2.75 billion.

After more than a decade of negotiations, Shell, CNOOC, and Guangdong province signed a contract for an 800,000-tpy ethylene project in October 2000, in which Shell holds 50% share.

With a total investment of about $4.05 billion, this is the largest-ever foreign investment project in China.

Construction started in December 2002 and should be completed by 2005. In addition to the ethylene plant, the downstream units include:

- 560,000 tpy of styrene monomer.

- 240,000 tpy of polypropylene.

- 250,000 tpy of polypropylene-epoxide joint production.

- 320,000 tpy of glycol.

- 200,000 tpy of high-density polyethylene.

- 250,000 tpy of low-density polyethylene.

Condensate or a mixture of condensate and naphtha will probably be the feedstock when the olefin complex initially starts up.

ExxonMobil, Saudi Aramco, and Sinopec signed an agreement in October 2002 to build an 800,000-tpy ethylene plant in Fujian.

Other units include 650,000 tpy of polyethylene and 400,000 tpy of polypropylene. ExxonMobil and Saudi Aramco each holds a 25% equity share in the joint venture.

Among the four major projects, this is the only one that involves a refinery expansion. Sinopec's Fujian refinery will be expanded to 240,000 b/d from 80,000 b/d (OGJ, Nov. 26, 2001, p. 9). The total investment is an estimated $3.2 billion.

The construction was scheduled to begin at yearend 2003 and completed by 2007. A final contract, however, has not yet been signed among the joint-venture partners.

With or without a joint-venture contract, Sinopec will probably proceed with the project and refinery expansion.

Dow Chemical Co. and ConocoPhillips have also attempted to enter the olefin business in China. ExxonMobil is also considering a joint venture with Sinopec to expand the Guangzhou ethylene plant. Currently Sinopec and CNPC/PetroChina continue to expand some of their own ethylene producing capacities (Table 3).

The authors

Kang Wu ([email protected]) is a fellow at the East-West Center, Honolulu. He conducts research on energy economic links, energy security, the environmental impact of transportation fuel use, and energy and economic policies in China and the Asia-Pacific region, with a particular emphasis on oil and gas. Wu holds a BA (1985) in international economics from Peking University and an MA.(1987) and PhD (1991) in economics from the University of Hawaii, Manoa.

Lijuan Wang is a research intern at the East-West Center, Honolulu, and a visiting scholar with Argonne National Laboratory. Previously, she was an editor-in-chief of the weekly English journal China Chemical Week at the China Chemical Industrial News Co. between 2001 and 2003. Wang was a principal editor and reporter for China Chemical Week in 1994-2000 and worked at Beijing University of Chemical Technology 1985-1994. She holds a BS (1985) in chemical engineering from the Beijing University of Chemical Technology.