Strong energy demand creates challenges for industry

Strong worldwide energy demand is creating both opportunities and challenges for oil and gas producers and the oil service industry, said speakers at the 10th annual RMI Breakfast Forum Oct. 8 in Houston.

"Global oil demand over the last 33 years has grown at a compound annual rate of 11/2%, while upstream capital spending has grown at about 8%/year," said Mark Urness, Merrill Lynch director of oil services and drilling research. This year, however, demand growth, led by China and other developing countries, will exceed 3%.

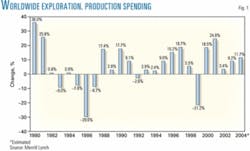

With demand lifting oil prices, Merrill Lynch forecasts growth in worldwide upstream capital spending this year of at least 10-12% (Fig. 1).

"I think we're probably looking at more like 15% growth this year," Urness said. "Next year, we're certainly seeing 8-10%."

Urness said upstream spending this year will rise 13.8% outside North America and 6.8% in the US and Canada.

Of the total $178.5 trillion E&P capital expenditures projected for 2004, 71% is outside the US and Canada, 20% is in the US, and 9% is in Canada. The major oil companies, spending $55.9 trillion, represent 32% of the E&P capital expenditure worldwide, Urness said. National oil companies account for 24% of the total, non-North American companies 22%, US independents 14%, and Canadians 8%, Merrill Lynch projects.

"On a year-to-year basis, we've seen 7 consecutive quarters of declining oil and gas production worldwide for the integrated oil companies," Urness said.

He said replacing production "may lead to higher capital investment going forward, and these [producers] may use at least a portion of their record free cash flows under current high prices to increase spending."

Mark Pease, senior vice-president of exploration and production for Anadarko Petroleum Corp., described how his company is managing cash.

"To ensure financial discipline and flexibility, Anadarko is putting some of [its] cash in the bank now while we're in the up cycle for the time when prices go below the mid-cycle, [then] we can take some of that cash out of the bank." Anadarko considers $32.50/ bbl a midcycle price.

Pease is optimistic about the industry. "There really is a lot of potential and reserves to be found in North America. There's going to be a lot of increase in activity," he said.

Joe Winkler, president and chief operating officer of Varco International Inc. echoed the optimism. "Most companies today are in good shape financially. There is a lot of opportunity," he said.

Lasting cycle

Urness expects the period of elevated oil and gas prices to last.

"I've been in the industry for 23 years now, and I certainly believe that the industry fundamentals are the strongest I've seen in my career."

He said, "What we're using for our forecasts next year is $50/bbl for WTI and natural gas at $5.25/Mcf."

When actual oil prices exceed expected oil prices, oil service stocks outperform expectations for the period, he noted.

"The question everybody seems to be asking these days is: 'How long will the current up cycle last?'"

With oil demand the key to longevity of the current cycle, Urness said, "We see the up cycle lasting at least 4-5 years."

Offshore drilling industry fundamentals, in particular, are showing signs of improvement, Urness said. Fleet utilization is expected to approach 90% during the next year.

"Our forecast shows drilling activity reaching the highest level in 20 years. And we expect sustained growth in 2005-06 as long as [global] economic growth remains strong."

Urness expects the global rig count to average 2,420 units this year.

Problems ahead

In the Gulf of Mexico, said Danny McNease, chairman and CEO of Rowan Cos. Inc., drilling rigs are in short supply, and a spate of lease expirations looms.

"One thing no one's paying any attention to is the fact that there's 1,280 leases going to expire by 2007," McNease said. Because "companies paid as much as $4-12 million for some of those leases, I think a lot of the oil companies are in big trouble," he said.

"Where will the rigs necessary to fulfill this requirement come from?" McNease asked. "There's not enough equipment out there."

"There's the problem of rigs leaving the gulf," he said, and the 30 semisubmersibles and other floaters in the gulf are contracted and cannot be brought in to drill the deep shelf leases.

McNease also noted that 79% of jack ups in the worldwide fleet are more than 20 years old, and that figure will escalate to 89% by 2007. "Just 4% of the fleet are less than 6 years old, and it takes 2 years to build a jack up," he said. He also added that builders are moving away from building rigs and toward building supertankers. "It's not easy to build a jack up."

Currently there are only 12 units under construction—9 jack ups and 3 semis.

Unconventional finds

Anadarko, seeking other solutions to the challenge of meeting demand, is focusing on nonconventional reservoirs, said Pease. About 70% of the resource in its US and Canadian prospect inventory is nonconventional, he said, adding: "That's a real key to Anadarko strategy."

It expects 35% of its production by 2009 to come from fields not producing today.

"We will do what we call high-impact exploration, mainly international," Pease said.

During 2000-04 Anadarko spent more than $1 billion/year in North America examining and developing nonconventional resources, including coalbed methane and gas from tight sands.

"The resource is there," Pease said. "We don't have to go out and discover the resource. What we have to discover is a way to make that resource economical."

Technology is central to the effort. "We're talking about going deeper, and going high pressures and high temperatures," Pease said. "The keys for future growth are innovation, cost effectiveness, and efficiency."