US 2004 well outlook up; Canada to slip on rig utilization

Drilling in the US should pick up modestly in 2004 from a strong showing in 2003.

Canadian drillers posted that country's first year of more than 20,000 wells in 2003 and look likely to make hole at almost as fast a pace this year.

Both countries started off with strong rig counts in the first weeks of 2004. OGJ looks for marginal increases in drilling in the Gulf of Mexico off Texas and Louisiana this year even though the number of rigs operating in the gulf was slightly lower in 2003 than in 2002.

Unconventional gas plays in low-permeability sands and shales dominate the rig count and the number of wells being drilled in US onshore areas (OGJ, Dec. 8, 2003, p. 34).

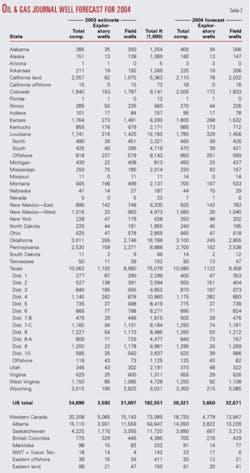

Here are highlights of OGJ's early-year drilling forecast for 2004:

- Operators will drill 36,321 wells in the US, up from an estimated 34,690 wells drilled in 2003.

- All operators will drill 3,650 exploratory wells of all types, up slightly from 3,593 such wells last year.

- The Baker Hughes count of active rotary rigs will average 1,080/week in 2004, compared with 1,030 in 2003.

- Operators will drill 18,726 wells in western Canada, down from an estimated 20,208 in 2003.

US drilling trends

The American Petroleum Institute estimated that operators completed 32,012 oil wells, gas wells, and dry holes in the US in 2003, based on preliminary reports from operators.

This is a 16% increase from 2002 completions.

API said 8,489 completions came in the fourth quarter of 2003, a 24% increase from the fourth quarter of 2002.

Operators spent $26.9 billion to drill and equip US wells in 2002, down 14.9% from 2001, API reported. Nevertheless, 2002 ranks fourth, behind 1981, 1981, and 2001, respectively, in terms of most money spent annually to drill and equip US wells, API said.

"In addition," API continued, "increases in the average depth (footage drilled) of wells drilled in most depth ranges pushed the average cost per well and per foot to their highest levels ever, past the 1981-82 peak years for US exploration," API noted.

Offshore spending totaled $8.8 billion, or 33% of total outlays, in 2002, but the offshore outlays were 26% lower than in 2001.

OGJ found that the 154 public US oil and gas operators reported having drilled 11,516 net wells in the US in 2002. The top 10 of those 154 companies reported having drilled 5,994 net wells in the US that year, or 52% of all wells drilled by public companies (OGJ, Sept. 15, 2003, p. 52).

Plays in the US

Among unconventional plays, the Powder River basin coal beds in Wyoming contained more than 12,000 wells producing and 3,600 others shut-in as of October 2003, said the Wyoming Oil & Gas Conservation Commission.

As of the same month, the coals were delivering nearly 1 bcfd of gas. The commission approved 5,583 permits to drill coalbed methane wells in 2003, and filings continued strong into January 2004.

Numerous other unconventional gas plays were generating the drilling of large numbers of wells in the Rocky Mountain region in Wyoming, New Mexico, Utah, and Montana.

Another extremely busy unconventional gas play is the Barnett shale in the Fort Worth basin (OGJ, Jan. 19, 2004, p. 45).

OGJ predicts a 5% increase in total drilling in Texas to 10,580 wells in 2004.

The Appalachian basin deep gas play got a boost this month when a unit of Talisman Energy Inc., Calgary, said a discovery near Corning, NY, has the capacity to flow more than 30 MMcfd of gas from a horizontal section in Ordovician Upper Black River carbonates. It could be the highest flowing well yet in the region (OGJ Online, Jan. 16, 2004).

Canada's outlook

Rig utilization is a factor in the 7.3% downturn OGJ predicts for Canada this year.

The Canadian Association of Oilwell Drilling Contractors noted that the 2003 third quarter was unusually busy for Canadian contractors. It forecast a 58% utilization rate for the third quarter of 2004, down from 62% in the third quarter of 2003.

In most years, Canadian field activity is busiest in the first quarter.

Nickle's Rig Locator put the 2003 average Canadian rig count at 415 rigs/week, or 61% of the fleet of 684 rigs. That is 115 rigs more than the 2002 average. The record was 424 working rigs in 1997.

Positive signs for 2004 include lease bonuses that have been at high to near record levels in 2003 in Alberta, British Columbia, and Saskatchewan.

The Northwest and Yukon territories are expected to pick up this year. OGJ looks for the drilling of 23 wells there compared with an estimated 18 in 2003.

One Canadian investment analyst predicted an 11.5% drop in capital spending in Canada to $30.7 billion this year. FirstEnergy Capital Corp., Calgary, said the trend toward shallow gas well drilling is likely to continue and that more-efficient rigs will feed a downward trend in rig utilization.