Worldwide refining capacity creeps ahead in 2004

The worldwide refining industry added capacity in 2004, despite a decrease in the total number of operating refineries. For the third year in a row, worldwide capacity is at a record level.

Click here to view the 2004 Worldwide Refining Survey (1 page) in PDF.

Click here to view the Worldwide Refining Capacities Report (2 pages) in PDF.

Click here to view US Refineries-State Capacities Report (1 page) in PDF.

Last year's refining report showed a worldwide capacity of 82.055 million b/cd in 717 refineries as of Jan. 1, 2004. This year, OGJ's survey reflects a total capacity of 82.409 million b/cd in 675 refineries, an increase of 354,000 b/cd.

Fig. 1 shows the trend in operable refineries and worldwide capacity. The large jump in number of refineries in 1999 was from improved information from China.

Capacity creep, expansions, and restated capacities in existing refineries, along with the inclusion of one new refinery, fueled the increase in capacity for the latest survey.

Asia-Pacific showed the largest increase in refining capacity, up 657,000 b/cd or 3.3%.

North America and Western Europe showed smaller changes, rising 106,000 b/cd and 75,500 b/cd, respectively.

Eastern Europe experienced the largest decrease of any region, down 327,500 b/cd or 3.1%. South America showed a smaller decrease of 147,000 b/cd or 2.2%.

Other regions were relatively flat. Africa increased capacity 6,600 b/cd and the Middle East decreased 17,000 b/cd.

Five refineries shut down in 2004 and three other refineries were removed from the survey because they are only processing gas condensate. Improved reporting from China allowed OGJ to remove 38 shutdown refineries from the survey.

New crude capacity

The only new refinery that appears in this year's survey is the 32,500-b/cd InterOil Corp. plant in Papua New Guinea (Fig. 2). The Canadian company reported that the first shipment of crude for its refinery arrived on June 15 and that it started selling refined products on Aug. 10.

Although the nameplate capacity is 32,500 b/cd, the company plans to operate at up to 36,500 b/cd of crude input. The refinery processes low-sulfur sweet crude to satisfy domestic requirements and to provide exports to the surrounding region.

The refinery consists of some new and some refurbished equipment. The crude unit is from the former Chevron Corp.'s Nikiski, Alas., refinery that was shut down in 1991 (OGJ, Mar. 19, 2001, p. 46). Other equipment is from an Oklahoma refinery also owned by Chevron.

The used equipment was refurbished in Houston and was shipped to Papua New Guinea in May 2003.

Refinery closures

Primary crude refining capacity was shut down mainly in Eastern Europe and South America.

The 27,000-b/cd refinery owned by Cyprus Petroleum Refinery Ltd. shut down in April 2004. The refinery was the only one in Cyprus and was owned 20% by ExxonMobil Corp.

ChevronTexaco Corp. reported that it shut down two refineries in South America. The company discontinued operations at the 60,000-b/cd refinery in Las Minas, Panama, and the 16,000-b/cd refinery in Escuintla, Guatemala.

The refineries will operate as oil terminals, according to the company.

Also in South America, Repsol YPF SA has shut down its 3,000-b/cd refinery in Sucre, Bolivia.

Updated information from Russia show that OAO Gazprom is operating three of its facilities to process gas condensates only. These include the 66,000-b/cd plant in Astrakhan, the 88,000-b/cd plant in Surgut, and the 9,000-b/cd facility in Urengoy, all in Russia.

OGJ, therefore, removed these facilities from this year's refining survey.

This year's survey also includes updated information from China Petroleum & Chemical Corp. (Sinopec). Since the last updates to the company's refinery capacity in 1999, several of its refineries have shut down.

Most of these shutdowns were very small: 27 out of Sinopec's total 56 refineries reported in last year's survey had less than 10,000 b/cd of capacity. A total of 38 refineries were removed from this year's survey, accounting for a capacity of 469,900 b/cd.

Sinopec, however, had sufficient expansions in its other facilities to show a net increase of 128,000 b/cd compared to the last survey.

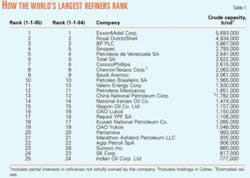

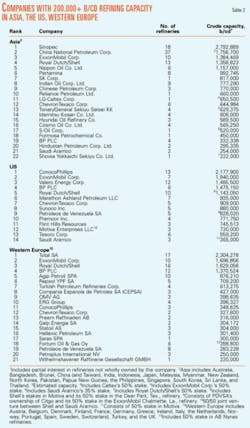

Largest refining companies

Table 1 lists the top 25 refining companies that own the most worldwide capacity. Table 2 lists companies with more than 200,000 b/cd of capacity in Asia, the US, and Western Europe. Capacities from Tables 1 and 2 include partial interests in refineries that the companies do not wholly own.

Significant changes from last year involve Valero Energy Corp., Sunoco Inc., OAO Lukoil, Reliance Industries Ltd., Formosa Petrochemical Co., Premcor Inc., and Flint Hills Resources.

Valero moved up two spots in Table 1 due to its acquisition of the 315,000-b/cd refinery in Aruba. In a deal finalized Mar. 5, Valero purchased the refinery and related operations from El Paso Corp. for $465 million.

Valero paid $365 million for the refinery and $100 million for related marine, bunkering, and marketing operations. In addition, Valero paid $162 million in working capital.

Valero has expanded its refining holdings in recent years. Bill Greehey, Valero chairman and CEO, said the Aruba refinery has a replacement value of $2.4 billion, noting that more than $640 million has been invested in the last 5 years to improve safety and profitability.

As part of the closing, El Paso will retire a $370 million lease financing associated with the refinery. This sale supports El Paso's long-range plan to reduce the company's total debt.

This is not the first time that El Paso has divested a refining holding to Valero. In 2003, Valero bought El Paso's Corpus Christi refinery.

This year's survey reflects another transaction involving El Paso. On Jan. 15, the company finalized the sale of its 150,000-b/cd Eagle Point refinery in Westville, NJ, to Sunoco.

The purchase price was $111 million, plus $138 million for inventories and certain assumed liabilities. Sunoco also signed an option to purchase El Paso's share of the Harbor pipeline, which connects the refinery to regional distribution systems.

The Eagle Point refinery is across the Delaware River from Sunoco's 175,000-b/d Marcus Hook and 330,000-b/d Philadelphia refineries.

Sunoco's total refining capacity is now 880,000 b/cd, which was enough to move the company to the 23rd largest refiner in the world, up from 26 in last year's survey.

Lukoil moved up two spots in Table 1 due to the reflection of updated ownership data. In 2002, Lukoil acquired the Nizhegorodsky refinery in Middle Volga (OGJ, Aug. 2, 2004, p. 42).

It also owns the Ukhta refinery, which was not reflected in last year's survey. Lukoil is now listed with 1.15 million b/cd of capacity.

Reliance increased the crude capacity in its Jamnagar, India, refinery from 540,000 b/cd to 660,000 b/cd. This additional capacity was sufficient to move the company to the 10th largest refiner in this Asia from the 16th largest refiner in last year's survey.

Reliance revamped its crude distillation unit in December 2003.

Formosa told OGJ that the company has three trains of 150,000 b/cd each, for a total of 450,000 b/cd capacity in its Mailiao, Taiwan, refinery. Last year's survey reported only 150,000 b/cd total capacity for this facility.

Premcor Inc. became one of the 10 largest US refiners, according to this year's survey.

On May 3, Premcor purchased Motiva Enterprises LLC's Delaware City refining complex—Delaware's only refinery—for $800 million, plus the value of petroleum inventories, and contingent payments totaling up to $125 million.

The purchase price was $435 million and the assumption of $365 million of tax-exempt bonds from the Delaware Economic Development Authority.

The 175,000-b/cd refinery, 15 miles south of Wilmington, is capable of meeting US Environmental Protection Agency low-sulfur fuel specifications with a modest investment, Premcor said, and also is capable of processing heavy-sour and high-acid crude.

Premcor already owns three refineries: a 237,500-b/cd plant at Port Arthur, Tex., a 190,000-b/cd refinery in Memphis, Tenn., and a 165,000-b/cd refinery in Lima, Ohio.

The Delaware City refinery will enable Premcor to increase its total crude oil processing capability by 30%, Premcor said.

Motiva, a joint venture owned 50-50 by Shell Oil Products US and Saudi Refining Inc., fell to the 12th largest US refiner from the 8th largest in last year's survey.

As mentioned in last year's report (OGJ, Dec. 22, 2003, p. 64), Williams Cos. agreed to sell its North Pole, Alas., refinery to Flint Hills Resources LP, a subsidiary of Koch Industries Inc. Flint Hills paid about $290 million, subject to closing adjustments for the value of petroleum inventories.

The deal for the 220,000-b/cd refinery was completed on Apr. 1, 2004. The deal also marks the exit of Williams from the petroleum refining and marketing sector.

Flint Hills moved up one spot in Table 2 due to the additional capacity.

Table 2 reflects a company name change in Western Europe. Petrogal EP is now known as Galp Energia SA.

Other changes in capacity that appear in Tables 1 and 2 are due to adjustments in declared capacity.

Other activity

This year's survey reflects the fact that TNK-BP—a 50/50 joint venture between BP PLC and Russian investors Alfa Group, Access Industries, and Renova (AAR)—owns five refineries in Russia. The previous survey listed only three.

BP's overall capacity increased to 3.867 million b/cd from 3.285 million b/cd last year.

In March, Coffeyville Resources LLC purchased the 100,000-b/cd refinery in Coffeyville, Kan. Farmland Industries Inc., which filed for bankruptcy in May 2002, was the previous owner of the refinery.

Early in 2004, Shell announced that it would shut down its 65,000-b/cd Bakersfield, Calif., refinery. In September, however, the company said that it would continue to operate the refinery until Mar. 31, 2005, and is evaluating bids from companies interested in purchasing the refinery.

If the refinery is either sold or shut down, next year's survey will reflect the change.

Largest refineries

Table 3 lists the world's largest refineries.

Refineries moving up the list due to capacity expansions include LG-Caltex's Yosu, South Korea, refinery and ExxonMobil Corp.'s Jurong, Singapore, refinery.

LG-Caltex reported a capacity increase to 650,000 b/cd compared to last year's reported value of 617,000 b/cd. ExxonMobil reported an increase to 605,000 b/cd from 587,000 b/cd for the Jurong facility.

Both refineries, however, dropped a spot in Table 3 due to increased capacity in Reliance's Jamnagar, India, refinery. As previously mentioned, the company increased capacity to 660,000 b/cd.

A newcomer to the list is Formosa's refinery, which has a capacity of 450,000-b/cd.

Regional crude capacities

Table 4 lists regional process capabilities as of Jan. 1, 2005. As previously mentioned, the largest increase in crude capacity occurred in Asia.

Asia growth was due to large capacity increases capacity in China, Taiwan due to Formosa, India due to Reliance, and the new refinery in Papua New Guinea. Smaller increases occurred in Japan, Malaysia, Singapore, and South Korea.

North America and Western Europe both increased capacity about 0.5% in this year's survey. Increases in North American capacity were due to expansions in Canada and the US. Western Europe capacity gains occurred in Belgium, Germany, Italy, the Netherlands, Sweden, and the UK.

Decreases in Eastern Europe and South America were due to the previously mentioned shutdowns and capacity reclassifications. Africa and the Middle East showed a slight increase and decrease, respectively.

Processing capabilities

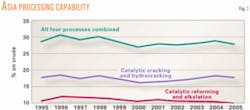

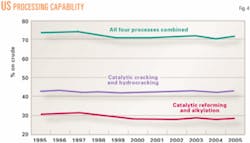

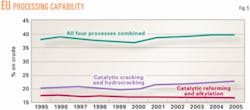

Figs. 3-5 show the processing capabilities of Asia, the European Union (EU), and the US for the past 10 years. Processing capabilities are defined as conversion capacity (catalytic cracking and hydrocracking) and fuels producing processes (catalytic reforming and alkylation) divided by crude distillation capacity (% on crude).

Countries in the EU include Belgium, Denmark, France, Germany, Greece, Ireland, Italy, the Netherlands, Portugal, Spain, and the UK.