Saudi Arabia's gas sector: its role and growth opportunities

Energy is a key driver of the economic growth of any nation, and the role of natural gas in the world's energy mix is growing.

The kingdom of Saudi Arabia has long recognized the significance and contribution of the domestic gas industry to the national economy. For this reason, the Saudi government is promoting aggressive growth of the gas sector and has formulated a progressive vision to maximize the economic and social benefits of the gas industry to the nation.

This article highlights the expanding role of the gas sector in the growth of the country's economy.

Historical perspective

In the early years of the kingdom's oil industry, all associated gas was flared. There was no developed market for gas.

In the late 1970s, the Saudi government embarked on a program to gather the associated gas and its valuable associated products. The goals were to protect the environment by eliminating flaring, conserve the valuable gas resource, develop the foundation for an industrial base, and add value to the gas and its associated products.

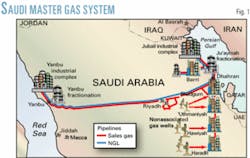

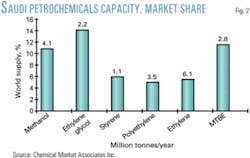

The Master Gas System (MGS) was launched, comprising gathering systems, processing plants, fractionation plants, storage facilities, transmission pipelines, and export terminals.

Gas and its associated products have led to the development of competitive gas-based utilities and petrochemical industries and provided the foundation for the twin industrial cities of Jubail and Yanbu on the eastern and western coasts of the kingdom, respectively.

While the initial MGS was designed to collect and utilize only associated gas, by the mid-1980s the amount of associated gas had declined, caused by lower worldwide demand for oil.

In order to meet the gas commitments and to provide secure supplies to customers, an exploration program targeting nonassociated gas reserves was initiated. Over the last decade, this program has added more than 54 tcf of nonassociated gas reserves to Saudi Arabia's resource base, more than doubling its proven nonassociated gas reserves to about 97 tcf. As these reserves were discovered, the country's national oil company, Saudi Aramco, prepared proactive plans for their expeditious development, more than doubling raw gas processing capacity to the current 9.5 bscfd from 4.3 bscfd in 1993.

Two world-scale gas processing plants, each with a feed gas processing capacity of 1.6 bscfd, have been constructed to process nonassociated gas exclusively. The Hawiyah and Haradh gas plants came on stream in 2001 and 2003, respectively. With the completion of these two megaprojects, the MGS was expanded westward to provide fuel gas (commonly referred to as sales gas in the kingdom) to Riyadh and Yanbu.

A world-scale turboexpander project was commissioned in 2003 at the Berri gas plant to recover up to 280 MMscfd of additional ethane and about 80,000 b/d of NGLs; these valuable products were directed to the domestic petrochemical industry, while also expanding NGL exports. Fig. 1 illustrates the current configuration and geographical coverage of the MGS subsequent to its various expansions.

The highly successful nonassociated gas exploration program further supported the growth of the kingdom's gas industry. With 138 tcf of associated gas reserves, Saudi Arabia currently holds the fourth largest gas reserves in the world at almost 235 tcf.

null

Saudi gas industry today

Natural gas is the fastest-growing energy source in the world. Its worldwide annual average growth rate during 1992-2002 has been robust at 2.2%.

This high growth rate is projected to be maintained during 2001-25, compared with 1.9% for oil and renewables, 1.6% for coal, and 1.8% for energy as a whole.1

In Saudi Arabia, gas consumption has been rising at a remarkable rate of 7.2%/year over the last 20 years and is projected to grow on average by 3.7%/year during 2004-25.

The contribution of gas within Saudi Arabia's energy mix is already ahead of the global trend. The percentage share of gas in the total in-kingdom energy mix grew to 41% in 2003 from 35% in 1990 and is projected to increase further to 51% by 2008 compared with an average projected global share of 24%. This reflects the increased level of domestic gas-based economic activities.

In terms of gas intensity, the kingdom has one of the highest per capita gas utilization rates in the world. Saudi Arabia utilized more gas per capita, estimated at 251 cfd/person in 2003, than some of the highest-income countries in the Organization for Economic Cooperation and Development, such as the US, UK, Germany, and Japan.

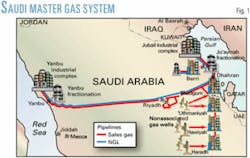

Part of that utilization of gas and gas products is the petrochemical sector. Saudi Arabia has become a world-class producer of basic petrochemicals. There has been an exponential growth in the number of petrochemical plants in the kingdom, rising from 25 in 1970s to 280 in 1995 and projected to reach more than 500 by 2005. Petrochemical investment has grown from a modest level of $500 million/year in the late 1970s to about $20 billion in 2000. Fig. 2 illustrates the current capacity of domestic basic petrochemicals together with their percentage share of total global capacity. Saudi Arabia's petrochemical industry now accounts for about 60% of nonoil Saudi export revenues.

Gas also fuels the fast-growing power generation and water desalination infrastructure and energy-intensive industries such as steel and cement. As a result, the gas industry has become a significant contributor to the Saudi economy, accounting directly and indirectly for up to 15% of gross domestic product, while directly employing more than 35,000 people.

Upstream sector opening

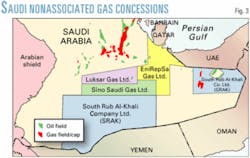

In continuation of the same vision that led to the creation of the MGS, Saudi Arabia recently invited international companies to invest in the gas industry with the aim of expanding participation of private capital in the development of this important sector. The execution of four upstream gas agreements in the Rub' al-Khali basin with prominent international companies represents the most recent achievement in an integrated and well-planned series of steps designed to optimally utilize the country's gas resources.

In November 2003, an agreement was reached with Royal Dutch/Shell Group and Total SA to explore for nonassociated gas in the southern Rub' al-Khali, covering an area of more than 210,000 sq km. During 2003, the kingdom also offered three exploration blocks ranging in size from 30,000 to 52,000 sq km in the northern Rub' al-Khali to qualified companies through one of the most transparent upstream bidding rounds the industry has ever seen. Twenty-two companies participated, and in March, exploration and development licenses were awarded to three successful bidders: Russia's OAO Lukoil for Block A, China's state-owned Sinopec (China Petroleum & Chemical Corp.) for Block B, and a consortium of Italy's ENI SPA and Spain's Repsol YPF SA for Block C to explore for and develop nonassociated gas on these blocks (Fig. 3). It is significant to note that the kingdom's upstream gas licenses have broken new ground in the industry, since the rights granted are only for gas and associated condensate and exclude crude oil.

Gas production from these areas would help pave the way for realizing the kingdom's vision for the growth of the gas sector, as outlined in the following sections.

Sales gas, NGLs

Over the past 20 years, Saudi Arabia's gas production has grown robustly, to rank among the top 10 global producers.

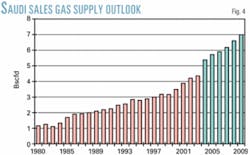

Fig. 4 illustrates the historical growth of sales gas production in the kingdom to date, with planned supply increments up to 2009. The total supply capacity, in terms of processed sales gas, will increase to 7 bscfd.

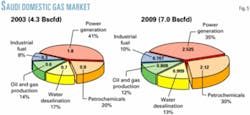

The incremental supplies of gas are being directed to their most economic use in the petrochemical industry as well as to other industries, adding the highest possible value to the Saudi economy, as depicted in Fig. 5.

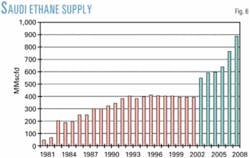

The kingdom's utilization of gas extends far beyond its more-recognized use as fuel. Saudi Arabia is a major producer of ethane extracted from gas. Being a premier petrochemical feedstock, this extracted ethane is directed domestically to produce olefins and exported in the form of higher-value petrochemical products such as polyethylene, ethylene glycol, styrene, and ethylene dichloride.

Current Saudi ethane production capacity is 550 MMscfd. The Hawiyah NGL recovery project to extract NGLs from the Hawiyah and Haradh plants' gas streams will further increase ethane supply to about 900 MMscfd, as shown in Fig. 6.

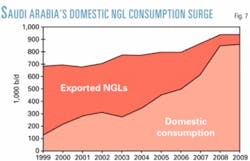

Saudi Arabia is the world's largest exporter of waterborne NGLs. As shown in Fig. 7, the kingdom currently produces about 770,000 b/d of NGLs (excluding ethane), of which 450,000 b/d were exported in 2003; the rest is consumed domestically, mostly as petrochemical feedstock and exported in the form of higher-value petrochemical products such as polypropylene and ethylene derivatives.

With the completion of the Hawiyah NGL recovery project, NGL production will reach about 950,000 b/d. A growing proportion of NGLs is being directed to domestic use spurred by a new wave of projects from both local and foreign investors; this local use is forecast to reach 860,000 b/d by 2009.

Petrochemicals growth

Availability, reliability, and competitiveness of feedstocks derived from gas have resulted in phenomenal growth in Saudi Arabia's petrochemical industry.

The kingdom enjoys a significant position in the petrochemicals industry, with a production capacity of 33 million tonnes/year (mty) of primary and secondary olefins, plastics, base chemicals, fertilizers, methanol, and fuel additives.

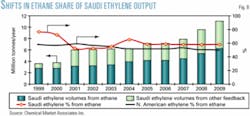

Saudi Arabia is one of the most competitive large-volume ethylene producers in the world. The kingdom's ethylene industry has the highest percentage of ethylene produced from ethane feed—even higher than that of North America (Fig. 8). This represents an important competitive advantage for the kingdom's petrochemical industry due to the higher ethylene yield with fewer lower-value by-products and lower overall capital costs compared with heavier hydrocarbon feeds. In fact, the kingdom has the lowest cash cost of ethylene production in the world.

Based on current plans, over the next 5 years, the domestic petrochemical industry will have feedstock and fuel to allow it to double in size, both in terms of the production capacity of primary petrochemicals and employment, a task that took over 2 decades to achieve since the inception of MGS.

Over the next 5 years, 10 giant gas-related petrochemical projects are expected to spawn investments worth $20 billion, creating some 12,000 additional direct jobs along with a larger number of indirect employment opportunities.

These projects, with investments from foreign and domestic sources, are scheduled to begin production during 2006-09.

Methane-based petrochemical capacity is expected to grow to 11 mty from 6.2 mty, as several traditional methanol and ammonia projects, to which feedstock has been allocated, will come on stream.

Meanwhile, eight ethylene projects, which already have been awarded feedstock allocations, will more than double the kingdom's ethylene production capacity by yearend 2008 (to 13 mty from about 6 mty). In addition, 4 new propane projects will come on line,; and three butane-based feed projects are under development.

Furthermore, sales gas currently fuels the production of about 13,500 Mw of power and 400 million gpd of desalinated water production. This will grow to 16,000 Mw and 650 million gpd by 2008.

Saudi gas strategy

In 2001, Saudi Arabia formulated its Gas Strategy to serve as a road map for the future development of the domestic gas industry.

The strategy recognizes the role of gas as a significant driver of industrial growth and job creation in the kingdom and outlines a future vision for the gas sector, which is "to continue maximizing the economic and social benefits to the kingdom from its natural gas resources."

The Gas Strategy focuses on expanding gas supplies to major industrial centers in the kingdom to drive further rapid industrialization and job creation where it is economic to do so.

The strategy and its accompanying vision call for continued expansion in the supply of gas, ethane, and NGLs to meet growing industrial and utility demand. The demand for sales gas is forecast to reach 12.2 bscfd by 2025 under the base case and 14.1 bscfd under the high-demand case.

In practical terms, the Gas Strategy encompasses an aggressive exploration of underexplored areas in the kingdom to discover large additional resources of gas that can be economically developed to expand supplies and satisfy projected gas demand. The required gas supply would be derived from combined resources located in all areas of the kingdom, those being already developed by Saudi Aramco and the ones to be explored by private investors.

The recently completed upstream exploration and development agreements signed with the international oil and gas companies to explore for gas in the Rub' al-Khali basin will complement Saudi Aramco's exploration effort.

Saudi Aramco's stewardship role will continue with added scope and greater responsibilities. These responsibilities include operating the MGS; aggregating gas produced from the joint ventures, i.e., consolidating gas produced by the new JVs with Saudi Aramco's own supply; transporting and distributing the aggregated supplies; and, finally, ensuring that the gas from the JVs is lifted and delivered to customers through appropriate planning and investing in the expansion of facilities and pipeline infrastructure in a timely manner.

Saudi Aramco will continue to maintain a rolling 20-year supply to all the gas plants through an aggressive exploration program to replace production and expand supply. The kingdom's total annual nonassociated gas production is expected to increase to 2.2 tcf by 2010 from 1.1 tcf currently.

Gas user groups

The Saudi vision for gas user groups focuses on expansion of nonassociated gas supplies besides targeting multiple user groups.

The Gas Strategy calls for petrochemical products derived from gas, ethane, and NGL feedstocks to receive particular attention. Olefins will be especially emphasized. To leverage the ethane available in the gas streams, utilization of mixed feedstocks (ethane and NGLs) for olefin production has been found to generate the most economic benefit for the kingdom.

Petrochemical projects integrated with refineries represent another major growth opportunity that will be stressed in the future. The memorandum of understanding recently signed between Sumitomo Chemical Co. Ltd. and Saudi Aramco to upgrade the Rabigh refinery on the kingdom's West Coast—leading to the establishment of an integrated world class refinery and petrochemical complex—is one such example (OGJ Online, May 11, 2004). This initiative is consistent with the Saudi government's goal of diversifying the national economy and encouraging foreign direct investment to assist in the achievement of the goal. Furthermore, in order to achieve even greater value addition and create more jobs, special attention will be given to downstream conversion of petrochemical derivatives into final consumer products, which has been demonstrated around the world to be a prolific creator of jobs.

Power generation and water desalination projects will be supplied with an economically optimum mix of gas and clean-burning liquids. This fuel mix can vary across the various regions of the kingdom, depending on the comparative economics of the competing fuels and the various end-use technologies employed. The supply of such an optimum fuel mix will facilitate expansion of utilities, which in turn will support economic expansion in the kingdom and meet the needs of households and commercial establishments by supplying them with the most competitively priced utilities.

A number of other industries, such as ceramics, glass, and metallurgy that require gas as a specialty fuel will receive it on a priority basis. Some of these industries are well-suited to investments by small-to-medium-size entrepreneurs who, in other countries, have proven to be important drivers of economic expansion and job creation.

Enabling framework

In order to bring the gas sector's vision to fruition, it was essential for the Saudi government to appropriately address the implementation plans.

The kingdom's vision of a gas industry enabling framework is based on pragmatic market liberalization balanced with appropriate regulatory oversight, which best serves the long-term national interest.

The government of Saudi Arabia has adopted efficient and transparent regulatory and fiscal frameworks to attract private investment, protect investor interests, and help achieve the kingdom's vision for the gas sector. Progressive regulatory and financial codes and rules have been enacted to govern the exploration, production, gathering, transmission, and sales of nonassociated gas.

Summing up

The foresight of the Saudi government has played a key role in achieving the great success of the gas and related industries.

Significant milestones have marked the phenomenal growth in the kingdom's gas industry since its inception, moving from flaring associated gas to becoming one of the highest per capita consuming countries in the world.

The kingdom's gas-based petrochemical as well as utility industries have grown to become world-class, globally competitive players and are experiencing rapid growth rates.

This development of the gas sector to its current position in just over 2 decades, combined with the planned and in-progress expansions are testaments to the Saudi government's compelling resolve to facilitate the growth of the gas sector as a dependable contributor in the drive for industrial development.

Saudi Aramco plays a pivotal role in this effort and is committed to building on its past successes and to contributing further to the future development and prosperity of the kingdom of Saudi Arabia.

Reference

1. US Energy Information Administration, International Energy Outlook 2004, DOE/EIA-0484(2004) (Washington, DC, April 2004).

The author

Khalid al-Falih is Saudi Aramco's exploration vice-president. Prior to that, he was vice-president of new business development. From 1999 to 2000, he was president and CEO of Saudi Aramco's affiliate in the Philippines, Petron Corp. Since September 2000 Al-Falih has been associated with the kingdom's Natural Gas Initiative, a program to attract investments into the kingdom's gas sector by international oil companies. His career with Saudi Aramco also has involved assignments with engineering, project management, and the Ras Tanura refinery. In addition to leading Saudi Aramco's exploration operations, Al-Falih currently serves as chairman of South Rub Al-Khali Co., a joint venture of Shell, Total, and Saudi Aramco. He holds a bachelors in mechanical engineering from Texas A&M University and an MBA from King Fahad University of Petroleum & Minerals.