Uncertainty about gas quality could delay US LNG imports

The significant expansion of plans to bring LNG into the US has raised questions and prompted debate about natural gas quality.

In a recent report, the US Energy Information Administration stated that LNG imports will become an important part of the US energy market.1 In February 2004, the US Federal Energy Regulatory Commission held a session on natural gas interchangeability and gas quality issues.2

Issues raised at the FERC hearing such as the condensation of heavier hydrocarbons in gas distribution were probably unrelated to LNG imports, but LNG imports could conceivably cause other problems related to natural gas quality.

Although some of the submitted comments at the hearing dealt with LNG imports, a broad discussion dealt with wider gas-quality issues. The submissions came from participants in LNG projects, gas transmission and distribution companies, end-users, equipment suppliers, midstream operators, and several industry associations.

Despite agreement in principle on some issues, there was no consensus on natural gas interchangeability in terms of the specifications or suitability for end use.

There is also a difference of opinion between, on the one hand, gas producers and some LNG exporters who want the discretion to leave heavier hydrocarbons for sale as gaseous constituents and, on the other hand, gas distribution companies and some end users who want to enforce hydrocarbon dewpoint specifications and object to the inclusion of the heavier hydrocarbons in the gas stream.

There are also other implications relating to LNG imports in Florida and California, including the prospect that these LNG imports could meet the summer peak power generation and air conditioning loads.

And, there is some uncertainty on how LNG imports will affect utilization of US interstate gas pipelines flowing into California and Florida.

Hydrocarbon dewpoint

Several comments focused on the need for hydrocarbon dewpoint specifications. Some of the submissions outlined incidents in which heavier hydrocarbons had formed as a liquid phase in gas pipelines or gas distribution systems.

Texas Gas Transmission LLC noted that "Historically, sellers of natural gas have reserved processing rights and arranged to have wet gas processed because of the economic value of the liquefiable hydrocarbons in the gas stream."

The American Public Gas Association stated that "certain producers/processors find it more profitable to leave the heavy hydrocarbons in the gas stream than to strip them out and sell as liquids–a phenomenon known as upside down economics."

Texas Gas said simply "When liquids form in the pipe, bad things often happen."

Most of the comments recognized the need for hydrocarbon dewpoint specifications.

While LNG imports from certain countries may have elevated levels of liquefiable hydrocarbons, the reported problems of hydrocarbon liquids have mostly involved natural gas produced from US sources. For these reasons, US gas pipelines will likely continue to monitor and to maintain hydrocarbon dewpoint specifications.

BP America noted in its comments that the hydrocarbon content in today's gas is higher as a result of the market demanding more supply. The company said "the monetary value of natural gas has increased relative to the value of extractable hydrocarbons.

"The result has been the creation of economic incentives to reduce the extraction of liquefiable hydrocarbons from the natural gas stream. Liquefiable hydrocarbons have a higher btu content than methane, and a greater volume of these hydrocarbons increases the overall btu level in the natural gas delivered to the marketplace."

In addition, BP America said that removing hydrocarbon content is "energy intensive, and the more processing that occurs the fewer btus are available for market. Producers/processors continue to meet the existing specifications in pipeline tariffs. But by allowing the liquefiable hydrocarbons to remain in the gas phase, producers can effectively increase the supply of gas by increasing the btu content of the gas ... 2-10%.

"This means that we can stretch our difficult-to-find supply of natural gas. In times of peak demand, such as in the winter, this added supply, created by retaining in the gas stream a greater heating value, can have a material effect in reducing both the level of and volatility of gas prices."

In recent years, many processing plants in the US have been sold to independent third parties that operate the plants for profit. While some of the contractual relationships may be on a fee-for-service basis, the economics for many processing plants are based on the liquids upgrade to spec products.

This then raises the question of whether these midstream functions will continue to operate as independent profit centers or will be reacquired by producers.

Liquid hydrocarbons have recently condensed in US gas transmission and gas distribution systems. Gas exports from Canada are less likely to have this problem for two reasons.

First, there is generally an economic incentive to recover any pentanes or heavier hydrocarbons in Canada for use as diluent for heavy crude or bitumen transportation. Secondly, Canadian gas exports are generally processed twice: initially at or near the point of production and then later at a straddle plant.

In Canada, there may be occasional plant upsets in which a facility does not operate properly for short periods, and this may affect gas quality from the relevant plant or plants.

NGL recovery economics

While these comments suggest that producers and processors may not always have an economic incentive to recover propane and heavier hydrocarbons, Fig. 1 shows that based on average propane prices from published sources there has generally been an incentive to recover propane and presumably heavier hydrocarbons.

The calculation of gross margins in Figs. 1 and 2 reflects deductions for transportation and fractionation costs and the value of gaseous shrinkage based on bid-week prices for natural gas on the US Gulf Coast. On the Gulf Coast, estimated T&F costs were 3.25¢/gal.

In certain periods the gross margin has been negative. The spot price for gas may have escalated such that the margin to recover propane and some heavier hydrocarbons has been negative for days or several weeks. The gross margin may also vary in specific producing locations within the region.

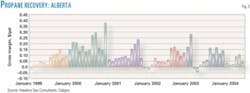

Fig. 2 shows that the gross margin for propane recovery in Alberta has also generally been positive. The gross margin in Fig. 2 also reflects deductions for typical T&F costs, and the value of gaseous shrinkage at the Alberta field plants. The estimated T&F costs were, in June 2004, about 2.8¢/gal (US).

Similar to the US Gulf Coast, the gross margin has been negative for brief periods. In many months, the gross margin was large. Figs. 1 and 2 show that the margins were substantial during 2000.

Since 2000, the gross margins have tended to be lower, suggesting that the gross margins have been squeezed as gas prices have escalated, consistent with the reported appearance of heavier hydrocarbons in US gas transmission and distribution systems.

Criteria for interchangeability

Many of the comments to the FERC proceeding dealt with natural gas interchangeability in terms of a quality specification and its suitability for end use. They also focused on the suitability and quality for use in appliances, gas turbines, and process applications and as vehicular fuels.

Some of the comments expressed concern about the fluctuations in gas quality and the importance of maintaining consistent gas quality. A few comments supported the continued use of an upper limit on higher heating value (HHV).

Several advocated adoption of the Wobbe Index as a basis for assessing natural gas interchangeability instead of HHV. The index is the HHV divided by the square root of the specific gravity. It can be calculated based on either traditional or SI units.

The Law Center of the University of Houston commented in the FERC hearing that "As the interchangeability arena has evolved worldwide, particularly in Europe and Asia, the Wobbe Index has received the widest application and popularity due to the advent of quick and reliable input data, its relative ease of calculation, and predictability characteristics. It is simple to interpret and is easily applied in field application."

The Wobbe Index is also used in Australia, where gas quality and the Wobbe Index have been matters of public debate and scrutiny.5 Based on comments to the FERC hearing, there seems to be no US consensus on this issue; hence, further analysis and consideration may be required.

CO2 content

A few of the submissions commented on the level of inerts such as nitrogen and CO2 in gas streams.

Because CO2 in water vapor or liquid water creates a corrosive environment, upper limits on CO2 levels are essential. The presence of CO2 also degrades the performance of some cryogenic gas plants designed to recover ethane.

A portion of the gas production in Canada is sour, and thus the gas produced and sold in Canada generally will contain CO2. Fortunately, the straddle plants will generally reduce the CO2 of gas exported from Canada.

The LNG liquefaction process ensures that the LNG will contain no significant levels of CO2. None of the comments to the FERC hearing by companies involved in LNG imports emphasized that LNG was a premium product and that the elevated HHVs of LNG may be partly attributable to the absence of CO2 in LNG.

The comments of Southern California Gas and San Diego Gas & Electric Co. stated that LNG supplies contained trace amounts of CO2.3 ChevronTexaco also noted that the CO2 content in LNG was less than 50 ppm.4

Imports via Bahamas

The gas demand in Florida is largely driven by power generation. Total Florida gas demand, according to data published by the EIA, can fluctuate between 1.5 bcfd and 2.5 bcfd. EIA data also show that natural gas used as fuel for power generation can range from 65% to more than 80% of Florida gas consumption, and the use of gas generally peaks during the summer corresponding to the use of air conditioning.

There are three proposals for LNG import terminals in the Bahamas,1 each with proposed pipeline connections to Florida. Each of these proposals has capacity of 800-850 MMcfd.

Combined, the proposed capacities of these LNG import terminals correspond to the total gas consumption in Florida. This means that only one or two terminals may be constructed in the Bahamas. The LNG imports into Florida will likely reduce the gas flows in the gas pipelines flowing from the US Gulf Coast to Florida, unless there is an increase in gas demand corresponding to the LNG imports.

Imports into California

The California gas market is about 10% of the total US market of about 65 bcfd.1

Because LNG imports into California would represent a significant portion of local and regional gas supply, these imports would likely displace gas from other regions or imports from Canada. In fact, the proposed LNG terminals for California are all located in Southern California or in the Baja California region of Mexico.

In California, the gas used for power generation may also peak during the summer months corresponding to the use of air conditioning.

Comments of SoCal Gas and San Diego Gas & Electric showed that 88% of total gas supply (2.8 bcfd) to Southern California was interstate gas supply from the Rocky Mountain states and San Juan Basin and the remaining 12% was intrastate supply of California gas (300 MMcfd).3

Proposed LNG imports from Baja California are 3.15 bcfd, and proposed LNG imports at Long Beach and offshore Ventura and Oxnard are 2.5 to 2.8 bcfd.

The comments stated that the proposed Long Beach terminal would have process equipment to reduce ethane content of LNG to 6% maximum and propane and heavier hydrocarbons to 3% maximum. This process equipment would also reduce the C6 and heavier to 0.2% maximum and ensure the inerts (N2 and CO2) to 1.5% to 4.5%. These are the specifications in California for motor-vehicle compressed natural gas.

BHP Billiton and Mitsubishi Corp. have proposed two of the offshore LNG terminals in California. Both are owners of the North West Shelf (NWS) natural gas project in Western Australia. ChevronTexaco and Shell are involved in two of the three LNG terminals proposed for Baja California region of Mexico. Each has affiliates that are also owners of NWS. ChevronTexaco has petroleum refineries in California, and some of the regasified LNG may meet their requirements.

The proposed LNG import volumes exceed the interstate gas transfers into Southern California. This implies that not all of the LNG terminal capacity serving Southern California will be built or, alternatively, that some of the regasified LNG may stay in Baja California or also move to markets in Northern California.

A recent press release issued by the office of John Howard, prime minister of Australia, indicated that he had discussed Australian LNG exports with California Governor Arnold Schwarzenegger.6

LNG imports to California may have a dramatic impact on the utilization of gas pipeline capacity serving Southern California and may influence the mechanisms that determine gas pricing in Southern California.

During January 1997 to June 2000, the basis differential between gas prices at the Southern California border and in West Texas and New Mexico averaged $0.19/MMbtu. Over July 2003 to June 2004 period, this differential averaged $0.17/MMbtu. In the previous 12 months ending June 2003, the basis differential was volatile. If and when LNG imports come to California, utilization of US interstate gas pipeline capacity for deliveries into Southern California may diminish.

Implications

There are significant markets for natural gas in both California and Florida with a significant portion of the gas consumed in these states is for power generation. Unlike the US Northeast or Midwest, where gas use tends to peak during the winter months, gas used for power generation in both Florida and California generally peaks during the summer.

Therefore there are benefits to sending LNG into the gas markets in both Florida and California. Some of the support for LNG import terminals in California may be from companies developing LNG export projects in Australia, or elsewhere.

Some sources of LNG such as Trinidad tend be relatively dry, while the quality of LNG from other sources may vary significantly.

With a tight gas supply-demand balance, North America is now experiencing a high gas price environment, conditions likely to persist and for varying periods may eliminate the economic incentive to recover ethane. Since most of the ethane is consumed as petrochemical feedstock, the price of ethane may have to rise to levels that ensure an incentive to recover ethane.

In recent years, many of the gas processing plants have been sold to independent third parties who operate these plants for profit. While some of the contractual relationships may be on a fee-for-service basis, the processing economics of many processing plants are based on the value added by liquids recovery. The recent escalation in gas prices may reduce or eliminate the profitability of facilities that depend on the liquids upgrade.

The contractual basis for processing may shift to a fee-service basis. This then raises the question whether these midstream functions will continue to operate as independent profit centers or will be reacquired by producers to ensure that the gas supply is merchantable and meets pipeline specifications.

Some of the comments to the FERC hearing mentioned the implications of blending off-spec supply with other gas streams. Some of the comments suggested that the party providing the stream into which off-spec gas is blended should receive some payment. None of the comments discussed the possibility of circumstances in which two off-spec gas sources could be commingled and the combined stream meet specifications.

Prospective LNG importers should assert that LNG is a premium product because of low levels of CO2 and that elevated HHVs of LNG relate to the absence of CO2 in the LNG stream.

References

1. "U.S. LNG Markets and Uses: June 2004 Update," US Energy Information Administration, June 2004.

2. "Agenda for February 18, 2004, Public Conference on Natural Gas Interchangeability," FERC Docket PL04-3-000.

3. "Comments of Southern California Gas Company and San Diego Gas & Electric Company on Natural Gas Interchangeability," FERC Docket PL04-3-000, Mar. 22, 2004.

4. "ChevronTexaco Panel 1 Technical Perspectives on Gas Interchangeability and Quality," for FERC Conference, Washington, Feb. 18, 2004; Bob Dimitroff.

5. "Review of the Gas Quality Specification for the Dampier to Bunbury Natural Gas Pipeline Western Australia," Office of Energy, November 1995.

6. "Transcript of the Prime Minister the Hon John Howard MP Rio Tinto Announcement Karratha, WA," July 28, 2004.

The author

David J. Hawkins (dh@ hawkinsgas.com) is president of Hawkins Gas Consultants Ltd., Calgary. He joined the Canadian affiliate of Purvin & Gertz Inc. in 1976 where he worked until 1997. During 1997-1999, he was a consultant to Alliance Pipeline. Hawkins holds a doctorate in control systems from the Victoria University of Manchester (England), a BASc in engineering science, and MASc in chemical engineering from the University of Toronto. He is a registered professional engineer in Alberta and Ontario.