Mississippi to offer tracts seaward of gulf islands

Mississippi enacted legislation earlier this year that allows oil and gas exploration in state waters.

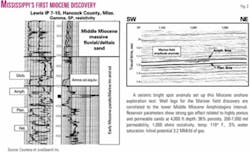

The Mississippi Mineral Resources Institute (MMRI) issued to the state legislature an assessment of the Miocene gas potential for the more than 500,000 acres of state offshore water bottoms (Fig. 1). This report is the first state assessment of hydrocarbon potential for the Mississippi Sound.

The Miocene resource estimate for the offshore is 350 bcf. No estimates were provided for the onshore Miocene Trend.

Deeper petroleum objectives were mentioned as Norphlet and James lime.

Five wildcats have been drilled in state waters since 1952 (Fig. 1).

Mississippi's first Miocene production was established in 2002 with the onshore discovery of Mariner field in Hancock County (Fig. 2). Hence, projections are based on Miocene exploration and production history in Alabama, where the drilling success ratio is 50% and cumulative Miocene gas production exceeds 106 bcf.

Miocene Trend

The Miocene Trend in the Eastern Gulf Coast Province produces dry biogenic gas from 1,200-5,000 ft onshore to offshore in Mississippi and Alabama.

Miocene reservoirs are associated with stratigraphic traps in both deltaic and marine sediments (Fig. 3).

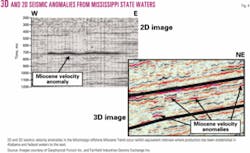

High drilling success rates are related to the application of seismic bright spot (AVO) methodologies (Fig. 4).

Water in Mississippi Sound and Lower Mobile Bay is generally less than 20 ft deep and averages 8-12 ft.

Drilling and completion costs for shallow offshore drilling using barge rigs are substantially less than other areas. Barge rigs bring $35,000 day. A turnkey contract for a 4,000-5,000 ft test in shallow water is about $800,000 plus a like amount for completion. Pipelaying cost is put at $100,000/mile.

If operators relocate jackups from the Gulf of Mexico, costs could be $1.6 million for drilling plus $2.5 million for completion, and pipelaying could reach $300,000/mile.

There may be a need for production managers to consider new production platform designs that would have a low profile as well as improved aesthetic footprint when commercial production is confirmed.

Offshore leasing and royalty fees are unknown at this writing, but state program managers expect revenues (lease bids and royalty) similar to that generated by the Alabama and Louisiana offshore programs. With wellhead gas prices above $5/Mcf, the Miocene Trend in the Eastern Gulf Coast Province is an attractive shallow gas exploration objective that independents have begun to watch.

Deeper formations

The MMRI report did not address Norphlet and James lime objectives, but these geologic intervals are of interest to larger independents and major exploration companies.

Lease bocks that are to be made available in eastern Mississippi Sound are prime Norphlet targets. Expected drilling depths to these aeolian dune sands are around 20,000 ft.

James lime prospects in Mississippi Sound are conceptual at present. Onshore production in south Mississippi strikes on line with Chevron's production in federal offshore waters in the Viosca Knoll area to the southeast, suggesting that James lime reservoirs may be present in the western portion of the sound.

A study is needed to assess both Norphlet and James lime potential and other possible objectives in Mississippi Sound, said Bennett Bearden, director, Eastern Gulf Region, Petroleum Technology Transfer Council (PTTC).

Seismic availability

One item of interest to exploration managers is the availability of seismic data covering Mississippi Sound.

Fairfield Industries Inc. and Seismic Exchange Inc. have proposed a two-phase, 3D spec shoot for the interior of Mississippi Sound and a portion south of the state's barrier islands. The proposed survey would extend to Alabama state waters as well.

The new 3D data will generate even more interest because it is to be acquired in a manner that will illuminate the shallow Miocene as well as the James lime and Norphlet potential, said Steve Mitchell of Fairfield. The company provided 3D seismic data acquired south of the barrier islands for MMRI's Miocene assessment.

Geophysical Pursuit Inc. also provided 2D seismic data to the study, making available its Mississippi-Alabama state waters seismic data set purchased from WesternGeco in 2002. Larry Galloway of Geophysical Pursuit advised that exploration companies are reviewing its 2D data to assess the possibility of initial drilling of potential prospects in the Mississippi-Alabama offshore.

In regard to seismic availability for Mississippi Sound, sufficient 2D and 3D data can be obtained now for lease blocks south of the islands in state and federal waters. However, in light of a predicted summer 2005 state lease offering, 2D data may be the only seismic available to assess lease blocks inside the barrier islands at sale time. Data from the proposed 3D spec shoot may not be available until after the first lease sale if seismic permits are not issued before spring 2005.

The US Oil & Gas Association and PTTC have scheduled an oil and gas forum for Oct. 5-6 in Jackson, Miss., to highlight exploration in the Deep South. MMRI will cosponsor the PTTC-EGR Miocene Workshop set for Oct. 6.

The MMRI OFR 04-2 report is available as a free download online (http: //www.olemiss.edu/depts/mmri/programs/MMRI%20OFR%2004-2.pdf).

Legislative background

Senate Bill 2853 passed the Mississippi House and Senate overwhelmingly, and Gov. Haley Barbour signed it in May 2004.

Joe Sims, president of the US Oil & Gas Association Alabama-Mississippi Division, led the bill through passage. He advises that there continues to be interest in Mississippi offshore development, particularly drilling for shallow natural gas.

The new law transferred the authority for leasing from the Mississippi Department of Environmental Quality to the Mississippi Development Authority, the state's economic development agency.

Barbour named Jimmy Heidel, former MDA executive director, to oversee the program transfer to MDA. Leland Speed, executive director of MDA, will administer the program.

MDA has begun revising the state lands program rules to bring them in to compliance with the change in program oversight and to update the rules of lease bidding and seismic permitting on state lands. Revisions should be completed this fall, and the first lease sale is expected to be held in the late spring or summer of 2005.

Exploration companies should be made aware that law allows leasing and drilling only on those blocks south of Mississippi's barrier islands (Fig. 1). Four blocks were also made available inside the islands near the eastern state boundary with Alabama.

The author

Steve Ingram ([email protected]) is a research associate with the Mississippi Mineral Resources Institute at the University of Mississippi in Oxford, Miss. His primary duties are to direct the institute's energy program and liaison with industry, academia, and government. He joined MMRI in 2001. His 20 years of geologic practice include oil and gas exploration with an independent and as a consultant. He has a bachelors degree from Millsaps College.