Creating Supply Advantage For Oil And Gas Companies With Strategic Procurement

In 1998, the rich, historic epic of the oil and gas industry entered a new era-one defined by mergers of breathtaking scope and scale and high-stakes positioning for the world-class projects of the future.

"Shareholder value" is the clear and consistent rallying cry, requiring competitors to intensify their efforts at cost leadership, while also seeking to boost revenues through the deployment of innovative technologies and processes. Many look to market innovations, while others seek to unlock "supply chain" value through innovative relationships with suppliers as a powerful tool to enhance shareholder value.

A recent A.T. Kearney survey into the latter trend-the industry's efforts at creating supply advantage-shows how leading oil and gas companies are taking strategic procurement beyond cost savings and actually contributing to revenue growth. The effect is quite striking, as many of these companies are discovering the full leverage that procurement can provide in driving the total return to their shareholders (see related story, p. 56).

In our study, we found a consistent viewpoint from procurement executives on how procurement strategies can create supply advantage. However, we also found that the execution of these strategies-as reflected in the alignment of implementation efforts with the agreed priorities-continues to lag, remaining largely focused on the traditional tools of cost leadership.

Creating supply advantage

Over the past decade, procurement has evolved from a tactical activity focused primarily on placing purchase orders to a more-strategic process in support of the business (Fig. 1). The procurement function now works effectively with users to understand requirements, select suppliers, and manage the supply base to fulfill needs. Most Fortune 500 companies have implemented, to varying degrees, strategic sourcing programs that have targeted tangible cost savings, most frequently measured in purchase price (despite an acknowledgment that this is a poor substitute for total cost). The oil and gas industry is no exception, as most of the major North American players have completed or are in the process of implementing strategic sourcing programs matched to their own business models.

As we examine leading trends in procurement-as shown by early innovators in the automotive and high-technology sectors, for example-it appears that procurement is ready for the next level of sophistication beyond strategic sourcing:

- The company aligns its procurement strategy with its overall business strategy, while taking into account the characteristics of the industry in which it operates.

- Such a company then enhances its competitive position by changing the nature of relationships with suppliers-seeking to accelerate innovation and provide access to new markets.

- The company further moves to apply best practices in all areas that complement and strengthen the procurement strategy.

Oil industry survey

It was clear that the game was changing for procurement across a wide range of industries. Less clear, however, was where the oil and gas industry stood by comparison with other industries in this evolution. The A.T. Kearney survey was aimed at understanding the current state of the industry's procurement practices. We hypothesized that the focus would go beyond traditional cost leadership, seeking to align business and procurement strategies to create supply advantage (Fig. 2).

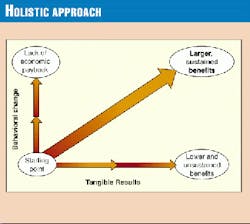

The survey posed four key questions under an overarching theme (Fig. 3): How can strategic procurement add to oil and gas industry participants' drive to create shareholder value-especially important for an industry whose returns in recent years have lagged those of the S&P 500 (Fig. 4)? The principal questions were:

- What procurement strategies are cited to contribute significantly to business success in today's challenging industry environment?

- What is the level of implementation across various procurement strategies among industry participants

- What barriers and issues does the procurement function face in the drive to add value?

- What are the most important issues for oil and gas procurement between now and 2002?

We purposefully did not look to quantitatively "benchmark" the companies on traditional productivity measures-instead choosing to focus on strategic issues that would materially influence the future of the function.

Top procurement strategies

The participants responded that the majority of "hypothetical" procurement strategies we suggested in the survey are applicable to their business. Those that were least applicable related to shifting ownership of assets to suppliers as a tool to increase capital productivity. The top strategies clearly fell into two major areas of focus, consistent with the mission statements and stated strategies shared by the participants. Four of the strategies focus on supplier selection and supplier management, while an additional four focus on total supply chain management. The top eight strategies, as ranked by the participant responses based on applicability, are detailed in the following sections.

Non-equity supplier incentives

Topping the list as the most applicable strategy for increasing shareholder value are nonequity supplier incentives.

Some participants reported, for example, providing suppliers with "balanced scorecards" and sharing the gains when benchmark performance (of, say, development wells in predictable formations in West Texas) was surpassed. Others were attempting to tie the revenue of all suppliers on a project to overall project performance, as has been done on at least one large offshore development. Other incentives include automatic contract extensions for MRO suppliers, effectively eliminating the retendering process when performance has been good. Safety incentives could also prove valuable. "Safety incentives promptly stopped accident(s)..." explained one executive.

But the executives noted that implementation of such incentive programs continues to lag, highlighting common barriers to achieving full success with this strategy. Predictably, many of the companies appear to struggle with defining the right metrics, benchmarking current performance, and measuring performance going forward.

"We are way behind... in the usage of performance measures," said one participant. "Having vendors capture data and measure performance is not satisfactory."

Another noted that when suppliers propose ideas to increase revenue or ways to reduce costs other than purchase price "...coming up with the right formula can be tough." And still others acknowledge the inadequacies of current performance measurement systems, as reflected in the comment that there are "no great successes because the metrics are not comprehensive" (Fig. 5).

Strategic sourcing

All the participants acknowledge the importance of strategic sourcing, procurement's major source of contribution to cost leadership. Most are currently engaged in sourcing activities that are generating positive business results. To ensure clarity, let's start with a consistent definition. We define strategic sourcing as: A rigorous and disciplined process by which a company segments its purchases into categories defined from the suppliers' perspective and then takes each category through a process to: define requirements; understand the supply market; and negotiate with selected suppliers to achieve advantageous commercial terms-leading to a portfolio of selected suppliers.

For example, several participants have used sourcing techniques for oil country tubular goods (OCTG) and line pipe. One participant achieved very significant cost reductions on OCTG by applying a probabilistic model that recognizes mills are able to produce pipe at much greater tolerances than those used for specifications by the American Petroleum Institute and that therefore lower-weight casing can be safely used. The same company also reached an agreement with a single Japanese mill for line pipe for the majority of projects worldwide, advantageous because it was able to bundle previously discrete buys for major projects around the world. "Sourcing has helped develop strategic relationships with key suppliers for key commodities and services," claimed one executive.

However, participants see opportunities to go beyond their initial sourcing efforts to achieve even greater returns. Sourcing, some report, "...only covers 20-30% of total spend" or "Sourcing only covers materials, not services and capital." In general, participants have picked the "low-hanging fruit" of less-complex categories-such as MRO, chemicals, and nonoperating services, e.g., travel. They are now at the threshold of attacking the major spend areas such as rigs, engineering-procurement-construction (EPC) contractors, and drilling services provided by the big three: Schlumberger, Halliburton, and Baker Hughes. Many of the participants are already expanding their sourcing activities, stressing that "Sourcing of services is a big area of opportunity," or sourcing is "...primarily completed for Tier 1 suppliers, (now) being expanded to Tier 2."

Standardization programs, spec reviews

Most of the survey respondents see a fertile ground of opportunity through this strategy yet predict an uphill battle that will require significant commitment from alliance suppliers. Others are reporting early evidence of success: "The prize was standardization...created by cross-functional teams working with the fabricating engineer and the procurement group." At least one company surveyed considers the process "well-embedded," although somewhat inconsistently, because strategic sourcing encourages standardization. One case example of success involved reaching standard specifications for large-horsepower turbines for use in gas reinjection. By agreeing with the supplier that the various operating companies would utilize a set of base specifications, with some fine-tuning to local requirements, the supplier committed to significantly reducing equipment lead times-on items that are frequently on a critical path for major projects.

But similar to strategic sourcing, there are barriers. In fact, the most significant barrier to many of these procurement strategies is the "we're different" mindset, especially as it relates to buying services. In particular, one respondent laments that it is "difficult to standardize foreign operations"-an experience echoed by others polled.

Capital procurement processes

As a capital-intensive industry, oil companies have developed extensive project management processes, such as CPDEP at Chevron Corp. and Advantage at ARCO. As 90-95% of project costs are paid to suppliers, and acquired materials and services drive a project's technical performance, it's critical that procurement processes integrate with the capital project process from start to finish. Several executives believe that they've made good progress in this area. One stated, "A major alliance is in place for capital project execution and procurement in both the upstream and downstream businesses." A second respondent noted having a "formalized process in place since 1996," while acknowledging that the expansion of the practice beyond refining and marketing into other business areas remains a future opportunity.

The nature of integration varies, too. In general, participants are flexible in how they integrate with the project team, recognizing that it's most important that they work together:

"For large EPC projects, we use the EPC contractors' procurement system or give EPC contractors access to the operator's ERP (enterprise resource planning software) system"-depending on the business unit and supplier involved. Flexibility and choice surface as consistent themes-"Procurement works with suppliers to determine whose supplier agreements to use...and EPC contractors sometimes provide innovation," but "relationship management is tough in this area"

Inventory management

Oil and gas executives see inventory management as a work in progress, saying that their organizations have a long way to go in this area.

Technology is providing some tools to more effectively manage inventory, such as including site-facility excess inventory as a virtual supplier in web site procurement catalogs. And there is an increasing trend toward sharing spares with other local operators, for example on the North Slope of Alaska, or moving inventory onto the suppliers' books and responsibility.

Some participants continue to pursue legacy-systems solutions, but recognize that "We are probably 2-3 years away from MRP (materials requirement planning) systems generating direct material orders when inventories reach reorder levels," explained one study participant.

Challenges are seen as significant and long-term.

"There is a 'cultural challenge' in getting plant operators to give up site inventory," said one executive, especially when it may have already been expensed or capitalized as part of a large project. Some view inventory management as "a never-ending process."

Another agrees, claiming that, while no successes have been reported to date, "...refining and chemicals inventories are now under central stewardship and are targeted...for reduction." Fortunately, the old accounting barrier ("I can only sell it for market value") is being proactively removed by some participants in order to get to the right answer for the business.

Access to suppliers' technical capabilities

With continued downsizing and consolidation, oil and gas companies find themselves in an initially uncomfortable situation where suppliers have greater expertise, deeper resource pools, and larger R&D budgets in their selective areas.

One participant says his company has developed relationships with three key suppliers solely to address technical capabilities, explaining it as a straightforward attempt to "...focus efforts on the critical few." Oil and gas companies have long been comfortable outsourcing activities in areas where they have traditionally not held expertise and resource depth; now they are increasingly willing to look to suppliers to provide capabilities in a much broader, more pervasive range of services.

Indeed, this practice is becoming a standard procedure, particularly in areas outside a firm's core competence or not in its base business. Procurement executives report confidence in this practice, indicating that "A number of alliances are designed to exploit supplier technical capabilities;" that "Joint technology licensing agreements are in place;" and in one company's case, its OCTG "ellipsesupplier is a part of an integrated team. They manage the supply chain on our behalfellipse" and are responsible for ensuring pipe is delivered inspected and ready to go.

Leverage supplier capabilities, infrastructure

This strategy is distinct from the preceding one in that it's focused on more local or operating company execution, rather than as a corporate-wide relationship.

The participants are well aware of the value of leveraging their suppliers' resources and infrastructures and do so extensively but not consistently. For example, participants commented that, in some disciplines and locations, "supplier employees are on our site."

The logging representative may be on-site for one business unit and included in engineering discussions aimed at developing a suitable technical solution to a particular problem. Yet, in another unit, these representatives maintain the more traditional "master-slave" relationship with their supplier.

In many cases, the motivation is sharply focused on joint cost reduction, such as "They use our facilities, we use theirs." In others, we find more sophisticated arrangements where the participant "ellipseoften utilizes a large supplier's buying power in commodities in which we have a small presence." And in yet another case, a respondent reported having "access to suppliers' knowledge of industry best practices"-for example, in scheduling turnaround maintenance work in multiple large plants.

Asset commercialization cycle time

Asset commercialization cycle time (that is, the time it takes, on average, to move from concept to revenue flow in major capital investments) is acknowledged as an area of opportunity that procurement can affect.

Nevertheless, it has received little direct attention from the survey participants-in fact, six of the nine respondents did not pinpoint any specific efforts, successes, or issues in this area in either their written comments or in interviews.

However, participants that did respond indicated that they are making some progress in this area, specifically where they have been involved in the "front-end loading" of capital projects. Front-end loading is the practice of making smaller investments at the start of asset development, before committing the major capital, to prove out the technical and economic viability as input to a decision to kill or complete the project. One participant has leveraged strategic sourcing of project requirements, linked to a bundling of similar requirements worldwide, to ensure that the project economics adequately reflect the potential true cost and to move a field into development.

This continues to be challenging for many of the participants, however, as they struggle to win the support of the project managers (who are, of course, accustomed to being in total control of their project's destiny) in order to provide procurement expertise.

Strategy vs. implementation

The survey findings reveal a definite difference between the strategies that procurement executives rank as important to creating supply advantage (Fig. 7) and the strategies that they are currently implementing (Fig. 8).

The four strategies with the largest gaps between importance and implementation (Fig. 9) relate principally to enhancing capital productivity-not to achieving cost leadership (Fig. 10). While supplier incentives can drive towards all three applicable value levers-capital productivity, reserve additions, and cost reduction (Fig. 11)-if the correct metrics are in place, the remaining three strategies are all focused on capital productivity.

By the same token, standardization, inventory management, and improved cycle times for asset commercialization also enhance capital productivity. Standardized specifications reduce capitalized engineering costs. Lower inventory levels reduce the level of working capital. And accelerating the time to commercialization generates increased revenues. All three improve a company's ratio of sales to capital.

On the other hand, two strategies that are not expected to deliver significant value, outsourcing and total cost of ownership models, are getting more attention than the participants feel is merited. Could this be in response to corporate pressure to pursue outsourcing as part of the current wave of cost reductions, although executives are not convinced of its validity?

Noticeably, the national oil companies show a markedly different strategic focus, highlighting strategic sourcing as a highly applicable strategy not being fully pursued.

Barriers and Issues

When asked, "Which barriers to strategic procurement are most significant?" the answers were the boom-and-bust business cycle along with mergers and acquisitions (Fig. 11).

The boom-and-bust cycles have made it exceptionally difficult to develop sustainable high-value supplier relationships, because behavior (on both sides) tends to revert to the more antagonistic them-and-us mindset in the face of economic adversity. Other barriers are internal constraints and insufficient capabilities in developing countries. Inadequate information technology (IT) systems, legal constraints on alliances, and supplier distrust of alliances were also significant barriers. The least problematic were production-sharing contract agreements, suppliers as future competitors, and supplier oligopolies.

IT and electronic commerce led the list of the top five procurement issues from now until 2002, consistent with procurement in other industries, too (Fig. 12). Cost leadership came in second, followed by personnel skills and retention, cultural and organizational factors, and oil prices. Less critical but still significant are issues of trade barriers, industry consolidation, integrating procurement and business strategies, and supplier alliances.

Conclusion

The survey has demonstrated that oil and gas procurement strategies do have the potential to meaningfully affect shareholder value creation but that implementation is firmly focused on cost reduction, presumably because this is what is demanded by company leadership.

The procurement executives who participated in the survey "get it" but do not have permission to expand their horizons to significantly affect value creation. The major challenge for the industry's procurement executives-and, more importantly, for the corporate and line-business executives they serve-is to reframe their thinking to accept that excellence in the procurement and management of externally purchased goods and services is truly one of the most powerful and leverageable drivers of shareholder value for the enterprise.

Until that time, this function in the oil and gas industry will remain behind the leaders (in such businesses as high technology and automotive) in adding value for shareholders.

The Authors

Niul Burton is a vice-president of A.T. Kearney and leads the firm's West Coast operations practice. Burton has more than 12 years of experience with A.T. Kearney, during which time his primary focus has been strategic sourcing, procurement, and business process reengineering across a number of industries, including oil and gas, consumer products, and pharmaceuticals, in North America, Asia, and Europe.

Dave Lanciault is a vice-president of A.T. Kearney and leads the firm's oil and gas consulting practice. Lanciault has been a leader of consulting services for the past 10 years. His previous experience includes 11 years in new product design and development, production and materials management, and program management in the aerospace and defense industry.

Study Delineates What Drives Total Shareholder Returns

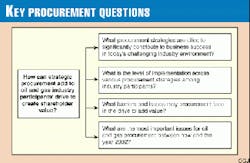

IN A RECENT STUDY, A.T. KEARNEY SOUGHT TO UNDERSTAND THE relationship between performance on total shareholder return (TSR) and over 40 common, underlying operating and financial measures for oil and gas companies. The study-focused initially on nine major integrated companies and later on upstream and downstream independents-had the main objective of understanding which of the variables seemed to have the strongest and most consistent bearing on TSR performance. The results of the survey, based on performance during 1993-97, showed that fully 80% of the variance in TSR performance for the integrated companies could be explained by three factors:

- Total capital productivity. Total capital productivity (TCP) looks at the ratio of sales to economic capital (or the sum of property, plant, and equipment; working capital; and other capital). In other words, TCP measures the company's efficiency in converting capital into sales. In the nine-company peer group, Mobil Corp.-led by dramatic improvement in the capital productivity of its downstream business over that period-is a clear example of leadership in this dimension.

- Adjusted reserve additions per well drilled. This calculation measures the ability to grow "organically," by examining the effectiveness of the organization in adding reserves through revisions, recovery, extensions, and new discoveries as sales and purchases are backed out. British Petroleum Co. PLC, as the industry leader in TSR performance over this period, can attribute most of that success to superb performance on this key driver.

- Relative price of crude at the wellhead. Crude oil prices are in terms of the price realized by an oil company and measure the relative attractiveness of production.

Of these three levers, the first two can be influenced most rapidly (although with a clear lag time); relative price of crude is essentially locked in based on the portfolio of fields owned. Furthermore, the ability to explain TSR variance by looking at all three factors combined is but a single percentage point stronger than the combined effect of the first two (80% vs. 79%). Consequently, we have focused our attention in our research here on the first two drivers.

Characteristics of Procurement Organizations Evinced in Survey

IN ITS SURVEY OF OIL AND GAS COMPANY PROcurement practices, A.T. Kearney found a fairly consistent picture of how survey participants had approached the structural and enabling components of their function.

Organization

More than half of the survey respondents classify their procurement organizations as "center-led."

In other words, coordination and guidance for global business units are provided from a centralized procurement group, while transactional procurement activities are carried out by decentralized groups.

In terms of global influence, more than two thirds say their role is a function of leadership, coordination, or support for global business units, including the sharing of best practices. There was only one company that pursued a centralized model.

Performance metrics

The executives cited many procurement performance metrics, but metrics on cost leadership were most commonly used.

The survey found that the five leading metrics are cost-focused, all respondents use price-cost approaches, and just over half have stated targets. Nearly half of the respondents use transaction costs or costs per dollar spent, most with stated targets. One third of the respondents use total cost of ownership-acquisition costs and consolidation or reduction of the supply base, but only consolidation-reduction consistently has targets. Only one company measures percent of EDI invoices, and it states targets. Other metrics with stated targets are percent expenditures under alliance and cycle time (ordering process); however, the respondents indicate these are rarely used.

Despite agreement that procurement will create real value through improving access to technology and speeding commercialization of assets, measures are predominantly focused on the more easily understood and measured cost reduction.

The number one issue over the next 3 years-electronic commerce-does not appear explicitly in any of the metrics.

IT capabilities

The majority of executives say their information technology capabilities are underdeveloped. For example, in terms of accessing basic information to manage their company's procurement, such as determining the company's total supplier count, they say the results are frequently inaccurate. Indeed, when asked about the supplier count reported in the written survey, four executives commented:

- About 29,000-34,000 suppliers, "ellipsebut there may be a lot of double-counting"

- About 50,000-80,000 suppliers, "ellipsebut no one really knows" and "SAP requires each employee to be set up as a supplier."

- 8,000 core suppliers, "ellipsebut maybe 4 times more if looking at accounts payable."

- At least 3,500, "ellipsebut the system does not capture most service suppliers."

Most organizations have implemented enterprise resource planning (ERP) software, seemingly without much focus on strategic procurement requirements (as distinct from the day-to-day transactional support). For example, several executives say that different business units are using different software packages and material-coding systems that are not linked to their ERP systems. Others are unsure as to how well their ERP and procurement systems will be integrated, saying that the "ellipseERP system is likely to support tax before supporting sourcing," and "We do not have the ability to reach into the system and get supplier-spend information."

In additional, despite these large investments in sophisticated ERP systems, respondents had resorted to more-basic tools when looking to develop information they could use for strategic decision-making:

- Corporate-wide data on spend and suppliers is only available from an internally developed "workbench" that doesn't yet cover all business units.

- Stand-alone "spend-save" repository not linked to an ERP system.

- Stand-alone Excel system used to capture spend data.

- Stand-alone Excel system used to capture TCO data.

Procurement Survey Methodology Detailed

A.T. KEARNEY'S PROCUREMENT PRACTICES SURVEY QUESTIONnaire and interview focused on current procurement organizations and included an examination of 11 strategies related to the two controllable value-drivers-capital productivity and reserve additions.

First, A.T. Kearney gathered general information regarding the company's current structure, information technology, and metrics to understand their profile.

For example, executives were asked if their procurement processes were integrated with project management for large capital projects. They were asked whether their suppliers were involved in key decision-making or if supplier resources were being leveraged. The executives were also questioned about issues such as standardization, inventory management and reduction, recapitalization, and use of build-own-operate agreements. In addition, there were questions about accelerated cycle times to asset commercialization. And on the topic of adjusted reserves, the inquiries focused on joint operator and supplier decision-making and whether their companies had access to their suppliers' technical capabilities and whether they offered their suppliers nonequity incentives.

A parallel line of questioning sought information about each company's cost leadership practices. For example, does the company: (1) have a strategic sourcing program in place with a selected portfolio of suppliers? (2) have a data-driven total cost of ownership model for decision-making? (3) leverage information technology, including enterprise resource planning software systems and electronic commerce procurement, to enhance efficiency and effectiveness of procurement processes? (4) use consortium buying? and (5) outsource its noncore processes?

Finally, we asked open questions regarding barriers and issues that the respondents expect to face and received fairly consistent answers.