CAPP: Environmental role, better communications at top of agenda for Canadian petroleum producers

The Canadian petroleum industry must satisfy growing public demand for more and better information on its aims, operations, and economic contributions, says Pierre Alvarez, president of the Canadian Association of Petroleum Producers (CAPP).

Alvarez, appointed in May, says effective communication is a top priority for his association, which represents 170 companies that produce about 95% of Canada`s oil and gas.

CAPP`s principal activities on behalf of members currently involve pipeline negotiations, regulatory issues in both Canada and the U.S., and effective communications with a growing list of stakeholders. Issues in that agenda range from environmental protection, including emissions control, to land access and getting the message out on the industry`s operations, policies, and economic impacts.

Federal and regional environmental issues are currently high on CAPP`s agenda, Alvarez says. He says association members are committed to being environmentally responsible contributors to sustainable development.

Kyoto efforts

The association is now focusing on a major effort to represent the industry`s position on the commitment made by Ottawa at Kyoto over a year ago to cut greenhouse gas emissions by 6% from 1990 levels by 2010.

"There are a number of processes under way on Kyoto. We have been very active and will continue to be, to bring industry`s perspective to the table," Alvarez said.

"There are working groups, task groups, and initiatives under way in various provinces. There is concern. We want to make sure the facts are debated, make sure we have good information, and make sure the economic consequences are examined. We want all facets looked at, all industries looked at, not just focusing on one or two. We will continue to play an active role as this unfolds."

Alvarez declined comment on the Kyoto stance taken by Imperial Oil Ltd., the Canadian unit of Exxon Inc., a CAPP member, and one of the most outspoken industry critics of Canada`s Kyoto commitment.

Imperial has stated bluntly that the emission reductions agreed to by Ottawa would lead to higher unemployment and do serious harm to the Canadian economy.

The company says that, because Canadians have increased energy consumption since 1990, emissions would in reality have to be cut by 20% to meet Ottawa`s target.

"The risks are not well-defined, the benefits are not clear, and the costs of Kyoto will be very, very high. It`s an inappropriate public policy in our view and requires reexamination," Imperial Chairman Bob Peterson told shareholders earlier this year.

A related issue at the federal level that refuses to die are suspicions in the petroleum industry that Ottawa will introduce a carbon tax that would do severe damage to the industry.

Alvarez says CAPP accepts repeated assurances from senior federal cabinet ministers that there will be no carbon tax.

"The minister of natural resources has said repeatedly that there will be no carbon tax, and the minister of finance stated at the CAPP annual dinner that there will be no carbon tax," Alvarez said. "We support that. We support the position of the government of Canada that there will be no carbon tax."

Gas flaring, sulfur

On a regional level, CAPP recently unveiled new measures to address public and government concerns on issues such as gas flaring and sulfur plant emissions.

The initiative comes as tensions have been rising between landowners and exploration companies in Alberta, Canada`s primary petroleum-producing province, over emissions from solution gas flaring and sulfur plant operations. There has been a rash of vandalism over the past 2 years against industry installations in northern Alberta.

A senior industry executive recently warned that the Canadian petroleum sector is perilously close to bankrupting its "reputation equity account" and must address public concerns about the industry`s effect on the environment.

Rick George, president of oilsands producer Suncor Inc., said there is a growing unease about gas emissions and the impact of exploration on wilderness areas. George praised the environmental efforts of the industry. But he said many people view the industry with suspicion, despite its role as a major economic engine and its efforts to improve environmental performance, reduce emissions, lessen the effect of its activities on the land, and improve safety standards.

The Alberta government has instructed the province`s energy regulator, the Alberta Energy and Utilities Board (EUB) to review 34 of 48 operating sulfur gas plants to update or clarify the sulfur recovery requirements for grandfathered sour gas plants. They were excluded from recovery requirements introduced in 1988. Rural residents and environmentalists have raised concerns about the possible impact of the plants on human health. The review is being conducted this summer by the EUB, and if upgrades are required, they could be costly for industry. CAPP says it will work with the government on the issue but adds that any review should include all industries emitting sulfur.

EH&S initiative

Alvarez says CAPP`s new Environment, Health, and Safety (EH&S) Stewardship program is an important step for dealing with public concerns on this and other environmental issues.

The EH&S initiative is a voluntary program under which CAPP members would sign on to meet a comprehensive and tough set of guidelines to deal with environment, health, and safety issues.

The program will promote improved performance and greater public accountability by members and will recognize companies that are leaders in meeting or exceeding the program`s regulatory requirements.

Ray Woods, chairman of the CAPP EH&S executive policy group, says that, when members sign up, their commitment will include: the provision of benchmarking data on current operating performance; public consultation with interested parties about company activities; maintenance of operations in accordance with industry recommended practices that are being developed by CAPP and will be recommended to members; and the implementation of audits consistent with CAPP guidelines.

Industry benchmarking data will be shared through CAPP with interested parties, but public consultation and individual corporate reporting will remain the responsibility of each participating company.

Alvarez rejects as unfair charges by environmental critics that the program is a largely public relations exercise and does not require participating companies to make public their individual performance on the environment.

"It`s an unfair criticism. A very significant initiative has been launched through CAPP. There`s a commitment to get as many members as possible to sign up to report publicly on the results of emissions in the first place," Alvarez said.

"This has been done voluntarily by the industry. It wasn`t ordered to do so by government, and I think that needs to be recognized in a positive fashion. You have members who represent a significant industry who have stepped up and say they will report on this, and they haven`t been forced by government. I think it`s a tremendous first step."

Alvarez says CAPP is still working with its members on the program and he hopes the public will wait until the end of the first year to make judgments.

Stakeholders proliferating

The CAPP executive says land access and regulatory issues involving governments at all levels are requiring the industry to deal with a far broader range of stakeholders than it did in the past.

CAPP`s governmental relations range from dealings on behalf of its members with federal and provincial governments in Canada to U.S. regulatory authorities, such as the Federal Energy Regulatory Commission in Washington, D.C. The association retains both consultants and legal representation in Washington, and CAPP staffers are frequently in Washington. Alvarez says the workload in dealing with U.S. regulatory issues can only increase.

"There is more and more interconnection between the Canadian producer side and the U.S. marketplace. We will have increasing involvement with the U.S. (Among) the changes coming up (are) the advent of the Alliance natural gas pipeline to the (U.S.) Midwest and Canada`s East Coast gas being brought on and delivered to U.S. markets," Alvarez said.

"The (Canadian) industry clearly sees there`s a very significant market available in the U.S., and I think you will see them continue to pursue opportunities very aggressively. Producers have been looking for market-based solutions and opportunities, and I think they will continue to do that."

In Canada, CAPP foresees companies operating in Canada dealing more and more with stakeholders, such as municipal authorities and First Nations native groups on issues such as land access and various forms of levies on industry activity.

Alvarez says industry interaction with First Nations groups has been relatively limited in the past by geographical factors. Now exploration and development activity is heating up in many of Canada`s northern areas, such as the Northwest Territories and Northern British Columbia.

There have been several large natural gas discoveries recently in the Northwest Territories.

The adjacent Yukon Territory recently decided to hold its first oil and gas land sale. Major gas discoveries in the Fort Liard area of the Northwest Territories by Chevron Canada Resources, Berkley Petroleum Corp., Paramount Resources Ltd., Ranger Oil Ltd., and other companies has sparked considerable industry interest in the area, which is close to natural gas pipeline connections.

At the same time, Alvarez notes, some First Nations peoples in northern areas are assuming greater control over their regions. Some are negotiating land claims, some have completed them, some have treaties, some don`t, and some are moving steadily along the road to self-government. He says that, to function effectively in these areas, the industry must be ready to deal with a variety of such changing relationships.

An example of such change is the Ikhil gas project, about 65 miles northeast of the community and administrative center of Inuvik on the Mackenzie Delta in the Western Arctic. It was developed and originally owned 100% by the Inuit people and now has Enbridge Inc. and Altagas Services of Calgary as partners. Ikhil will begin supplying commercial and residential natural gas to Inuvik in September in a partnership between the Inuit and southern companies.

The CAPP president also notes that municipal and regional councils are taking on more and more authority. In the area of fees and taxes, he says, they have the view that a local industry activity is a way to raise revenues-for example, for moving equipment through the area to a site.

Local governments and agencies are also dealing more with land-access issues as urban areas expand to areas where exploration companies want to operate. Regional regulatory bodies are dealing increasingly with disputes between landowners and companies on the urban fringes of cities such as Calgary.

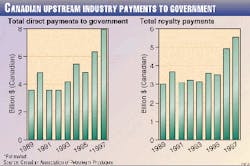

"Fiscal issues for the industry used to revolve around royalty rates. Now you see a much broader number of fiscal considerations, from occupational health and safety costs to road taxes and cost recovery from regulatory agencies," Alvarez said. "There`s now a whole series of additional fees and taxes that are being levied on the industry. You have to look at those in the context of the total government take, not just the historical focus on royalties."

Competing for capital

A related issue for CAPP is the ability of companies to compete effectively for investment capital in an industry that is increasingly continental and international in its scope and operations.

Alvarez notes that more Canadian companies are now involved in offshore international ventures, pipelines are criss-crossing North America, natural gas is moving around the continent, and LNG is coming into the market from South America. But he says the petroleum sector continues to make major capital investments in Canada.

"There continues to be very significant investment in Western Canada and the East Coast offshore, and there`s talk of considerable funds being invested in northern areas," Alvarez said.

"Individual companies are making their own investment decisions, but, overall, industry is still investing here. The industry has invested more than $50 billion (Canadian) in Alberta in the past 5 years."

Tolling structures

A major project for CAPP now coming to completion has been negotiating an agreement on tolling structures with crude oil and natural gas pipelines in Alberta.

An agreement announced in March between producers represented by CAPP and Calgary-based TransCanada PipeLines Ltd. will abolish Alberta`s traditional 20-year-old postage stamp tolling system for gas pipelining, under which all producers paid the same rate, regardless of location.

Alvarez says the agreement is an example of a trend toward more and more incentive-type agreements rather than a traditional, formal regulatory and adversarial process.

Under the new receipt point structure, to be phased in over 4 years, producers would pay a variable export shipping price, depending on where the volumes are produced, size of pipe used, and length of transportation contract. Rates would be 19.9-35.9¢/Mcf. The agreement also includes financial transitional support, under which TransCanada will contribute $25 million/year over 2 years and shippers will contribute up to $20 million/year over the same period.

Hearings on the agreement will be held before the EUB.

The deal will affect the intra-Alberta pipeline system operated by NOVA Corp., Calgary, which TransCanada acquired in a $14 billion merger in 1998. NOVA transports about 18% of all gas produced in North America.

A sticking point at this stage is that the agreement has not been endorsed by the Small Explorers & Producers Association of Canada (Sepac), which is concerned its small-producer members could face increased costs under the deal. TransCanada would no longer automatically build small lateral lines to connect new wells to its main line. Producers would have to build their own laterals or approach large producers or nonregulated midstream companies for connections.

"CAPP worked hard to secure an agreement that would have positive benefits for the greatest number of members possible. Some compromises were made," Alvarez said.

"We are continuing to work closely with Sepac on a few outstanding issues. Perhaps through the hearing process these can be resolved as well."

Improved communications

The primary thrust running through all of CAPP`s efforts is more effective communications with a widening range of constituents.

Alvarez says there is a growing desire from the public for more and better information on the industry, its operations, and its economic impact. That includes beating the industry drum on major environmental initiatives and getting across the fact that the petroleum sector is a major economic contributor in many areas of Canada.

In Alberta alone, CAPP says, the industry employs 160,000 people, directly and indirectly, has invested more than $50 billion in the past 5 years, and accounts for 63% of goods exported from the province.

Delivering that kind of message will be job number one for Alvarez, whose background is as a senior energy bureaucrat and power industry executive.

Alvarez was chairman and CEO of Northwest Territories Power Corp. before leaving to head Alvarez, Sloan & Associates, an energy consulting firm. The CAPP president has also held positions as secretary to the cabinet, deputy minister to the executive council, and deputy minister of energy, mines, and petroleum resources with the government of the Northwest Territories.

And there`s one item in his resum? that many in Canada`s petroleum sector find appealing: During a stint with the federal department of energy, mines, and resources in the 1980s, he played a role in developing and implementing a new federal energy policy in 1984. The new program dismantled the former National Energy Program, which was widely condemned by the industry as a federal tax and land grab.

CAPP Pres.

Pierre Alvarez

There is a growing desire from the public for more and better information on the Canadian upstream industry, its operations, and its economic impact. That includes beating the industry drum on major environmental initiatives and getting across the fact that the petroleum sector is a major economic contributor in many areas of Canada. Pierre Alvarez

There is more and more interconnection between the Canadian producer side and the U.S. marketplace. We will have increasing involvement with the U.Sellipse.The Canadian industry clearly sees there's a very significant market available in the U.S., and I think you will see them continue to pursue opportunities very aggressively. Producers have been looking for market-based solutions and opportunities, and I think they will continue to do that.

Fiscal issues for the industry used to revolve around royalty rates. Now you see a much broader number of fiscal considerations, from occupational health and safety costs to road taxes and cost recovery from regulatory agencies. There's now a whole series of additional fees and taxes that are being levied on the industry. You have to look at those in the context of the total government take, not just the historical focus on royalties.