Saudi Arabia's petrochemical industry diversifies to face challenges

Increased competition has created some long-term challenges for Saudi Arabia's petrochemicals industry.

In the face of increased production costs, shifting world trade patterns, and a fall in petrochemical prices, the petrochemical industry of Saudi Arabia has adopted a strategic plan to maintain and increase its competitiveness.

This plan includes increasing its production capacity, diversifying its product mix, increasing its involvement in joint ventures, heightening emphasis on research and development (R&D), allowing a larger role for the private sector, and diversifying its petrochemical products further downstream.

The future of Saudi Arabia's petrochemicals industry is bright as long as it maintains the advantages derived from advanced technology, abundant hydrocarbon reserves, and relatively low production costs.

Saudi Arabia's petrochemicals industry is a significant global producer of commodity petrochemicals. As new ethane crackers and ethylene-derivative capacities come on stream by 2002, its global share of ethylene and polyethylene capacity will reach 7-8% and that for ethylene glycol will be close to 20%.

Early petrochemical production

In 1976, Saudi Basic Industries Corp. (Sabic), a majority-owned government enterprise which manufactures basic and intermediate petrochemicals, was established to reduce Saudi Arabia's reliance on oil revenues. Over the past 2 decades, Sabic has become one of the world's fastest growing petrochemical companies. Its contributions to Saudi Arabia's economy include:

- A sizable petrochemical output, which adds significantly to GDP. In 1998, for example, it transformed about 9.0 billion cu m of low-value natural gas into petrochemical products valued at around $5.0 billion.1

- Opening of large export markets. In 1997, about 40% of Saudi Arabia's total non-crude oil exports consisted of petrochemical products.2

- Provision of job opportunities to Saudis. Sabic currently employs about 16,000 persons, 71% of whom are Saudi nationals.1

The pace of petrochemical production in Saudi Arabia picked up rapidly after production of methanol by Sabic's affiliate Ar-razi in 1983.

Since then, Sabic has become not only the dominant regional petrochemical producer but one of the top 25 diversified chemical companies in the world. The company produces about 16.0 million tons of basic and intermediate petrochemicals in its 12 complexes located in the industrial cities of Al-Jubail and Yanbu.1

The country's strategic planning has resulted in a modern infrastructure, competitively priced feedstock, and financial incentives. Surprisingly, this development has not been in response to a surge in local demand or to a development of indigenous technologies, as has been the case in the industrialized countries. Instead, it can largely be attributed to:2

- * The very low boiling point of associated natural gas, which renders its transportation uneconomical. As a result, it can be flared, used as a fuel, or reinjected into the oil fields. These uses generate a low or negative economic value for the natural gas.

- * Volatile oil-export earnings, caused by the large oil-price fluctuations in the international markets. This price instability prompted the Saudi government to take steps towards adding value to its vast natural hydrocarbon reserves (crude oil and natural gas).

- * The accumulation of financial capital following the upward adjustments in crude oil prices in the 1970s.

Currently, Saudi Arabia's annual petrochemical production accounts for about 5% of the world petrochemical output.3 This is a remarkable achievement, considering the short time span since production began in the 1980s. This ratio is still modest, however, in view of the country's current proven oil and gas reserves, which represent 25% of the world's proven oil reserves and 4% of the world's proven gas reserves.4

Future challenges

In the future, environmental regulations and new technologies will present challenges to Saudi Arabia's petrochemical industry. Other short to medium-term challenges to the industry include sustainability of the competitive advantage, the Asian challenge, technological innovations, and the open-market challenge.

Sustainability of competitive advantage

The petrochemical industry's major challenge is to maintain its low-cost feedstock competitive advantage in the future.

Feedstock is the single largest component of total production costs, accounting for as much as 50% of these costs.5 It is the key contributor to Saudi Arabia's cost competitiveness.1 The country's hydrocarbon abundance translates into low prices for natural gas and ethane, the petrochemical industry's most versatile feedstocks.

The competitive edge based on feedstock cost is weakening, however, and there is growing evidence that low natural-gas prices may not prevail in the long term. Last year, gas prices increased by 50% to $0.75/million BTU. For Sabic, this increase translated into a production cost increase of about $84 million in 1998.6

In addition, electricity prices are expected to increase by about 20% from their current level, which will lead to significant increases in production costs.

In the short term, increased charges will hardly make a dent in Sabic's competitiveness. In the long term, however, the impact on feedstock pricing may be severe as new ethane sources become scarcer. As a safeguard against this scarcity, the latest cracker projects will have the flexibility to use propane and light condensates as well as ethane feedstock.7

The scarcity is tied to the production of associated gas in Saudi Arabia, which depends on crude-oil output. Crude-oil output, in turn, is constrained by OPEC quotas. In line with its quota, Saudi Arabia cut production back at yearend 1998 to 8 million b/d, 800,000 b/d less than a year ago.

Gas demand is growing at 7%/year.8 To accommodate this growth, Saudi Aramco is pressing ahead with a $4 billion program, initiated in 1997, to increase the capacity of its master-gas system to serve rising demand from the petrochemical industry. Additionally, there is a scheme to maximize the recovery of ethane and heavier NGL from the gas stream.

Given the current pressures on Saudi Aramco's finances, gas production could be significantly increased if Saudi Arabia readmits international oil companies to help Saudi Aramco meet projected gas demand and to develop new discoveries of non-associated gas fields. It is believed that the latter alternative source is not as economical as the ethane derived from associated gas.7

Asian challenge

A strong export orientation renders the Saudi petrochemical industry vulnerable to changes in international market conditions. Recently, the ongoing Asian economic crisis has hurt the profitability of the industry.

A considerable share of Saudi Arabia's major commodity petrochemicals was exported overseas in 1997. Fig. 1 shows that 75% of methanol output and 93% of MTBE and ethylene glycol output were exported in 1997.5

This strong export orientation renders Saudi Arabia's petrochemical industry vulnerable to international market conditions.

Asia is the largest importer of Saudi petrochemicals. In 1996, Asia purchased more than 50% of Saudi Arabia's petrochemical exports. In the aftermath of the Asian crisis, two potential changes could occur: a shift in world trading patterns and a fall in petrochemical prices.

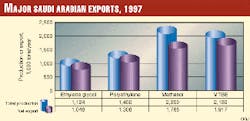

Shift in world trading patterns. Post-Asian crisis projections indicate that at least three Asian countries (Malaysia, the Philippines, and Thailand) will become large net exporters of petrochemicals after 2000.9 10Current projections suggest that Asia will remain a net importer because some markets within Asia, such as China and India, have remained largely untouched by the crisis. China and India have large and rapidly growing populations, high economic growth potential, and a large demand for petrochemicals. In 2005, China will import about 8.5 million metric tons/year (mty) of commodity polyolefins (Table 1).9

Like Asia, Europe, which accounted for about 10% of the Saudi petrochemical sales in 1996, could become a more significant petrochemical market in the future. Currently, Europe is a net exporter of ethylene derivatives, but by 2005, the region will import 750,000 mty.11

Fall in prices. Given that Asian demand for petrochemicals accounted for 20% of global demand, the Asian crisis and the ensuing decline in economic growth have weakened the demand for petrochemicals. Across most of the Asian markets, the domestic petrochemical demand fell sharply during 1998. The drop in demand compared to the 1997 demand will range from 5% in Taiwan to more than 50% in Indonesia.12Overall, petrochemical prices in 1998 were 20-35% less than 1997 prices.13

This damaged the profitability of the Saudi petrochemicals producers. Sabic's profits fell by 56% in 1998.1 Worse still, the Saudi petrochemical producers were both hit not only by a drop in Asian demand but also by increased competition from Asian producers who started exporting overseas to boost foreign currency earnings.

As more Asian capacity comes on stream and as supplies become more readily available in the future, Asian importers will have the opportunity to buy at lower prices. As a result, only the lowest-cost producers will be able to sell commodity grades in Asia.

Saudi Arabia's low production costs and low delivery costs mean that the Saudi exporters are well equipped to meet this demand and sustain the pressures arising from weak prices.

Technological innovations

The petrochemical industry is technology-intensive. Refinements of existing technologies continue to be introduced, leading to lower unit production costs, higher-quality product grades, or new desirable product properties. The technological challenges facing the Saudi petrochemical industry can be assessed by three factors:

- * The need for continuous process improvement. The alternative is a distinct possibility of technological obsolescence.

- * The need to expand the product portfolio. Technology providers turned down several Saudi attempts to license leading technologies to manufacture products such as acetic acid, vinyl acetate, acrylonitrile, and linear alpha-olefins.

- * The need to closely monitor the impact of new technological innovations. A major innovation, currently being commercialized, is the development of metallocene catalysts that improve the properties of the polyolefins (polyethylene, polypropylene, and polystyrene). Being a global producer of these commodity petrochemicals, the Saudi petrochemical industry could be affected by this development.

Alternatively, improvements in gas-conversion technologies, such as the methanol-to-olefins (MTO) technology, could be advantageous to the Saudi petrochemical producers. By converting methane, the principal component of natural gas, into ethylene, the MTO technology will help in overcoming the limitations on ethylene availability. New technologies using ethane or LPG feedstock, such as conversion of ethane to vinyl chloride monomer (VCM), could lead to a future new wave of petrochemical investment in Saudi Arabia.

Open-market challenge

Saudi Arabia's desire to join the World Trade Organization (WTO) is primarily driven by the health of the Saudi petrochemical industry. Although the full impact of the WTO on world trade will not be completed until about 2005, Saudi Arabia believes that its membership will enhance the competitive advantage of the Saudi petrochemical industry and strengthen its international market position.

In fact, the benefits of joining the WTO are not as much of an issue as the potential challenges facing Saudi Arabia's petrochemical producers, which include removal of trade barriers and disputing U.S. and European claims that Saudi Arabian's natural gas feedstock is subsidized.

Trade-barrier removal, as stipulated by the WTO agreement, will allow Saudi petrochemical producers to have lower landed price access to protected markets, such as the European and the Japanese markets. In return, Saudi Arabia will lower its own tariffs and open its market to imported petrochemical products. This may have a pricing ramification in the domestic market and may narrow the profit margins on local sales.

The tariff reductions in the tariff-protected economies will induce a large increase in Saudi petrochemical exports. The extent to which the tariff reductions will increase the Saudi exports depends on how supply and demand in those economies respond to lower prices resulting from tariff reduction.

In this environment, the high cost producers will find it difficult to meet the lower market prices resulting from the tariff reductions. They may reduce their production level and possibly sell at a lower profit margin or at a loss.

Industrial output is likely to decline less than prices in the short term. In the long term, an industry restructuring is most likely to take place. Restructuring would reduce the numbers but increase the productivity of the producers. Marginal producers are pushed out and the remaining ones achieve lower production costs, which match the lower market prices.14

A second concern that has been repeatedly raised in connection with Saudi Arabia's membership in the WTO is the competitive advantage of the petrochemical industry derived from low-cost feedstocks. These include natural gas, which is sold to local plants at $0.75/million BTU, and LPG, which is sold at prices about 30% less than the lowest export price received by Saudi Aramco during the preceding quarter.

European and U.S. petrochemical producers claim that these incentives are subsidies. An analysis of these incentives, in light of the WTO agreement on subsidies, however, suggests that the objections against them are largely inappropriate.15

This is because natural-gas prices represent the cost of production in Saudi Arabia, and the LPG discounts reflect the cost savings of not having to store the products and conduct international marketing efforts.

While these arguments are convincing, the issue is likely to receive continued scrutiny in the EU and the U.S. even after Saudi Arabia gains membership to the WTO. This issue may be among others that will catalyze future reconsideration of the current pricing formula, which is a major concern for petrochemical producers and potential investors alike.

The markets opening may possibly bring strong competition among petrochemical producers, both globally and locally. Those with a strong cost competitive advantage are more likely to survive the competition.

Saudi producers must strive hard not only to preserve their market shares in domestic and international markets but also to gain entrance into new export markets. To achieve this end, they need to focus attention on reducing their production costs and ensuring that their product qualities match that of the prevailing world standard.

Strategies

In the short to medium term, the Saudi petrochemical industry is taking several steps to prepare for future challenges and ensure its long-term health.

These steps include increasing capacity, diversifying its feedstock, forming more joint ventures, placing a greater emphasis on R&D, allowing a larger role for the private sector, and producing more downstream petrochemicals.

Increased capacity

Saudi Arabia plans to add 10.7 million tons of basic, intermediate, and final petrochemical production capacity between 1998 and 2003.5 By 2003, the country's annual production capacity will reach about 27.1 million tons, up from its current capacity of 16.4 million tons. This represents a cumulative annual growth rate (CAGR) of 13%, which is remarkable by international standards.

The driver for ethylene capacity growth is local demand and not feedstock push. This captive demand for ethylene is an indicator of future growth for the Saudi petrochemical industry.

By 2003, the Saudi ethylene production capacity will grow from its current level of 3.18 million tons/year to about 5.5 million tons/year. Since the entire Saudi ethylene output is consumed captively, capacity additions will tend to be in line with expected captive demand growth. Fig. 2 summarizes the capacity additions for ethylene and its derivatives to 2003.

More diverse feedstock

The feedstock used by the Saudi industry to produce the basic petrochemicals are predominantly methane, ethane, and NGL, all derived from natural gas. Given this gas-based feature, it is not surprising that the most developed product chains in the Saudi petrochemical industry are those derived from methane and ethane.

This nondiverse feedstock results in an unbalanced product mix, as reflected in the under-development of product chains based on propylene, butylenes, and benzene, toluene, and xylenes (BTX). This imbalance can be adjusted by the steam cracking of liquid feedstock (LPG, condensates, and naphtha), which will produce a broader product mix.

Sabic is diversifying its feed, and thus its product mix, in two plants. In 1994, Petrokemya, a Sabic affiliate, commissioned a flexible feed cracker.2 In March 1999, Yanpet, another Sabic affiliate, started up Saudi Arabia's first world-scale aromatics complex. It uses LPG as feedstock in the Cyclar process.

These developments suggest that the Saudi petrochemical industry will further diversify its product range in the years to come.

Between now and 2003, a more balanced product mix at the basic petrochemicals level is expected. Plans involve significant capacity expansions for propylene and BTX. Production capacities of propylene and BTX will grow at annual rates of 53% and 32%, respectively, which are the highest among the annual growth rates of the rest of the basic petrochemicals listed in Table 2.

More joint ventures

Since its early beginnings, the Saudi petrochemical industry sought business partners who could provide what it then lacked: technology and marketplace. This led to partnerships with international petrochemical companies. About 70% of Saudi Arabia's initial petrochemical projects were established as joint-venture (JV) projects.5

Today, European and U.S. petrochemical companies have combined investments of $6.17 billion in JV projects planned for 1998-2002.5 These commitments represent confidence in the future of Saudi Arabia's petrochemical industry from the international community.

Table 3 lists the planned JV projects by European and U.S. companies over the next 5 years.

For some time to come, JVs will continue to be a viable strategy for the Saudi petrochemical companies. A compatible foreign partner complements the country's strengths, offsets its weaknesses, and provides access to new geographic markets.

The rate of new JV establishments in Saudi Arabia will accelerate after the approval of a more friendly foreign investment law; that is, one with lower taxes on JVs. The new law, expected to be approved this year, will replace the existing 30-year old direct foreign investment law, which taxes foreign corporate profits as high as 45% after a 10-year grace period.

Greater emphasis on R&D

Research and development are widely recognized as a source of competitiveness and a key to sustaining future growth. Sabic's commitment to R&D led to the establishment of its $67 million state-of-the-art R&D center in Riyadh, Saudi Arabia, in 1991, designed to increase its technological capabilities.

To expedite its technology acquisition process, Sabic has leveraged external R&D centers to supplement the research activities of the Riyadh center. Sabic established its first satellite research center in Houston and is considering additional centers in India and Europe. These centers will also enable Sabic to improve local technical support services to its customers.16

Sabic's growth so far has been largely based on imported technology. Sabic has also developed and commercialized its own technologies, however. The Alphabutol technology, which was first licensed to Sabic by IFP in 1987, after extensive process modifications, is now known as "IFP-Sabic" technology for butene-1 production.17 Sabic and IFP jointly own the modified technology.

Overall, Saudi R&D efforts are modest by international standards. The average R&D investment per dollar of sales by the Saudi petrochemical industrial sector is less than 0.5%, compared to the 4-5% average posted by the international petrochemical producers.5

Although this rate needs to be increased in the future, the key issue for the Saudi petrochemical industry is not just increasing its R&D investment but upgrading its R&D performance.

Larger role for private sector

In response to the steady decline in oil revenues, Saudi Arabia is promoting greater private sector participation in the economy. In the Saudi petrochemicals industry, private investment has occurred in several large petrochemicals projects.

Saudi Chevron Petrochemical LLP is a 50-50 JV company owned by Chevron Chemical Co. and Saudi Industrial Venture Capital Group, a private firm. The JV is building a grassroots $650 million petrochemical complex in Al-Jubail. The plant will produce 480,000 tons/year of benzene and 220,000 tons/year of cyclohexane and is scheduled to be complete in 1999.

Chevron's proprietary Aromax process technology will be used to manufacture benzene from a natural-gasoline feedstock supplied by Saudi Aramco. Institut Fran?ais du P?trole licensed the technology to manufacture cyclohexane from the benzene.

National Industrialization Co. (NIC) is a private firm that is building a plant to manufacture 400,000 mty of propylene and polypropylene using the propane dehydrogenation route.

Table 4 presents the planned private sector petrochemicals projects in Saudi Arabia. Major petrochemical projects in Saudi Arabia for the 1998-2002 period total $10 billion; a significant part of this amount is expected to come from the private sector.5

Downstream expansion

Current investments in the Saudi petrochemical sector are heavily concentrated in upstream segments of the petrochemical industry. Saudi petrochemicals benefit from a low-cost and abundant feedstock, which provides them with a substantial cost advantage at the basic and intermediate petrochemicals levels.2

A move further downstream in the petrochemical chain dilutes the feedstock cost advantage, as the share of feedstock cost in the total production cost decreases.5 Production costs include overhead, labor, capital, and additional technical support.

Conversely, however, a downstream move along the production chain maximizes the added value. As such, Sabic's current expansion phase includes the production of polymers and polyolefins. The production capacities for polyvinyl chloride, polystyrene, polyester, and melamine is set to increase by 4 million tons/year until 2001.18

Further polymer capacity additions are directed in part to meet the demand increases in local and regional markets. The development of the Saudi plastic industries in the last decade supports these plans. There are about 300 plastic-processing factories in Saudi Arabia today, which account for a combined annual production capacity of about 1.2 million tons. Investment in Saudi Arabia's fabricated plastic industries grew rapidly from $489 million in 1988 to more than $1.9 billion in 1998.5

The future development of the downstream petrochemical industry in Saudi Arabia will heavily depend on raw material prices and access to leading technologies. It is therefore important to encourage the formation of partnerships between the basic petrochemical producers and their downstream counterparts. The partnerships could be cemented by agreements entailing fixed-price feedstocks and/or share holdings.

References

- Saudi Basic Industries Corp. (Sabic), Annual Report, 1998.

- Al-Sa'doun, A.W., Al-Tawon Al-Sinae in the Arabian Gulf; No. 68, April 1997, pp. 3-22.

- Al-Sa'doun, A.W., Oil and Arab Cooperation, Vol. 23, No. 81, 1997, pp. 23-43.

- BP Statistical Review of World Energy, June 1998.

- Al-Sa'doun, A.W., Al-Tawon Al-Sinae in the Arabian Gulf, No. 75, January 1999, pp. 3-23.

- MEED Petrochemical Special Report, MEED, Vol. 43, No.16, Apr. 23, 1999, p. 23.

- Farry, Michael, "Ethane from associated gas still the most economical," OGJ, June 8, 1998, p. 115.

- MEED Oil & Gas Special Report, MEED, Vol. 43, No. 3, Jan. 22, 1999, pp 7-14.

- Warnke, J., "The Asian Challenge: Will China and India Fulfill their Potential?" Chem Systems Annual Planning Seminar, Dubai, May 1998.

- "Asia's petrochemical sector still reeling from economic collapse," Oil & Gas Journal, Oct. 12, 1998, p.24.

- MEED, Vol. 41, No. 40, Oct. 3, 1997, p. 2.

- Coles, R., Hydrocarbon Asia, March 1999, p. 24.

- Gulf Industry & Saudi Arabia Review, November/December 1998, p. 41.

- Zind, R., Al-Tawon Al-Sinae in the Arabian Gulf, No. 61, July 1995, pp. 3-18.

- Miles, S., MEED Special Report: Saudi Arabia, MEED, Vol. 43, No.12, Mar. 26, 1999, pp.17-19.

- Al-Mady, M.H., The FT Conference "The Petrochemical Industry-What Next: Old World/New World," London, Nov. 21-22, 1996.

- Al-Sa'doun, A.W., Applied Catalysis-A; Vol. 105, 1993, pp. 1-40.

- MEED Petrochemicals Special Report, MEED, Vol. 43, No. 22, June 4, 1999, pp. 2-4.

The Author

Abdul Wahab Al-Sa'doun is director of the industrial information and coordination department at the Qatar-based Gulf Organization for Industrial Consulting (GOIC).

He started his professional career as a research chemist in the research department of Sabic R&D Center, Riyadh, Saudi Arabia, where he worked from 1990 to 1995. He joined GOIC in January 1996 where he worked as a petrochemical expert in the projects department until 1997, when he was appointed to his current position.

Al-Sa'doun holds a PhD in industrial chemistry from King's College, University of London.