US offshore LNG terminals face technical, political maze

Experience to date with US offshore LNG projects teaches critical lessons and offers many clues for where the offshore LNG market is heading. And nowhere is that experience more vivid than in the files of the LNG Deepwater Ports Program at the Maritime Administration of the US Department of Transportation.

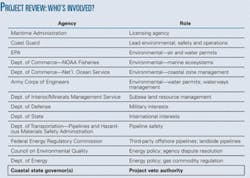

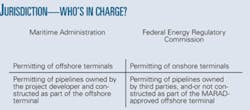

As the federal agency responsible for permitting offshore facilities, MARAD’s looking glass offers one of the best predictors for how current and future proposals will shake out. The rest will be up to the marketplace (Fig. 1).

Over the past 4 years, commercial, environmental, and political factors have fundamentally shaped how projects are designed, as well as where terminals should be located to have the best opportunities for success.

What emerges is a shift from large, permanent or fixed designs that aim to emulate onshore facilities to smaller, more flexible and environmentally friendly designs that target markets where onshore facilities would be difficult, if not impossible to build.

A tale of two coasts sheds light on the current and future state of offshore LNG terminal siting in the US.

When Gov. Arnold Schwarzenegger in May 2007 denied BHP Billiton’s application to construct a massive floating LNG terminal off California, he brought to an end more than 3 years of comprehensive federal and state review and extensive efforts by BHP to pursue the project.

The terminal, proposed for siting off Malibu, was heavily lobbied for by the Australian government on behalf of BHP and fiercely opposed by environmental interest groups, as well as several notable (and vocal) celebrities, worried about increased air and water pollution, the dangers of LNG fires, and a host of other issues.

Several months back, on the US East Coast, two offshore LNG projects met with a different fate. On Dec. 26, 2006, then-Gov. Mitt Romney approved applications from Northeast Gateway Energy Bridge, an affiliate of Excelerate Energy, and Neptune LNG LLC, an affiliate of Suez Energy North America, to construct two terminals off the coast of Boston. Concerns about the close proximity of the terminals to a sensitive marine sanctuary were overcome by small design footprints and extensive environmental mitigation measures, which enabled the projects to gain state and federal approval.

Offshore realities

All things being equal, onshore terminals have advantages over current offshore designs. Onshore terminals have robust gas storage capabilities, use proven technologies, and have seamless compatibility with conventional LNG carriers. Many current offshore proposals, in contrast, offer no storage, rely on new technologies, and in some cases require use of specialized LNG vessels.

But offshore terminals, despite their current limitations, offer one crucial advantage over their onshore counterparts: They offer siting options in markets where onshore terminals may face insurmountable hurdles. This enables offshore terminals to target markets where new onshore facilities will not likely appear, including densely populated urban areas where safety concerns are high and real estate is limited.

This emerging trend, even reality, for offshore terminals to target niche markets is a departure from many of the original LNG projects that were planned for the US.

Big footprints

In 2002, following amendment of the Deepwater Port Act to include natural gas terminals, the first wave of project proposals were for facilities in the Gulf Coast that were designed primarily around the use of large gravity-based structures“Texas Towers,” in oil and gas parlance. The projects were designed to compete effectively with onshore facilities, with features including gas storage and the ability to accept shipments from conventional LNG carriers.

None of the proposed Texas Towers, it now appears, will likely be constructed in the gulf (Fig. 1). Their designs are capital intensive, with construction cost estimates that escalated significantly over time. In the case of Chevron’s Port Pelican project, approved in 2004 by MARAD for siting 40 miles off Louisiana, cost estimates rose to well more than $1 billion from $700 million. Despite having the necessary approvals to proceed, Chevron suspended work and wrote off tens of millions in project costs.

Shell’s permitted Gulf Landing project shared a similar fate, as the company announced in March 2007 its intent to suspend the project indefinitely. Two other similar projectsExxon’s Pearl Crossing and ConocoPhillips’s Beacon Portwere cancelled by the companies during the permitting process.

The sole gulf gravity-based-structure survivor is a project sponsored by Freeport-McMoRan, Main Pass Energy Hub, which MARAD approved in January 2007. The project would involve the conversion of an existing sulfur-mining platform to a deepwater port. While the developer is actively pursuing the project, its future is unknown as, to date, no supplier has committed for capacity at Main Pass.

Other fixed terminals, known as floating storage and regasification units (FSRUs), have been proposed in the Gulf Coast (ConocoPhillip’s Compass Port, for example) and along the coasts of California (the BHP project already noted), New York (the Broadwater project in Long Island Sound), and Florida (Suez’s Calypso LNG). FSRUs are large, permanently moored floating facilities, which also have relatively high capital costs.

The high cost of the gravity-based structures and other fixed designs is and likely will remain a significant factor threatening the commercial viability of such offshore projectsin the gulf and in any other region where competitive onshore capacity exists. The gulf region features robust onshore capacity in the Trunkline LNG terminal in Lake Charles, La., as well as several other terminals under construction totaling about 15 bcfd of capacity by 2010.

East Coast exception?

Beyond the gulf, the jury is still out on the remaining fixed-structure projects.

On the East Coast, three projects that would use such designs are currently under review by regulators. Two of the projects are in the New York area, Broadwater Energy and Atlantic Sea Island Group’s Safe Harbor Energy project.

Broadwater proposes to use an FSRU that would be permanently moored in Long Island Sound. Because the facility will be in state rather than federal waters, the Federal Energy Regulatory Commission has jurisdiction. The Safe Harbor Energy project, to be located south of Long Island, proposes to construct an about 60-acre artificial island to serve as an LNG terminal. The final terminal, Calypso LNG proposed by Suez, would lie off Fort Lauderdale, Fla., and would use an FSRU as part of its design.

What the future portends for these projects depends on how open state and local officials, as well as local citizens, will be to allowing large energy infrastructure projects off of their coasts. That may turn in large part on perceived environmental issues (discussed below). If the projects ultimately are approved, any higher costs associated with their designs could well be absorbed by providing natural gas supplies to the lucrative New York and Florida markets.

Small footprints

While the larger, more capital-intensive offshore designs have not materialized in the gulf and elsewhere, a totally different breed of offshore facility, with a novel design configuration, has been constructed in the gulf and shows promise for other markets. The first of this breedExcelerate Energy’s Gulf Gateway Energy Bridge terminal 116 miles off Louisianahas been in operation since March 2005.

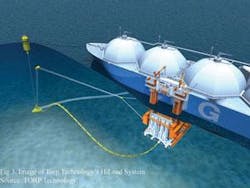

The design utilizes custom-built LNG vessels with onboard regasification equipment. The vessel connects to underwater pipelines through a buoy system that attaches to the underside of each ship (Fig. 2). This proven model has become the preferred design of many offshore project developers.

The design’s imperceptible environmental footprint offers its premier advantage. When the buoy is not in use, it drops below the ocean surface, leaving what looks like a beach ball in place to tether the buoy. This key feature makes the design more palatable with the “Not in My Backyard” crowd, as the terminal is not a permanent fixture on the horizon.

The buoy terminal also has lower capital costs, depending in large part on the length of the pipelines needed to connect the terminal to the trunk pipeline, either onshore or offshore.

On the other hand, these facilities require the use of custom-built regasification ships that are significantly more costly than their conventional counterparts. But while the vessels’ cost must be factored into the overall cost of the project, the ships can be redeployed in regular LNG trade if market prices at the buoy terminal market are less favorable than in alternate destinations.

Excelerate has relied on this flexibility, bringing only a handful of shipments into its Gulf Gateway facility since its christening but using its vessels in other international trade.

Another design that shares many of the same benefits as the vessel regasification-buoy system is the HiLoad system, currently under development by TORP Technology. The HiLoad unit is a floating L-shaped terminal that docks with conventional LNG carriers. Like the buoy systems, terminals utilizing the HiLoad system have a relatively small footprint and can be sited far from shore (Fig. 3).

The smaller environmental footprint designs provide much greater flexibility in siting locations. Because the length of the pipeline is the main determining factor as to how far the terminals can be placed from shore, terminals can be sited very remotely, as is the case with Gulf Gateway.

Offshore terminals located away from densely populated areas and congested waterways can avoid many of the public safety and security concerns that increasingly have been raised by local governments, federal regulators, and members of the US Congress in recent months.

Limitations of ‘smaller’

From a commercial perspective, remote siting means market access, as terminals can be placed far off the shores of high-value, high-demand markets, where siting new onshore facilities would be difficult, to say the least.

Smaller footprint terminal designs, however, have significant potential downsides. Many of the designs lack storage capabilities, preventing them from offering a steady baseload supply of gas. To achieve a baseload, two or three vessel shipments would be needed in close succession, which increases capital costs when custom-built vessels are required.

Another potential limitation is gas interchangeability of imported LNG. US domestic natural gas supply has generally been leaner than in European and Asian markets. As a result, LNG produced upstream may have to be treated or conditioned upon importation in order to be interchangeable with domestic natural gas to meet the specifications of FERC-approved tariffs for interstate pipelines.

Without storage or some means of onboard or in-tank mixing or blending, the offloaded gas must be pipeline quality, which potentially limits the available upstream gas supply sources. This limitation is particularly relevant in locations like the Mid-Atlantic and Northeast where there is little if any infrastructure to process incompatible upstream gas.

While smaller footprint terminals have great potential to reach new markets, the ability of developers to overcome commercial limitations may be the key as to whether these terminals will take hold and become part of a viable gas market in the US.

Regulatory tightrope

Finding the right market to locate an offshore terminal is only the beginning; significant barriers stand in the way of gaining regulatory approval to make the project a reality. For offshore terminals, the “800-lb gorilla,” for better or for worse, comes in the form of the state governor’s veto authority.

Under the federal Deepwater Port Act, the governor of each adjacent coastal state, which are usually states directly connected by pipeline or states within 15 miles of the terminal, has almost unfettered authority to veto projects and broad authority to impose conditions for approval. This places the governor (or governors) “in the catbird’s seat,” as Keith Lesnick, director of the Deepwater Ports Program at MARAD is apt to say.

Over the years, this veto authority has been used aggressively by governors to force project developers to make their projects as green as possibleor to deny projects for not being green enough. This power, coupled with the range of required federal approvals from the US Environmental Protection Agency, Army Corps of Engineers, and others, creates a strong current against which developers must swim to gain project approval.

By far, the main regulatory hurdles to project approval have been environmental issues. Project developers with any hope of success must design projects with environmentally benign technologies that can pass muster with both state and federal officials. This regulatory tightrope is best illustrated by the heated and ongoing debate regarding offshore regasification systems.

The regasification controversy originated in the Gulf Coast, where several developers planned to use “open-loop” (also known as “open-rack”) regasification systems (Fig. 4). Open-loop systems use seawater as the heat source for regasification and can potentially harm marine life by trapping organisms in water intake screens and through thermal shock from discharged water that is colder than surrounding water. The main concern in the gulf is the perceived threat to fish populations, namely the Gulf Coast red drum.

The proposed use of open-loop systems created a firestorm. In an unlikely but massive undertaking, environmental activists, sports fisherman, local politicians, media groups, and other citizens formed a coalition known as the “Gumbo Alliance” that united in opposition to the technology.

The environmentalists sought to protect and rebuild fish populations in the gulf, which they believed would be threatened by the open-loop systems. The sport fishermen sought to protect fish, particularly the red drum, because they are a prized and favorite catch of Gulf Coast anglers.

While there were several projects embroiled in the open-loop controversy, the main battleground involved Freeport-McMoRan’s proposed Main Pass Energy Hub terminal.

Despite significant outreach efforts by Freeport-McMoRan and nods from MARAD, the Coast Guard, and EPA regarding open-loop technology, Gov. Kathleen Blanco (D-La.), under considerable public pressure, vetoed the Main Pass project on May 5, 2006, stating that she would “oppose the licensing of offshore LNG terminals that will use the open-rack vaporizer system.”

Within the same month, Freeport-McMoRan, aggressively seeking project approval, amended its application to use a closed-loop regasification system. Closed-loop systems burn a portion of gas cargo to provide the heat source for regasification. The technology has minimal impact on marine life but increases air emissions from gas combustion. This move by Freeport ultimately paid off, as Gov. Blanco approved the redesigned facility on Nov. 20, 2006.

Blanco’s veto had a cascading effect. Seeing the line drawn in the sand, ConocoPhillps withdrew its two pending Gulf Coast open-loop applications in the face of certain veto by Gov. Blanco and a likely veto by Gov. Bob Riley (R-Ala.).

The open-loop controversy is now in its last embers, as only one remaining facilityTorp Technology’s Bienville Offshore Energy Terminalproposes to use open-loop technology.

While the two recently approved Boston area terminals will use closed-loop systems, the State of California has not embraced the technology due to air emissions issues. As a result, several California projects have proposed new technologies that focus on minimizing air emissions.

Clearwater Port and Woodside Natural Gas plan to use ambient air systems, which use forced air as the heat source for regasification. Also, Esperanza Energy is currently developing a waste-heat-recovery system that would utilize water discharges piped from a nearby power plant to provide heat for regasification.

The regasification battles demonstrate, first, the power of the governor’s veto to force projects to use more environmentally benign technologies. Secondly, and more importantly, they show that through innovation and flexibility on the part of developers, offshore terminals can be designed and configured to overcome environmental and other hurdles to gain regulatory approval.

Future

To increase the potential of offshore projects, developers must continue to push the envelope to refine project designs to overcome the commercial limitations and environmental concerns that are associated with many offshore proposals. Recent progress has been made, for instance, in pioneering ship-to-ship transfer technology that will enable regasification vessels to connect with conventional LNG carriers to offload cargo, expanding the universe of vessels that can call at such terminals.

While many of the current offshore project proposals, which utilize small environmental footprints and increasingly green technologies, have the potential to gain approval from local communities, regulators, and politicians, obstacles remain. If they can be overcome, this next wave of offshore terminals may open the door for LNG to serve commercially lucrative markets in the US.

The author

Daron T. Threet (daron.threet @sablaw.com) is counsel, Sutherland Asbill & Brennan LLP, Washington, a member of the firm’s LNG Group., and former counsel, LNG Deepwater Ports Program, Maritime Administration, US Department of Transportation. He holds a BA (1996, cum laude) from the University of Colorado at Boulder, a JD (2000) from Notre Dame Law School, and an LLM (2003) from American University.