Canadian drilling pace slows

Fewer wells are being drilled in Canada this year, equivalent to activity 5-6 years ago. Canadian operators face escalating field costs, softening natural gas prices, gas transportation cost differentials to the US, and weakening of the US dollar.

The Canadian drilling industry suffered from a protracted spring breakup, exacerbated by newly built rigs swelling the available drilling fleet. This led to lower rig fleet utilization and movement of some rigs across the border to drill in the US Rocky Mountains. Frac equipment spreads were even relocated as far as Arkansas (OGJ, Sept. 17, 2007, p. 59).

Forecasts

On July 26, the Petroleum Services Association of Canada in an updated Canadian drilling forecast predicted a continued slowdown of drilling activity. PSAC expects 17,650 wells to be drilling across Canada in 2007, down 24% from the 23,306 wells drilled in 2006.

Among the provinces, PSAC forecasts:

- 12,815 wells in Alberta, down 27% from 2006.

- 795 wells in British Columbia, down 42% from 2006.

- 3,520 wells in Saskatchewan, down 7% from 2006.

- 440 wells in Manitoba, down 17% from 2006.

- 55 wells in Ontario, down 39% from 2006.

- 15 wells in eastern Canada (Quebec, New Brunswick, Nova Scotia, Prince Edward Island, and Newfoundland-Labrador), down 46% from 2006.

Another 10 wells will be drilled in northern Canada this year (Yukon, Northwest Territories, Nunavut), down 30% from 2006.

PSAC based its July forecast on crude oil at $65/bbl (WTI) and natural gas at $7.75 (Can.)/Mcf (AECO).

Drilling contractors

According to Precision Drilling Trust’s second-quarter report, the company “experienced some of its lowest activity and equipment utilization levels in a decade.” In addition to being seasonally soft, record rainfall and low gas prices in the second quarter led to a downturn in drilling activity after spring breakup. Precision’s contract drilling in the Western Canada Sedimentary basin was 54% lower than during second-quarter 2006.

Coinciding with a record level of drilling rig capacity (too many newbuilds?), Precision said this led to “competitive spot market pricing.” The company had 13 rigs under construction at the end of the second quarter, 7 destined for Canada and 6 for the US (all supersingles). The company’s North American fleet will reach 259 drilling rigs by second-quarter 2008.

Precision is building a new employee training center in Nisku, Alta., that will include a decommissioned drilling rig.

Akita Drilling Ltd. operates 42 drilling rigs, 39 in Canada and 3 in Alaska, as well as 3 well-service rigs in Canada. In the first 6 months of 2007, the company drilled 487 wells in Canada and 3 in Alaska. Akita added two heavy oil pad-drilling rigs to its fleet in second quarter, and one began operating immediately under a multiyear term contract. Management says the drop in demand has adversely affected shallow, deep, and northern rig types, but there has been minimal effect on medium-depth rigs and heavy oil pad rigs.

Ensign Energy Services Inc. is Canada’s second largest land-based drilling contractor and third largest well-servicing contractor. The fleet is operated by Ensign Drilling Partnership, consisting of five businesses: Big Sky Drilling Ltd. (Saskatchewan and Manitoba), Champion Drilling (largest driller in southern Alberta), Encore Coring & Drilling Inc. (Alberta), Ensign Drilling (Alberta and British Columbia), and Tri-City Drilling (northern and central Alberta).

Ensign continues to expand its US fleet, adding three new automated drill rigs (ADR design) in first-quarter 2007; another five new ADRs began term contracts in second-quarter 2007 (Fig. 1). The company relocated two drilling rigs from Canada to Australia during the second quarter and is refurbishing two drilling rigs and upgrading and reactivating a previously idle drilling rig for the Middle East-Africa fleet.

Calgary’s Trinidad Drilling Ltd. is also building rigs, backed by contracts, and will soon have a fleet of 110 drilling rigs ranging in depth capacity of 1,000-6,500 m, along with 22 service rigs. In July 2007, Trinidad purchased the assets of PC Axxis LLC, Drilling Productivity Realized LLC, and associated DPR companies, including four land drilling rigs, one barge rig, and a second barge rig under construction. Trinidad also acquired 20 preset and coring rigs during its earlier acquisition of Titan Surface Casing Ltd.

Calgary-based Saxon Drilling Canada Limited Partnership runs eight double drilling rigs and one single rig in Canada. Saxon Energy Services Inc. also has drilling fleets in the US, Mexico, Peru, and Colombia, and workover rigs in Venezuela and Ecuador.

In August, Saxon announced deployment of its first advanced technology single (ATS) drilling rig. The first of five new ATS rigs spud a well in July. The second rig was finished in September, and the company expects to complete one ATS rig per month for the remainder of the year. The rig fleet will then consist of 38 rigs in North America and 21 in South America, including 50 drilling rigs and 9 workover rigs.

Nabors Canada, a subsidiary of Nabors Industries Ltd., operates 97 drilling rigs across Canada, including 3 singles, 36 doubles, 49 triples, and 9 coiled-tubing hybrid rigs, capable of drilling from 1,050-7,000 m. More than a quarter of the rigs (26 of 97) have top drives, including 14 PACE rigs, four of which are helitransportable.

Operators drilling

According to Nickle’s Rig Locator, the five busiest operators drilling in Canada at the end of September were:

- EnCana Corp., 40 rigs.

- Talisman Energy Inc., 22 rigs.

- Husky Energy Inc., 20 rigs.

- Canadian Natural Resources Ltd., 19 rigs.

- Devon Canada Corp., 18 rigs.

Western Canada

Most of Canada’s drilling is in the Western Canada Sedimentary basin, predominantly in Alberta. In July, Roger Soucy, PSAC president, said that many areas in the WCSB now need natural gas prices of $8-10 (Can.)/Mcf to attract new drilling.

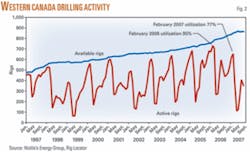

According to Nickle’s Daily Oil Bulletin, companies have drilled 12,222 wells in western and northern Canada during January-August 2007, down 11% from 13,807 wells drilled over the same period in 2006. The fleet has had an average of 862 rigs in 2007, up from 803 rigs last year, and has operated at 43% average utilization in 2007, down from 64% utilization in 2006.

On July 23, the CAODC forecast that 16,339 wells would be drilled in western Canada this year, and said there would be a slight increase in the size of the fleet to 865 from 857 by yearend. Overall, this represents a 27% decrease in drilling (about 6,000 fewer wells) from 2006. This represents about 37,500 fewer operating days, a 24% reduction from 2006.

CAODC attributes the decrease to reduced drilling for natural gas, primarily in Alberta and British Columbia. CAODC thinks the rig fleet utilization will be 44% for the year, with an average of 376 rigs drilling.

Historically, the average Canadian drilling rig utilization over the past 3 years has been 64%:

- 64% in 2006.

- 64% in 2005.

- 63% in 2004.

The fleet usually reaches peak utilization in February each year (Fig. 2). In February 2007, peak utilization was only 77%, down from 95% a year earlier. Peak utilization has not been this low since 2002, when it was 75%.

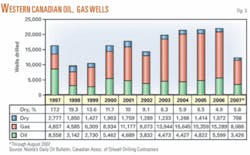

The drilling success rate remains high in western Canada and the percentage of dry holes in 2006 reached a record low of 4.9%. For the first 8 months of 2007, 5.8% of all wells were dry, equivalent to the midyear figure in 2006 (Fig. 3).

The percentage of oil drilling, relative to gas drilling, has been increasing since 2004. There were 8,088 gas wells and 3,426 oil wells drilled in the first 8 months of 2007, about 2.4 gas wells/oil well. This compares with previous years:

- 2.7 gas/oil wells in 2006.

- 3.2 gas/oil wells in 2005.

- 3.5 gas/oil wells in 2004.

The lower 2007 figure may be attributed to Canadian gas prices, which are not keeping pace with the rise in oil prices. There is no energy parity; gas is now trading at a substantial discount to oil in terms of its energy value.

In a presentation to the Canadian Association of Drilling Engineers, Paul Ziff, chief executive officer of Calgary’s Ziff Energy Group, showed that Canadian gas drilling is down 40% this year, and gas well completions are down 19%. “Current Canadian gas rig activity is barely above the levels of 6 years ago, while US drilling activity is 50% higher.”1

Ziff said “Alberta gas economics for new gas activity are at a significant disadvantage compared to most US gas basins.”2

Alberta royalties

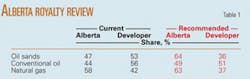

On Sept. 18, the six-member Alberta Royalty Review panel issued its final report on hydrocarbon royalties to the provincial government. The report states that Alberta is not receiving a fair share and recommends increasing royalties on oil sands, conventional oil, and natural gas production.3 Natural gas royalties would rise to 63% from the current 58% royalty, conventional oil to 49% from 44%, and most dramatically, oil sands to 64% from 47% (Table 1).

In a Sept. 24 press release, Ziff said, “Although the western Canada public perception is of an oil and gas industry, the reality today is a predominantly natural gas conventional industry alongside the burgeoning unconventional oil sands industry.” Ziff said gas drilling has accounted for 75% of conventional drilling in western Canada in the last several years.

Bill Gwozd, vice-president of gas services at Ziff Energy Group, said that the proven gas reserve life (current production divided by remaining proven reserves) in Canada is less than 9 years, and he said maintaining current production is unlikely, given the amount of drilling required. He told OGJ, however, that probable and potential reserves represent about 15 years of production, for a total of 24 years of gas production remaining in western Canada.

Gwozd said that western Canada is producing about 16.6 bcfd, and he expects it to decline to 13.1 bcfd by 2015, based on Ziff’s proprietary supply numbers. Western Canada produces about 6 tcf/year and holds an ultimate resource of 300-350 tcf. He noted that the reserves estimate has plateaued in the last 5-10 years, despite increased exploration and drilling. With finite resources and declining production, Gwozd said, the gas supply to the US will naturally decrease and will probably be replaced by production from the US Rocky Mountains or newly arriving LNG.

Ziff Energy Group ultimate resource analyses are based on studies by the Canadian Gas Potential Committee, a volunteer organization of geoscientists and engineers that conducts a study every 3 years and other industry resource assessments. The National Energy Board and pipeline companies also examine the industry, with the result that at least one study is released each year.

Off Newfoundland

The Canada-Newfoundland and Labrador Offshore Petroleum Board (C-NLOPB) released its 2006-07 annual report on June 21, detailing activities in the province.

The Rowan Gorilla VI jack up drilled four delineation wells and one exploration well on the Grand Banks for Husky Oil during the April-November 2006 drilling program:

- White Rose O-28X, O-28Y.

- West Bonne Bay F-12, F-12Z.

- North Amethyst K-15 exploration well.

The Eirik Raude semisubmersible spudded the Great Barasway F-66 exploration well in the Orphan basin in August 2006, but tensioner wires in the marine riser parted in January 2007 and resulted in a spill of 74,000 l. of synthetic-based mud (SBM). After repairs in Marystown, Newf., the rig reconnected to the well in March and completed the well.

- Hibernia. The field is about 300 km east-southeast of St. John’s, Newf., the Hibernia Management & Development Co. Ltd. (HMDC) drilled four development wells and one delineation well from the Hibernia platform during the fiscal year ending Mar. 31, 2007.

Through March, 56 of 64 drilling slots on the platform had been used, and the field had produced 531 million bbl oil, with 713 million bbl oil remaining. The Hibernia field was shut down from September 2006 to February 2007 because of a backfire in the turbine exhaust unit on one of the main power generators.

About 97% of the gas produced at Hibernia was used for fuel or oil recovery in 2006; only 3% (2,424 MMscfd) was flared. Hibernia uses a cuttings reinjection system and successfully reinjected 100% of all SBM cuttings in 2006. - Terra Nova. The field lies 350 km east-southeast of St. John’s where the Henry Goodich semisubmersible had drilled 32 wells through the end of March for Petro-Canada and its partners. After completion of another well in May, the 28 drilling slots were fully utilized. Drilling at Terra Nova will resume in 2011 when additional drilling slots become available, according to C-NLOPB.

About 78% of the gas produced at Terra Nova was used for fuel or oil recovery in 2006; 22% (84.9 million cu m) was flared. - White Rose. The field is about 350 km east of St. John’s and produced 32 million bbl oil in 2006 from six production wells, about 87,800 bo/d. Husky Oil has initiated drilling operations on 19 wells; 16 of which have been drilled to TD and 15 completed. In 2006, Husky drilled two delineation wells in the field with the GSF Grand Banks second-generation semisubmersible.

About 39% of the gas produced at White Rose was flared in 2006 (270 million cu m). C-NLOPB attributes the high percentage to the typically high rates seen at the beginning of oil production. Gas injection into the field began May 5, 2006.

On Sept. 7, 2007, C-NLOPB approved Husky Energy’s South White Rose extension. The South White Rose extension is estimated to contain 24 million bbl of oil and is one of several possible extensions to the White Rose project.

According to the C-NLOPB annual report, operators produced a total of 111 million bbl oil in 2006, valued at more than $8.2 billion (Can.), representing 12.6% of Newfoundland and Labrador’s gross domestic product. The industry spends about $1.3 billion (Can.) a year across Canada, 55% of it in Newfoundland and Labrador. As of Mar. 16, 2007, operators were committed to spend an additional $816 million (Can.) on future exploration activities.

During 1966-2006, operators spent nearly $21.6 billion (Can.) on offshore petroleum exploration, development, and production in the province. About half, $10.7 billion, has gone towards development activities.

Western Newfoundland

According to the August 2007 oil and gas report from the Newfoundland and Labrador Dept. of Natural Resources, another well may be drilled in western Newfoundland this year.

In September, Houston-based Tekoil and Gas Corp. announced a farm-in agreement with St. John’s-based Ptarmigan Resources Ltd. and has received operating and exploration licenses from the provincial government. Tekoil plans to drill a well just north of the Port au Port peninsula to validate the second term of Ptarmigan’s offshore exploration license 1069. Tekoil will earn a 33% working interest in EL-1069 upon completing the well.

Off Nova Scotia

The Canada-Nova Scotia Offshore Petroleum Board (CNSOPB) issued its 2006-07 annual report in July 2007. The board authorized a single drilling program during the fiscal year ending Mar. 31, 2007, but there were no exploration wells drilled during the year. One development well, Alma 3 (N-76), was completed.

The period 2006-07 set a record for drilling deposits, however. The CNSOPB report lists six new $250,000 (Can.) drilling deposits posted for exploration license (EL) areas 2404 (Norsk Hydro Canada Oil & Gas Inc.), 2406 (Canadian Superior Energy Inc.), 2407 (BEPCo. Canada Co.), 2412 and 2413 (Richland Minerals Inc.), and 2414 (EnCana Corp.). There are 17 additional exploration licenses open, with a total committed work expenditure of $902 million (Can.). Two EL areas, 2401 and 2408, were forfeited during the year.

CNSOPB issued two significant discovery licenses to EnCana (SDL 2701, 2702) for its Deep Panuke gas development project on July 27. EnCana is awaiting regulatory approvals from the CNSOPB and the National Energy Board to begin operations.

Onshore Nova Scotia

Triangle Petroleum Corp. began drilling gas shales in Nova Scotia in September. Triangle contracted Precision Drilling Rig 176 to drill two vertical wells in the Windsor basin, beginning with the Kennetcook No. 1 well. Estimated TD is 1,350-1,500 m, targeting the Mississippian Horton Group shales. The wells will be completed in October.

Calgary-based Contact Exploration Inc. farmed out the Windsor block to Triangle in June 2007. Triangle can earn the right to 70% of Contact’s 516,000-gross acre Windsor block by completing the Kennetcook No. 1 well. Contact has an interest in 1.5 million acres onshore Nova Scotia.

Triangle also has an option to earn a working interest in Contact’s 68,000-acre shale gas horizon in New Brunswick, according to a Sept. 6 press release.

New Brunswick

Contact Exploration holds 165,000 acres onshore New Brunswick. The company drilled its South Stoney Creek prospect in southern New Brunswick in August. The Shenstone G75-2328 well reached a TD of 2,180 m (rig capacity), nearly to the planned TD of 2,200 m. It is the first of two wells proposed on the 35,000 acre prospect.

Contact said the objective of the well was to test the Hiram Brook, Fredericks Brook, and Dawson Settlement formations. Contact has 60% of the field; a partner holds 40% working interest.

Contact began producing its 100%-owned Stoney Creek field in June, with 750 bbl in the first month and 900 bbl in July. The field has estimated reserves of 1.2 million bbl oil and 6.5 bcf natural gas and the company plans to rework 14 vertical wells, pending approval (OGJ Online, Aug. 27, 2007).

Canadian R&D

Calgary’s Xtreme Coil Drilling Corp. is a drilling contractor developing and operating coil-over-top-drive (COTD) drilling rigs that can handle coil or jointed drill pipe. According to the company’s presentation at the Peters 2007 North American Oil & Gas Conference in September, six COTD rigs were in the US and two in Canada.

XTC 200ST Rig 5 is moving to southern Alberta for a multiwell project, and XTC 300 Rig 11 is commissioning in Nisku. The US-based rigs are working in the DJ basin and Piceance basin, Colo. (OGJ, June 25, 2007, p. 45).

Xtreme has five different models of CT drilling rigs. The two smallest, XTC 200ST and 200DT, can drill to about 7,900 ft. The XTC 400 can drill to 10,000 ft with 3½-in. coiled tubing or to 14,000 ft with jointed drill pipe (Fig. 4).

As of June 30, the company had 11 rigs under construction and expected to complete 14 rigs by yearend. The fleet will include 10 rigs by the end of third quarter and expects to run 18 COTD rigs in 2008.

Xtreme is also engaged in a joint venture, Coil-X Drilling Systems Corp., with Shell Technology Ventures Fund 1 BV.

Acquisitions

Earlier this year, Abu Dhabi National Energy Co. PJSC (ADNEC; now TAQA) purchased Calgary-based Northrock Resources Ltd., a subsidiary of Houston’s Pogo Producing Co., for $2 billion (OGJ, June 11, 2007, p. 32). Northrock had properties in Alberta, Saskatchewan, and Northwest Territories.

In August, TAQA purchased a second company with Canadian assets, Pioneer Natural Resources Canada Inc., for $540 million (OGJ, Sept. 24, 2007, p. 29).

Canadian Beaufort

Imperial Oil Resource Ventures Ltd. and ExxonMobil Canada Properties have jointly bid and won exploration rights for EL 446 in the Canadian Beaufort Sea for $585 million (Can.). The parcel covers 507,368 acres, about 160 miles north of Inuvik, NWT. The companies need to spend 25%, or $73.1 million (Can.), within 5 years to earn a 4-year license extension (OGJ Online, July 19, 2007).

ConocoPhilips Canada Resources Corp. bid $12.08 million (Can.) for EL 447, consisting of 256,270 acres, 85 miles north of Inuvik.

Chevron Canada Ltd. bid $1 million (Can.) for the 267,325 acres in EL 448, 120 miles north of Inuvik.

Devon Canada completed a wildcat in the Canadian Beaufort last year.

Successfully exploring and exploiting the technology-intensive Beaufort will probably depend on the growth of the Mackenzie delta gas project and construction of the Mackenzie gas pipeline.

Drilling ahead

How will the industry adjust to the drilling downturn in Canada? Adjust royalty programs to encourage drilling by recognizing the front-end risks and costs.

British Columbia’s provincial government has introduced a net profit royalty program to encourage exploration of coalbed methane, tight gas, shale gas, and enhanced oil recovery projects. The new royalty will be 2% of gross revenue from the start of production over a maximum 10-year period or until the initial capital investment is paid off. The asset then follows one of three tiers:

- 5% of gross revenue or 15% of net revenue, whichever is higher, until capital cost + 30% is recovered.

- 5% of gross revenue or 20% of net revenue, whichever is higher, until capital cost + 105% is recovered.

- 35% on net revenue or 5% on gross revenue, whichever is higher.

The new royalty structure in British Columbia is modeled on Alberta’s current oil sands royalties (currently under review, as discussed above).

Royalty on Alberta oil sands is 1% of gross revenue until project payout, after which the rate is either 25% of net revenue or 1% of gross revenue, whichever is larger.

References

- “Energy consultant challenges Alberta Energy conclusions on natural gas profitability,” Daily Oil Bull., Sept. 17, 2007.

- “Western Canada gas pricing now disconnected from oil prices,” Ziff Energy Group press release, Sept. 24, 2007.

- “Our Fair Share,” 104 pp., www.albertaroyaltyreview.ca.

- Park, Gary, “BC tests new horizons,” Petroleum News, Aug. 12, 2007.