More operators eye Maverick shale gas, tar sand potential

Gas potential in the overpressured Cretaceous Pearsall shale has drawn two of the world’s largest oil and gas companies to South Texas and the Maverick basin, a province almost exclusively tended by smaller independents for the past few decades.

The new, well funded players EnCana Corp. and Anadarko Petroleum Corp. are almost certain to step up the basin’s exploration and development pace, but how soon and to what extent are difficult to predict.

The basin’s long-term host operator, TXCO Resources Inc., formerly The Exploration Co., is in various stages of developing only a few of the basin’s 20 prospective formations, most of which produce in widespread parts of the greater Gulf Coast.

Besides the Pearsall shale, TXCO is mainly developing light oil in the Cretaceous Glen Rose formation and has just started a shallow tar sand pilot project. After years of operating almost solely in the Maverick, it has also begun to devote limited attention to other Midcontinent basins, including the Gulf Coast, Anadarko, and Marfa basins.

Pearsall shale

EnCana, Anadarko, and TXCO all credit Pearsall shale gas prospects as the main reason for their entries into the Maverick basin.

TXCO and others have produced 20 bcf of gas from the Pearsall through 50 vertical wells, said James E. Sigmon, chief executive officer. This was before 3D seismic, underblanced drilling, advanced fracturing, or horizontal drilling were available.

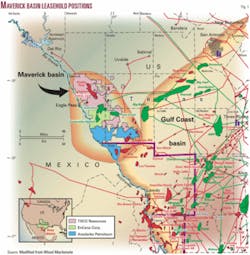

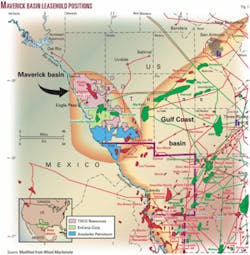

Horizontal drilling and advanced completion techniques have the potential to turn the Pearsall into a predictable resource play across nearly all of the basin, TXCO said. The company holds more than 600,000 net acres on the Chittim anticline (see map).

To pursue the Pearsall, TXCO enlisted EnCana, which brings horizontal drilling and fracturing experience from the Barnett shale. TXCO gained acreage interests as part of the deal (OGJ Online, Feb. 21, 2007). EnCana has estimated that the Pearsall averages 900 ft thick and has 100-300 bcf/sq mile of gas in place. The companies budgeted to drill three Pearsall wells in 2007 and in July were attempting a completion in the lateral at the second well.

Anadarko, meanwhile, has leased 330,000 acres in the southern part of the basin and has estimated 950 tcf of gas in place in the Pearsall and shallow Eagle Ford sections combined.

Anadarko has drilled five vertical wells, and its drilling permits include at least one horizontal well.

Another independent, Cornerstone E&P Co., Irving, Tex., holds more than 190,000 acres, is targeting the Cretaceous and Jurassic intervals, and is completing its first vertical Pearsall well.

Tar sand

TXCO and Pearl Exploration & Production Ltd., Calgary, are conducting pilot tests of separate tar sand and heavy oil deposits in the northeastern Maverick basin 30 miles northeast of Eagle Pass.

The overall tar sand deposit has an estimated 7-10 billion bbl of 0° gravity hydrocarbon in place in Cretaceous San Miguel at 1,400-2,200 ft on 170,000 acres and 50 ft thick on 123,000 acres of that. The deposit is geologically similar to the larger one at Cold Lake, Alta.

TXCO and Pearl hold 36,000 acres of lease rights in a 68,000-acre area of mutual interest on the west side of the deposit, and TXCO has 100% interest in another 41,000 acres on the east side.

The companies are in the third steam cycle, alternately injecting steam in one of two 2,000-ft wells and producing from the other. The first two cycles raised the bottomhole temperature to 300° from 100°, and the second cycle briefly elicited 48 b/d of oil production. Optimum temperature is 400-450°, TXCO said.

The steam generator consumes 300-500 Mcfd of TXCO’s produced gas.

A 16-well, 1,500-ft deep, coal-fired pilot is under design.

Produced tar is under analysis, and TXCO would mix it with Glen Rose crude to yield an 18-20° gravity blend.

The companies are evaluating three steam technologies: steam-assisted gravity drainage (SAGD) pioneered in Canada, fracture-assisted steam technology (FAST) employed successfully at Saner Ranch in Maverick County by Conoco Inc. in the 1980s, and cyclic steaming.

Just west of the tar sand deposit is an estimated 100 million bbl of 10-14° gravity oil in place in San Miguel on 6,000 acres in which TXCO has 100% working interest.

The company has drilled two 2,000-ft laterals 200 ft apart through the oil deposit 150 ft deep and back to the surface. Next it drilled five vertical wells 25-100 ft from the laterals to monitor heat propagation. A steam generator is on order.

Other plays

Total production from the basin has been increasing since 2004 on an oil-equivalent basis, with gas production by itself declining, noted Wood Mackenzie consultants.

TXCO and ConocoPhillips are the basin’s two largest oil and gas producing companies.

Gas production has fallen in Prickly Pear field, but that has been partly offset by growth from TXCO and AROC (Texas) Inc. in Chittim East field.

TXCO also has a coalbed methane pilot in early stages in the Maverick basin (OGJ Online, Feb. 10, 2004).

TXCO reported oil sales from the Glen Rose porosity play (Comanche-Halsell field) were 168,425 bbl in the quarter ended June 30, up from 123,300 bbl for the first quarter. CMR Energy LP, Houston, also operates in the field.

TXCO said that its Maverick basin drilling in mid-July included five wells targeting the Glen Rose porosity play and one well each to the Pearsall, Georgetown, and Pena Creek San Miguel formations.

ConocoPhillips continues to develop Sacatosa (San Miguel) oil field, discovered in 1956.