Sudan’s oil production, refining capacity climb

Sudan is climbing on the list of African oil producing countries and is seeing its refining capacity expand as well.

The country’s oil production averaged 414,000 b/d in 2006, up from 363,000 b/d in 2005, said the US Energy Information Administration, and China is in the forefront of the country’s oil developments.

Capacity of the two main pipelines from interior oil fields to Port Sudan totals 450,000 b/d, and together these are expandable to 950,000 b/d. Minister of State for Mines and Energy Angelina Tany said Sudan plans to be producing 1 million b/d of oil by the end of 2008.

Sudan consumed 94,000 b/d of oil in 2006 and exported 320,000 b/d, most of it to Asian countries, EIA said.

“Factional fighting in the south and rebel attacks on oil infrastructure have kept oil production and exploration from reaching full potential to date,” EIA said.

An expansion of the Khartoum refinery to 100,000 b/d from 50,000 b/d was completed in mid-2006, and a 100,000 b/d refinery is under construction at Port Sudan for completion in 2009.

Exports of Sudan crude in 2006 went to Japan, China, South Korea, Indonesia, and India, EIA said.

Muglad basin

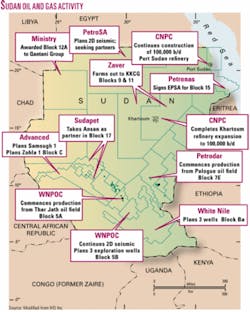

Sources of oil production in Sudan have spread out to multiple blocks since the first oil shipment left Port Sudan on the Red Sea in September 1999.

Greater Nile Petroleum Operating Co., as successor to Talisman Energy Inc., Arakis Petroleum Corp., and Chevron Corp., still operates Sudan’s largest share of production, from Heglig, Unity, and surrounding fields on blocks 1, 2, and 4 in the Muglad basin (OGJ, May 17, 1982, p. 36).

These fields produced 260,000 b/d of Nile blend crude in January 2007, EIA said. Nile blend is 33° gravity with 0.045% sulfur. Arakis initiated development in 1996.

Capacity of GNPOC’s 994-mile pipeline to Port Sudan is 300,000 b/d and is expandable to 450,000 b/d. GNPOC is a joint venture of China National Petroleum Co. 40%, Petronas of Malaysia 30%, Oil & Natural Gas Corp. of India 25%, and Sudan National Petroleum Corp. (Sudapet) 5%.

Meanwhile, another group known as White Nile Petroleum Operating Co. started production from Block 5a in mid-2006. Production from Thar Jath field remains at 38,000 b/d as of March 2007, EIA said. The block also contains Mala field.

Thar Jath oil flows through a 110-mile pipeline to Unity field, where it is shipped to Port Sudan on the GNPOC pipeline.

Elsewhere, White Nile Ltd., London, spudded an exploration well Apr. 19 on 67,000 sq km Block Ba in the Jonglei subbasin of the southeastern Muglad basin on acreage that is also claimed by Total SA of France (OGJ Online, Apr. 20, 2007).

Melut basin

The Petrodar group of companies produced 165,000 b/d of oil in January 2007 from Palogue field on blocks 3 and 7 in the Melut basin and could build this to 200,000 b/d by late 2007, EIA said. Estimated recoverable oil in Palogue and Adar-Yale fields is 460 million bbl.

CNPC started up the Petrodar pipeline from blocks 3 and 7 to Port Sudan in late 2005. Capacity is expandable to 500,000 b/d. The project also includes a 300,000 b/d central processing facility at Al-Jabalayan and production facilities at Palogue.

Palogue’s Dar blend crude is understood to have a high acid content that the Port Sudan refinery is being designed to handle.

Members of Petrodar are CNPC 41%, Petronas 40%, Sudapet 8%, Gulf Petroleum 6%, and Al-Thani Corp. 5%.

Other areas

CNPC is producing oil since November 2004 from Fula field on Block 6 in troubled Darfur Province 400 miles southwest of Khartoum.

The company is producing 40,000 b/d, EIA said, and intends to raise this to 80,000 b/d. It has built a pipeline that transports the Fula crude to the Khartoum refinery.

Exploration is at a much earlier stage in other parts of the country, where various companies are acquiring blocks, planning seismic surveys, and seeking partners (see map).

“It is estimated that vast potential reserves are held in northwest Sudan, the Blue Nile basin, and the Red Sea area in eastern Sudan,” EIA said.