Exploratory-appraisal drilling surged outside North America in year 2000

World exploration and delineation drilling outside North America in 2000 was 20% higher than in 1999, IHS Energy Group estimates. This performance reflected the surging oil price throughout much of the year.

Exact figures on the number of wells completed are not available for some areas such as Russia and onshore China, where a high percentage of the world's wells were drilled.

The biggest increases in drilling were reported in the former Soviet countries and Latin America, and Africa and the Far East also registered significant jumps. Exploratory drilling in Europe, the Middle East, and Australasia was at levels similar to those of 1999.

The supergiant Kashagan East oil discovery in the northern Caspian Sea off Kazakhstan dominated the picture in year 2000. Estimates of reserves varied from 6 billion to 20 billion bbl of oil plus a significant amount of gas. Major hydrocarbon discoveries were also reported in Iran, Saudi Arabia, Trinidad, Egypt, Nigeria, Colombia, and Angola.

This article is designed not to be an exhaustive review but rather a summary of what we consider to be the main events that occurred during the year by region with particular emphasis on exploration and delineation drilling.

Western Europe activity

The UK offshore was the most active drilling province in western Europe.

Amerada Hess Corp. (15/27-9, 9/12a-11A), Kerr-McGee Corp. (30/17a-14Z), and Murphy Oil Corp. (28/3-1) made discoveries, all comparatively minor.

The 19th bidding round was formally announced in November with 44 blocks/part blocks in the White Zone open for applications. Dealmaking ran at an hectic pace throughout 2000 with companies continuing to focus on core areas.

Denmark's relatively high activity was due to commitment wells on fifth round acreage. These included oil discoveries made by Dansk Operatorselskab IS at Nini 1A and Cecilie 1A.

The Faroe Islands first bidding round opened in February 2000, and the government awarded seven licenses covering 38 blocks/part blocks in August.

Wintershall AG brought A6/B4 gas field on stream off Germany in September 2000 at 116 MMcfd. This was the first true offshore project implemented in the German sector of the North Sea.

Greenland saw the drilling of one wildcat. Statoil AS's Qulleq 1 was dry but found reservoir quality Cretaceous sands. Meanwhile Greenland invited nominations for areas of interest ahead of a planned round in 2001 off the southwest coast.

Enterprise Oil PLC drilled two successful appraisal wells at Corrib gas field off Ireland, and Providence drilled two successful appraisal/development wells at Helvick oil field.

Norway announced 16th round awards in April with 34 blocks/part blocks being granted. Norway opened another round in September.

Nine discoveries were announced in total in Norway. Significantly Agip SPA reported two discoveries (one oil and one gas) in the Barents Sea, and ExxonMobil Corp. is understood to have encountered oil and gas in its high pressure-high temperature wildcat in the Norwegian Sea. Norsk Hydro AS also encountered oil and gas in an appraisal well of Ormen Lange, a discovery previously considered exclusively gas.

Rohol Aufsuchungs AG and OMV AG drilled successful exploratory wells in Austria.

Two exploration wells in France's Paris basin were unsuccessful.

Four wildcats and a delineation well were drilled in Greece. Triton Energy Corp. and Enterprise drilled four dry wildcats in onshore western Greece.

Three gas finds were reported in Italy in 2000.

Repsol-YPF SA's Barracuda 1 was successful flowing 4,000 b/d of oil in Spain.

Switzerland had one exploration well as Forest Oil Corp. tested Weiach 2 with disappointing results.

Eastern Europe action

Foreign companies lifted force majeure in Albania after 3 years, and Occidental Petroleum Corp. spudded the country's first outside-operated onshore well, Shpiragu 1 on Block 2, in November.

The Bulgarian government shelved the long awaited third bidding round and replaced it with an open door policy.

Four Croatian exploration wells were completed, including INAGIP's offshore gas discovery at Marcia 1 in the northern Adriatic.

Hungary, similar to the previous year, had a flurry of contract activity with 11 new exploration blocks being granted in 2000 to the new domestic oil company Hungarian Horizon Energy.

The first Latvian bidding round comprising 73 offshore blocks, officially announced in November 2000, was to open in April 2001.

The UAB Minijos Nafta joint venture's Pietu Siupariai 2 onshore discovery in Lithuania tested around 3,150 b/d of oil.

Poland's Ministry of Environment opened the third bidding round for 17 blocks in the northwest and central areas of the country. It also awarded some 15 blocks in 2000, including 10 to EuroGas Inc. in southeastern Poland.

Poland had several exploratory successes including Apache Corp.'s gas and condensate discovery at Wilga 2 and a number of gas discoveries by state PGNG.

One of the most important wells in Romania was state Petrom's first appraisal of the Pescarus 60 offshore discovery in the Black Sea. The delineation well, Pescarus 62, successfully tested oil.

During the year Petrom offered 36 closed fields to independent operators, and the country awarded 15 exploration blocks.

Medusa Oil & Gas Ltd. shot the first offshore seismic since 1988 on the Montenegran shelf.

Former Soviet states

The most active country here was Russia, where less than 5% of total exploratory drilling can be attributed to joint ventures with foreign companies.

In the Russian sector of the northern Caspian Sea, OAO Lukoil encountered hydrocarbons in the first two wildcats. Its Khvalynskaya 1 well flowed over 1,000 b/d of oil and 34 MMcfd of gas from Jurassic sandstones, and Yuri Korchagin 1 (or Shirotnaya 1) tested around 3,000 b/d from Jurassic carbonates and 4,400 b/d from Cretaceous sandstones.

OAO Gazprom drilled two successful wells in the Ob Estuary in the western Siberian basin. Wildcat Kamennomysskaya Severnaya 1 flowed at the rate of 13 MMcfd, while Kamennomysskaya 1, drilled on an offshore extension of the Kamennomysskiy field, flowed over 15 MMcfd.

ExxonMobil's Chayvo-More 6 delineation well off Sakhalin Island tested 6,000 b/d from a Miocene reservoir on the western flank of the structure. This well significantly upgraded oil reserves in the field.

Ukraine was the next most active country. Domestic companies Ukrgazvydobu- vannya and Ukrnafta undertook the bulk of the drilling in the Dnieper-Donets basin and focused some activity on the Carpathian foredeep and East European platform.

Uzbekistan saw a large increase in drilling, and the country also offered 16 projects for exploration and production investment.

Turkmenistan saw a decline in drilling, and the government offered 32 offshore blocks for tender.

Offshore Kazakhstan International Operating Co. Kashagan East 1 off Kazakhstan in the Caspian was the world's biggest discovery of the year. The oil is contained in Devonian and Carboniferous aged reservoirs at 4,000-5,000 m.

Drilling in Azerbaijan was focused on appraising the Shah Deniz gas discovery.

Far East exploration

China was by far the most active country in terms of drilling in the Far East (and the world outside North America), but reliable figures are difficult to obtain for the onshore.

For the state companies 2000 was a good year in terms of new reserves added and include gas in the Tarim and Ordos basins and oil in the Junggar basin.

Foreign companies which were successful, both in Bohai Gulf, include Kerr-McGee (Caofeidian 12-1-1, oil) and Phillips Petroleum Co. (Penglai 9-1-1, oil; Penglai 25-6-1, oil).

China National Offshore Oil Corp. and Sinopec-Star Petroleum stepped up exploration efforts in the East China Sea. The results are mixed as CNOOC's two wildcats were dry while Sinopec-Star's appraisal wells on the Chunxiao and Tianwatian structures were successful.

India was the next most active country in the Far East, and year's highlight was the award of 26 new contracts including 23 from the first licensing round under the New Exploration Licensing Policy (NELP).

Oil & Natural Gas Corp. made its first deepwater discovery at KD-AA (KD-1-1) off Krishna-Godavari. The well encountered modest quantities of gas. Meanwhile off Cambay, Cairn Energy PLC made three gas discoveries on the same block, CB-A-1 (Lakshmi), which was subsequently appraised, CB-C-1 (Ambe), and CB-B-1 (Gauri).

Pakistan saw a similar level of activity to 1999 but other than a modest amount of onshore gas reported no significant discoveries. Ocean Energy Inc. drilled the first two wildcats in 22 years off the Makran coast, but neither was successful.

The Bangladesh government continued to refuse to be drawn into any argument concerning the politically sensitive issue of potential gas export to India until completion of a USGS study on the country's gas reserves. Unlike previous years no discoveries were reported in Bangladesh.

Indonesia was the most active country in Southeast Asia. Despite many contracts awaiting signature there was disappointment with only five new awards being made. Indonesian Petroleum Ltd. (Inpex) made perhaps Indonesia's most important discovery in the deepwater Masela PSC in the Timor Sea.

Following a series of disappointing wells in recent years on the Indonesian side of the Timor Sea, Inpex's Abadi 1 (ST) tested gas and condensate with reserves estimated at 1.5 to 2 tcf.

Unocal Corp. made several gas finds on its deepwater PSCs off East Kalimantan. Other successes worth noting include Premier Oil PLC's Sidayu 1 oil discovery in the East Java Sea, Premier's Iguana 1 and Gajah Baru 1 gas discoveries in the West Natuna Sea, and Pertamina/Santa Fe's Koi 1 oil discovery off West Papua.

In Brunei at yearend the government had a "soft" opening of its much awaited deepwater round.

Malaysia saw established operators Shell Malaysia and Petronas Carigali Sdn. Bhd. make discoveries, and newcomer Murphy was testing its first well in Malaysia, Patricia 2 off Sarawak at yearend.

Myanmar had a significant rise in drilling. Activity was mainly concentrated onshore where state company Myanma Oil & Gas Enterprise made two gas discoveries and Westburne Oil Ltd. made two oil discoveries.

In the Philippines three exploration wells were completed and no significant hydrocarbons were found.

The year saw a record number of exploration and delineation wells drilled in Thailand and a dramatic increase of 120% from 1999. The most significant successes were in the former Thai-Viet Nam overlap zone in the North Malay basin, where Petroleum Exploration & Production PLC made several gas and condensate discoveries on the Arthit trend. A total of 87 onshore and offshore exploration blocks were offered for bid under the open ended 18th licensing round.

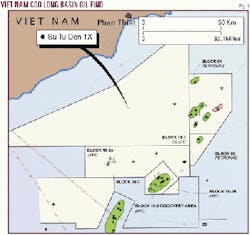

Viet Nam also had a significant rise in drilling. No doubt the most important well was the Conoco Inc. group's 15-1-SD-1 oil discovery in Block 15-1 in the Cuu Long basin (Fig. 1). This well flowed an impressive 17,800 b/d of oil from six zones and represented a record flow for a single well in Viet Nam. Field size estimate is 200-300 million bbl with a large amount of the hydrocarbons in the basement section.

In the Viet Nam portion of the North Malay basin, Unocal encountered gas in two wildcats.

Activity in Africa

The largest number of wells drilled in Africa was in Egypt, which had double the number of wells drilled in 1999.

Among the more significant wells were Apache's Akik 1 gas and condensate discovery on the North Alamein concession, BG PLC's Sapphire 1 gas and condensate find on the West Delta Deep Marine (WDDM) Block, and Gulf of Suez Petroleum Co.'s GS 302-2 in the Gulf of Suez which flowed up to 4,000 b/d of oil. WDDM reserves are estimated at 2.9 tcf.

Algeria had 40% more exploratory and appraisal wells than in 1999. Arco (BP PLC) completed the Semhari East 1 wildcat on the Hassi Messaoud high as an oil and gas discovery, and Sonatrach's wildcat Azrafil Sud Est 1 in the West Region tested 14.4 MMcfd.

Sonatrach also made an oil and gas discovery at Hassi Terfa 1 in the East Region. The well flowed 1,440 b/d of oil with some gas. Sonatrach's Djebel Heirane Kahla Tablbala 1 wildcat in the West Region tested gas.

In Libya significant wells included Agip's oil and gas discovery at A-1-NC180 in the Ghadames basin and Sirte Oil Co.'s gas discovery at OOOO-1-06 in the Sirte basin. Meanwhile in the Murzuk basin Repsol announced test results from exploration well A-1-NC186, which flowed 2,500 b/d. Libya also launched a "bid round" in May 2000, offering 137 blocks onshore and offshore.

Moving to Tunisia, Agip completed long term tests its Nassim 1 wildcat, its first well on the Jenein Nord permit in the Ghadames basin. It suspended the oil discovery in late August.

In Cameroon, the third licensing round was largely ignored.

Two wildcats were drilled in Ghana, including an oil and gas discovery at Western Tano 1X by Dana Petroleum PLC.

In South Africa two wildcats and four delineation wells were completed. These included Forest's successful appraisal of A-K (Ibhubezi) gas field.

The 2000 licensing round in Nigeria was a big success and was the first open licensing round in the country's history, but the country experienced a fall-off in drilling in 2000.

In the deepwater, Statoil confirmed the extension of the Texaco Inc. Agbami structure into its acreage in OPL 217 and made an oil and gas discovery at Bilah 1 on adjacent block OPL 218. Meanwhile TotalFinaElf drilled two delineation wells on the Akpo structure in OPL 246 (Fig. 2).

In Angola 10 oil discoveries were made in deep waters during the year, two on Chevron Corp.-operated Block 14 (Lobito 1 and Tomboco 1), three on ExxonMobil-operated Block 15 (Batuque 1, Mondo and Saxi 1), two on TotalFinaElf-operated Block 17 (Jasmin 1 and Perpetua 1), and three on BP-operated Block 18 (Galio 1, Cromio 1, and Paladio 1).

In Equatorial Guinea, Triton put Ceiba oil field in the Rio Muni basin on stream in November 2000, less than 14 months after its discovery. Two exploration and two delineation wells were drilled in the country.

Gabon launched the ninth international licensing round in April 2000 with 27 blocks were offered corresponding to the country's open acreage. This included 13 onshore and five offshore blocks plus nine ultradeepwater blocks. Three wildcats and a single delineation well were drilled in 2000.

Mozambique launched its first offshore licensing round March 31, 2000, and it closed on Oct. 31with no bids submitted (although certain negotiations were understood to be continuing). Sasol Ltd. drilled two exploration wells on the Sofala-Sengo offshore block. The first had gas shows and the second was dry.

Tanzania Petroleum Development Co. launched Tanzania's first offshore licensing round Sept. 14, 2000. The round closes Apr. 19, 2001. The inventory includes six deepwater blocks covering a combined 64,050 sq km in 100-3,000+ of water in the Mafia offshore deep-sea basin.

Morocco launched its first offshore licensing round in October 2000 with closing on Apr. 30, 2001. Eight blocks are on offer in the Rabat-Safi Atlantic province (conventional and deep water). Exploratory drilling was successful in the Talsinnt area of the High Plateau, where Lone Star Energy Inc. found oil and gas with its first onshore well.

Latin America action

Argentina was South America's most active country in 2000. Drilling increased significantly compared with the previous year. Operators completed a number of important deep Devonian gas wells in the Noroeste basin and collected a record amount of seismic data, although seismic activity slowed after midyear.

Brazil awarded 21 new licenses from the second ANP round.

Shell made a heavy oil find with its first wildcat, and Amerada made a modest discovery with its first wildcat. Petroleo Brasileiro SA (Petrobras) made a 700 bcf gas discovery (preliminary estimates).

Petrobras also announced a possible oil discovery in ultradeep water 17 km east of supergiant Roncador field in the Campos basin but was still operating the well at year end.

Mexico's drilling level was similar to Brazil's with all wells completed by state Petroleos Mexicanos, the most in any year since the 1980s.

Unofficial estimates are that 20 of these wells resulted in discoveries, though their commerciality is uncertain. Of the 20, 19 were gas discoveries and one was an oil discovery. The oil find, Alak 1, is only the second deepwater Gulf of Mexico strike on the Mexican side of the gulf. All of the gas discoveries were made in historically productive onshore trends.

Ecuador was the venue of two important discoveries on Block 31 by Perez Companc. There was a modest jump in drilling in Venezuela compared with 1999.

Colombia saw similar drilling levels in 2000 and 1999. Of several oil discoveries in 2000, Nexen Inc.'s Guando 1 was the biggest. This was South America's biggest oil discovery of the year with around 280 million bbl recoverable.

One of the wells spudded in Colombia was Oxy's controversial and long delayed Gibraltar 1, a short distance outside of the officially recognized U'wa lands.

Colombia awarded a record 32 new contracts including 31 association contracts and one coalbed methane contract. This compared with a single contract award in 1999, and the 32 awards surpassed the next-high 31 granted in 1985.

Bolivia notched no significant discoveries in 2000, but the government announced that overall gas reserves increased 36% on the year to 32.2 tcf in 2000 while oil reserves climbed 35% to 690 million bbl.

Trinidad and Tobago generated much excitement. BP made two major discoveries during 2000. In early May, the company confirmed discovery of an estimated 2 tcf at the Manakin 1 wildcat in the Columbus sub-basin. The well is in 222 m of water 2 km from the maritime boundary with Venezuela and was drilled on the same structure as Petroleos de Venezuela SA's Cocuina gas discovery of the 1980s.

PDVSA, BP, and the Trinidad and Tobago Ministry of Energy and Energy Industries were discussing possible joint development of Manakin-Cocuina field.

BP in September announced one of the largest finds Trinidad and Tobago history at Red Mango 1 in the Columbus sub-basin between Immortelle and Kiskadee fields. The well reportedly encountered net gas and condensate pay sands in a Plio-Pleistocene section totaling 258 m. BP estimated reserves at 3 tcf of gas and 90 million bbl of condensate.

BHP Petroleum Ltd. made a significant gas discovery at Aripo 1 on offshore Block 2(c). A single pay zone flowed at rates of up to 46.3 MMcfd.

Aripo 1, along with BHP's nearby Angostura well, represent the first commercial discoveries to be established in the Columbus sub-basin north of Darien ridge. Unofficial estimates of combined reserves at Aripo and Angostura are said to rival those at BP's Red Mango discovery.

ExxonMobil in early December spudded its first deepwater exploratory well in Trinidad. Adelpha 1 is in the Columbus sub-basin in 1,025 m of water.

Cuba's state Comercial Cupet SA in March 2000 began promoting exploration opportunities for private companies in the Gulf of Mexico and northwestern Caribbean portion of its deepwater territory. The round generated significant interest, and it was revealed in late 2000 that Repsol-YPF was granted six deepwater tracts, the country's first deepwater awards.

Middle East exploration

Turkey was the most active country in the Middle East, but no significant discoveries were made. Turkey awarded 43 new contracts.

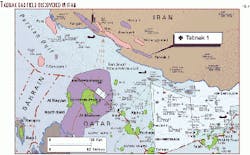

Iran also saw a small drop in drilling compared with the previous year and made significant oil and gas discoveries at Tabnak (Fig. 3), Homa, and Changuleh. During the year several firms concluded buy-back agreements, and Saga signed the first exploration block by a foreign company in recent years.

Similar to previous years little work occurred in Iraq due to the UN embargo. Two seismic crews operated. The embargo did not stop numerous companies waiting in the wings for change, and it was understood that some of these firms reserved a large number of fields and exploration blocks until the situation changes.

It was an important year for Israel with two major gas discoveries made at Gaza Marine and Mari B. There is much debate as to how this gas will be used and whether enough will eventually be discovered to sustain any sort of self sufficiency for the country. Israel hosted a huge jump in drilling compared to 1999 and awarded 18 new licenses.

The year saw the exit of the Japanese from the Saudi section of the Neutral Zone, but they will remain in the Kuwaiti portion until 2003.

In Syria all seven wildcats were reported as discoveries with varying degrees of success.

Little activity was reported in Jordan, but a licensing round for Risha gas field was held at midyear with no successful bidder announced by yearend.

In Kuwait the plan to involve selected western companies in the development of certain northern oil fields made slow progress.

Yemen showed an increase in exploration and delineation drilling. One of the more important wells was Dove Energy PLC's Sharyoof 1, which came in at 5,000 b/d. Dove followed up with Sharyoof 2 at 16,000 b/d, one of the most significant tests seen in Yemen to date.

During the year the Yemen-Saudi border dispute was settled with the provisional creation of new blocks.

Little information on upstream activities is available in Saudi Arabia, although discoveries were reported at Al Gazal with 3 tcf of gas plus 430 million bbl of condensate and Al Manjour with 750 bcf.

Australasia situation

Exploration in Australia showed a recovery in 2000, although the more buoyant approach has only led to a slight increase in the number of exploration and appraisal wells drilled.

In the Browse basin, Inpex made the discovery Dinichthys 1, which tested 22 MMcfd of gas and 1,300 b/d of condensate, followed by a further gas discovery at Gorgonichthys 1, not yet tested.

Farther northeast Nippon Mitsubishi Oil Corp.'s third well on its Browse basin-Vulcan sub-basin acreage, Crux 1, flowed 65.5 MMcfd and 1,921 b/d.

In the Carnarvon basin, Apache continued an aggressive exploratory drilling campaign in the vicinity of its existing development facilities at Harriet field and Varanus Island. However few of these exploratory wells led to any significant successes, with the exception of Linda 1, which proved up a new play in Jurassic Biggada formation submarine fan sandstones.

The deepwater Exmouth Plateau continued to arouse interest with the drilling by Chevron of two additional deepwater gas discoveries, Maenad 1 and Urania 1. ExxonMobil drilled a well, Jansz 1, on an adjoining deepwater permit, which is understood to have proven up the trend.

In the Exmouth sub-basin, Woodside Petroleum Ltd. followed a successful Enfield appraisal with a new discovery within the Macedon sandstone, Laverda 1. In the Bonaparte basin, Kerr-McGee drilled a gas discovery well, Prometheus 1, which intersected a 72 m gross gas column within Upper Permian sandstones and successfully appraised it at Rubicon 1, which intersected a 30 m gross gas column in the same reservoir.

New Caledonia was the focus of an onshore exploration program by Victoria Petroleum NL in 2000. The program saw the drilling of one well, with two geological sidetracks, with disappointing results, however.

New Zealand had a large increase in the number of exploration and appraisal wells drilled in 2000. Activity was mainly in the onshore Taranaki basin. Fletcher Challenge Energy Ltd. made what appears to be a significant gas and condensate discovery at Pohokura, and results from appraisal drilling on Swift Energy Co.'s Rimu oil and gas discovery are encouraging.

Activity in Papua New Guinea during 2000 has been unusually low. The key factor in this has been doubts as to whether the proposed Papua New Guinea to Queensland pipeline project would go ahead. Only two exploration wells were drilled during the year, and no significant hydrocarbons were encountered.

The author

Ian Cross compiled this review based on work undertaken during the year by IHS Energy Group's team of regional managers located in Houston (US), Tetbury (UK), Geneva (Switzerland), Perth (Australia), and Singapore. Cross is vice president of worldwide information services for IHS Energy and is based in Singapore. He worked as a geologist for Elf, BP, and Fina and has a BSc from Cardiff University. E-mail: [email protected]