Southwestern to probe new areas, won’t accelerate Fayetteville in ‘09

Southwestern Energy Co., Houston, which had planned to accelerate its Mississippian Fayetteville shale play in Arkansas in 2009, will instead keep about the same level of activity as in 2008.

The company, however, indicated that it is more immune to weak gas prices than companies in many other shale plays.

The Fayetteville shale is “very economic” at present gas prices, Harold Korell, chairman and chief executive officer, said Dec. 2. With $1.2 billion cash flow in 2008, it is hard to imagine the company’s 2009 capital plan being less than it was in 2008, Korell said.

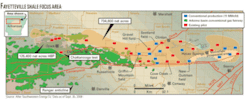

Southwestern is running 20 rigs in the play spread across nine counties (see map). Six small rigs drill the vertical part of each hole, and 14 larger rigs drill the curve and lateral.

The company’s Fayetteville production target for 2008 is 190-192 bcf, up about 70% from 2007 and an average of 526 bcfd. Gross production reached 600 MMcfd at the end of September 2008.

Fayetteville progress

Southwestern’s land holding is 855,000 net acres and still growing. Of that, 125,400 net acres are held by conventional production on the west side of the play.

Through September, Southwestern had drilled 720 wells, 650 of them horizontal, in the numerous pilot areas marked by red and blue squares on the map.

The company was to have participated in 520 horizontal wells in 2008, 75% of them operated.

“The name of the game is to contact the most rock for the dollar spent,” Korell said.

The company has more than doubled the average initial producing rate of its completions in a little over a year by drilling longer laterals, increasing the density of perforations, and hiking the number of fracs along each lateral.

Some of the newer wells have laterals longer than 3,000 ft, and these are recovering new reserves, Korell said, not just accelerating production.

In the past 2 years, the addition of 3D seismic has helped guide wellbores to avoid faults.

It was in 2002 that Southwestern spent 9-10 months mapping the shale and determining where to buy acreage, Korell recalled.

Occasionally Southwestern has discovered productive sands similar to the conventional sands that produce off to the west, as indicated by the blue squares.

Economic factors

A combination of elements leads Southwestern to believe that the Fayetteville is one of the best quality North American shale plays, Korell indicated.

Years from now when we can look back and compare the shale plays, the Fayetteville will have yielded better returns than the core of the Fort Worth Barnett shale, he opined.

Part of this is because of Southwestern’s low costs and dominant position with finding and development costs under $2/Mcf, he said. Southwestern’s royalty interest averages 15%, low relative to later Fayetteville entrants.

Korell said he has reorganized the company’s “idea people” who have been implementing the Fayetteville play into a new “idea generation group” and dedicated some seed money to investigate new opportunities. He did not elaborate.

Meanwhile, the 1.2 bcfd Boardwalk Pipeline Partners LP pipeline from Conway County to White County, expected to begin taking gas in late 2008 or early 2009, will add 800 MMcfd of capacity for Southwestern.

Boardwalk, originally expected to start up in September, is tackling a troublesome 2,300-ft river crossing. Pipeliners are boring through extremely hard rock underneath the Little Red River near the sprawling Greers Ferry Lake.

Reaming had reached 28 in. in early December toward an ultimate borehole size of 36 in.

A second phase from Bald Knob, Ark., to near Greenville, Miss., will provide Fayetteville gas access to northeastern US markets next year.