Gas pipeline proposals reviving interest in Arctic Canada E&D

A pipeline to tap Arctic Canada's natural gas reserves for southern markets in the US and Canada is a possibility once again, for the first time in more than 2 decades.

But that possibility is still qualified by large questions of how, where, when-and even if.

Healthy natural gas prices and forecast increases in annual US demand to 30 tcf by as early as 2010 are creating new interest in tapping gas reserves in Canada's Mackenzie Delta and Beaufort Sea and the estimated 35 tcf of proven gas reserves on Alaska's North Slope.

Major producers with substantial reserves in the onshore Mackenzie Delta are well into a feasibility study on development of delta reserves and a possible pipeline to the south. Most analysts estimate that 2007 would be the earliest date that a pipeline project could complete the necessary regulatory requirements and construction phase before gas can flow-likely to pipeline connections in northern Alberta.

Turnaround

However, delta producers, pipeliners, politicians, and the largely aboriginal population of Canada's Northwest Territories and Yukon Territory are now actively considering the possibility of a pipeline as a bridge to economic growth. That is a turnaround in public sentiment from the early 1970s, when political and environmental opposition and poor economics killed several pipeline proposals.

Exploration fueled by generous super-depletion allowances from Ottawa spurred Dome Petroleum Ltd. and other major companies to explore and establish substantial gas reserves in both the Beaufort Sea and Mackenzie Delta in the late 1960s and early 1970s.

A 3-year inquiry during 1974-77 by Justice Thomas Berger into Mackenzie Valley pipeline development put the final nail in the coffin of pipeline plans with its recommendation for a 10-year moratorium on activity. Low gas prices, the cost of pipeline projects, and Ottawa's cancellation of generous tax treatment for frontier exploration were also factors.

The pendulum has now swung in the other direction, and most northern residents and their political leaders have opted in favor of development.

Without that change in public support, it is questionable whether delta producers would seriously consider pipeline development.

Pipeline feasibility study

Imperial Oil Ltd., Toronto, Canada's largest oil company, and several other producers with Mackenzie Delta reserves are now conducting a feasibility study on whether gas can be economically developed and delivered via pipeline from the remote area on the edge of the Beaufort Sea.

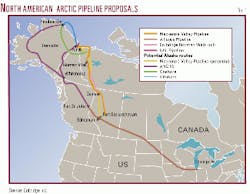

Imperial said recently the study assumes construction of an 800 MMcfd pipeline to extend from the onshore fields to Inuvik on the Arctic Coast and south from there to Norman Wells, NWT, where the company operates a long-established oil field.The 1,090-mile line would likely cost about $3 billion (Can.)

The pipeline project would be supported by about 6 tcf of onshore gas reserves in three fields. Imperial holds about 3 tcf, Gulf Canada Resources Ltd., 1.8 tcf, and Shell Canada Ltd., 1 tcf. There are an estimated 12 tcf of gas and 1.7 billion bbl of oil in the area adjacent to the Beaufort Sea. Gas potential in the region is estimated at 65 tcf.

The gas would then be shipped on a right-of-way parallel to an oil pipeline operated by Enbridge Inc., Calgary, from Norman Wells to main line pipe connections in northern Alberta (Fig. 1).

Pipeline issues

Kenneth Williams, an Imperial senior vice-president, recently told a seminar that the pipeline would be a Canadian-only development and a phased project.

"It's a bit smaller than various Alaska proposals, and it's one that potentially could be compatible with a much larger Alaska development one day," Williams said.

The Imperial executive said the producer group involved in the study with Imperial-including Gulf Canada, Shell Canada, and Mobil Oil Canada-are not proposing a project and do not have a development plan.

"We have a development concept that we hope to improve upon after consultation with interested parties. The feasibility of this concept is dependent not only on the technical and economic challenges, which in the past were viewed as the major hurdles to be overcome, but the socioeconomic and regulatory challenges," he said.

"The most significant challenges are those that are external to our companies. There are four key issue areas" in which the companies must:

- Assess support from northern parties for such a development, including the benefits associated with development.

- Assess the regulatory and environmental approvals required, including the process and timing of getting such approval.

- Examine the issue of pipeline ownership and financing. Pipeline ownership is one of the key issues, because the cost of transporting gas to market will be paid for by producers.

- Examine the fiscal terms, royalties, and taxes that would apply to such a development and explore options to enhance the economics for the initial infrastructure on a stand-alone basis.

Williams said the producer group has begun discussions with many parties, including the NWT territorial government, aboriginal and Metis groups, northern communities, the federal government, other gas producers, and pipeline companies.

The Imperial executive said the development concept is based on a number of key assumptions:

- Development of only Canadian onshore gas.

- Use of proven technology and centralized facilities.

- Concurrent production of the Taglu, Parsons Lake, and Niglintgak Fields on the delta coast, with an initial production rate of 800 MMcfd and 11,000 b/d of condensate.

- A gas-gathering pipeline to the Inuvik area and gas processing near Inuvik to remove water and dehydrate the gas.

- Use of existing rights-of-way (ROW) and common corridors that would minimize the environmental footprint; a single pipeline from the delta to Imperial's Norman Wells infrastructure and a pipeline route following the existing ROW south of Norman Wells through the Mackenzie Valley.

- Pipeline accessibility to other producers at commercial tariffs and terms.

- Concept flexibility for future expansion and pipeline extension for either additional Mackenzie Delta or nearshore gas.

Pipeline prospects

The study results are expected in early 2001, and Williams said the producer group is cautiously optimistic about prospects for development.

"The feasibility study is a way to focus our efforts, gauge support, and work in parallel with renewed exploration activity in the Mackenzie Delta," Williams said.

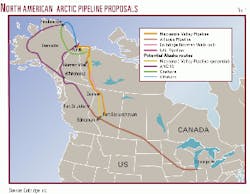

The Mackenzie route now under study is one of several possibilities for moving gas from the delta and/or Prudhoe Bay (Fig. 2). They include:

- The Alaska Highway route, also know as the Foothills route, because it was originally proposed by Foothills PipeLines Ltd. in the 1970s. It would ship gas from Prudhoe Bay to southern markets. The 1,674-mile line, with an estimated price tag of $6 billion, has the advantage of already having routing and environmental approvals from both US and Canadian regulators. As originally proposed, it would extend from Prudhoe via Fairbanks and Whitehorse to pipeline connections near Fort St. John, BC.

- The Dempster Lateral, also a throwback to the 1970s, would be a 745-mile line through Yukon Territory following the Dempster Highway from Inuvik to connect with the Alaska Highway line at Whitehorse in the Yukon. Cost would be about $2 billion.

- A direct line from Prudhoe Bay to the delta, connecting with a Mackenzie Valley line to the south. This concept would involve a 1,400-mile line with a price tag of up to $8 billion.

- A 583-mile line, with a $1.5 billion price tag, from Prudhoe Bay through the Yukon and Northwest territories to connect with a Mackenzie line. It would have to cross Alaska's Yukon Flats Natural Wildlife reserve.

Fort Liard hot spot

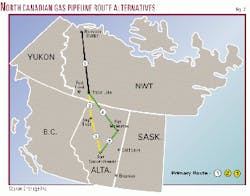

Adding to the attraction of an arctic line are growing gas reserves in the region of Fort Liard, NWT, just north of the Alberta-British Columbia borders.

Chevron Canada Resources Ltd. and partners announced first production May 1 from their K-29 discovery well near Fort Liard, one of a number of discoveries in the exploration hot spot. Chevron began producing at a rate of 35 MMcfd and ramped up to 75 MMcfd from the prolific well. Initial estimates of raw gas in place for the field were 400-600 bcf.

A second discovery, M-25, was drilled about 5 miles south of K-29 and is expected to begin production by this November or December at a rate of 75 MMcfd. It will be tied into the K-29 pipeline system. The line takes gas to an existing pipeline at Pointed Mountain, NWT, and into a Westcoast Energy Inc. gas processing plant at Fort Nelson, BC, where it enters the main sales gas system.

Interests in the two wells are Chevron, as operator, 43.43%; Purcell Energy Ltd., 24%; Berkley Petroleum Corp., 21%; Anderson Resources, 4.1%; and Paramount Resources Ltd., 2.76%. Minor interests are also held by Ranger Oil Ltd., CanNat Resources Inc., Numac Energy Inc., AEC Oil and Gas, Talisman Energy Inc., and several others.

In addition to the Chevron et al. wells, Ranger has begun production of 40 MMcfd from its P-66 well, the initial discovery in the region, where there is now extensive seismic survey activity under way.

The Fort Liard discoveries and pipeline proposals have also revived exploration interest in the Mackenzie Valley region.

Pipeline race

Rick de Wolf, senior vice-president of Calgary-based Ziff Energy Group, said various pipeline proposals are in a horse race with no one ahead at this stage. He said a critical factor will be what concept producers support, and that is not clear at this stage.

John Browne, CEO of BP Amoco PLC, has made it clear that his company is interested in participating any northern gas development. He told the World Petroleum Congress in Calgary in June that BP Amoco would consider taking an ownership interest in an arctic gas line. He said BP Amoco would likely join with other companies to build a pipeline. Westcoast Energy Inc, Vancouver, BC, and TransCanada PipeLines Ltd. and Enbridge Inc., both of Calgary, have said they are interested in building a pipeline.

Tim Holt, CEO of BP Amoco Canada, later said the company is looking at the feasibility of a number of routes to move gas south from Alaska and the Mackenzie Delta. Holt said BP Amoco Canada would like to be in a position to make a decision on a route by mid-2001 and "optimistically could have it built and operating in a 2007 time frame." Holt said he has already met with delegations from the Northwest and Yukon territories to discuss pipeline possbilities, as have most of the potential players.

Ed Porter, vice-president of gas pipeline development, West, for Enbridge, says a number of pipeline concepts are being considered as possibilities to move both Canadian Arctic and North Slope gas. He said Enbridge is in touch with all parties, and his company would be interested as a pipeline builder, operator, and equity interest participant in a future project.

Porter noted that the North Slope has large established gas reserves, while the Mackenzie Delta play "is still in its infancy."

He said that, from a Canadian perspective, a Mackenzie Valley pipeline route is simpler, while Alaska gas could come to market via the Foothills route or by subsea pipeline under the Beaufort Sea from Prudhoe Bay to landfall around Inuvik, NWT.

"Both sides (prospective Alaska North Slope and Mackenzie Delta gas developers) are talking about a similar time frame, so there is a possibility that two projects could be combined. That could create a supply glut, although the delta gas might not have much impact. It would support declining production in the Western Canada Sedimentary Basin," Porter said.

The Enbridge executive said an arctic gas pipeline would likely take 7 years from approval to completion, depending on the technology used. He said Enbridge, which already operates the crude oil line from Norman Wells and a natural gas system serving Inuvik, is in touch with all parties and recently made a presentation to the producer group studying a Mackenzie line.

Porter said aboriginal groups in the Northwest Territories now support pipeline development, and his company and other potential stakeholders have had several meetings to date with aboriginal representatives.

Local support

Apart from improvements in pipelining and drilling technology, the most significant change affecting northern development since the 1970s is support by northern residents for development.

In January, leaders from aboriginal communities across the Northwest Territories issued a unanimous statement supporting pipeline development in which their people can participate.

Harry Deneron, chief of the Fort Liard Acho Dene Koe First Nation, which hosted a conference, said northerners now want to participate in construction and ownership of a Mackenzie line. He said that is the objective of the Aboriginal Pipeline Working Group, a task force formed to investgate strategies for partnership in pipeline development.

Stephen Kakfwi, Northwest Territories premier, opposed development in the Mackenzie Valley as a young man but now has swung his support behind it.

Kakfwi says the Alaska and Yukon governments support alternate routes to get arctic gas to market, but argues a Mackenzie Valley line makes the most economic sense for the Northwest Territories and Canada as a whole. He noted the Mackenzie Valley is already a well-established pipeline corridor with the crude oil line from Norman Wells to Alberta.

Meanwhile, Pat Duncan, Yukon Territory premier, says the proposed Foothills line following the Alaska Highway through the Yukon is the best route for arctic gas to move south and has a 3-year head start on rivals because regulatory approvals are already in place.

Duncan said her government would support the Alaska Highway line but would oppose a mid-Yukon route or any offshore line through the Beaufort Sea for environmental reasons.

Mackenzie Delta revival

Industry interest in acquiring exploration permits in the Mackenzie Delta region was revived in 1999. Prior to that, no exploration licenses had been granted in the region since 1991, and no well has been drilled since 1992.

In September 1999, Ottawa granted four 9-year exploration licences. One pair was awarded to a partnership of Burlington Resources Canada Energy Ltd. and Poco Petroleums Ltd., the other pair to a partnership of Anderson Resources and Petro-Canada. The companies agreed to spend a combined $180 million on exploration and development, and seismic work is under way to pinpoint drilling locations.

This spring, the Inuvialuit Regional Corp., which oversees an Inuvialuit land claim in the Beaufort-Delta region, awarded four exploration licenses on its lands in the region of Inuvik and Tukotyaktuk on the Arctic Coast. Successful bidders were Chevron Canada Resources, Petro-Canada, and Anderson Resources.

Ottawa recently issued a new call for exploration proposals on 10 parcels of land in the region.