Integrity management improves long-term profitability in aging assets

Tom Nolan

Gareth Burton

ABS Group of Companies Inc.

Houston

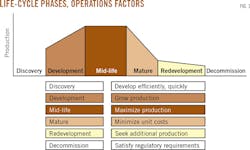

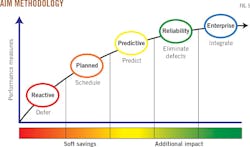

As offshore production facilities near the end of their design-lives, operators often increase focus on maintaining asset integrity. Some mature fields could deliver additional resources with more efficient production assets, but achieving this goal can be problematic without an asset integrity management (AIM) program. An operator at some point must decide either to extend the life of an asset or decommission it (Fig. 1).

Maintaining structural, mechanical, and control systems integrity effectively can drive production gains in aging assets and maturing fields.

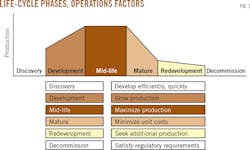

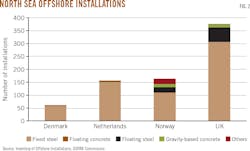

Wood Mackenzie Ltd. has reported that, given the current oil price, 142 fields will cease production by 2020. With a continued low-price environment, an additional 50 fields could discontinue production earlier than originally planned. Fig. 2 shows the UK's dominance in offshore North Sea installations. Statistics from the UK Department of Energy & Climate Change show cessation of production (COP) declarations in the North Sea peaking in 2020 and declining with periodic rallies through 2040 (Fig. 3). Assets that discontinue production will need to be managed carefully through the end of their productive life cycles.

Engineering assessment

An asset management plan should be aligned with classification-society surveys. Inspections, engineering assessments, class, and regulatory work must be planned and executed according to a predetermined timeline.

A successful approach considers end-of-life maintenance as part of the complete asset life cycle and focuses on delivering safe, responsible, and compliant operations in a reliable, efficient, and cost-effective way (Fig. 4).

An integrated AIM solution in conjunction with risk-based inspection (RBI) can help decrease cost, prevent nonproductive time (NPT), and increase efficiency over the remaining or extended service life of the asset (Fig. 5).

Risk factors, failure modes

RBI focuses on failure modes initiated by material deterioration and their consequences. The process is controlled primarily through equipment and structure inspection in conjunction with reliability analysis. The methodology combines criticality, risk assessment, and risk management techniques with inspection activities-such as planning, documentation, and data analysis, in addition to inspection itself-to develop plans that focus on areas of highest risk. RBI can be applied to all types of material deterioration that can cause loss of integrity for pressure-retaining equipment and structural components.

Identifying and managing risk factors that impact the safety, environmental integrity, and reliability of complex offshore assets is critical to avoiding NPT. Experience has shown that adopting a systematic, risk-based approach to inspecting structures, machinery, equipment, and control systems allows for more effective management of the risks encountered offshore.

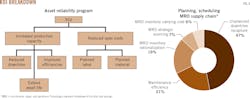

Managing these risks includes assessing the integrity framework of the asset, benchmarking its integrity maturity relative to industry peers, identifying areas for improvement, developing improvement programs, and providing technical support during implementation. For units with a longer remaining field life, AIM programs also can improve profitability (Fig. 6).

Life extension

Operators should consider service-life extension well before the field approaches the end of its life cycle. The process is dependent on available records, such as asset condition assessments and historic field data and maintenance records. It can take years to compile the original design criteria documents, planning and inspection reports, engineering assessments, and the appropriate technical specifications and regulatory approvals that are used as a baseline for evaluating remaining life.

With all of the documents in hand, operators can develop an upgrade or mitigation plan along with an in-service inspection plan that includes any corrective actions needed.

Managing asset integrity

In a recent application of the AIM program, engineers worked with an operator contending with frequently overloaded maintenance backlogs for its FPSO fleet. As in any maintenance operation, the goal was to minimize downtime and carry out the necessary work as safely as possible within the parameters of applicable regulations.

After identifying each piece of equipment to create a master asset list and carefully evaluating each system and subsystem, the engineers developed a comprehensive asset criticality ranking to identify specific maintenance approaches for each asset based on operational and safety criteria.

Applying a risk-based approach, engineers defined the extent and frequency of maintenance needed for each piece of equipment and implemented a preventive-predictive maintenance program to form a complete mechanical integrity plan. The specific needs of each critical component, including its usage and exposure to wear, drove the recommendations.

The process included a review of the client's computerized maintenance management system (CMMS) data and the development of a plan for prioritizing concerns. The engineering team then implemented new maintenance schemes and updated the process flow in the CMMS to manage ongoing scheduling and maintenance frequency.

Identifying the specific equipment maintenance needs and eliminating unnecessary or overscheduled maintenance resulted in a 40% reduction in the work-order backlog. The operator can now better prioritize and complete critical maintenance projects without interference or duplication of maintenance from standard scheduled maintenance tasks.

In addition to addressing the primary issue of the maintenance backlog, the engineers reviewed and made improvements to more than 20% of the critical system maintenance plans, rationalizing the maintenance process, avoiding excessive downtime, and reducing overall operating costs.

The Authors

Tom Nolan ([email protected]) is vice president of Marine and Offshore at ABS Group of Companies, Inc., a subsidiary of the American Bureau of Shipping (ABS), based in Houston. Nolan has more than 30 years' experience in the engineering, design, and analysis of ships and offshore structures and has spent more than 23 years with ABS in both the classification and consulting sides of the organization and its subsidiary. He holds a BS in Marine Engineering from the United States Merchant Marine Academy in Kings Point, New York. He is a member of the Society of Naval Architects and Marine Engineers.

Gareth Burton ([email protected]) is senior director of Offshore Asset Integrity Management at ABS Group, based in Houston. With 20 years of engineering experience, Burton recently served as director of engineering for the ABS Singapore office. Burton holds a BS from the University of Manchester in England and MS and PhD in engineering from the University of Ulster in Belfast, Northern Ireland. He has been designated as a Chartered Engineer by the Engineering Council of the United Kingdom.

Data gathering, decommissioning studies

Wood Mackenzie estimates £55 billion will be invested in decommissioning on the UKCS within the next 5 years (OGJ Online, June 6, 2016). Upcoming projects for the region include eight concrete platforms, 21 floating production systems, 225 jackets, 278 subsea production systems, and 3,000 pipelines.

As the UK North Sea enters the final phase of decommissioning, several joint-industry projects have worked to gather data related to health, safety, and environmental (HSE) incidents as well as determining best methods for removing platforms and subsea infrastructure with consideration toward current technology and cost feasibility.

Safetec Nordic AS, an ABS Group company, developed a JIP in 2010 to gather HSE incident data from projects in the North Sea. The JIP brings major operators together to share data and experience to safely and effectively manage future decommissioning operations.

The primary goal is to improve hazard identification for future projects by identifying the main causes of the most common HSE incidents, estimating accident rates for different decommissioning activities, gathering experiences and lessons learned, and proposing appropriate risk-reducing measures.

Event data are recorded in a database available to participating industry partners as well as regulatory bodies HSE (UK) and Norway's Petroleum Safety Authority. The JIP has collected and input hundreds of HSE incidents from North Sea decommissioning activities. The principle aim now is to expand the database by adding new events as they occur so the data can be analyzed to identify continuous safety improvements.

Facilities decommissioning can often be carried out through standardized methods. For the UK, subsea bundles provide an additional engineering consideration for operators seeking to remove subsea pipelines and infrastructure. International Association of Oil and Gas Producers (IOGP) published "Options for Decommissioning Subsea Bundles" in June 2014 to identify technologies, costs, and legislation associated with bundle decommissioning.

Subsea bundles are a complex multipath form of subsea pipeline that have been integrated into a single piece of infrastructure containing all the required flowlines, control systems, and manifold structures needed to tie back a subsea a field to a host facility. Subsea bundles typically range up to 7.5 km in length and 300-1,250 mm in diameter.

Each bundle is individual by design, and the first North Sea bundle was installed in the Murchison field in 1980. More than 70 bundles have been installed since then. The JIP was sponsored by eight North Sea operators, and outlines two primary options: full removal or leaving bundles in place.

According to the study, the UK Department of Energy and Climate Change (DECC) emphasizes that bundle removal be considered on a case-by-case basis. But DECC also calls for new bundle designs to address removal. To date no bundles have been decommissioned in the North Sea or elsewhere. The report states that full removal of a bundle by reverse installation is impractical with current technology and the absence of experience.

Additional cost to recover all bundles installed in the North Sea, compared to leaving them in place could increase North Sea decommissioning estimates to £1.67 billion. IOGP anticipates a bundle decommissioning project within the next 5 years, which will provide a better understanding of the actual costs and technical issues related to future bundle decommissioning projects.