In its November Short-Term Energy Outlook (STEO), the US Energy Information Administration (EIA) forecasts the Brent crude oil price will increase from an average of $90/bbl in fourth-quarter 2023 to an average of $94/bbl in first-half 2024 and an average of $93/bbl for the entire year. Modest upward oil price pressures in the coming months reflect a slight decline in global oil inventories in first-half 2024 as risks of supply disruptions remain high, according to EIA.

“Current OPEC+ production targets are set to expire at the end of 2024, and we assume that continuing voluntary cuts and other factors will keep actual OPEC+ crude oil production well below targets as the group tries to limit increases in global oil inventories. However, should OPEC+ produce closer to target levels than we currently assume, it could reduce prices in 2024,” EIA said.

In the current STEO report, EIA forecasts global liquid fuels production will rise by 1 million b/d in 2024, down from growth of 1.6 million b/d this year. While a rise in global oil production is expected next year, EIA anticipates that ongoing cuts by OPEC+ will keep global production growth lower than global consumption growth and contribute to inventory draws and upward oil price pressure in the early part of 2024.

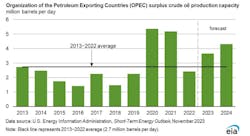

EIA noted that a combination of voluntary production cuts by Saudi Arabia and ongoing production cuts from other OPEC+ members have led to an increase in OPEC’s spare crude oil production capacity to an anticipated 4.3 million b/d in 2024 from 2.4 million b/d in 2022 with the majority of this spare capacity being held by Saudi Arabia and the United Arab Emirates (UAE).

Despite rising OPEC spare capacity in 2023 and in 2024, EIA lowered its estimate of Iraq’s spare capacity compared with last month’s STEO. EIA removed production capacity assets in northern Iraq that relied on the northern Iraq-to-Turkey pipeline for access to global markets. The pipeline has been offline since March 2023 because of a dispute between Turkey and Iraq over an international court ruling.

The report also addresses that, although the conflict between Israel and Hamas has not affected physical oil supply at this point, uncertainties surrounding the conflict and other global oil supply conditions could put upward pressure on crude oil prices in the coming months.

Regarding Russia, after a significant drop in total liquids production following its invasion of Ukraine in early 2022, its production has steadied in mid-2023 at about 10.6 million b/d. EIA assumes Russia’s oil production will remain relatively flat over the remainder of the forecast period at an average of 10.7 million b/d.

The US lifted sanctions on Venezuela’s crude oil exports on Oct. 18 for 6 months, contingent on electoral reforms. While the political situation remains in flux, EIA expects sanctions relief will only lead to limited oil production increases. With the sanctions lifted, EIA forecasts that Venezuela will increase crude oil production by less than 200,000 b/d to an average of 900,000 b/d by end-2024. Further increases in Venezuela’s crude oil production will take longer and require significant investment after years of deferred maintenance and lack of access to capital.

Iran’s crude oil production rose in recent years and the country has increased exports to China using heavily discounted prices. EIA’s assumption is that Iran will raise production by an additional 200,000 b/d in 2024. Sanctions on Iran’s crude oil, insufficient upstream investment, and limited oil consumption growth in China cap Iran’s oil production beyond this limited growth.

US gasoline consumption

In the report, EIA predicts a 1% drop in US gasoline usage in 2024, potentially leading to the lowest per capita gasoline consumption in two decades. An increase in remote work, improvements in the fuel efficiency of the US vehicle fleet, high gasoline prices, and persistently high inflation have reduced per capita gasoline demand.

Natural gas

EIA estimates that US natural gas inventories totaled 3,835 bcf at end-October, 6% more than the 5-year (2018–2022) average. EIA forecasts US natural gas inventories will end the winter heating season (November–March) 21% above the 5-year average with almost 2,000 bcf in storage.

Inventories are full because of high natural gas production and warmer-than-average winter weather, which reduces demand for space heating in the commercial and residential sectors. According to EIA’s forecasts, Henry Hub spot price will average near $3.2/MMbtu in this November, down from a price of almost $5.50/MMbtu a year earlier.