Oasis Petroleum Inc., Houston, plans to spend $295 million in 2022 without accelerating activity on current assets.

The Williston basin producer said it is committed to returning $70 million per quarter to shareholders through base dividend, variable dividends, and share repurchases.

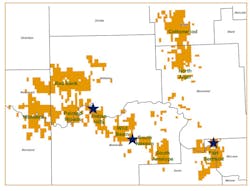

With a reinvestment rate below 40%, the company said it expects volumes of 65,000-70,000 boe/d (64% oil cut) with a focus on South Nesson, Indian Hills/City of Willison, and Fort Berthold Indian Reservation areas in North Dakota.

Its 2022 program envisions drilling 40-42 gross operated wells (about 72% working interest) with about 25% 3-mile laterals and 9 completions in first-half 2022.

Oasis produced 68,800 boe/d in fourth-quarter 2021 with oil volumes of 44,400 b/d. Exploration and production capital expenditure was $45.3 million in the quarter and $168.2 million for full-year 2021.

Net cash provided by operating activities was $269.4 million, net income was $225.9 million, and net income from continuing operations was $188.2 million.

For fourth-quarter 2021 and full-year 2021, the company had net income from continuing operations of $188.2 million and $189 million, respectively. Excluding certain non-cash items and their tax effect, adjusted net income attributable to Oasis from continuing operations was $89.3 million in the fourth quarter, and $196.4MM million in full-year 2021.

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.