Southwestern Energy Co. has agreed to acquire private Haynesville producer GEP Haynesville LLC for $1.85 billion, creating a large dual-basin natural gas producer with expanded access to Gulf Coast markets, the company said in a release Nov. 4. The company expects some 65% of its daily natural gas production will be marketed to demand centers along the Gulf Coast.

GEP Haynesville, a joint venture formed by GeoSouthern Haynesville LP and funds managed by GSO Capital Partners LP, acquired Haynesville natural gas assets in northern Louisiana from Encana Oil & Gas (now Ovintiv) in 2015 for $850 million (OGJ Online, Dec. 1, 2015).

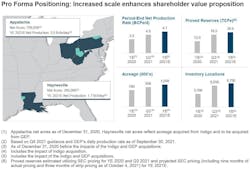

Southwestern Energy currently holds over 789,000 net acres in Appalachia spread across Pennsylvania, West Virginia, and Ohio. A 2020 acquisition of Montage Resources Corp. added to the operator’s position in the northeastern US and Haynesville assets were added earlier this year with a $2.7-billion acquisition of Indigo Natural Resources LLC (OGJ Online, Aug. 20, 2020; June 2, 2021). Southwestern Energy’s Haynesville operations span 275,000 net effective acres and 149,000 net surface acres in Louisiana’s Haynesville and Bossier shale reservoirs.

The deal with GEP builds scale in the Haynesville with some 700 MMcfd of production. Once closed, the combine is expected to produce about 4.7 bcfed. In addition, inventory is expected to expand to 700 locations across stacked-pay Haynesville and Middle Bossier.

The deal adds 2.2 tcfe of estimated year-end 2021 proved reserves at projected SEC pricing with expected yearend 2021 total proved reserves of about 20.9 tcfe.

Annual synergies of $25 million from complementary assets are expected.

Total consideration will be comprised of $1.325 billion in cash and some $525 million in Southwestern common shares. As of Sept. 30, Southwestern had total debt of $4.2 billion. After financing the cash consideration of the deal, the company expects its yearend 2021 debt balance to be about $5.4 billion with a leverage ratio of some 2.0x.

The transaction is expected to close by yearend 2021, subject to customary closing conditions.

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.