Chesapeake solidifies gas focus with $2.2 billion Vine acquisition

Chesapeake Energy Corp. has agreed to acquire Vine Energy Inc., an energy company focused on the development of natural gas properties in the over-pressured stacked Haynesville and Mid-Bossier shale plays in northwest Louisiana. The acquisition is a zero premium transaction valued at $2.2 billion.

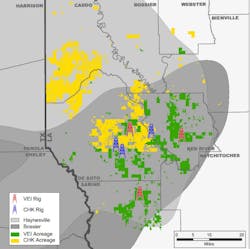

The Vine position consolidates Haynesville/Bossier adding some 370 premium 50% rate of return drilling locations at $2.50 NYMEX gas price, Chesapeake said Aug. 11. With the deal, Chesapeake aims to become a large Haynesville producer with 348,000 pro forma net acres, 1,500 gross locations, and second-quarter 2021 net daily production of 1,581 MMcfd.

Pending a successful close, Chesapeake's preliminary plan is to operate 10-12 rigs in 2022, with 8-9 rigs working its gas portfolio and 2-3 rigs concentrating on its oil assets. The company anticipates a 2022 capital reinvestment rate of 50–60%. At NYMEX strip pricing as of July 30, the preliminary capital program is expected to generate $2.55-2.75 billion in total adjusted EBITDAX and maintain average annual 2022 oil production along fourth-quarter 2021 average levels, the company said.

Chesapeake said the deal increases its cumulative 5-year free cash flow outlook by about $1.5 billion, or 68% of the transaction value, to $6.0 billion, or 66% of pro forma enterprise value. Average annual savings of about $50 million are expected from operating and capital synergies, the company said.

Gas focus, operational synergies

The deal solidifies Chesapeake’s post-reorganization focus on gas, said Andrew Dittmar, senior M&A analyst at Enverus.

“Following its emergence from a Chapter 11 reorganization, Chesapeake was well positioned to participate in deal markets and M&A was seemingly one way to rebuild momentum around its stock. Given its high focus on gas with nearly 90% of capital spending slated for the Haynesville and Appalachia, it makes sense that the company would look to one of those two basins for an acquisition. With a mix of public and private acquisition opportunities, strong well results, and higher confidence around future pricing for production given its geographic location close to Gulf Coast gas markets and adequate infrastructure, it is easy to see why Chesapeake ultimately chose the Haynesville for expansion,” he said.

The deal is “a return to 2020’s model that investors seemed mostly to applaud,” Dittmar continued. “The deal is a zero-premium merger between two public companies that operate in the same basin, bringing economies of scale and operational efficiencies to the table in addition to the usual G&A savings.”

Vine shareholders will receive fixed consideration of 0.2486 shares of Chesapeake common stock plus $1.20 cash per share of Vine common stock, for total consideration of $15.00 per share, comprising of 92% stock and 8% cash. Upon closing, Chesapeake shareholders will own 86% and Vine shareholders will own 14% of the fully diluted shares of the combined company.

The deal, which is subject to customary closing conditions, including regulatory approvals and approval of Vine shareholders, is expected to close in this year’s fourth quarter. Funds managed by The Blackstone Group Inc. own about 70% of outstanding shares of Vine common stock and agreed to vote in favor of the transaction.